Good day traders,

let’s hit the charts:

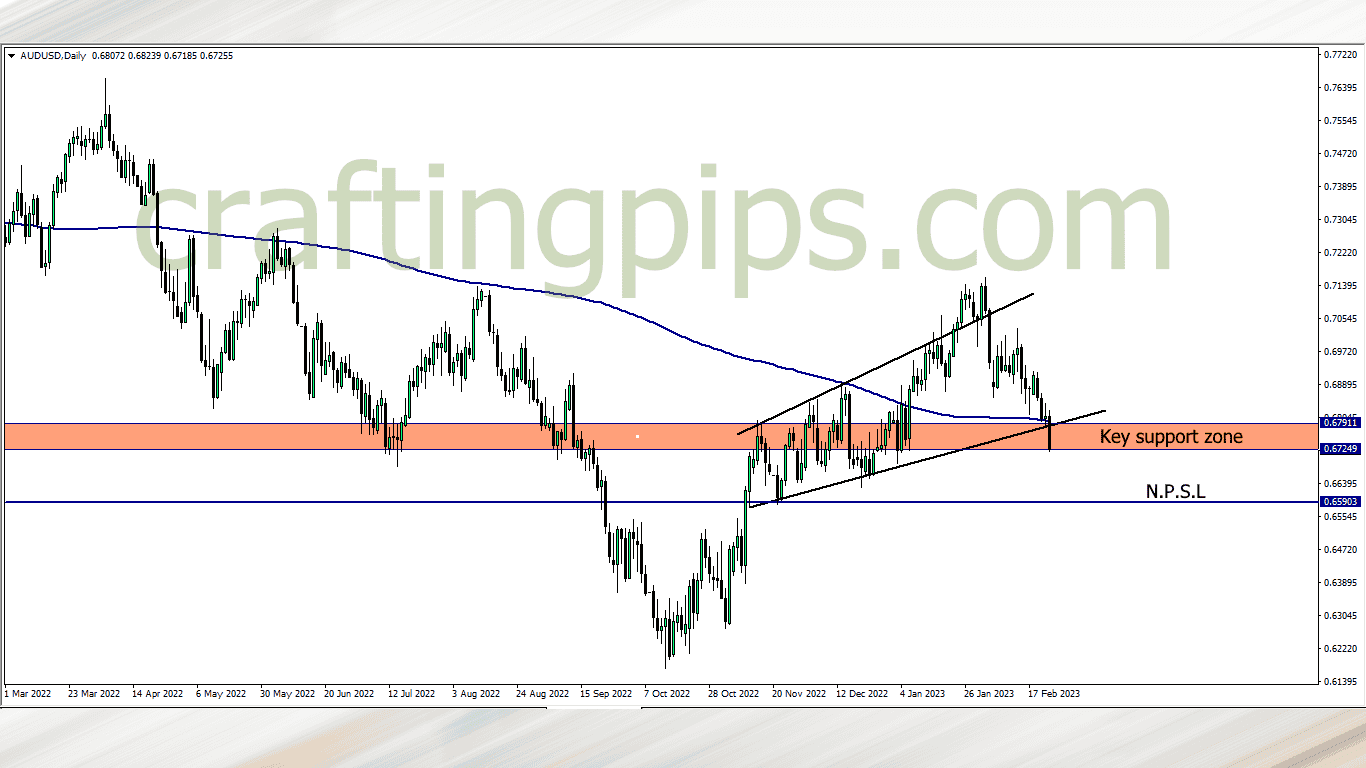

1. AUD/USD

Price on the AUD/USD is resting within a key support zone after breaking through the the support level of an expanding ascending channel and the 200 ma

The close of Monday’s daily candlestick will determine if the bears have fully taken over price or if we still have to worry about bulls causing a pull back. If Monday’s daily candlestick close gives us a bearish breakout, then we should be looking for sell opportunities on Tuesday

