Hey traders,

We have some interesting setups lined up for Wednesday. Both of the pairs move the same direction most of the times, but in this case we are having conflicting directions.

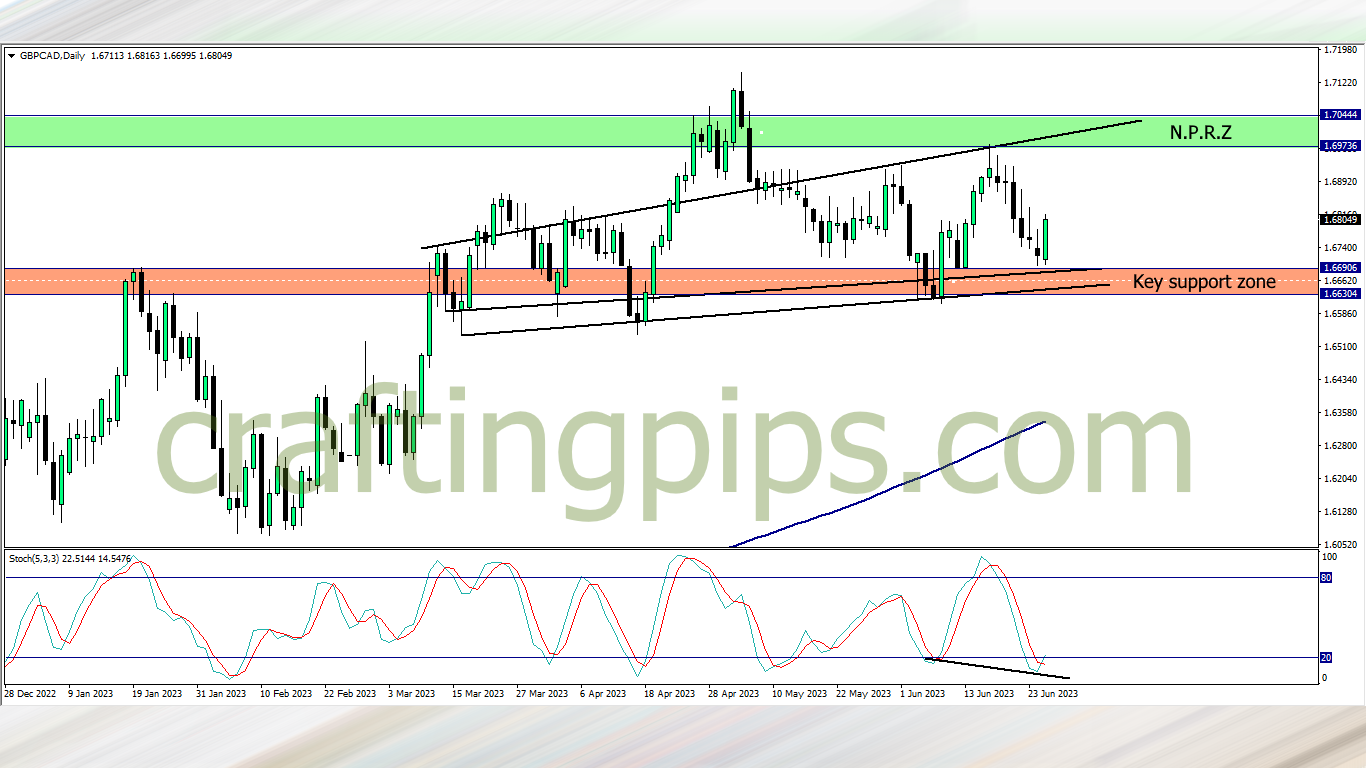

1. GBP/CAD

To all my swing traders in the house, there is an active bullish divergence setup on the daily time frame of GBP/CAD

The bullish engulfing candlestick gives us a strong confirmation to ride with the bulls. All we now have to do is wait to see how the daily candlestick closes (I hope it maintains it’s current status)

2. EUR/CAD

On the EUR/CAD we can spot a bearish divergence, which aligns well with the 200 ma

Yes, I know you will be wondering which way to go. Do you sell the EUR/CAD or do you buy the GBP/CAD?.

Well, let me give you my professional advice…, but before I do, understand that “This is not a financial advice, it’s just my educated opinion”, so please do not bet your farm on it.

The bullish divergence on the GBP/CAD is happening on the daily time frame, so there is enough room to breath since the stop loss is far (over 100 pips), so we could hold on our buy and manage through the rough waves before price possibly hits NPRZ (even if that happens on Friday) on the other hand

The bearish divergence on the EUR/CAD is on the 4-hour time frame, and the stop loss should be less than 60 pips. Meaning we are to expect a possible drop in price between Tuesday’s Asian session to Wednesday Asian session.

So which are you trading?

NOTE:

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.tech/purchasechallenge/?sl=758

- BESPOKE FUNDING PROGRAMME: https://www.bespokefundingprogram.com/The_Crafter?ref=The_Crafter