My reason for sharing my trade journal is to encourage traders to also keep one for two major reasons:

- Track your weekly trading performance.

- Build a better psychology, which will sharpen your trading intuition

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY 04/03/2024

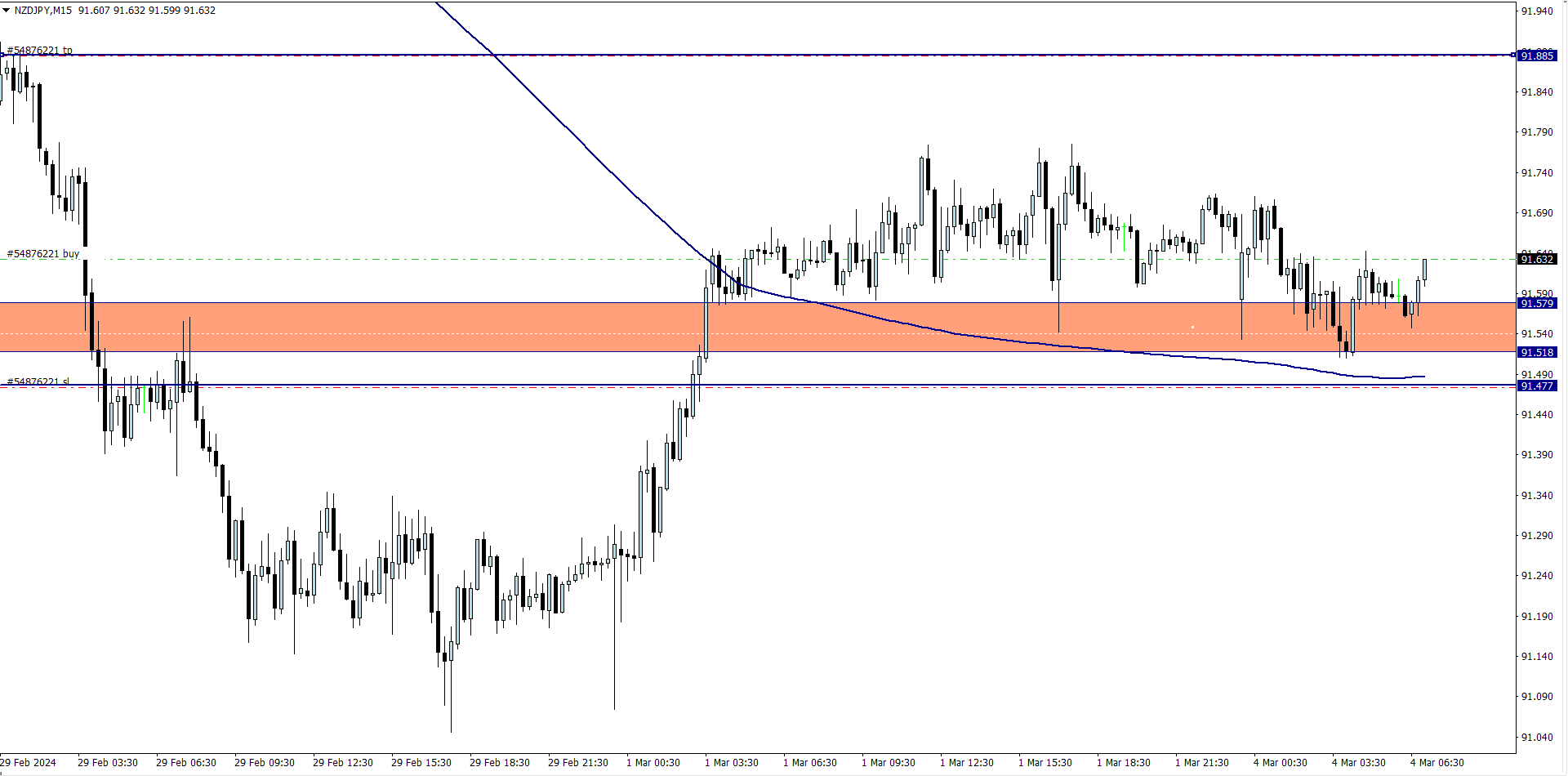

NZD/JPY (6.15 am)

