Hey traders,

This week is packed full with decent setups, let’s hit the charts:

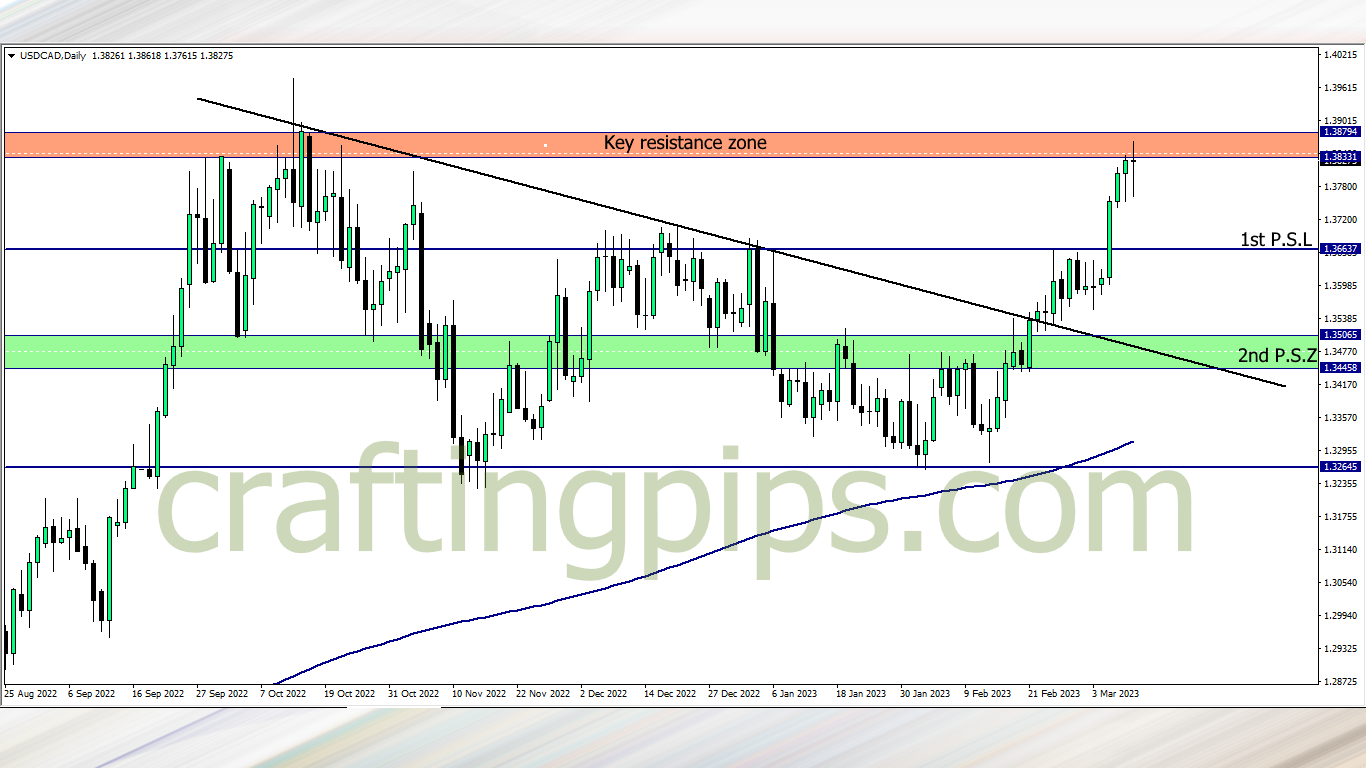

1. USD/CAD

Price on the USD/CAD has reached a key resistance zone that was last visited October 2022.

There is a huge probability that price could hit 1st PSL this week, even if price ultimately breaks the key resistance zone. and if the 1st PSL gets broken during the week, our next possible support zone is marked green in the chart.

If the key resistance zone for any reason breaks… USD/CAD will spill over 500 pips before the close of March

2. GBP/USD

GBP/USD kissed the 200 ma and key resistance zone in the last few hours before the close of market on Friday.

If we do get a bearish confirmation as the market opens, Monday and Tuesday may be a good time to sell GBP/USD and use NPSZ as our target profit

3. AUD/USD

On the AUD/USD we can see 3 bearish pinbars… What does that tell you?

