Hello traders,

let’s hit them charts:

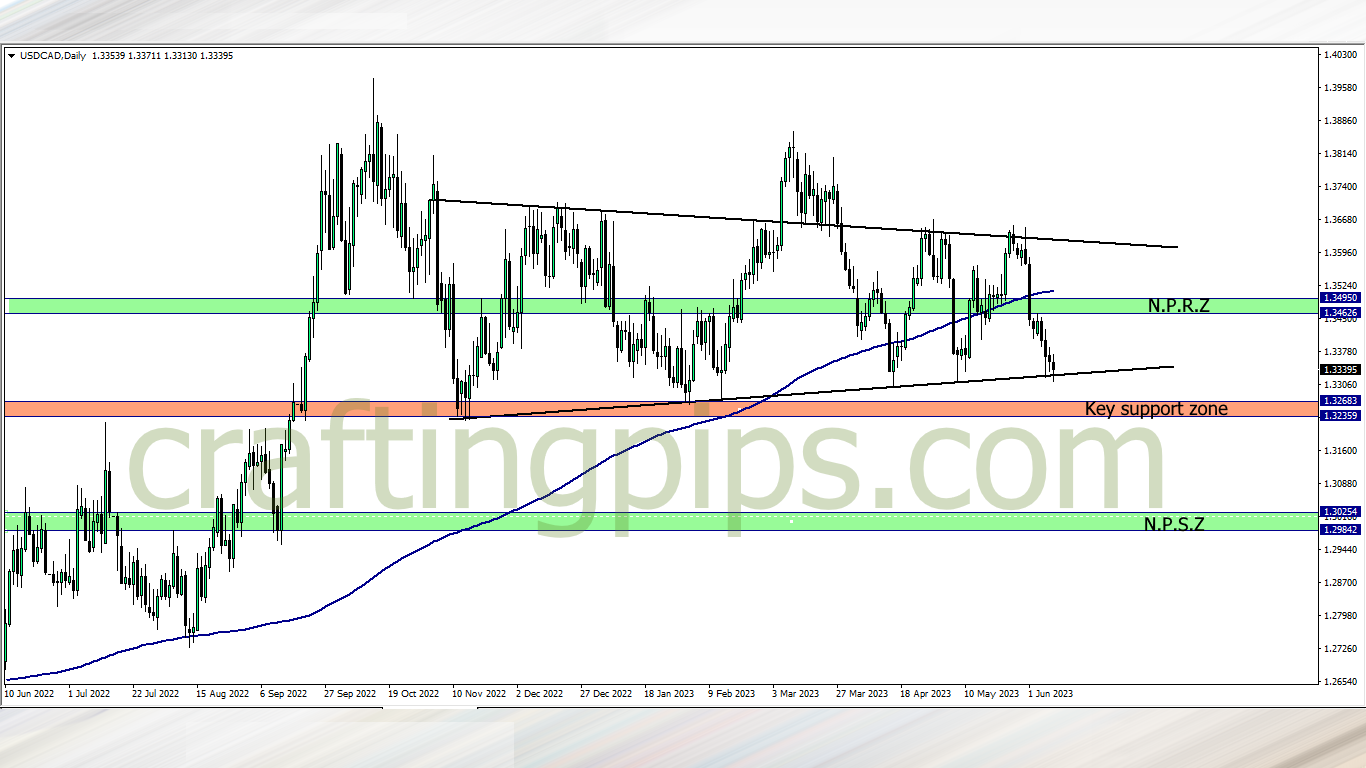

1. USD/CAD

We can see a triple bottom on the USD/CAD, also an active key support zone that may give sellers a tough time this week.

I am expecting a reversal at this point, but until I see a bullish engulfing candlestick at the close of Monday’s daily candlestick, I will be staying on the sidelines. That said, we may see the bears continue their campaign this week.

If that happens, I will wait to see the key support zone get broken before I join the sellers to the NPSZ

