Hello traders,

let’s hit them charts:

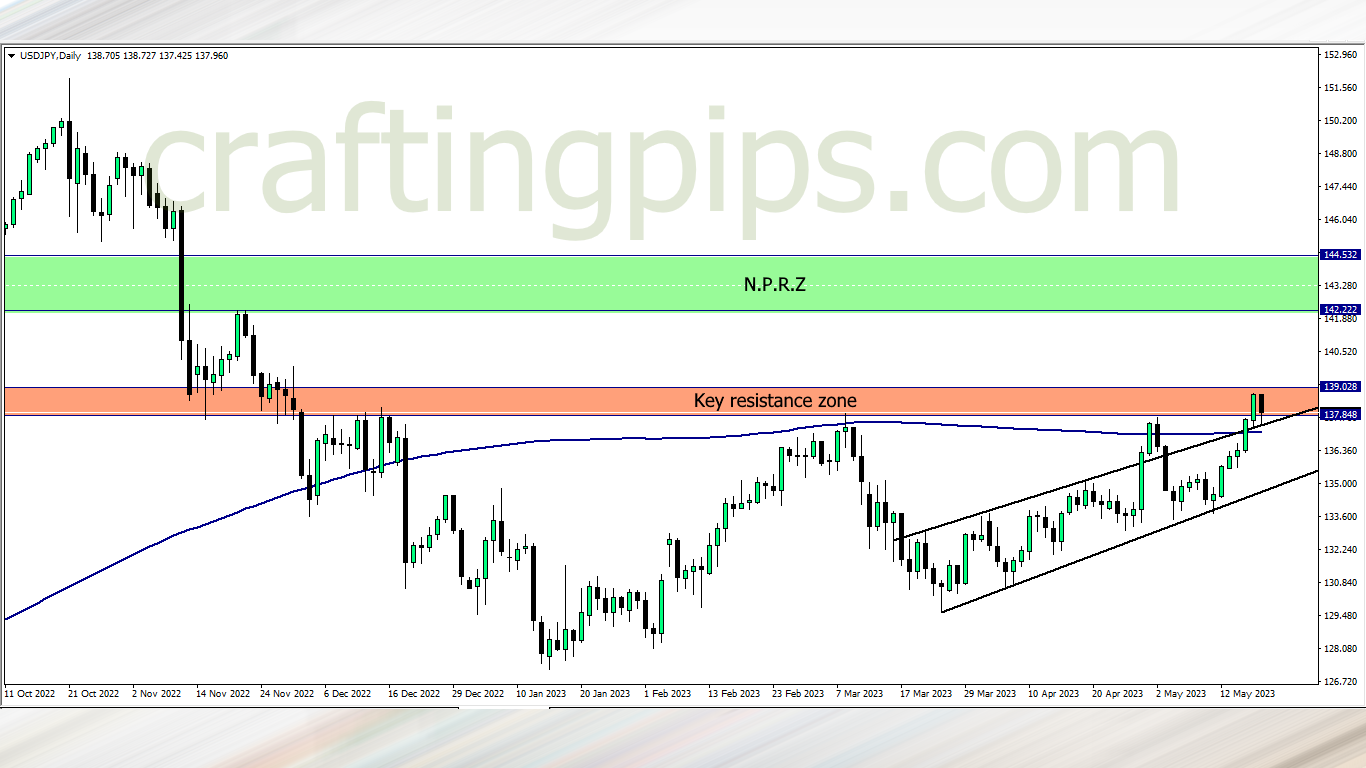

1. USD/JPY

Last week we saw price breaking a 5 months old key resistance level (137.848) before retracing

The retracement will become a reversal only if the 200 ma which is our last support level holding price, gives way. If not, then price is most likely to completely break the key resistance zone, and head to NPRZ

2. USD/CHF

The month’s old resistance zone was broken last week Wednesday, and on Friday we got a 50% retracement.

We have two components still supporting our bullish bias:

- The ascending trendline has acted as an area of value since the beginning of May, so the bulls are more likely to become dominant this week

- The 200 ma is just below the key support zone.

