TGIF Traders,

It’s almost the last day of the trading week and the last trading day of the month of January.

Before we start the weekend, let’s quickly see what our charts are saying.

1. AUD/USD

On the daily chart, the AUD/USD succeeded in breaking support level 0.68064 at the beginning of the week and price is presently heading straight to the next support level (0.66805).

This will be the 4th time the support level is being tested. If you ask me, the support should be weak by now, and a little push by the sellers may most likely break it this time.

Don’t take my word for it, though I am bearish on this pair, let’s not forget it’s Friday. We may most likely see a pull-back and probably next week will be the revenge of the Bears.

Just saying!!.

That said, if the Bears do break the present support level, we most likely will see price head to the next possible support level (0.64428), if not, a pullback to resistance level 0.67596 may most likely occur.

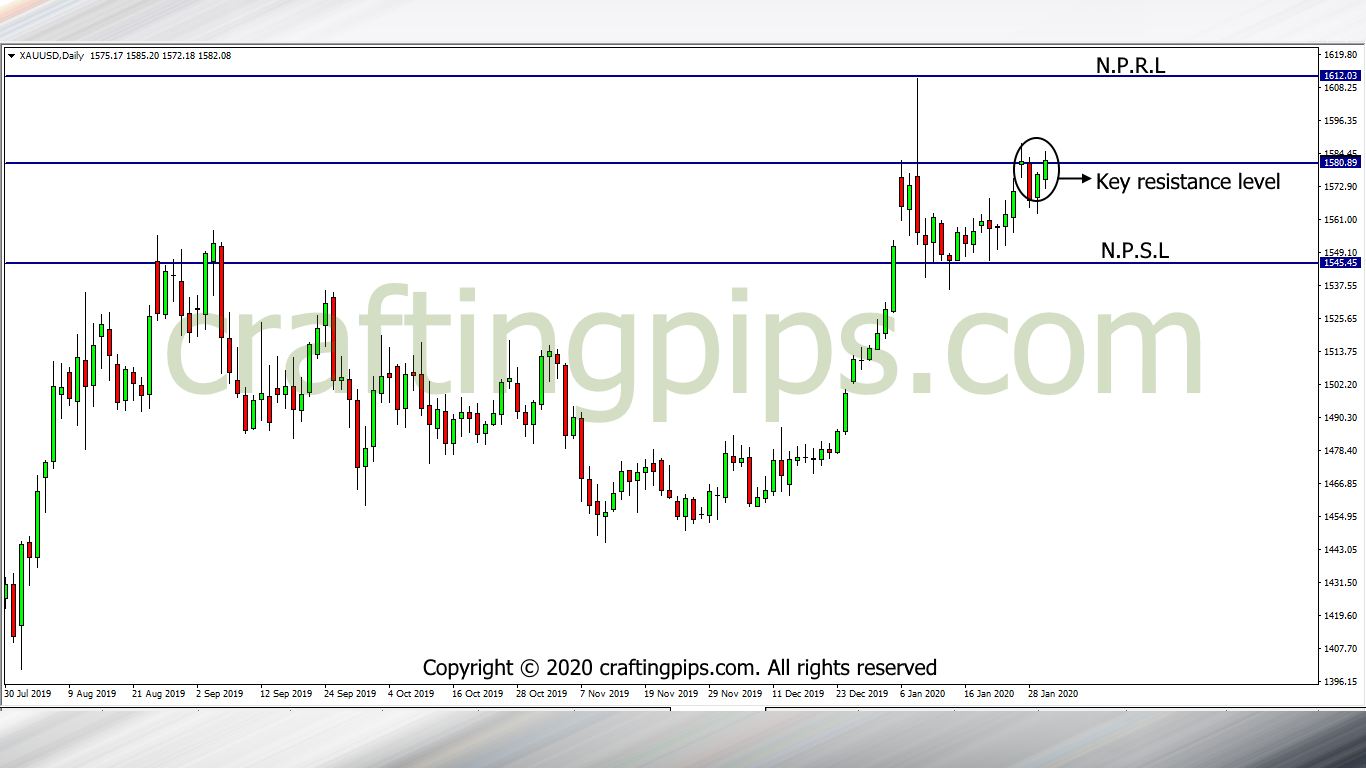

2. XAU/USD (GOLD)

Gold has reached a critical resistance level (1580.89).

How the daily candlestick closes by 11 pm will determine what direction we will be expecting Gold to take this Friday.

If we see a full bullish candlestick breaking through the present resistance level, there is a great tendency that the Bulls may rule Friday market, and if we get to see our daily candlestick close with a bearish pin-bar, we most likely will see the Bears rule.

Either way, price next support and resistance level would be 1545.45 and 1612.03.

That’s all for today folks.

I apologize for our analysis coming a little late. Today is my birthday and I have been all over the place (If you know what I mean).

I just had to ensure I put this out for us before the daily candlestick closes (hahaha).

Thank you for your birthday wishes fam, I do appreciate.

Alright…, see you ‘ll on Sunday where we take a look at the market through our weekly telescope.

Do stay safe friends.