Analysis: I was inspired to buy due to our Weekly Market Analysis

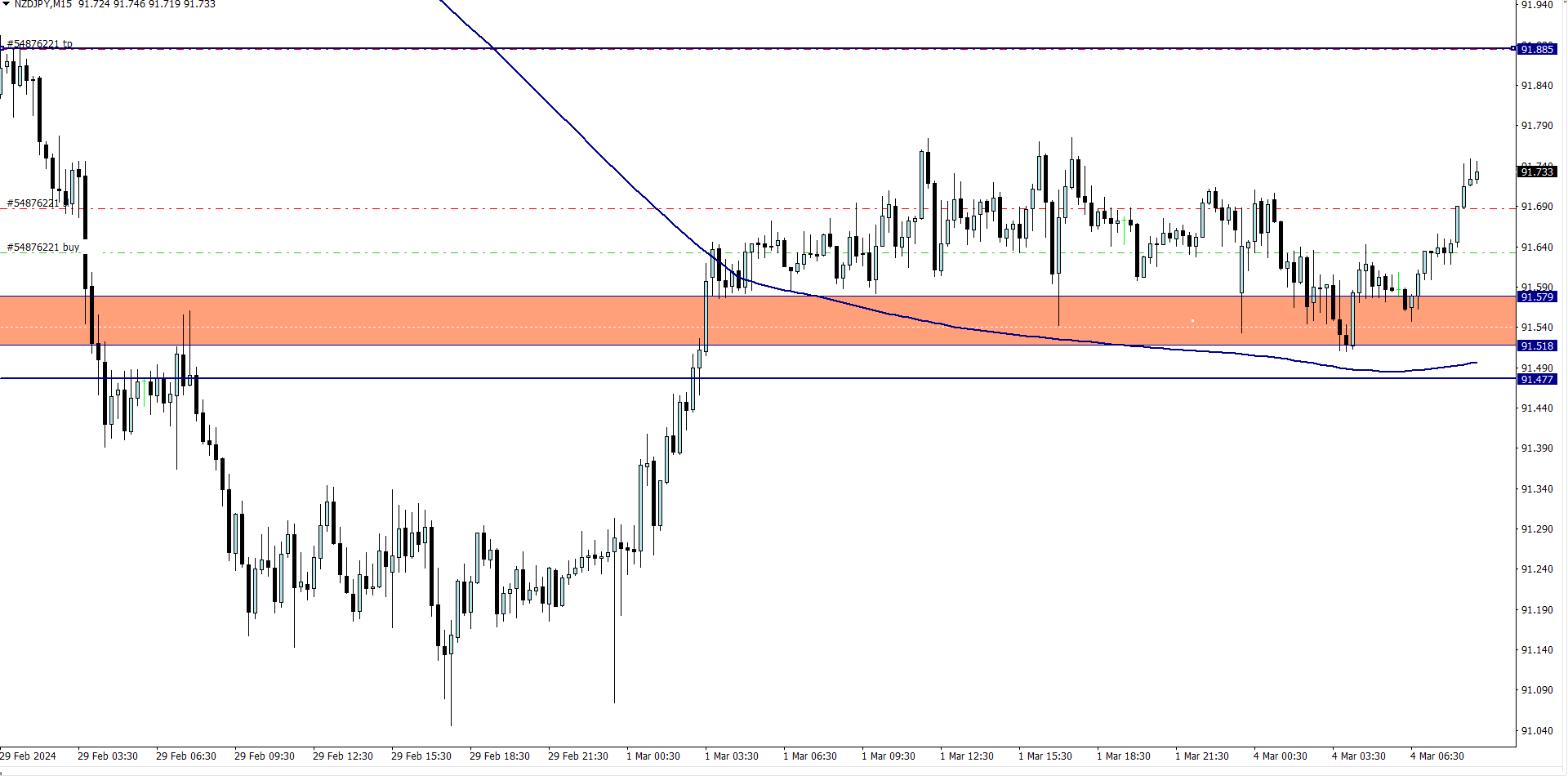

NZD/JPY update (8.20 am)

Analysis: I trailed the NJ till my trailing stop got hit (+6 pips)

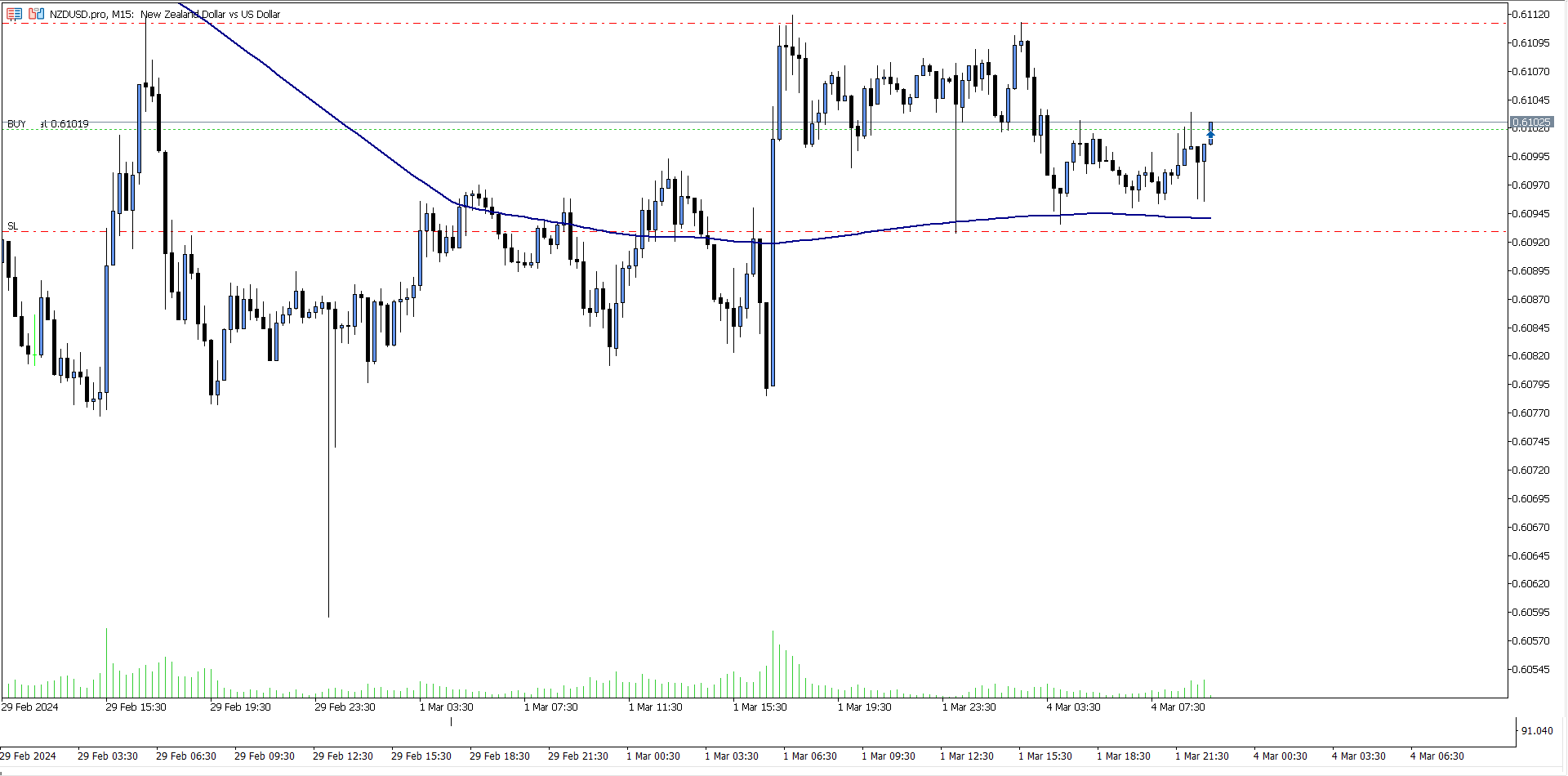

NZD/USD (8.20 am)

Analysis: I bought NU judging the 4 hour tf bullish outlook, but this trade had other plans in mind. My SL was hit (-8 pips)

