Hello Traders,

With a few hours to Friday and less than 48 hours before the market shuts down for the weekend, we still got a little window to scout for some trading opportunities.

Let’s hit the charts and see what we can do:

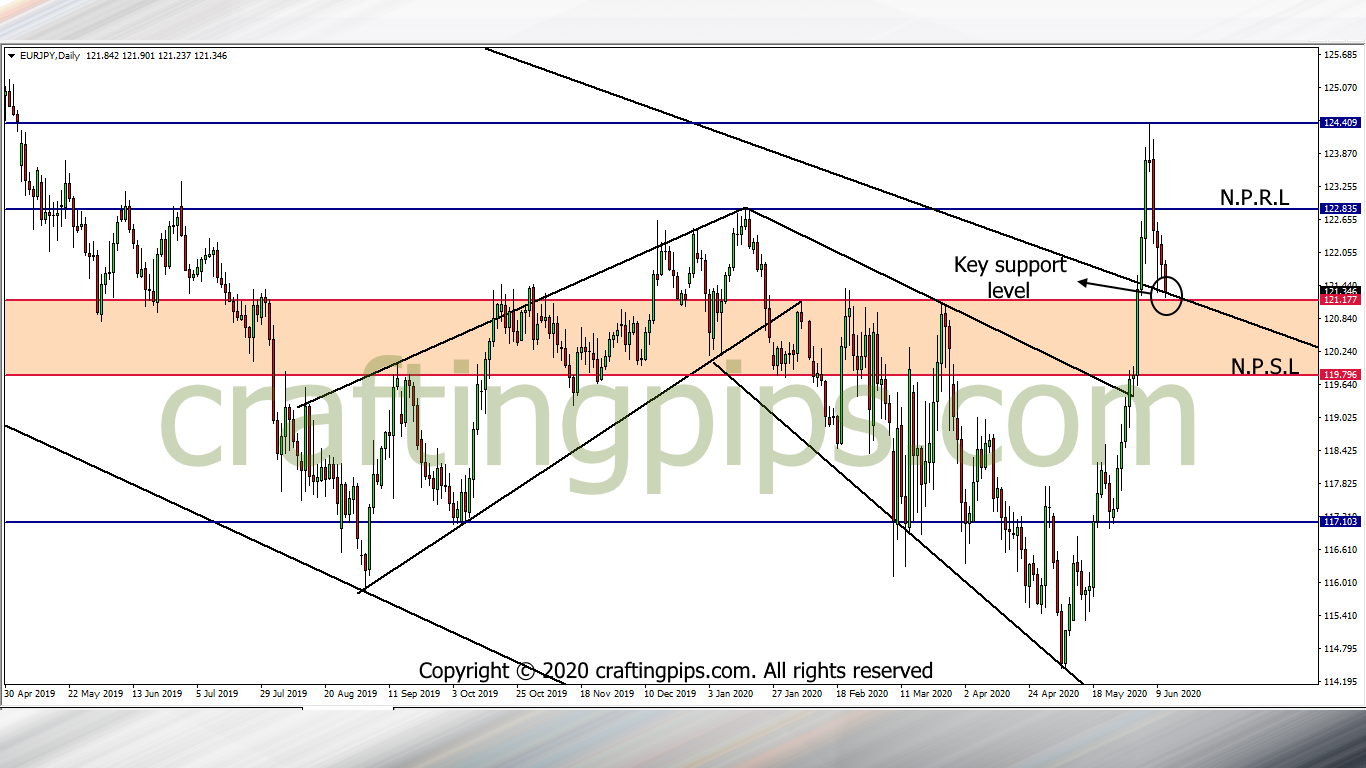

1. EUR/JPY

On the EUR/JPY, the bears have succeeded in driving price back down to a key support level (121.177)

Do you think the Bears are running out steam? or

Do you see bears getting ready to break through the present support level?

Personally I believe the close of the daily candlestick will reveal to us price next move.

If the candlestick closes by compromising the present support level, the bears are most likely to drive price further down.

On the other hand, if support level 121.177 stands firm, there is a possibility for the Bulls to give us a slight pull-back before the market closes.

2. EUR/CHF

EUR/CHF is presently testing support level 1.07107.

I personally believe the Bears are immensely strong, and the current support level is most likely to snap under their pressure.

