Hello traders,

let’s hit them charts:

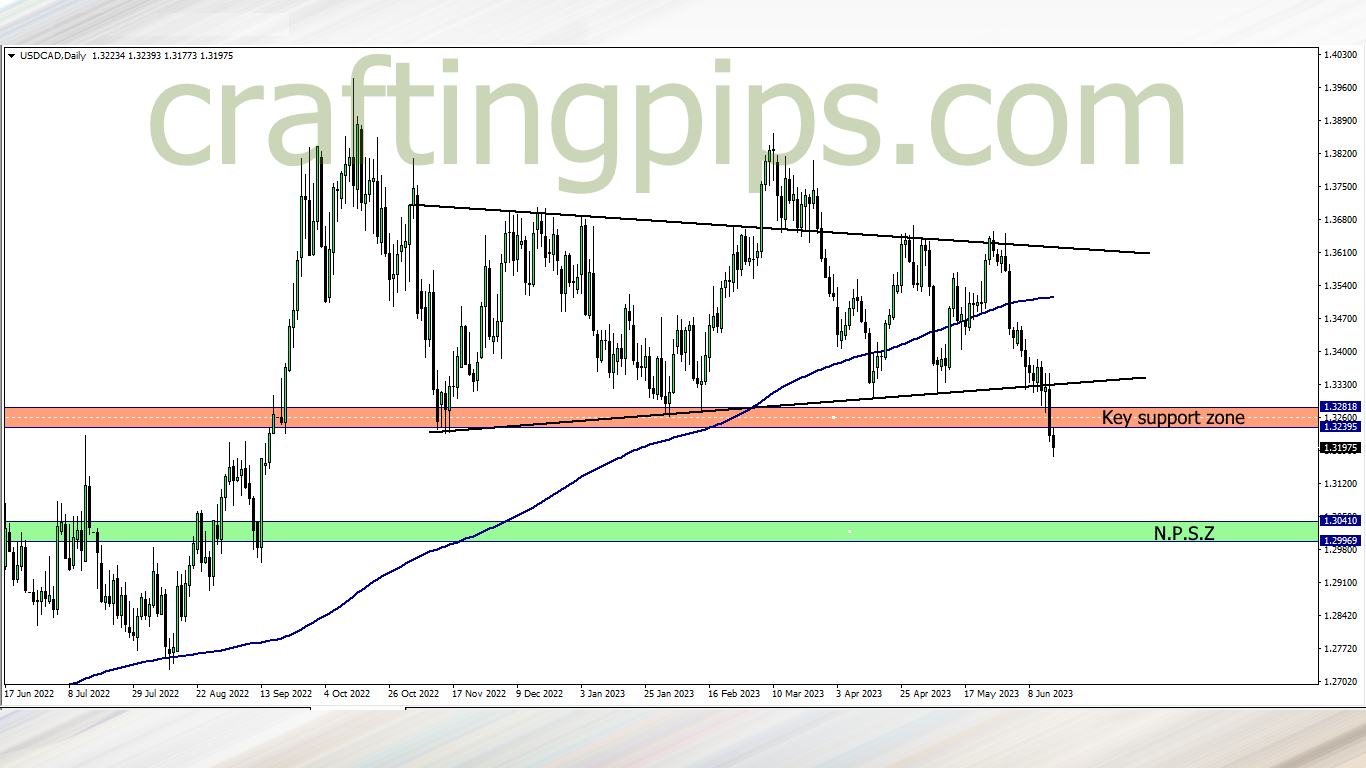

1. USD/CAD

In the past few weeks, USD/CAD has become my most popular pair to trade. It was part of my Friday market analysis , and it was the last trade I took last week as seen in my trade journal

This week I will be looking for an opportunity to re-enter a sell position. We may start the week with a retracement, If that happens and it gives me a setup I like, then I will be riding it’s fall to the NPSZ

2. AUD/USD

Six months ago was the last time price broke the key resistance zone on the AUD/USD.

Last week we saw the bulls question the key resistance zone. This week I will be watching out for a breakout. Once that happens, then NPRZ will be our next bus stop

3. USD/JPY

On the USD/JPY, price has hit the roof of the key resistance zone. Don’t forget that all JPY pairs are heading to the moon.

