Hello traders,

let’s hit the charts:

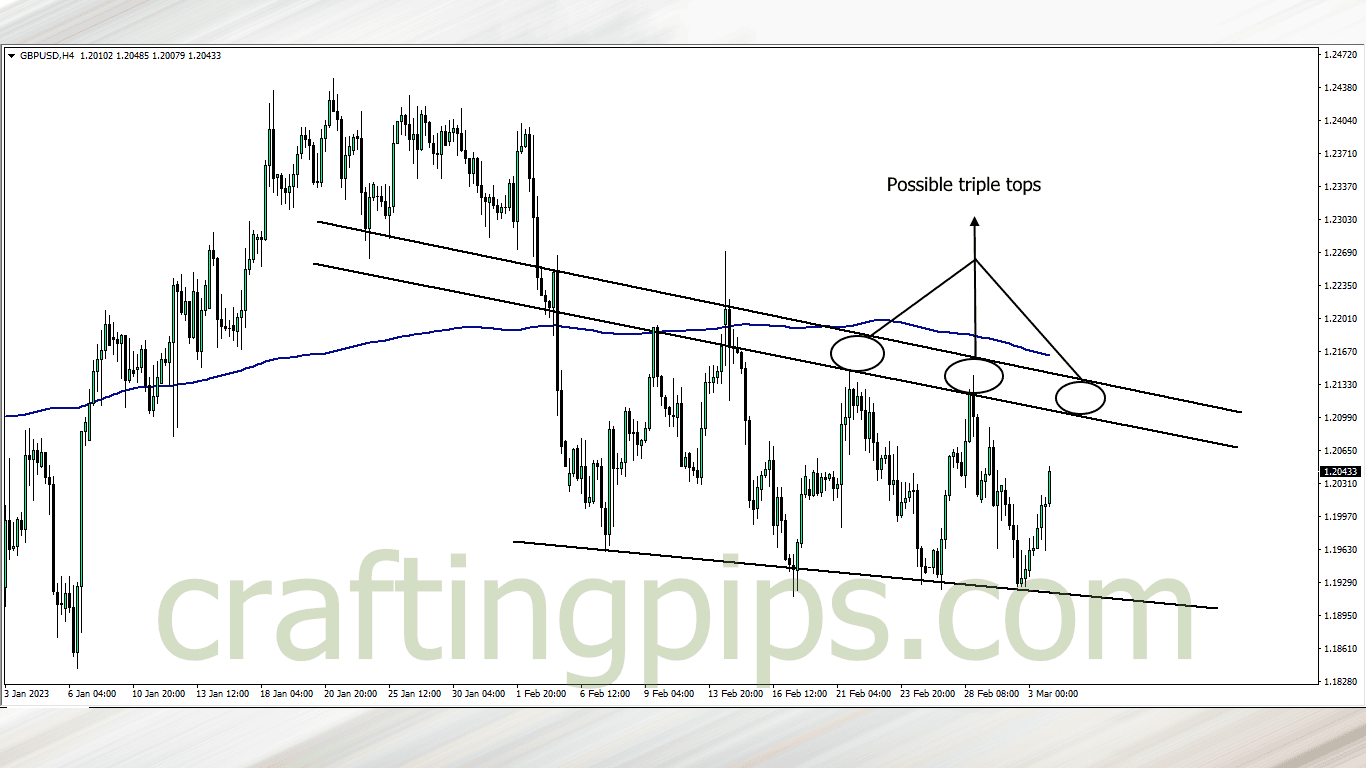

1. GBP/USD

On the GBP/USD, price has formed a consolidation within a descending channel.

This week if price continues with the consolidation, we may see a triple top play out, and price may re-visit support level 1.19288. My bias is bearish due to the pattern formation and the role the 200 moving average is playing in this setup.

