Hello traders,

let’s hit the charts

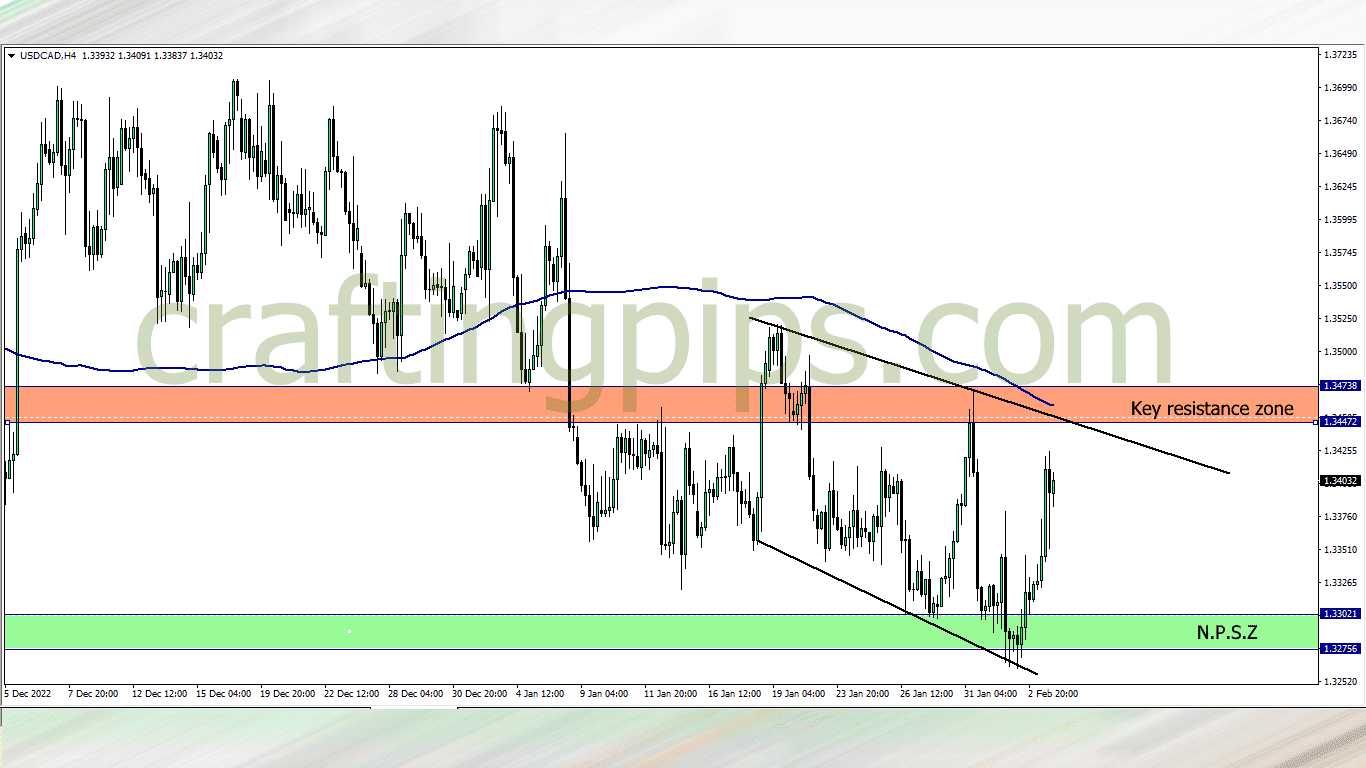

1. USD/CAD

USD/CAD closed bullish last week Friday, but let’s not forget that price is approaching a a key resistance zone and 200 M.A which may most likely scare the bulls away.

If that happens, then price may most likely revisit NPSZ this week.