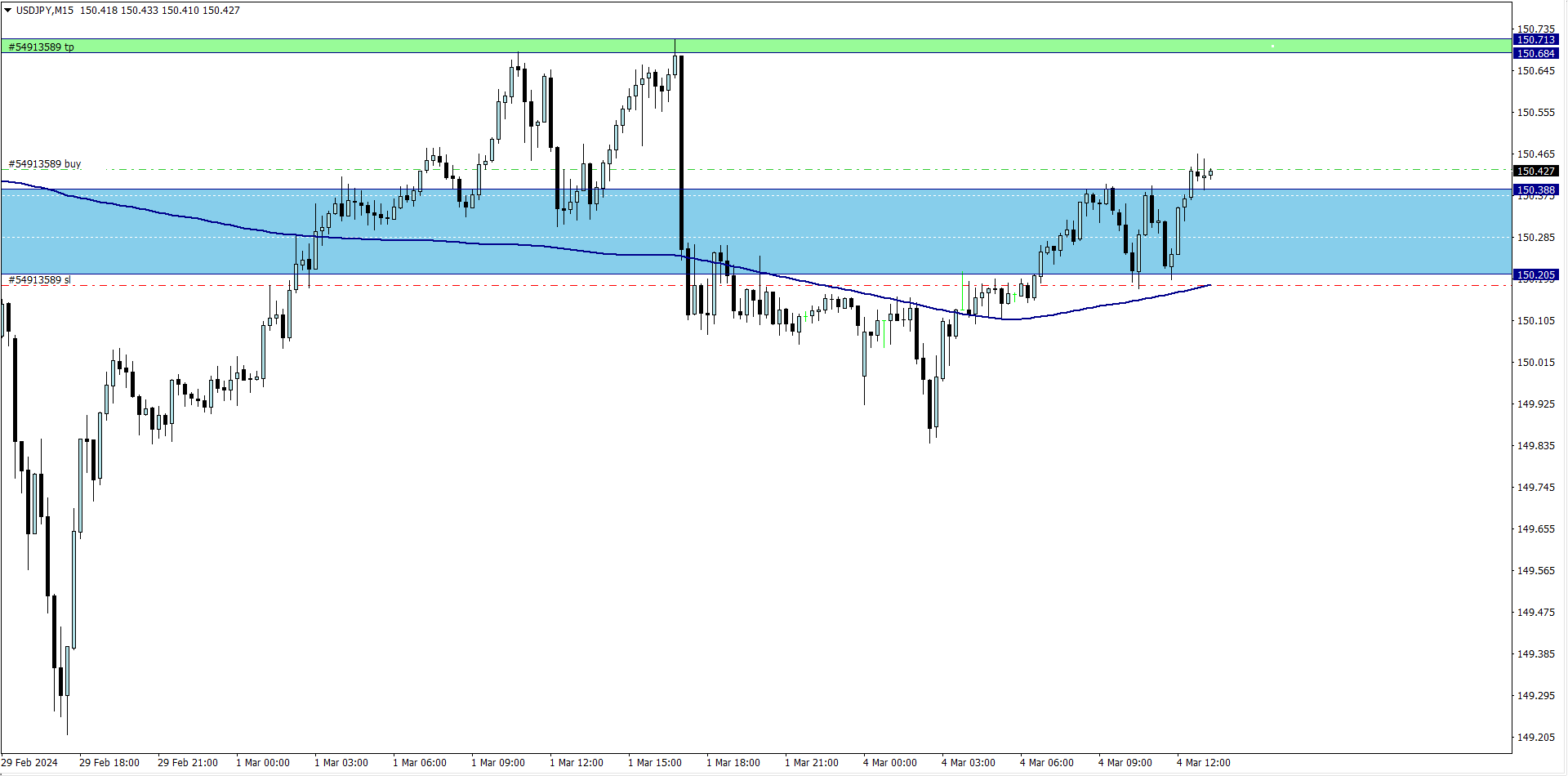

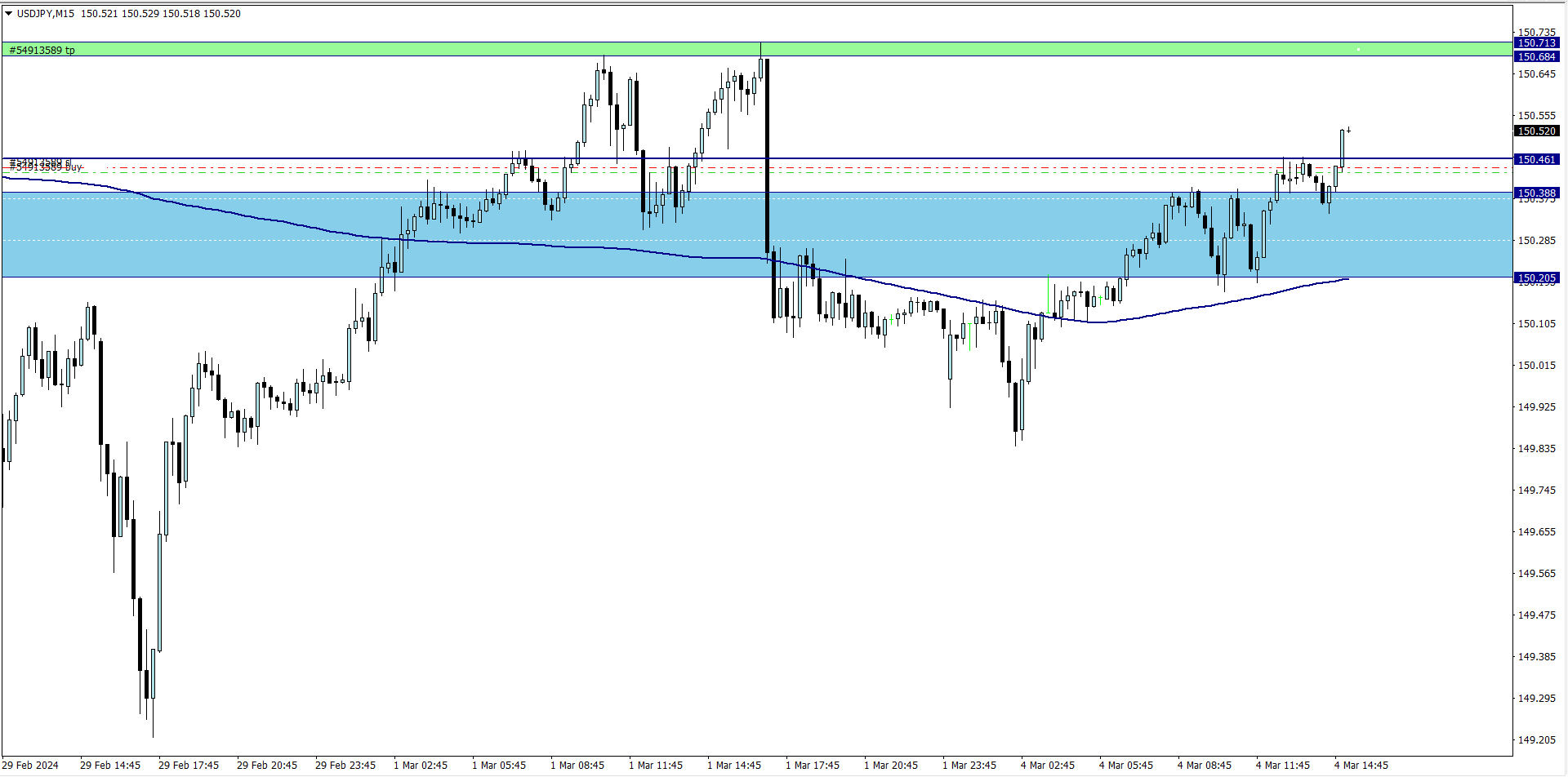

USD/JPY (12.30 pm)

Analysis: A bullish outlook on the 4 hour tf and a breakout from consolidation inspired this trade.

USD/JPY (3.49 pm)

Analysis: Shifted loss to breakeven when the opportunity presented itself. Price ended up taking me out at breakeven

