Hello traders,

let’s hit them charts:

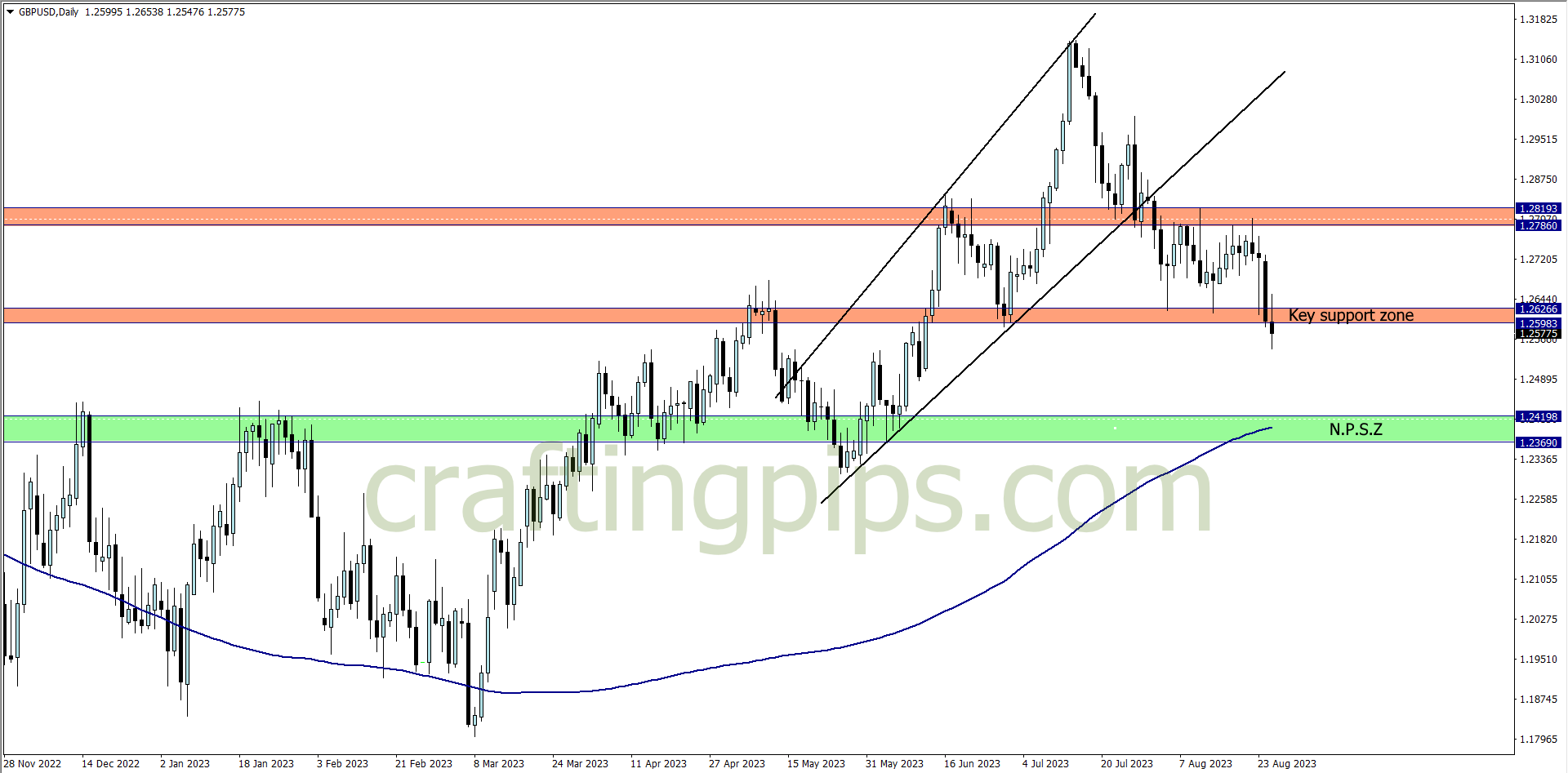

1. GBP/USD

Head and shoulder loading on the GBP/USD.

The neckline of the head and shoulder was partially broken last week before the close of market. This week, looking for a bearish entry confirmation won’t be out of place.