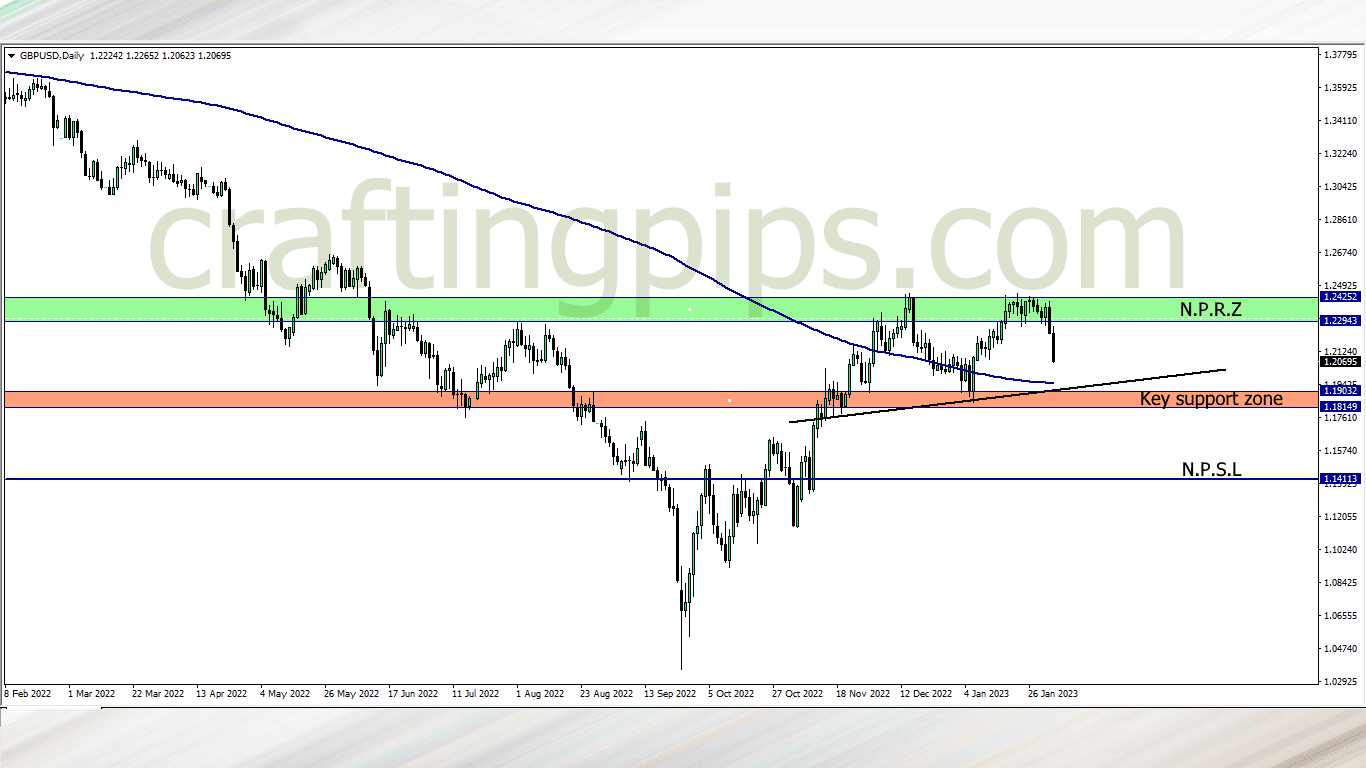

2. GBP/USD

GBP/USD is the exact opposite of USD/CAD.

The key support zone is something to watch out for this week. If we do get a reversal structure or candlestick pattern at the key support zone which also has the 200 M.A serving as a support zone, then the bulls may take price back to NPRZ.