The bears are chilling, feeding fat and getting ready to slay the bulls this week. All we need is a breakout on the lower time frame and hell will be unleashed against the bulls this week.

We may most likely see price fall over 150 pips to the NPSZ

4. GBP/CHF

I spot a weak support zone on the GBPCHF. Price has revisited the same zone for the fourth time now.

The last time price visited this zone, price reluctantly moved upwards, formed a lower high, and it came back to the support zone. I smell a possible breakout this week. If that happens, then price first bus stop will most likely be 1st PSL, and if that gets broken, then 2nd PSL will be price next stop

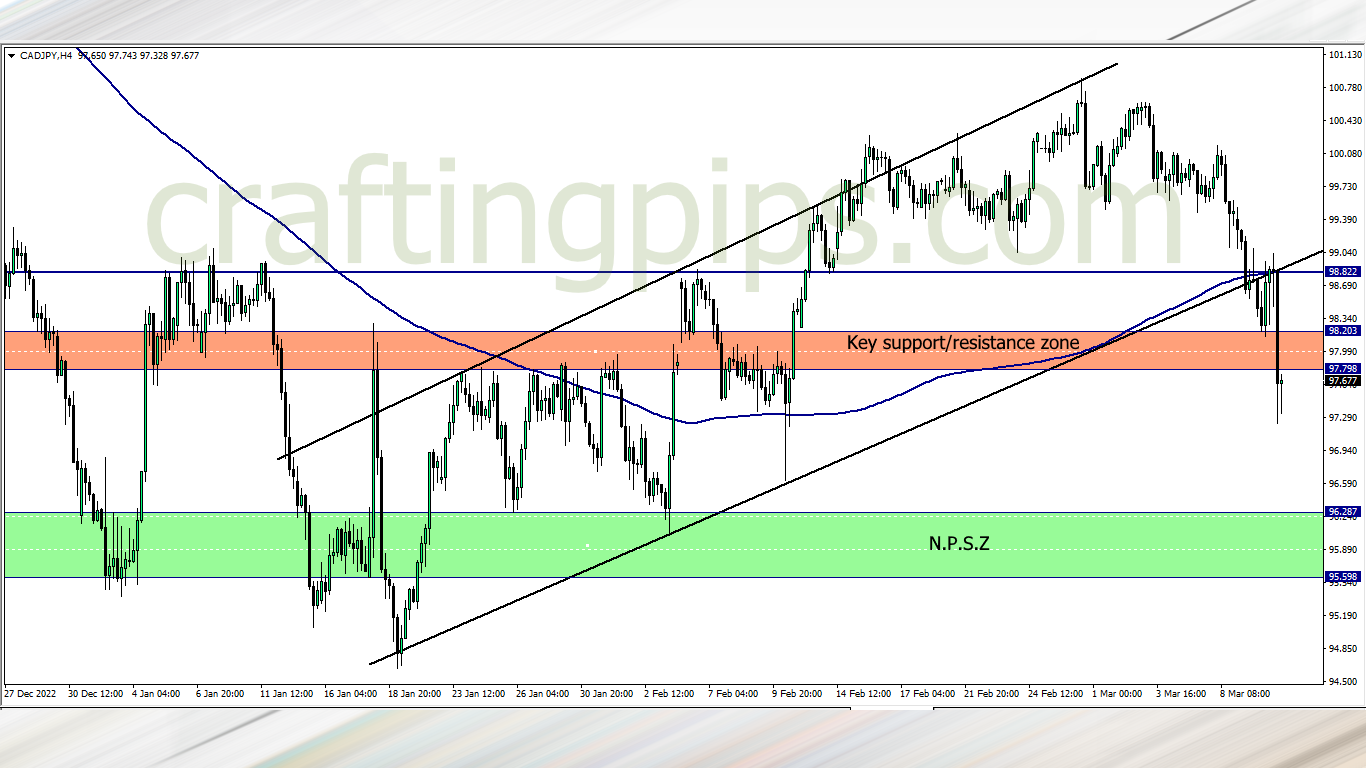

5. CAD/JPY

We expected this move on CAD/JPY, and price moved exactly the way we speculated, as seen on our Friday market analysis

This week there is a huge probability that we may see a small pullback before price further drops to the NPSZ

What say you?

-

FIDELCREST: https://fidelcrest.com/#CRAFTER

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.com/#a_aid=THE_CRAFTER