TUESDAY 05/03/2024

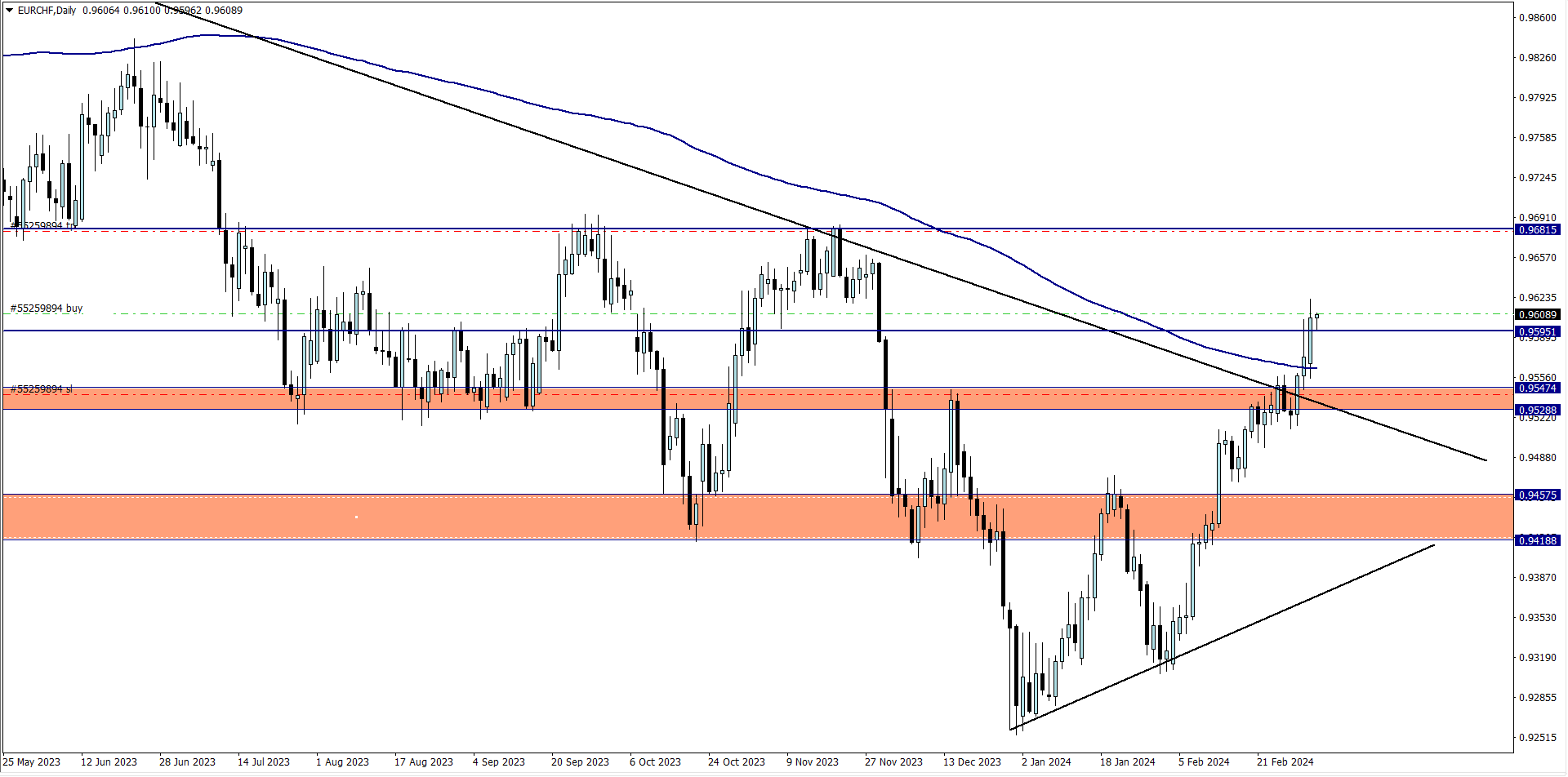

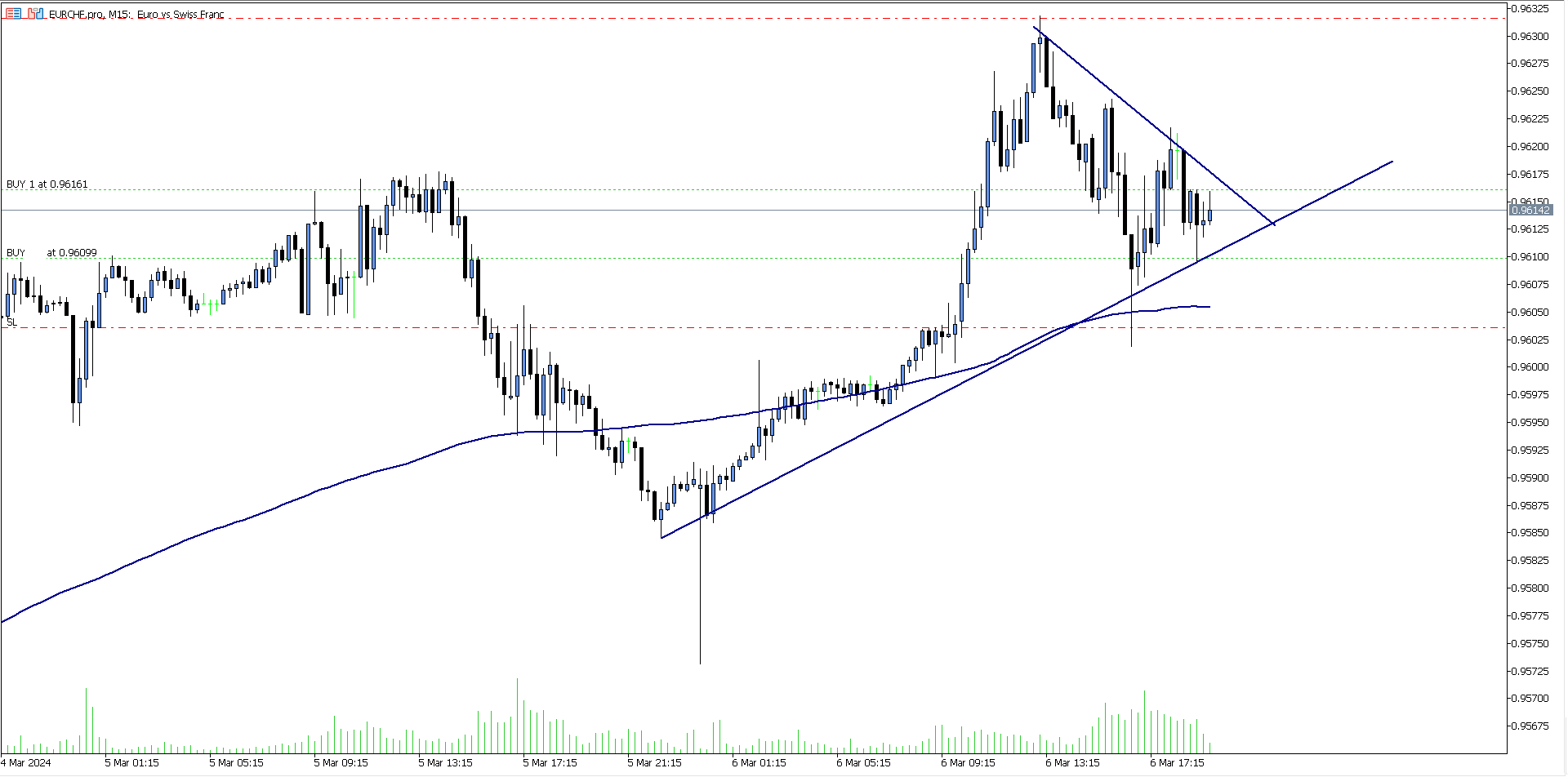

EUR/CHF (6.19 am)

