Hello Traders,

welcome to the last week of the third quarter. There are three setups I am interested in as soon as the market comes alive. These setups are:

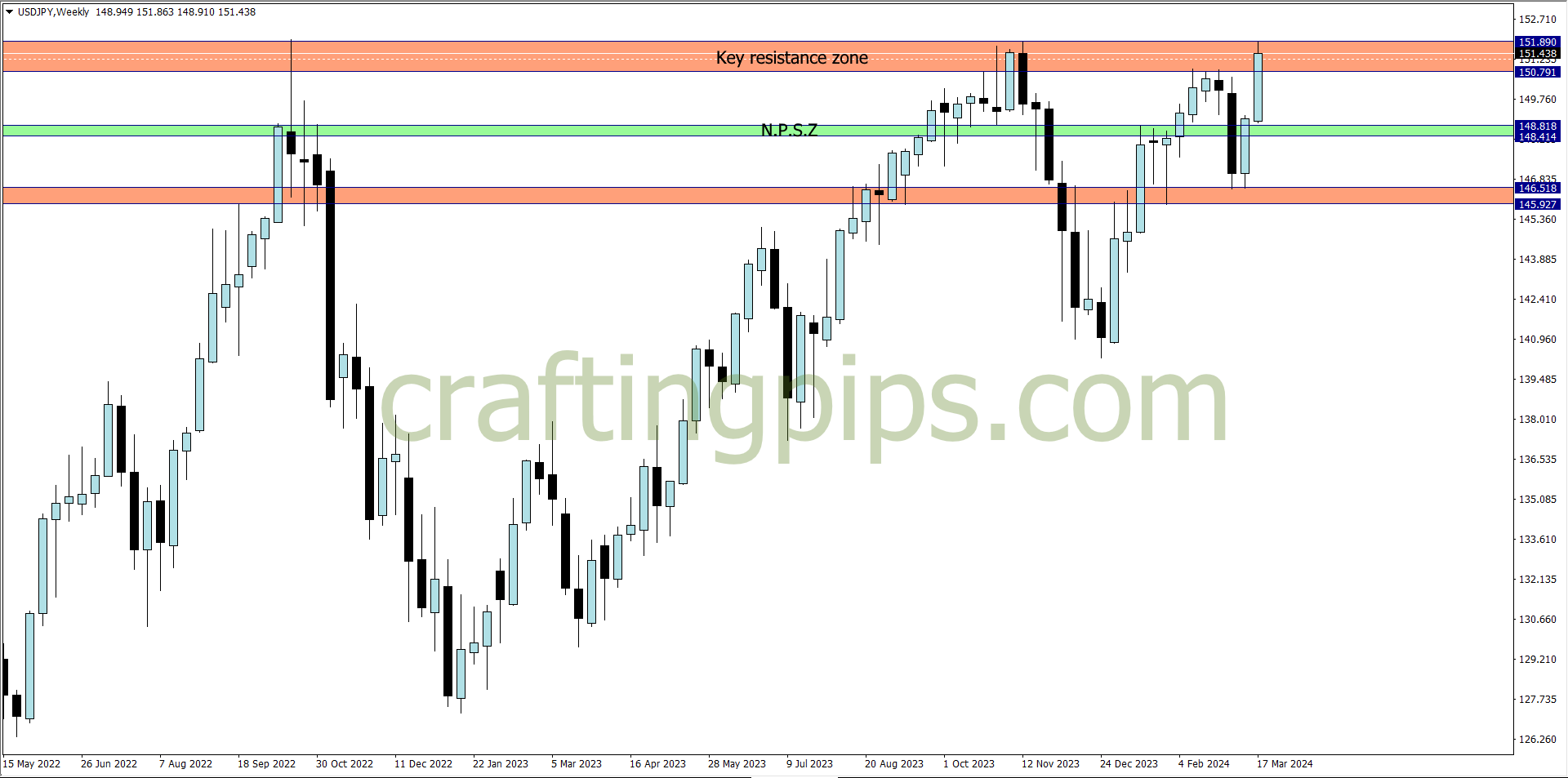

1. USD/JPY

Since January of 2023, price has been making higher lows on the USD/JPY.

We are currently looking at a triple top on the weekly time frame. The last two tops were formed within 4 months, and the first two tops were formed within a year.