If the current support zone is broken, then the bears will most likely rule the market till price hits NPSL

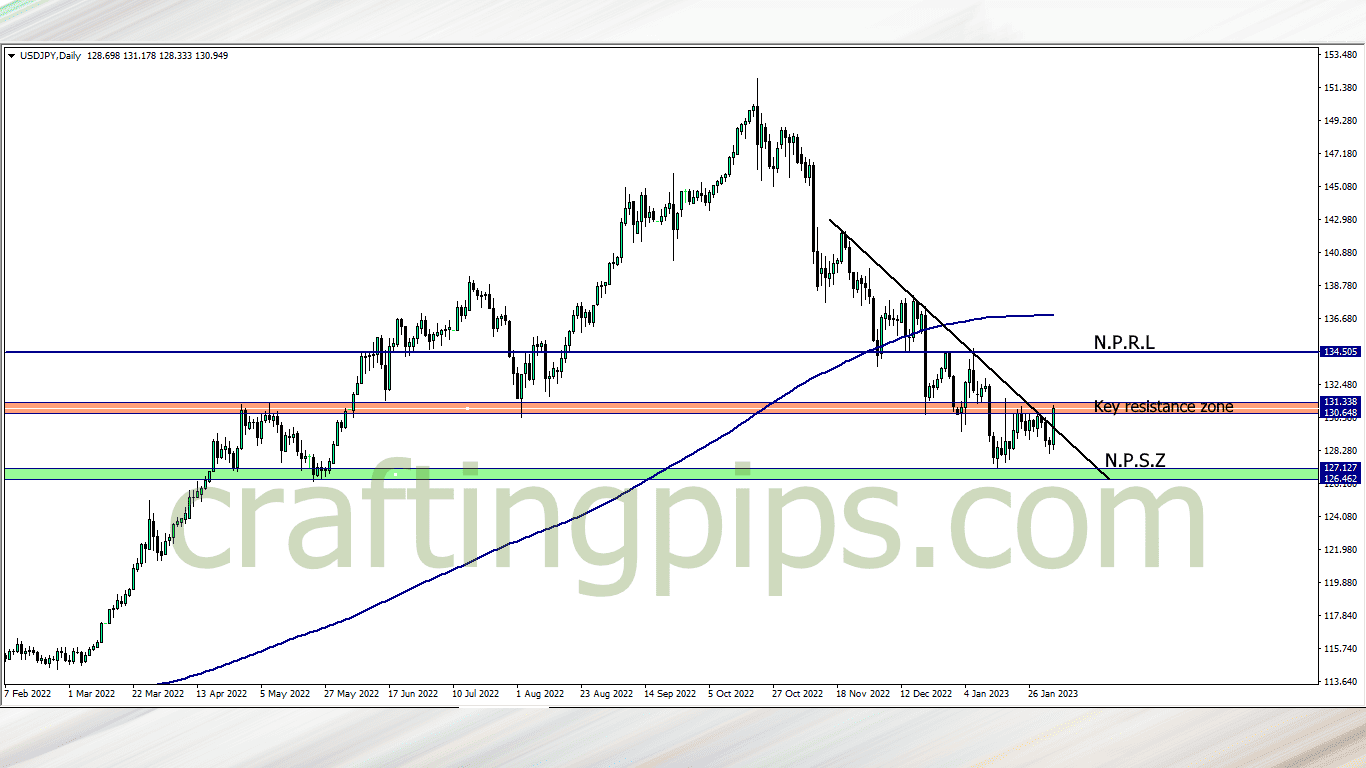

3. USD/JPY

On the USD/JPY, price has revisited a key resistance zone for the second time after forming a higher low.