The green zone is price’s NPSZ

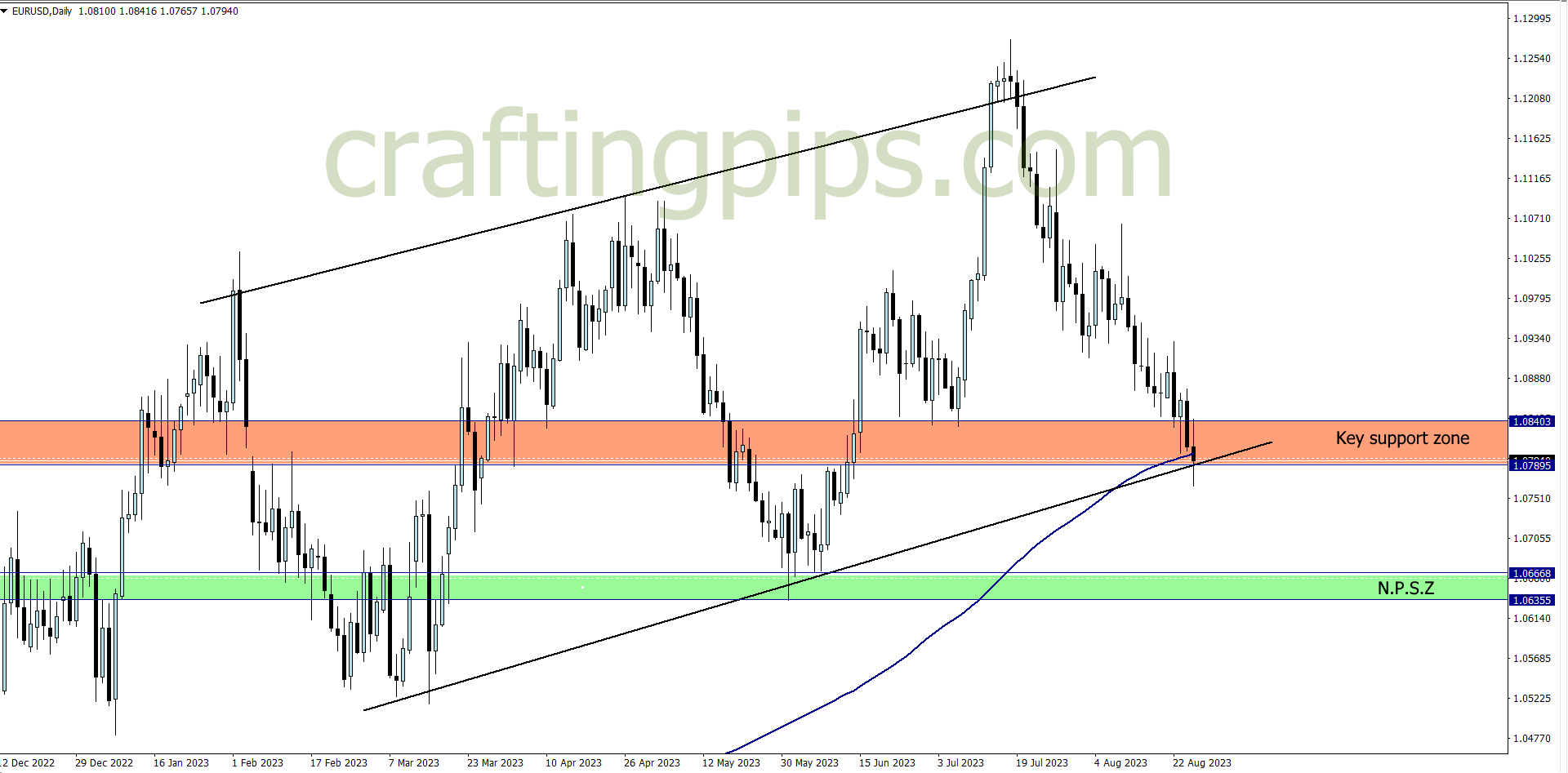

2. EUR/USD

Ascending channel spotted on the EUR/USD.

Though last week closed with bears dominating the market, we can’t conclude by joining the bears since the key support zone and 200 moving is yet to be broken.

Waiting till Monday’s candlestick close is important. A break below both levels(key support zone and 200 moving average) will give us a sell confirmation, and NPSZ will be price next bus stop.