Analysis: My reason for buying was because of our Weekly Market Analysis

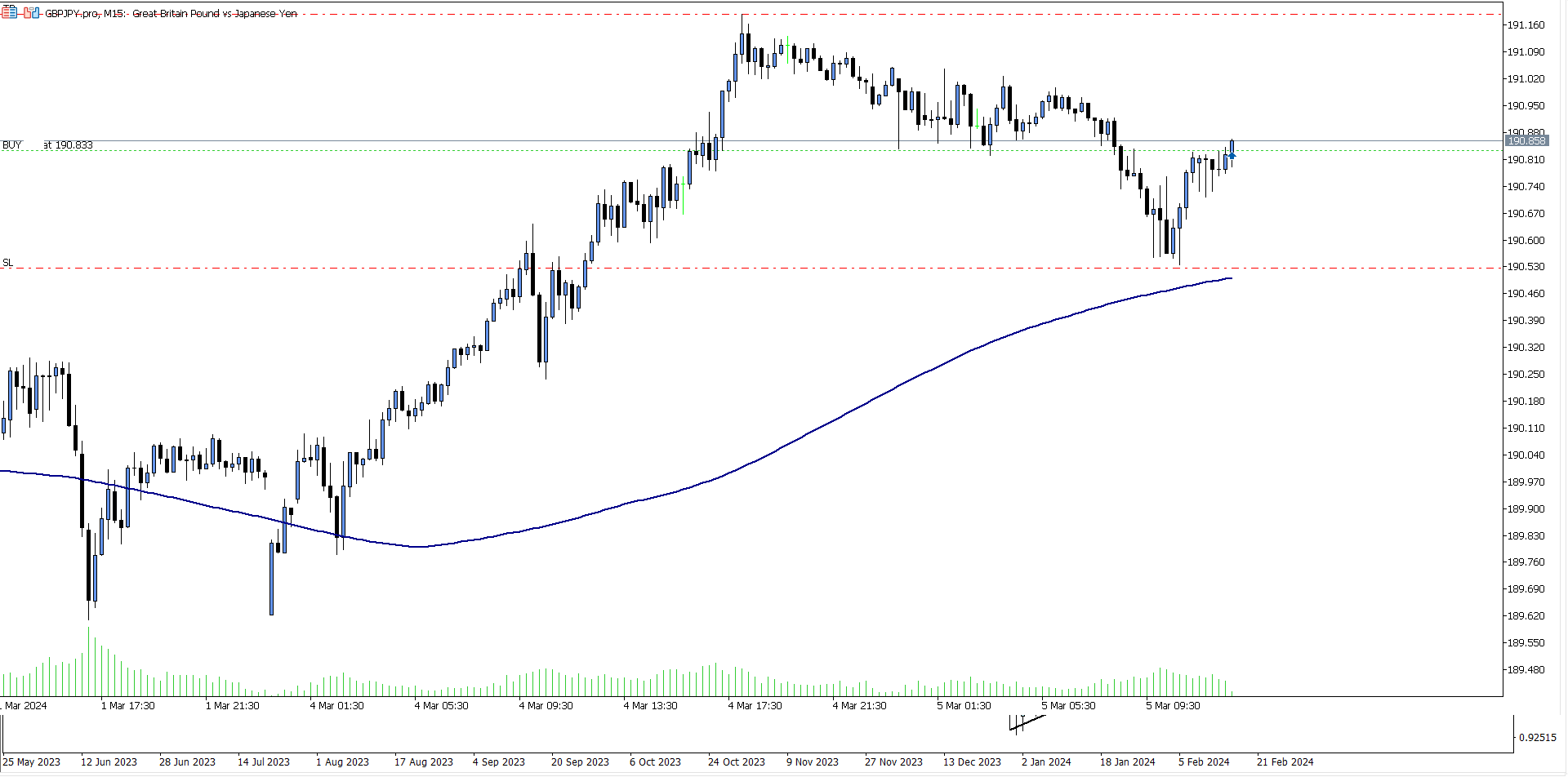

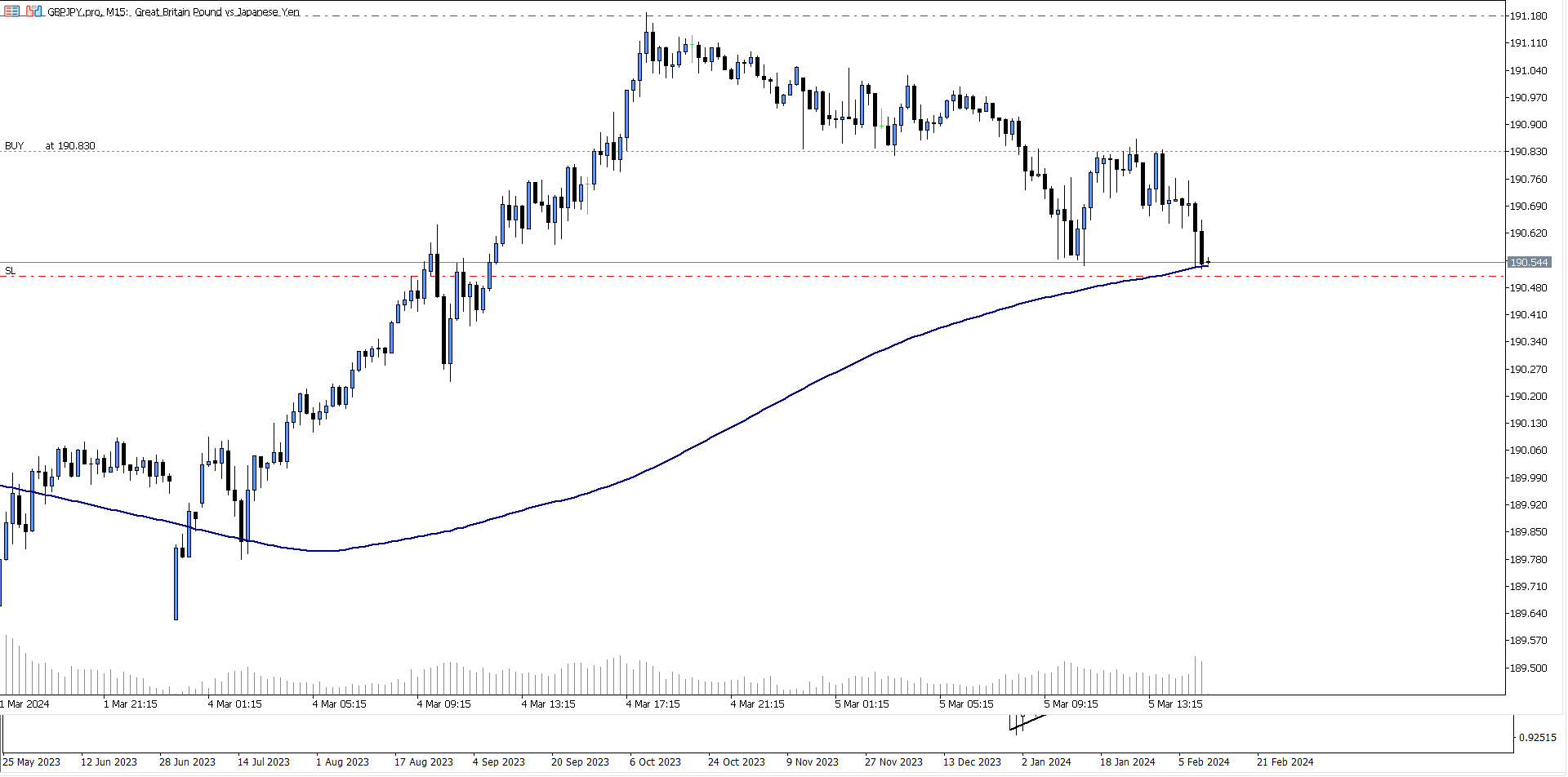

GBP/JPY (11:49am)

Analysis: I am taking this trade JUST based on the breakout on the 15 mins time frame and the 200 ma bounce, and neglecting the fact that price is currently at a key resistance zone

GBP/JPY Update (2:42 pm)

Analysis: SL got hit (-32 pips)