If the bulls break the key resistance zone this week, we may most likely see price visit NPRL before the week runs out. That is the only reason I will trade USD/JPY, if not, I will observe it this week

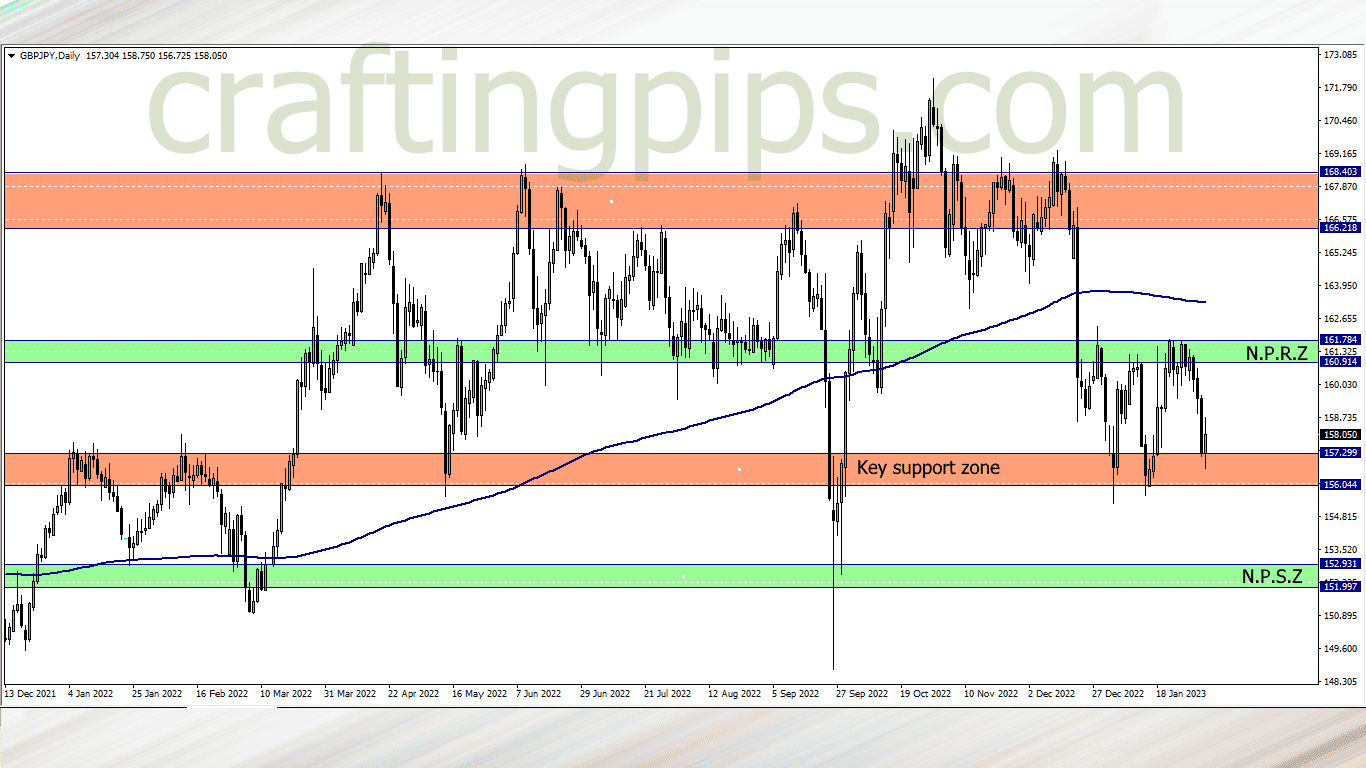

4. GBP/JPY

GBP/JPY is visiting the key support zone for the third time in less than 5 weeks.

Do you thing buyers have what it takes to drive price back to NPRZ?

I will be looking for sell or buy opportunities only if price breaks the key support zone or NPRZ. Buying at this point is risky for me, except I see an interesting setup