A bullish confirmation candlestick may do the trick this week, and our first target should be 0.90554

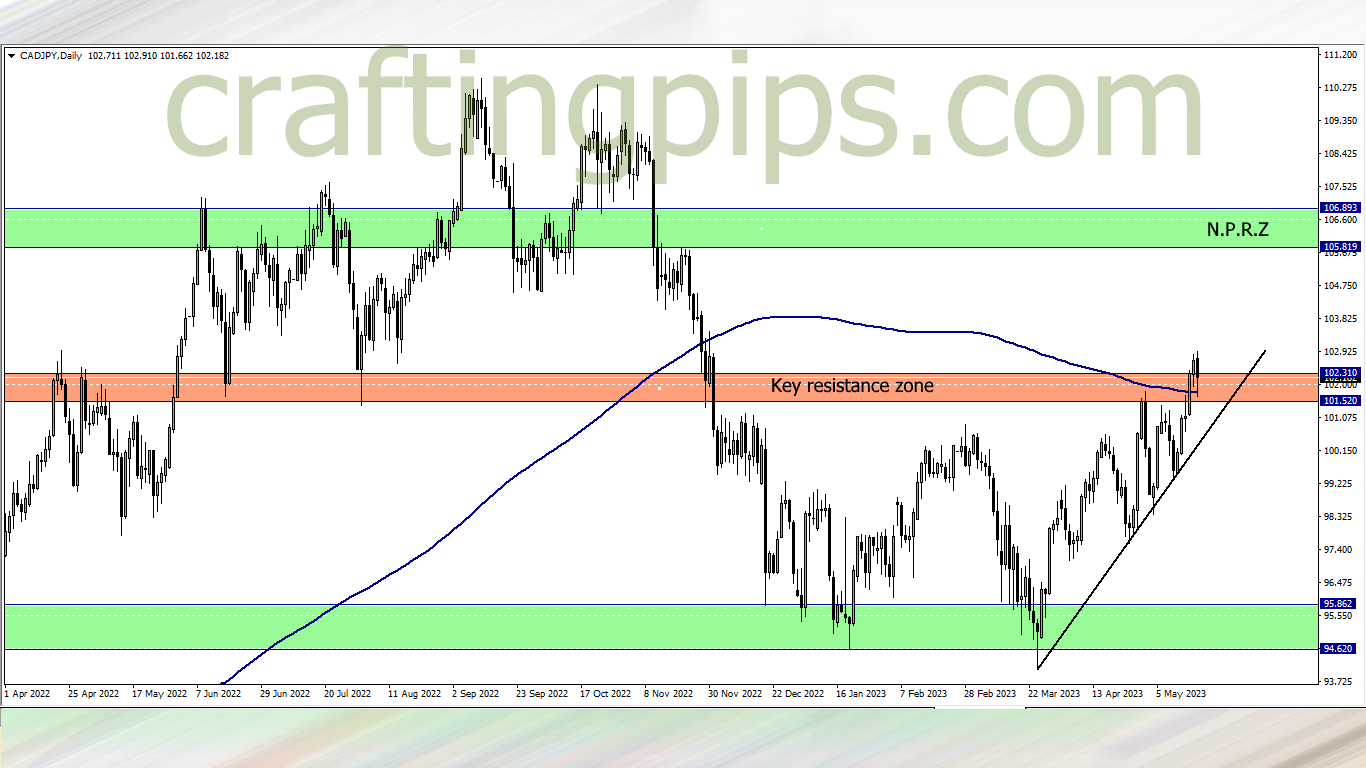

3. CAD/JPY

A 6 months old resistance zone finally got broken last week Thursday.

The bears dominated Friday, which gave us a retracement that pinched the 200 ma on the daily time frame. This week, waiting for the close of the Monday candlestick is paramount.

If the bulls use the 200 ma and the key resistance zone as a springboard, then our next possible resistance zone should be the zone marked green. This is over 300 potential pips for trader who will be trading the CAD/JPY.

You don’t have to grab all those pips, just a few with a good R/R is all you need this week.

What say you?

NOTE:

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.tech/purchasechallenge/?sl=758

- BESPOKE FUNDING PROGRAMME: https://www.bespokefundingprogram.com/The_Crafter?ref=The_Crafter