However, if we do get a pullback, then we are to watch how price will react when re-visiting the 200 ma before buying or re-selling

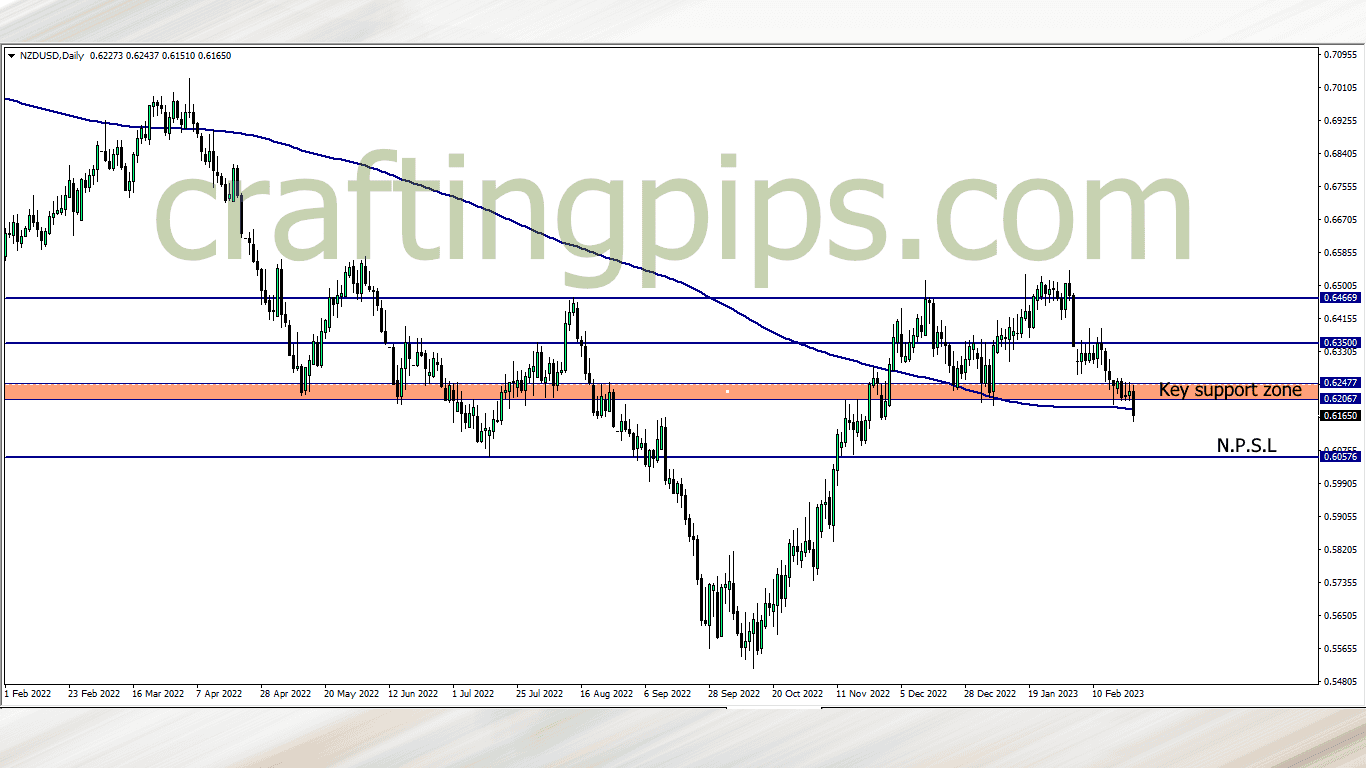

2. NZD/USD

The NZD/USD closed at a sweet spot last week, though price did not convincingly break the 200 ma, but I am confident that the bears may most likely finish what they started last week.