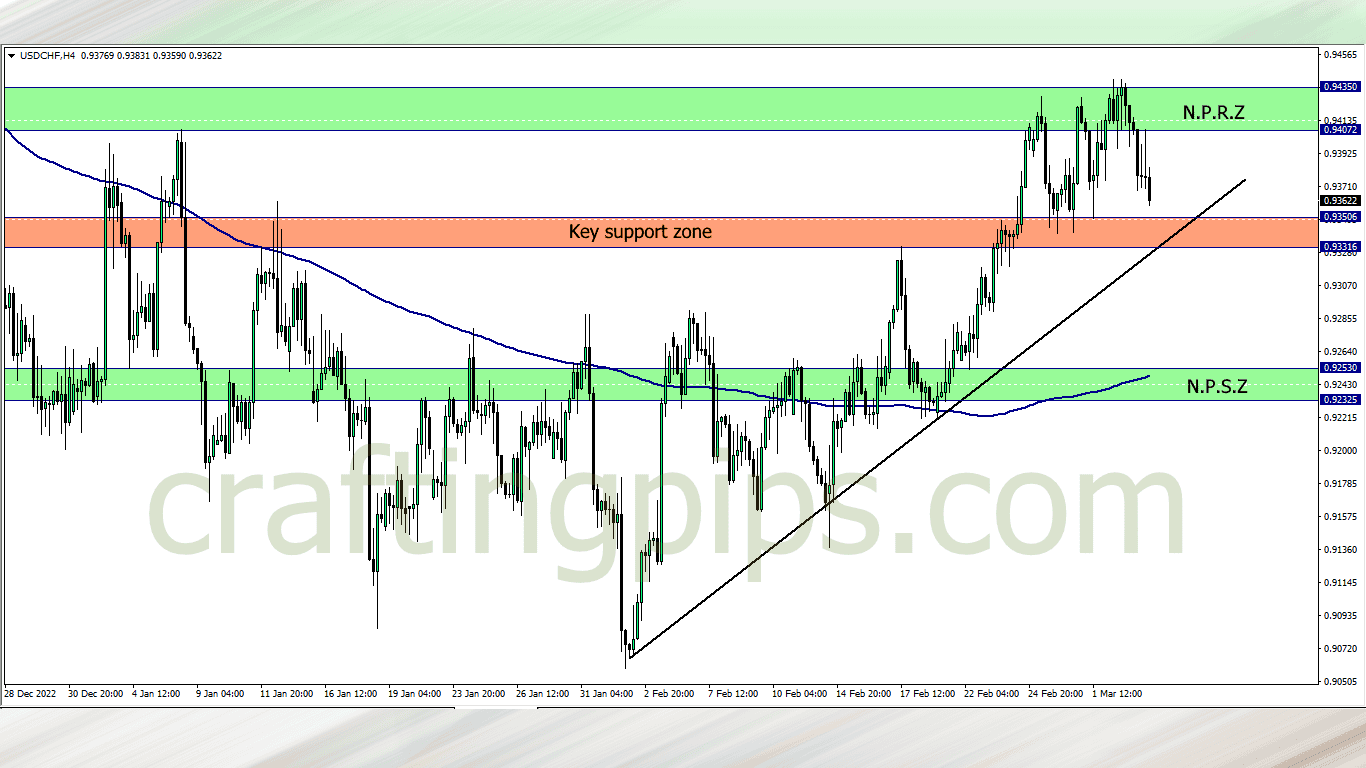

2. USD/CHF

Another consolidation can be spotted on the USD/CHF. I will wait to see how price reacts to the key support zone.

If we do get a candlestick pattern that suggests the entrance of buyers into the market, then I may join the buyers back to the N.P.R.Z. My bias here is bullish

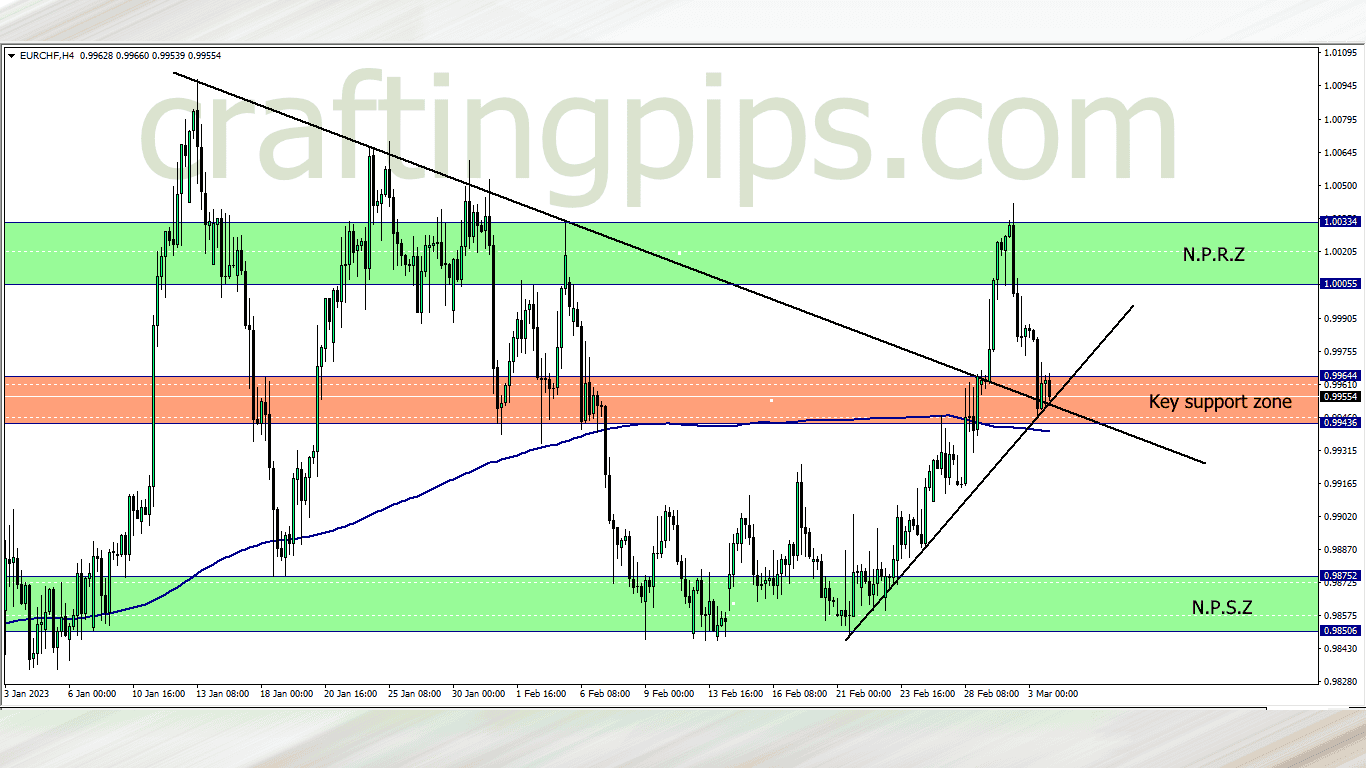

3. EUR/CHF

A possible pullback is spotted on the EUR/CHF.

It will take a lot for the bears to break the key support zone and 200 ma. So if the week presents us with a bullish confirmation, then we may join the buyers to ride price back to NPRZ.

That said, there is a possibility that the bears may come in strong this week and break the key support zone and 200 ma. If that should happen, then NPSZ will most likely be our next target.

What say you?

-

FIDELCREST: https://fidelcrest.com/#CRAFTER

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.com/#a_aid=THE_CRAFTER