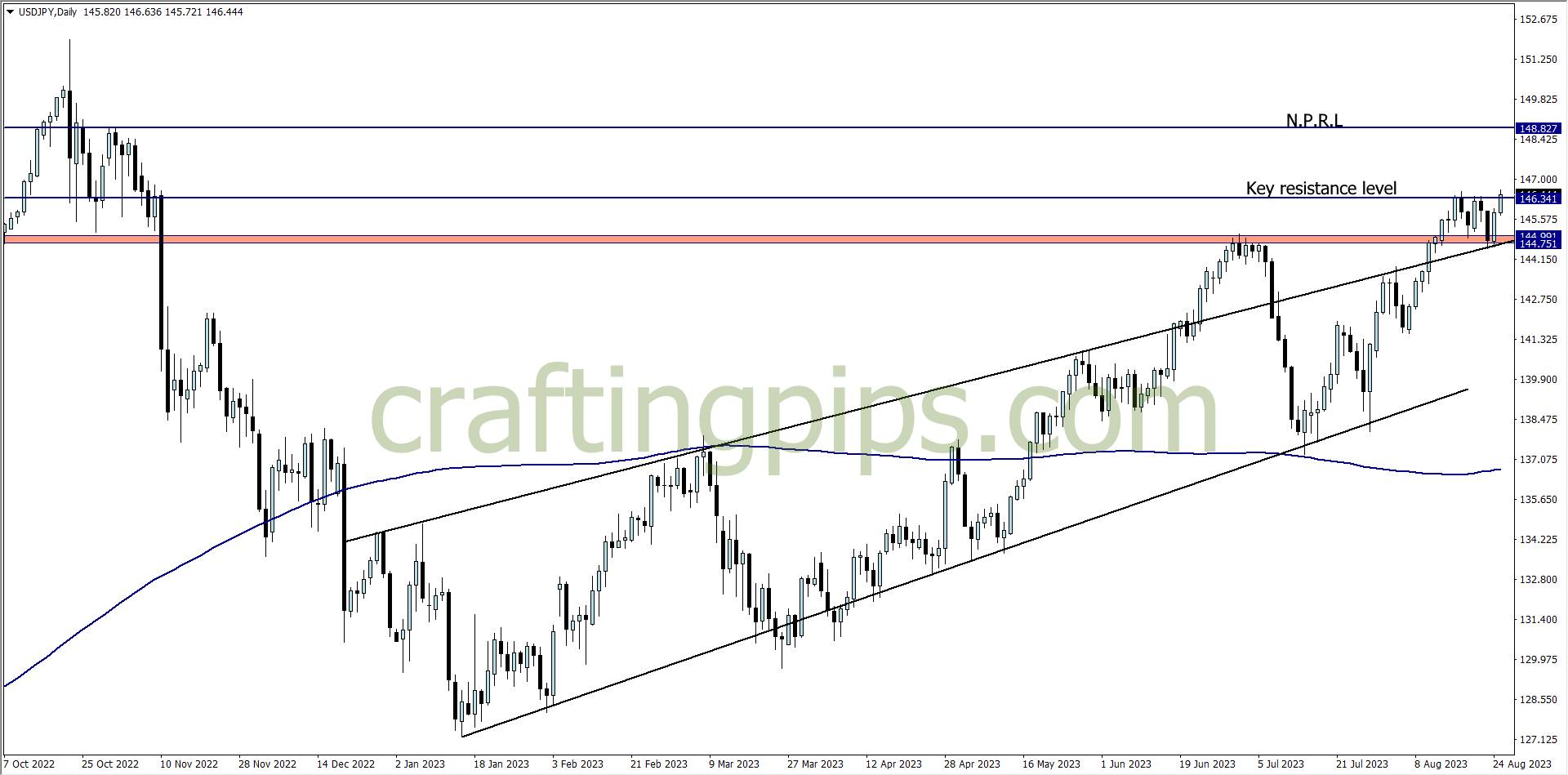

3. USD/JPY

USD/JPY spent slightly over a week in consolidation mode.

Before the close of last week, we saw a partial breakout of resistance level 146.341. This week if you are going to enter a buy position, then use the last swing low as your stop loss, and NPRL as target profits, which is over +200 pips.

If you are not a swing trader, you can explore other means of entering bullish positions on the lower time frame

4. NZD/USD

NZD/USD is another solid setup to watch out for.

At the beginning of last week we saw a pullback, then on Thursday and Friday, the bears established their authority once more. Judging from price minor break below the key resistance zone, there is a huge possibility of a massive bearish explosion this week that could fetch us over 250 pips.

NPSL is price next bus stop

What say you?

NOTE:

-

THE FUNDED TRADER: (use the coupon code: THE0CRAFTER)

- BESPOKE FUNDING PROGRAMME

- FUNDED ENGINEER

- BLUE GUARDIAN (use the coupon code: CRAFTER)

- GOAT FUNDED

- LARK FUNDING

- SKILLED FUNDED TRADER

- MAVEN TRADING

- MY FLASH FUNDING