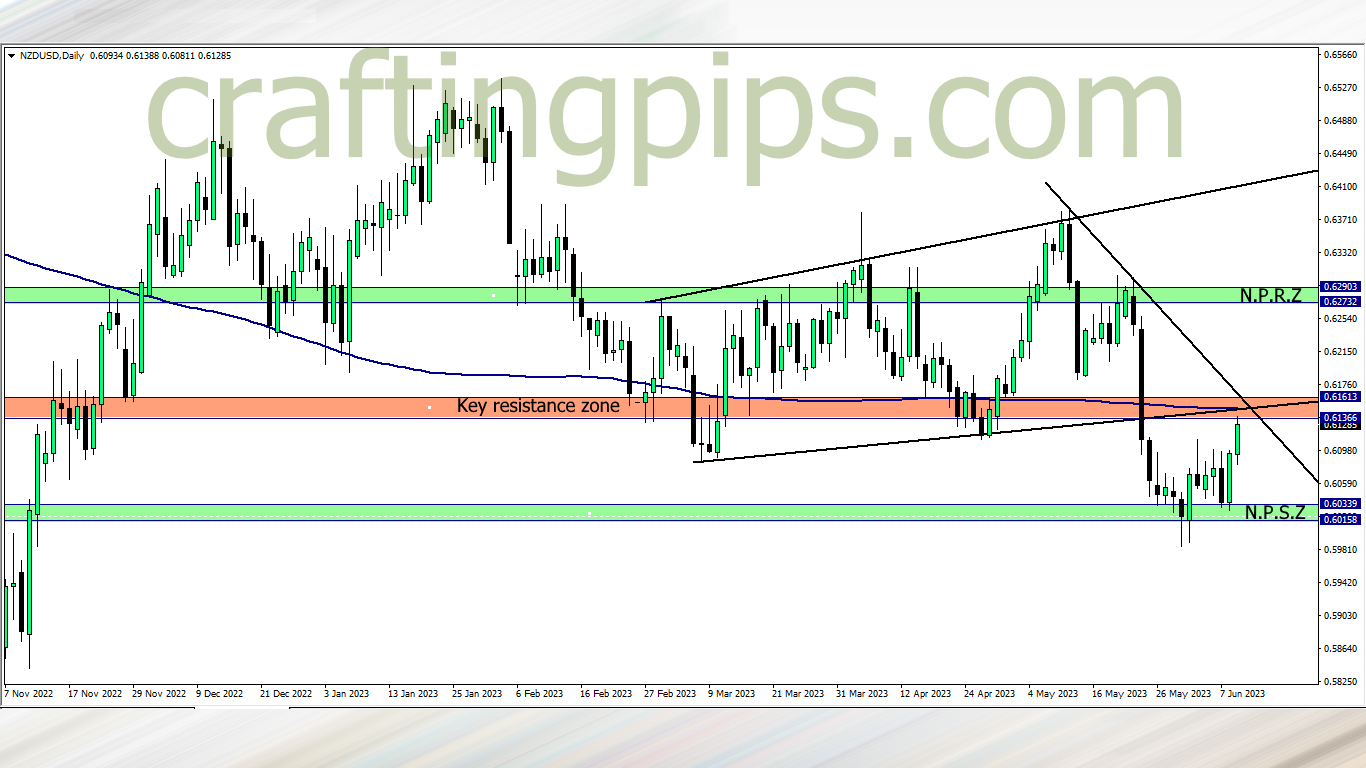

2. NZD/USD

On the NZD/USD, we can see price revisiting the key resistance zone and 200 ma.

There is a huge possibility that we may see a reversal this week that may encourage sellers to take price back to NPSZ. However, if the bulls are aggressive and price break the key resistance zone, then price next stop is most likely to be NPRZ