Personally I will be waiting for a pullback, then a breakout of the current support level before joining the sellers to the NPSL

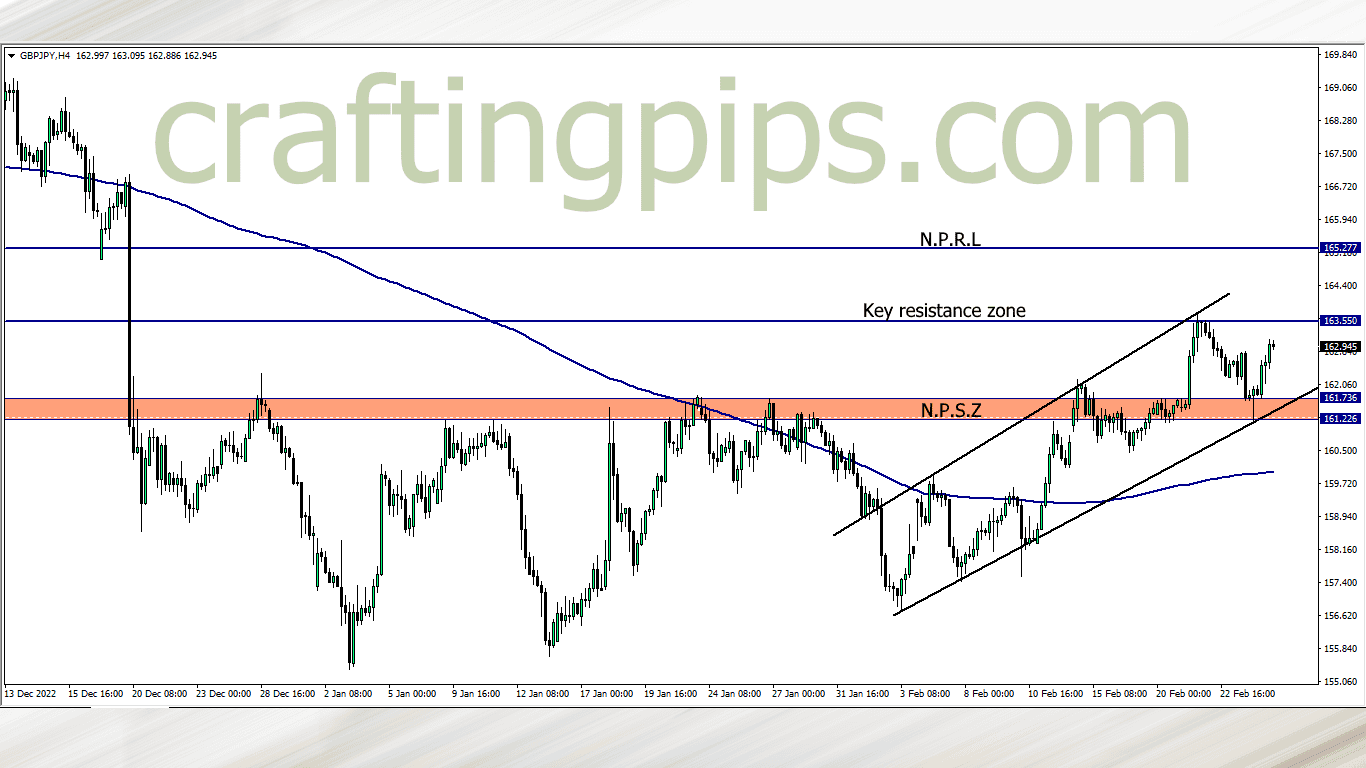

3. GBP/JPY

GBP/JPY closed bullish last week, but do the buyers have what it takes to break the key resistance zone? That’s a big question we should be asking ourselves this week.