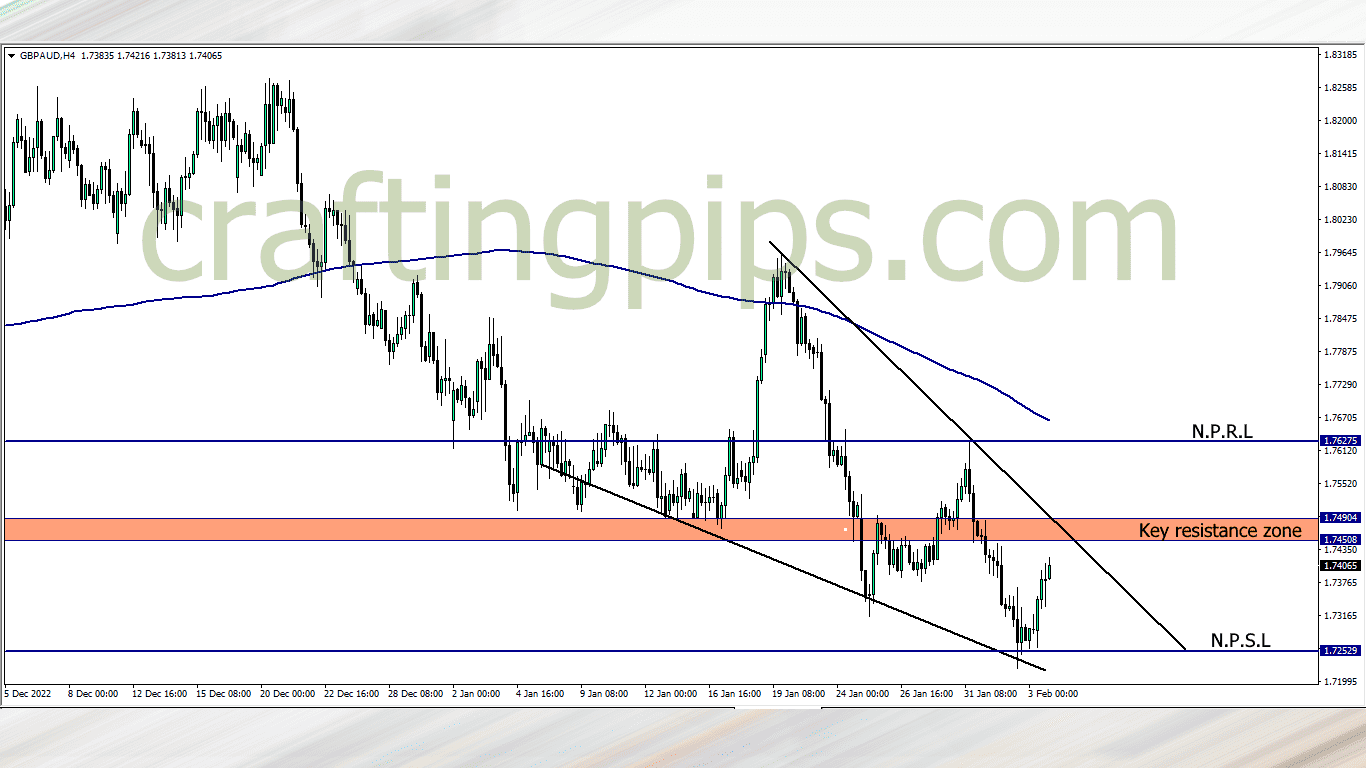

5. GBP/AUD

GBP/AUD is approaching a key resistance zone and if you check out the daily time frame, you will observe that the key resistance zone may most likely be broken this week.

If that happens, I will be joining the buyers and buy to the NPRL. Selling at the key resistance zone could be very risky even if we do get a reversal setup.