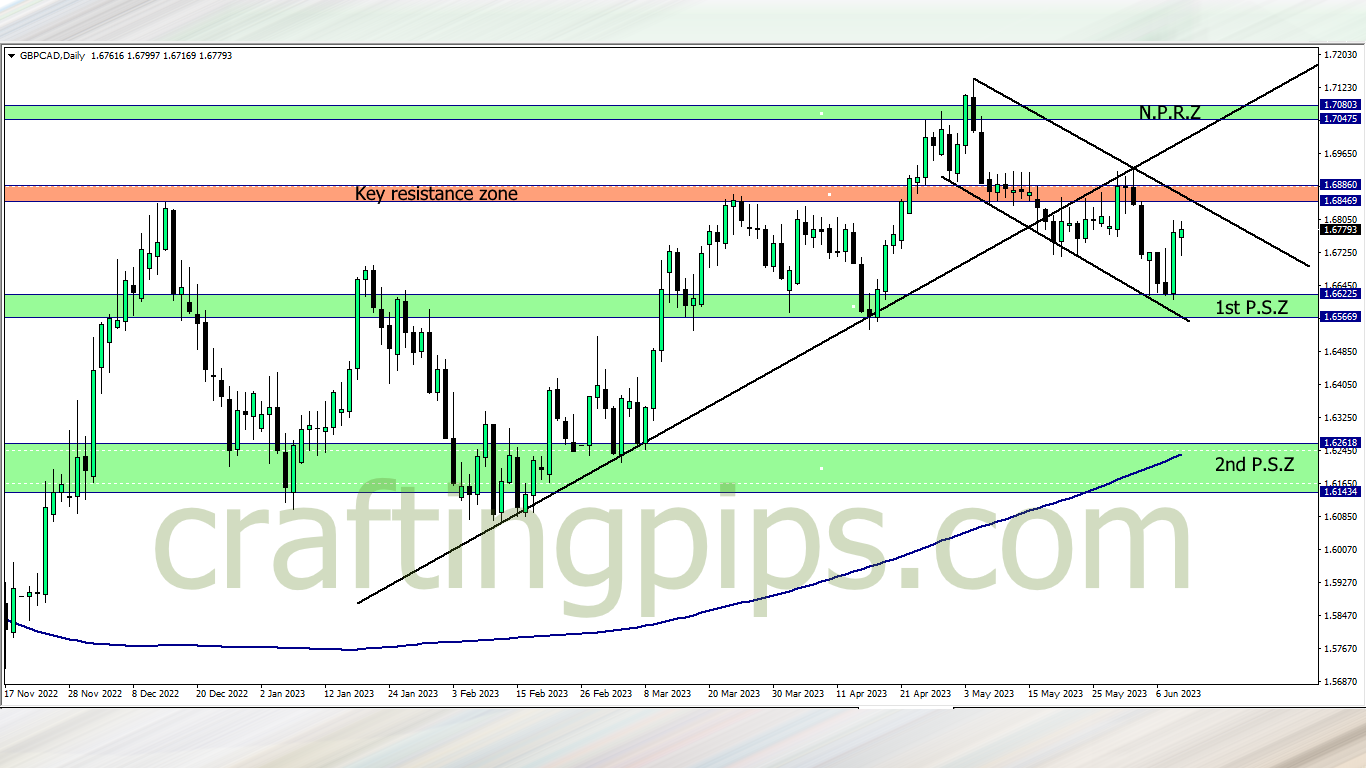

3. GBP/CAD

On the GBP/CAD, we can see price retesting a key resistance zone.

We can also spot a descending channel, which makes this setup more viable. If we do get a rejection/multiple rejections of price at the key resistance zone, then joining the sellers to 1st PSZ won’t be a bad idea.

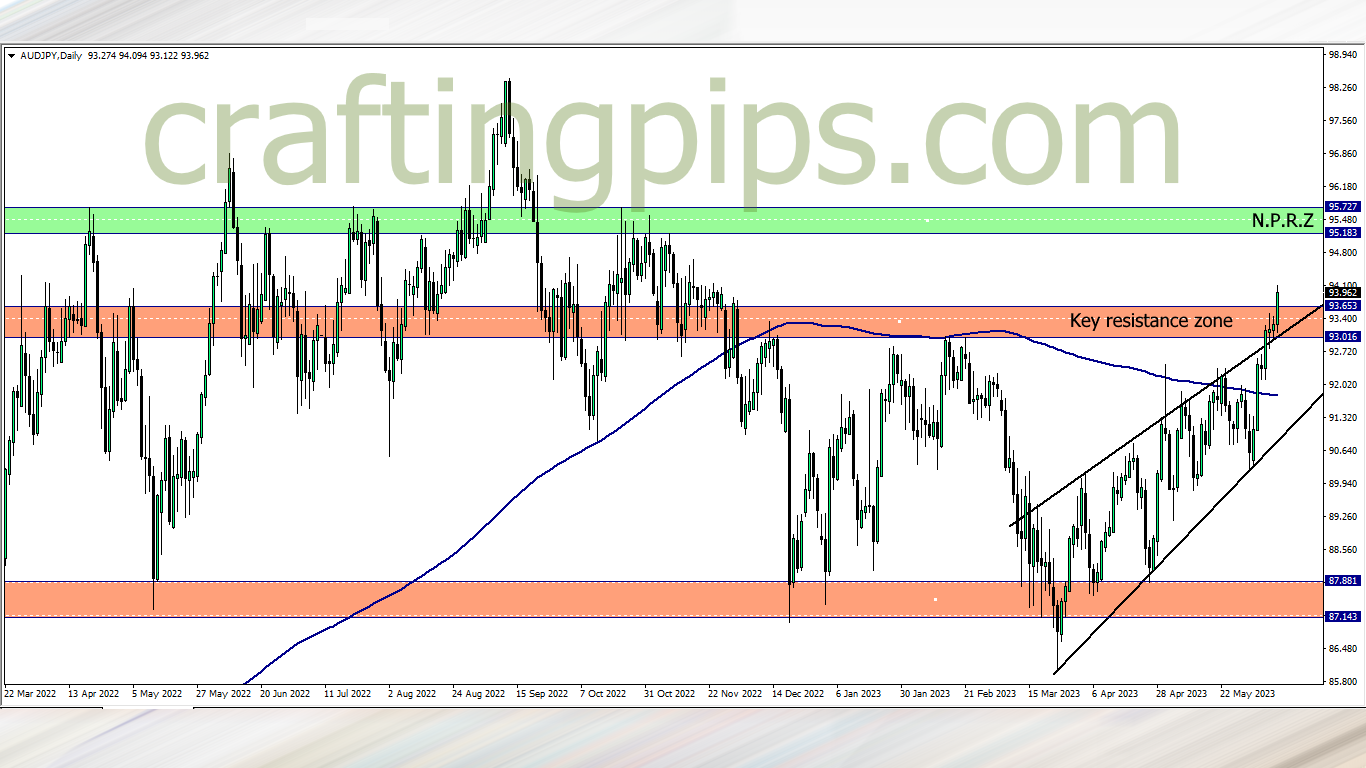

4. AUD/JPY

AUD/JPY closed being heavily bullish last week.

Though the key resistance zone was broken last week, and jumping in with the buyers is extremely tempting, I suggest waiting for a pullback will be better, just to get a better risk to reward.

What say you?

NOTE:

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.tech/purchasechallenge/?sl=758

- BESPOKE FUNDING PROGRAMME: https://www.bespokefundingprogram.com/The_Crafter?ref=The_Crafter