That goes a long way to show that we are more likely to see a breakout within the week. However, we should also be cautious, because a bullish breakout is not certain till the weekly candlestick closes

Personally…,

I will be waiting to see how the Monday’s candlestick closes. A bullish breakout means I will be looking for short buy opportunities, and a strong bearish pin-bar at the close of Monday means I will be looking for short sell opportunities

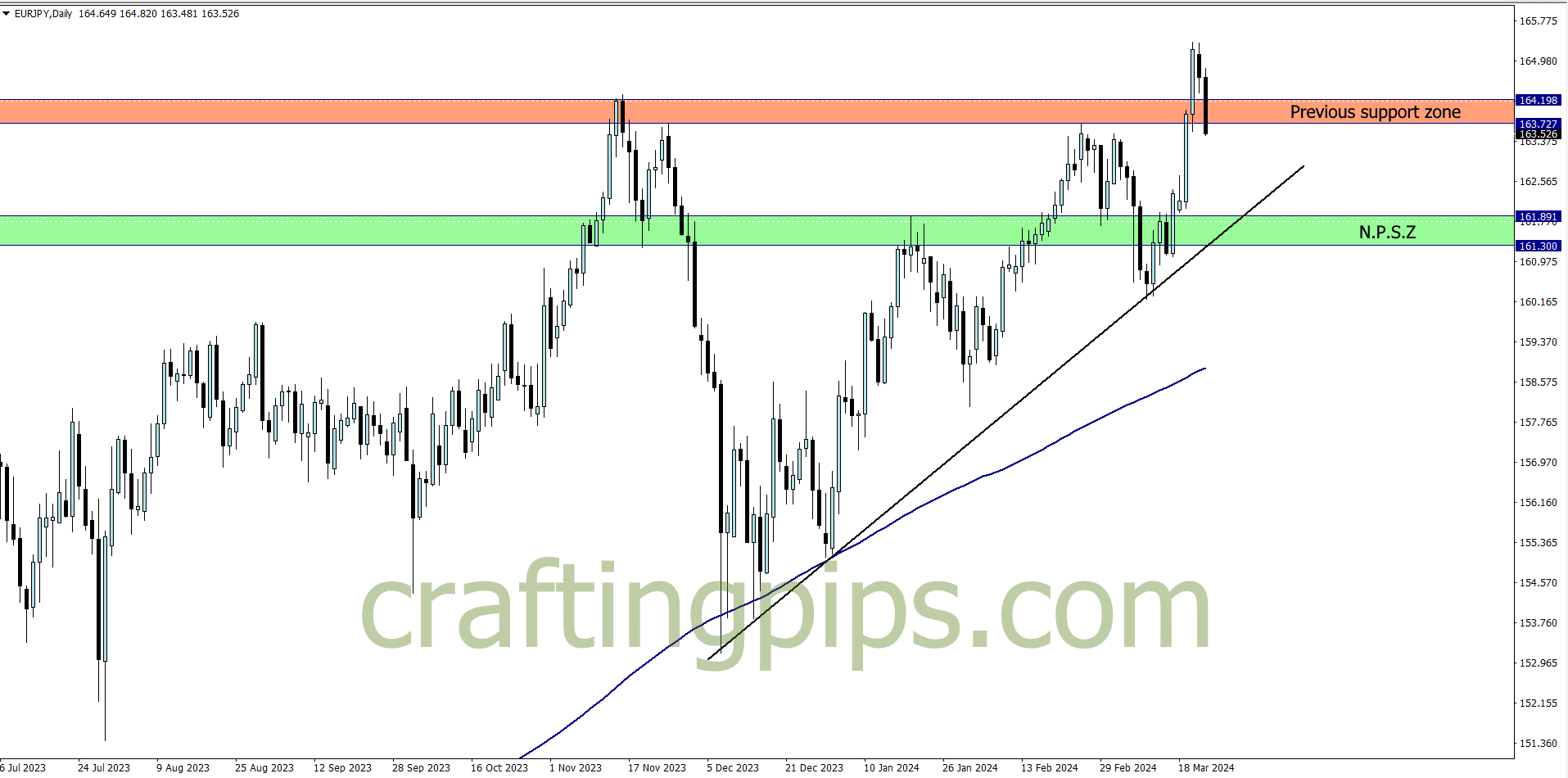

2. EUR/JPY

EUR/JPY is looking very interesting.

The strong resistance zone that was broken on Wednesday (the last time it was broken was June of 2008) was a fakeout, so buyers lost their steam on Thursday and Friday, hence butchering swing traders who bought on Wednesday.

This week I foresee the bears continuing their campaign, and we are most likely going to see NPSZ get hit. So as market resumes, I will be hoping for a little retracement before joining the party

3. NZD/USD

I am delighted that NZD/USD broke a key support zone on Friday, just before the market closed, so this week I will be hunting for sell opportunities in the market

Hopefully we ride the breakout to NPSZ

What say you?