This week, all I will be watching out for is: The close of the daily candlestick on the USD/JPY. If we do get a close above the key resistance zone, then I will be joining the aggressive buyers to the NPRZ

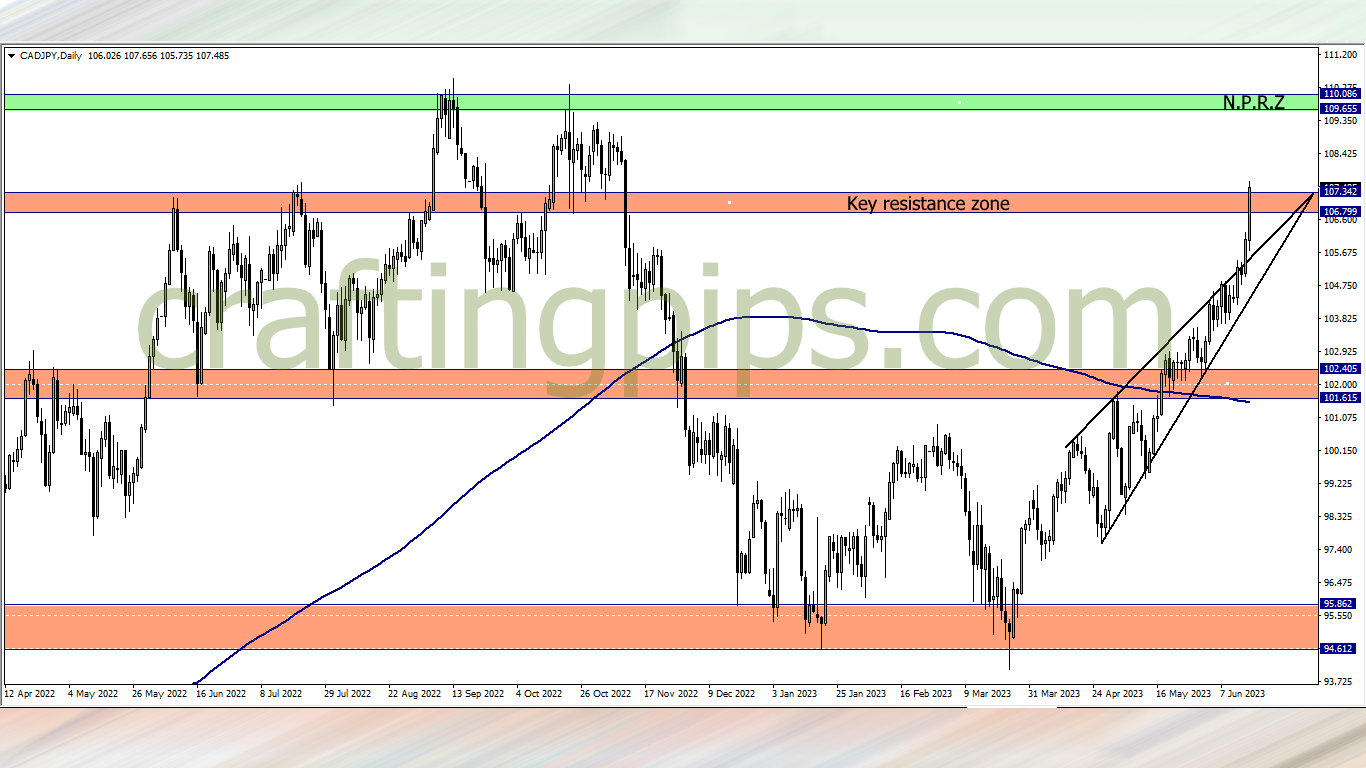

4. CAD/JPY

October last year was the last time price broke the key resistance zone.

Last week we saw aggressive bulls partially break the 8 months old resistance zone, This week all we can do is wait to see how the Sunday/Monday daily candlestick closes before joining in.

If the bullish move is confirmed, then we will ride with the buyers to the NPRZ. If we do get a pullback/retracement, we will wait and see how well it fairs against the ascending trendline which will be serving as a support level

5. CHF/JPY

Since 2001 till date (over 20 years), price has only hit resistance level 159.581 just once.

If you are buying, be cautious as the week may present consolidations at this level.