I believe we are looking at a 50/50 chance of price breaking through the resistance level and hitting NPRL, or reversing at the key resistance level and retesting NPSZ. Candlestick patterns shall tell us our next line of action during the course of the week

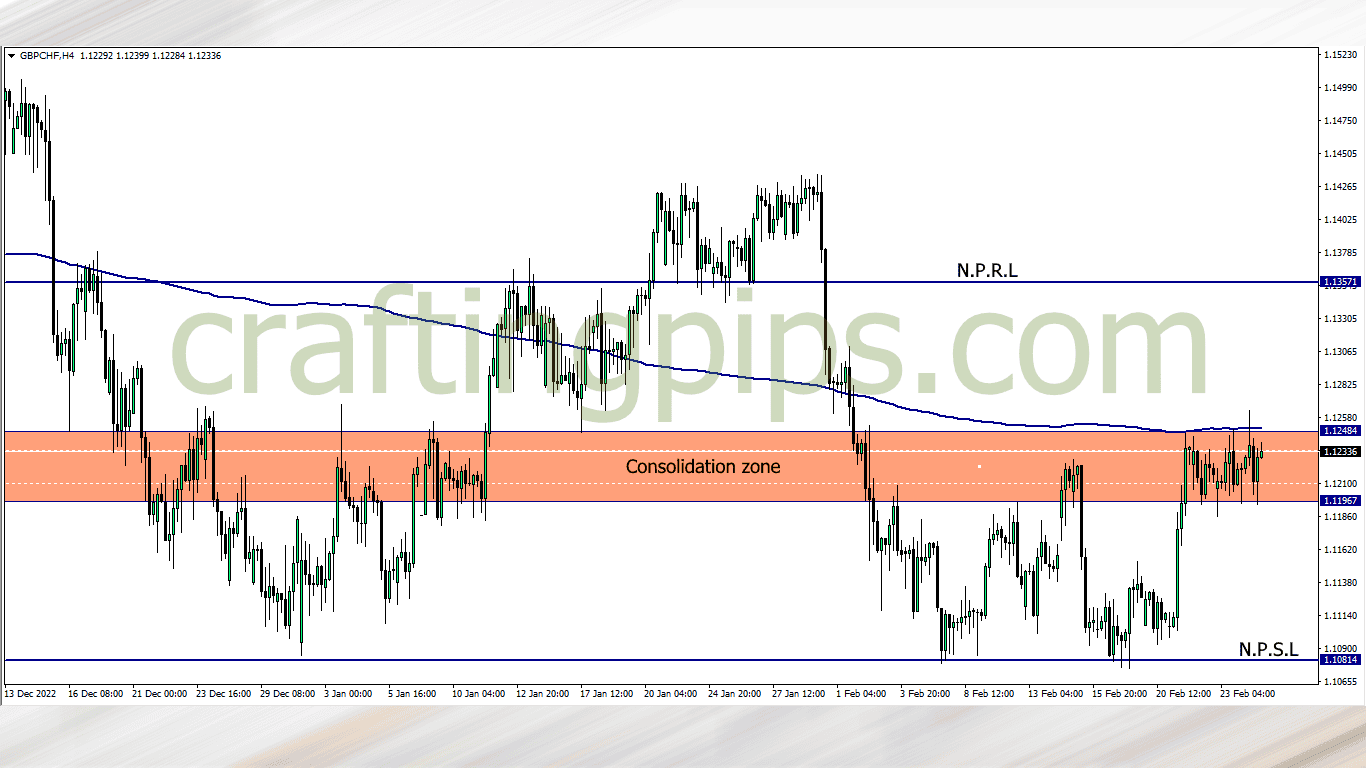

3. GBP/CHF

I have been chasing this bad boy for over 2 weeks now. GBP/CHF was on our Wednesday market analysis and also the previous week’s weekly market analysis

We can clearly see that the bulls fought a good war last week trying to contain the bears within the consolidation zone despite the fact that the 200 ma served as a resistance zone.

This week I will be watching out for bulls possibly breaking the consolidation zone and 200 ma before joining them to the NPRL. My bias is bullish so if price for any reason reverses, I most likely won’t sell to the NPSL

What say you?

-

FIDELCREST: https://fidelcrest.com/#CRAFTER

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.com/#a_aid=THE_CRAFTER