Hello traders,

let’s hit them charts:

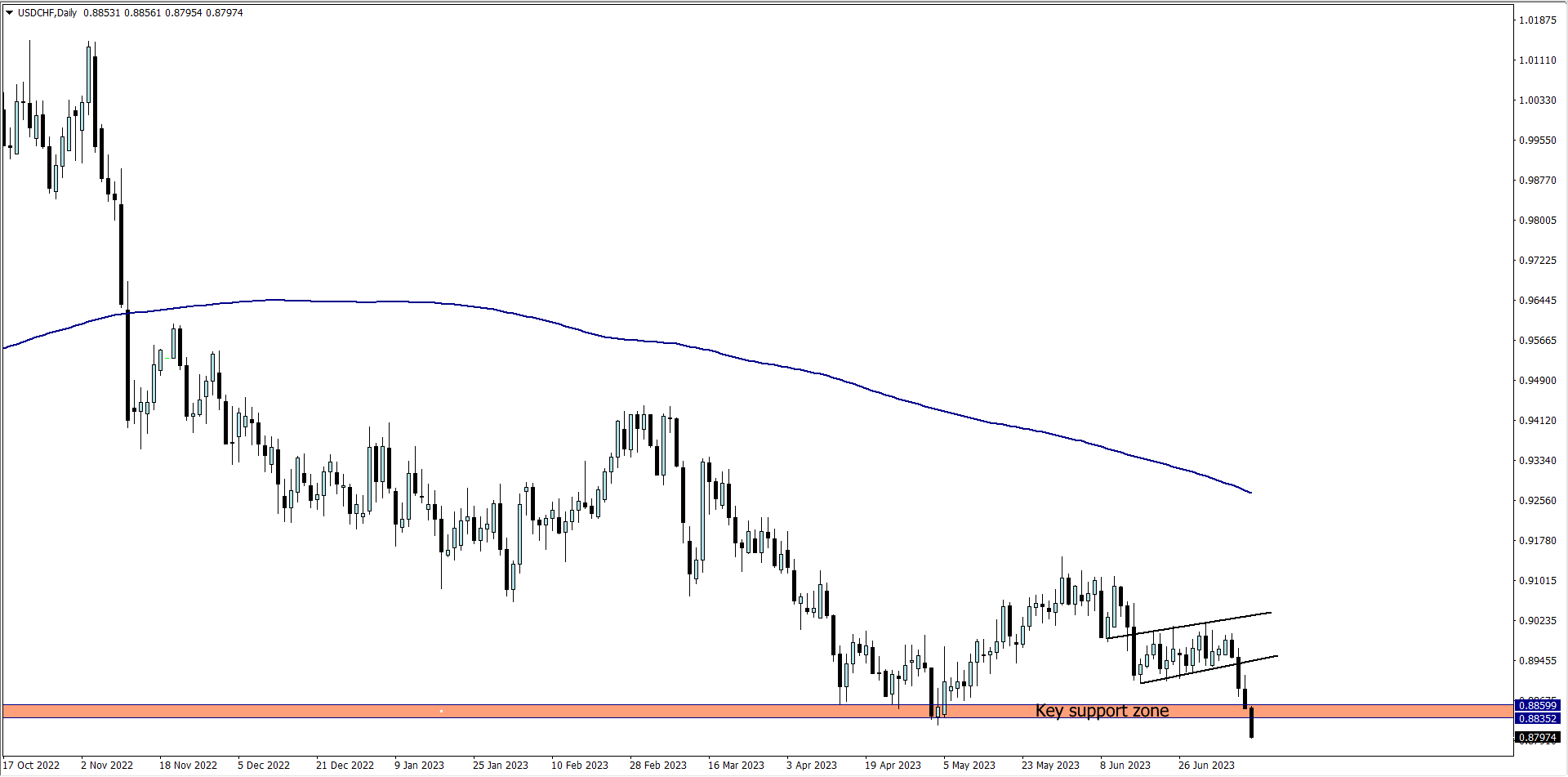

1. USD/CHF

After USD/CHF consolidated for about 3 weeks, we can see a strong bearish breakout that has broken a key support zone that is over 2 years old.

Between Tuesday’s Asian session and 1.30 pm on Wednesday where we have CPI news on the US dollar, USD/CHF could still spill 40-60 pips while still heading south.