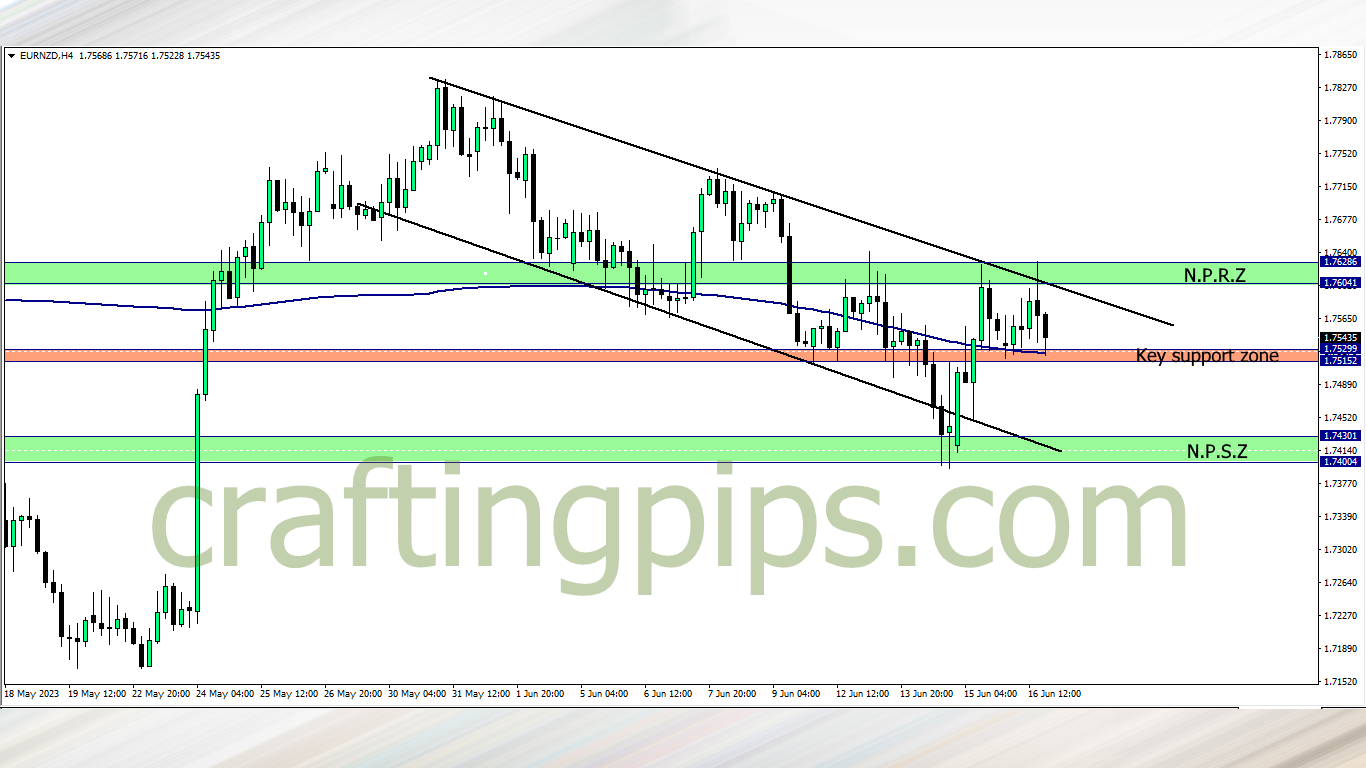

6. EUR/NZD

I was asked by Oluwaseyi, who is a member of our trading community to do an analysis on EUR/NZD, so let’s go right ahead.

Last week, Euro and the New Zealand dollar were bullish, and this can be seen in the consolidation of price on EUR/NZD, and how well the 200 ma is holding price.

This week, if Euro loses steam and NZD continues it’s bullish campaign, we may most likely see price fall below the key support zone, then we could join the sellers, but I must advice traders to place a generous stop loss as this pair has proven to have deep retracements when on the move

What say you?

NOTE:

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.tech/purchasechallenge/?sl=758

- BESPOKE FUNDING PROGRAMME: https://www.bespokefundingprogram.com/The_Crafter?ref=The_Crafter