WEDNESDAY 06/03/2024

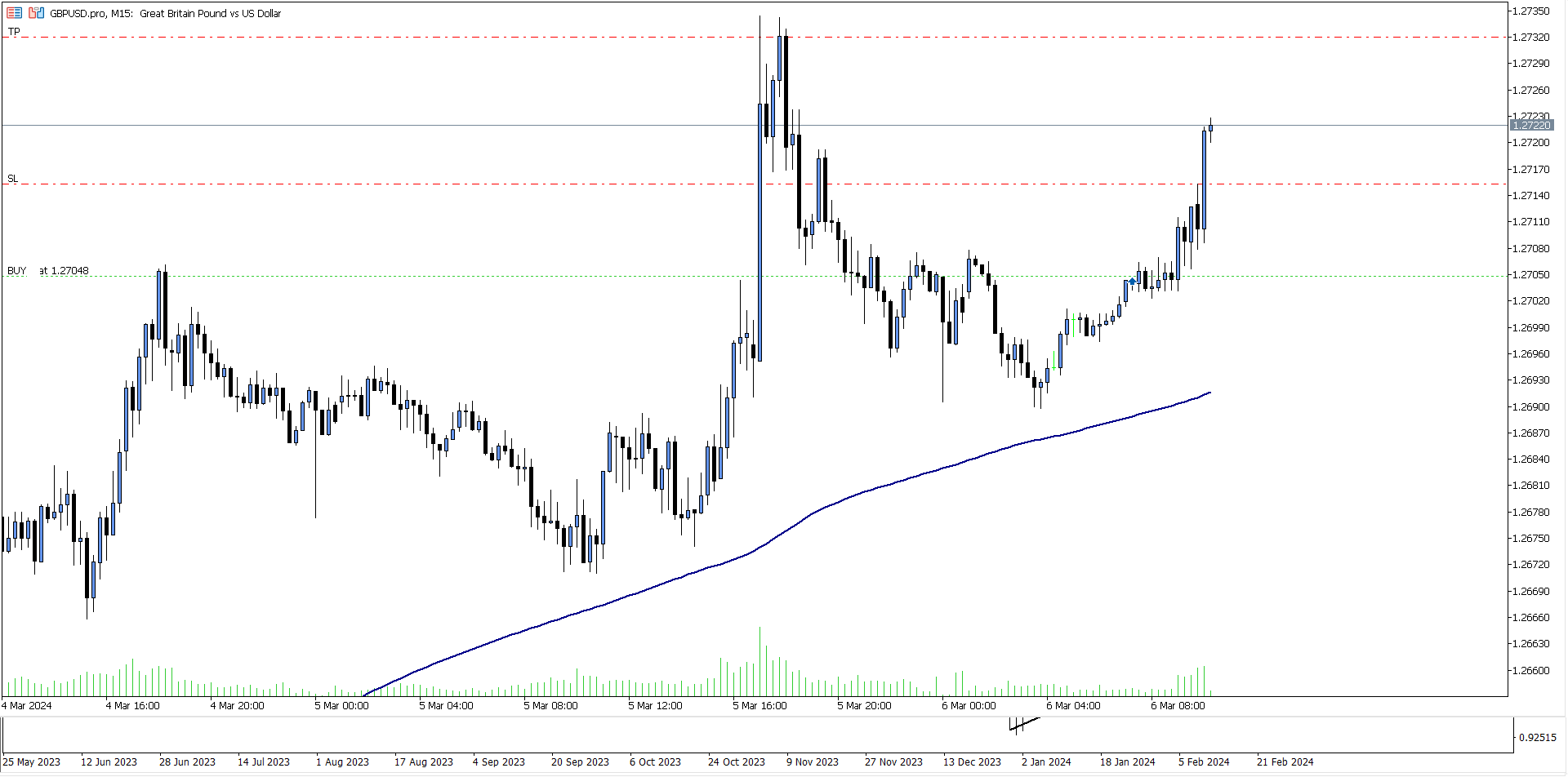

GBP/USD (6.38 am)

Analysis: The key support zone on the 4hr time frame was respected, so a buy opportunity presented itself on the 15min tf, after bounced off the 200 ma

GBP/USD update (9.35 am)