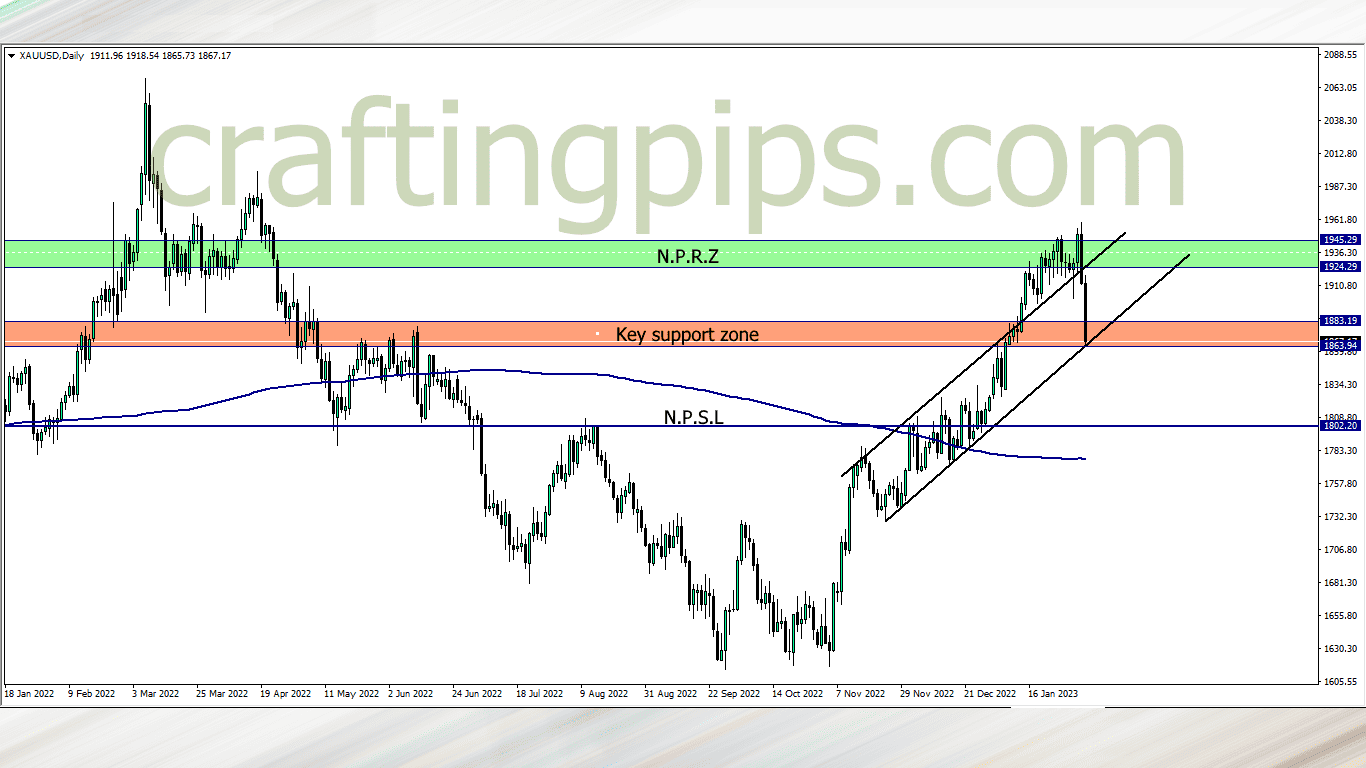

6. XAU/USD (GOLD)

Gold deceived most bullish biased traders last week after giving a false breakout before the deep reversal.

This week we should be looking at the key support zone currently holding price. A breakout below the key support zone at the close of the Monday’s daily candlestick may encourage sellers to come in and push price down to the NPSL.

However, if the close of Monday’s candlestick gives us a doji hanging above the key support zone, then we may wait for additional bullish confirmations before buying

What say you?

NOTE:

Hey traders,

If you are into trading for proprietary firms which I believe you should due to the many advantages involved, check out these carefully selected proprietary firms listed below.

The funded trader needs no introduction, as they are currently becoming one of the most sorted proprietary firms in the industry due to their flexible challenge rules which consist of you being able to use an EA (expert advisory or trading robot) on one of their packages.

Also their packages are pretty affordable, which also comes with unlimited trials even if you fail to hit the set target within the 35 days period.

If you are interested in getting a 5% discount upon purchase, hit THE FUNDED TRADER and use THE0CRAFTER as the coupon code