So, for traders who trade the lower time frame (5 mins to 1hr), there is a possibility you could still profit from this breakout before news release

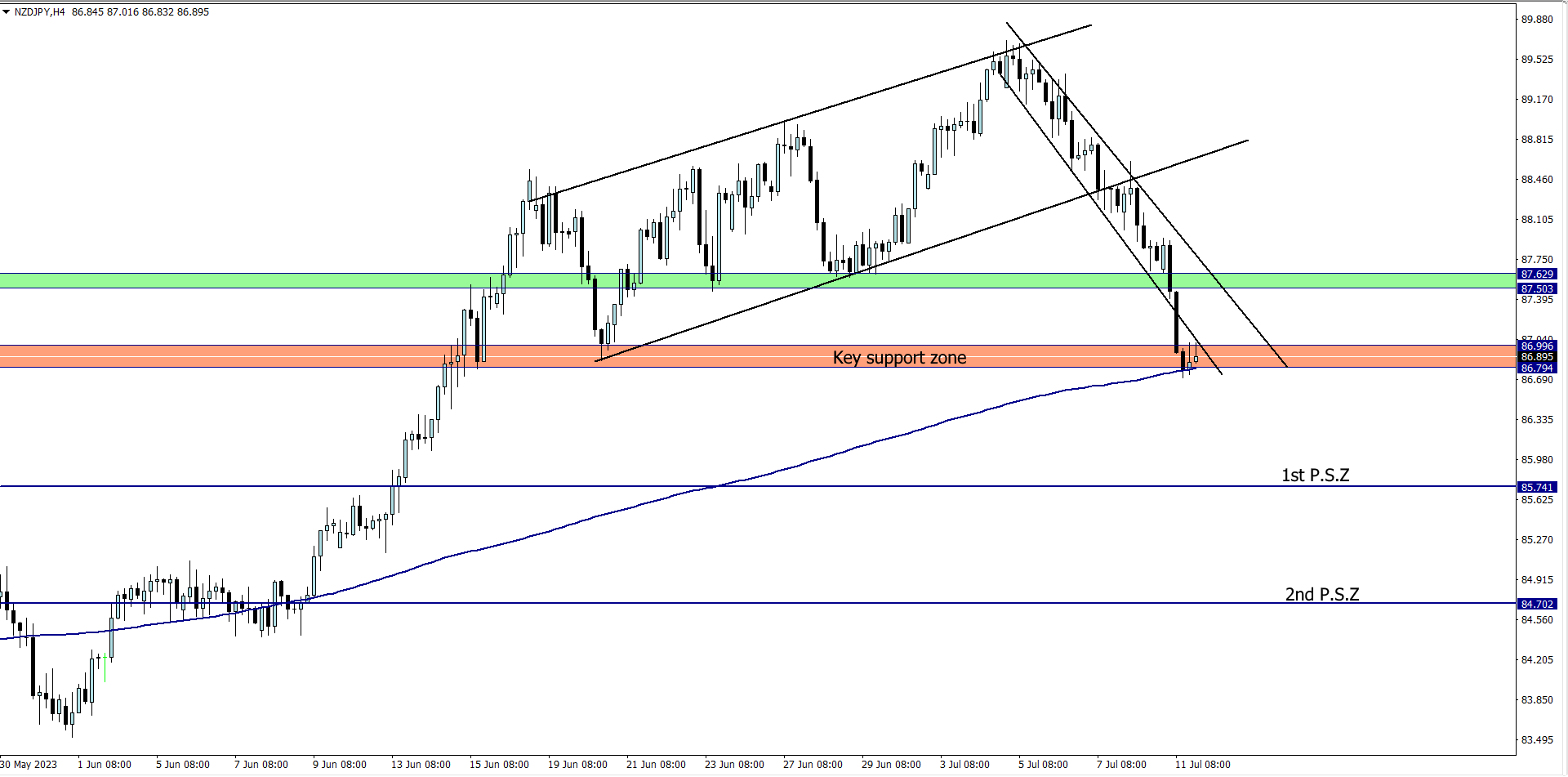

2. NZD/JPY

While the key support zone on the NZD/JPY has significantly weakened, the 200 moving average still holds price from falling further.

A break below the 200 ma may encourage sellers to pull price to the 1st PSZ, but we must be cautious if we are to take this trade because we have high impact news scheduled by 3 am GMT on the NZD. This may most likely cause disruption, so be cautious

What say you?

NOTE:

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.tech/purchasechallenge/?sl=758

- BESPOKE FUNDING PROGRAMME: https://www.bespokefundingprogram.com/The_Crafter?ref=The_Crafter