However, before I make any conclusions, let’s see how the daily candlestick closes.

If we get to see a good full bearish candlestick, then the Bears are most likely to rule for the better part of tomorrow, hence making support level 1.05782 our next possible support level.

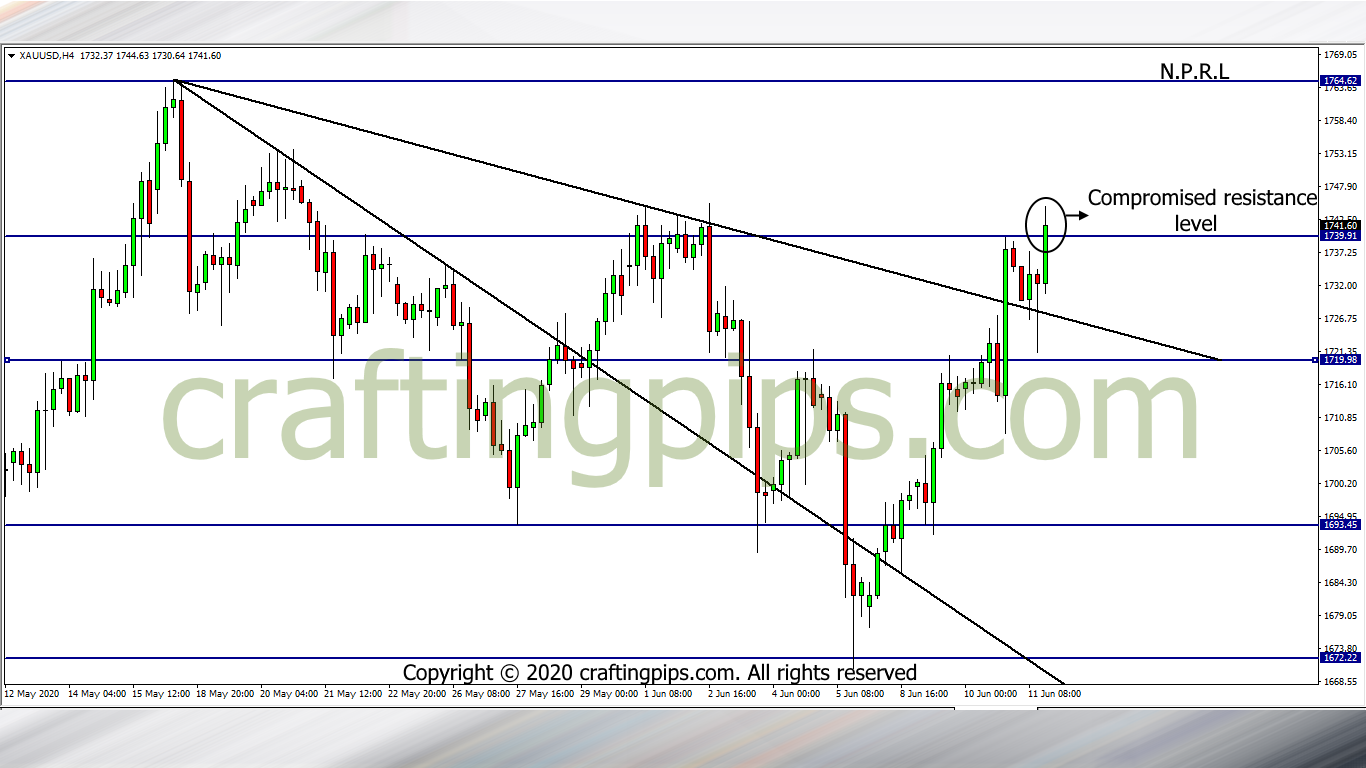

3. XAU/USD (GOLD)

Gold has been ranging between support level 1719.98 and resistance level 1739.91.

Let’s see how the daily candlestick closes.

If we see a decent breakout through resistance level 1739.91, then we may most likely see price hit the next possible resistance level (1764.62) before the close of business tomorrow.

Personally, my bias is bearish on this one.

But hey…

let’s see how we close on the daily candlestick before making up our mind.

In conclusion, let’s remember that we are heading into Friday, and the market could be a wild horse for the most part, so let’s tread with caution.

What do you think?