Analysis: I locked +10 pips, and price knocked me off at +10 pips

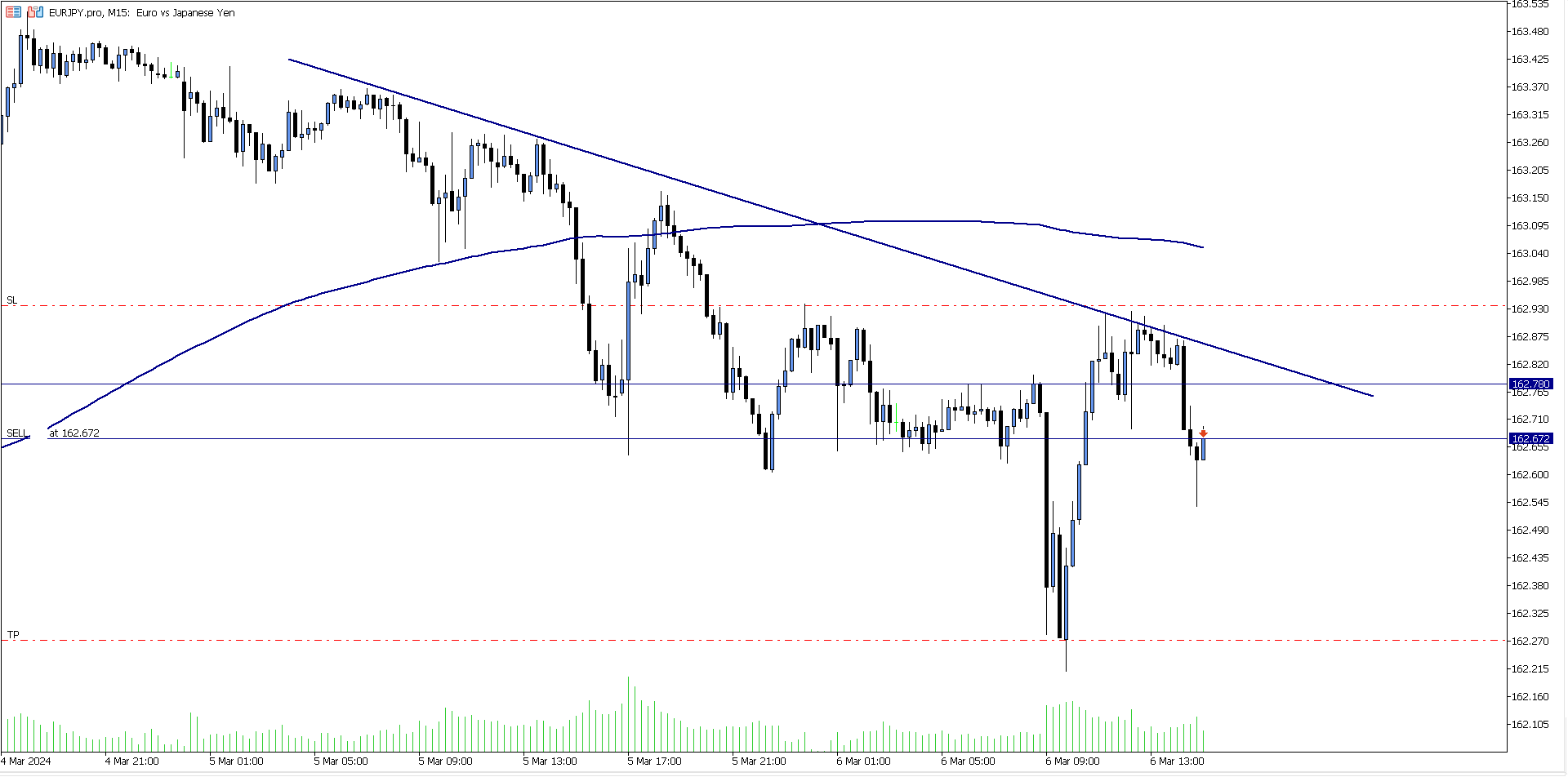

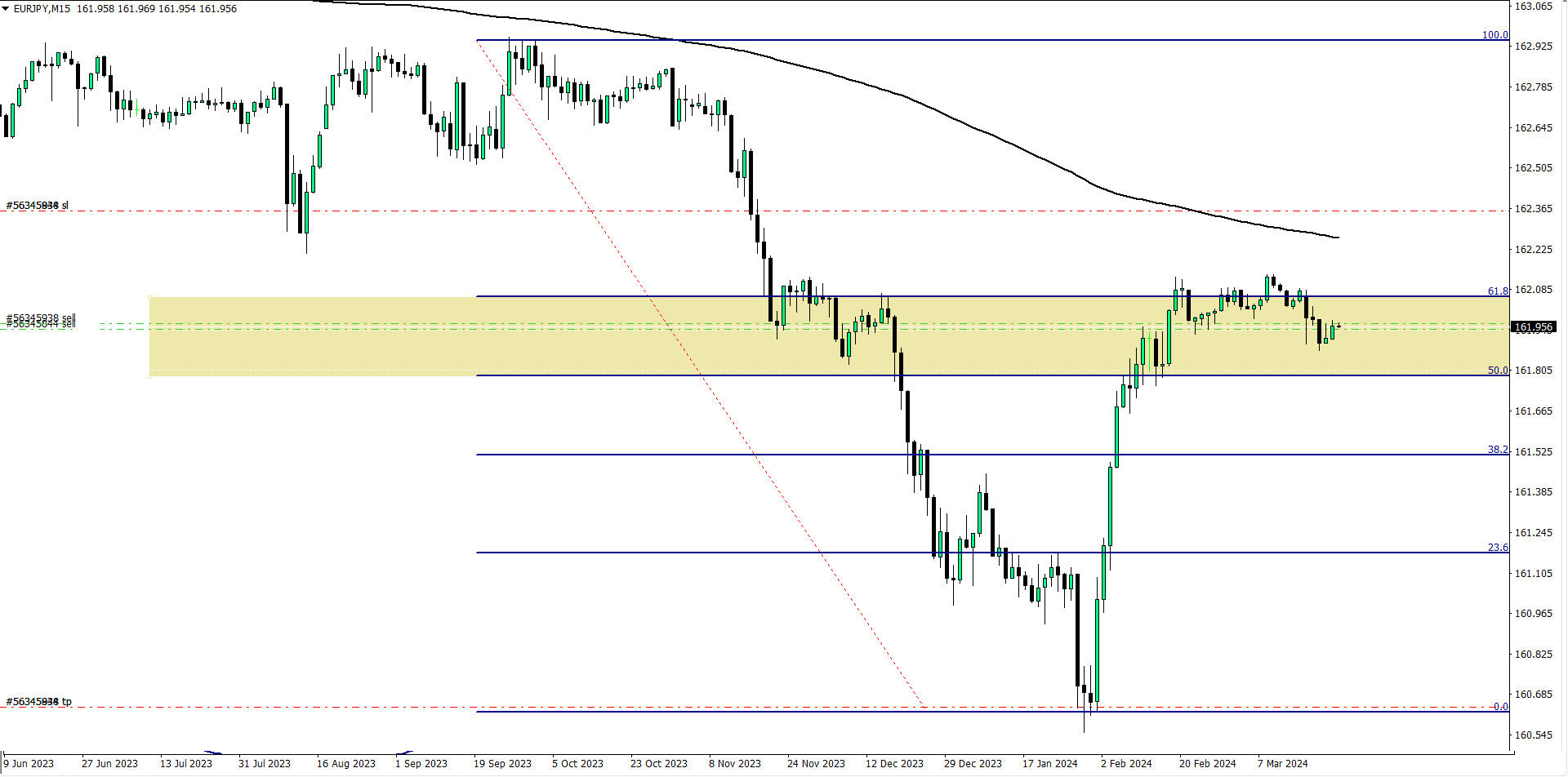

EUR/JPY (2:04 pm)

Analysis: Sold EJ due to a bearish outlook on the 4 hr timeframe, but the high impact news on the USD affected the drop, so I closed at breakeven.

EUR/CHF (6.37 pm)

Analysis: My reason for buying is the strong bullish setup on the 4 hour time frame… I closed with -12 pips after the setup became invalid

FRIDAY 08/03/2024

EUR/JPY (12.40 am)

Analysis: My reason for selling was shared on our Friday Market Analysis.

This trade was closed at breakeven around 9.18 am after it took out my trailing SL

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (04/03/2024) | NZD/JPY | BUY | +6 pips |

| NZD/USD | BUY | – 8 pips | |

| USD/JPY | BUY | Breakeven | |

| TUE (05/03/2024) | EUR/CHF | BUY | Pending |

| GBP/JPY | BUY | -32 pips | |

| WED (06/03/2024) | GBP/USD | BUY | +10 pips |

| EUR/JPY | SELL | Breakeven | |

| EUR/CHF | BUY | – 12 pips | |

| FRI (08/03/2024) | EUR/JPY | SELL | Breakeven |

| TOTAL | – 36 PIPS |

In conclusion:

It was a busy day at the office last week. Out of the 9 trades I took…

- 2 closed with profits

- 3 closed with losses

- 3 breakeven and

- 1 pending trade

I closed the week with a -2.2% loss, and what I could have done differently was:

I should not have taken the GJ trade on Tuesday due to the consolidation on the 4-hour time frame. Although there was a perfect setup on the 15 mins time frame, but the higher time frame was messy

If I had not taken the GJ trade, I would have closed the week with -1.6%, which is a lot more better than -2.2%.

That said, every other setup was well taken and managed. Hopefully next week will be a lot better

How did your trading week go?

NOTE:

-

THE FUNDED TRADER: (Use the coupon code: THE0CRAFTER)

- BESPOKE FUNDING PROGRAMME

- FUNDED ENGINEER

- BLUE GUARDIAN (Use the coupon code: CRAFTER)

- GOAT FUNDED

- LARK FUNDING

- SKILLED FUNDED TRADER

- MAVEN TRADING

- MY FLASH FUNDING (Use the coupon code: “FILLIPO” for a -25% discount)

- THE5ERS