T.G.I.F Traders,

It’s the first Friday of the year, and I hope non of the setups tricks us. Let’s hit the market and see what the market has for us.

1. CAD/CHF

CAD/CHF on the daily chart spent the most part of yesterday and today bouncing off a descending support line.

When viewing through the binoculars of the 4 hours chart, we notice that, the bounce caused by a previous descending support level has taken taken price to a key resistance level (0.73395).

All we need is for this support to either get broken in order for price to hit it’s next resistance level (0.74109) or the resistance ends up reversing price to start another bearish run to its previous descending support line 0.71738.

This is a trade I call 50/50. Until a confirmation is set, sitting on one’s hands could also be considered as a form of trading.

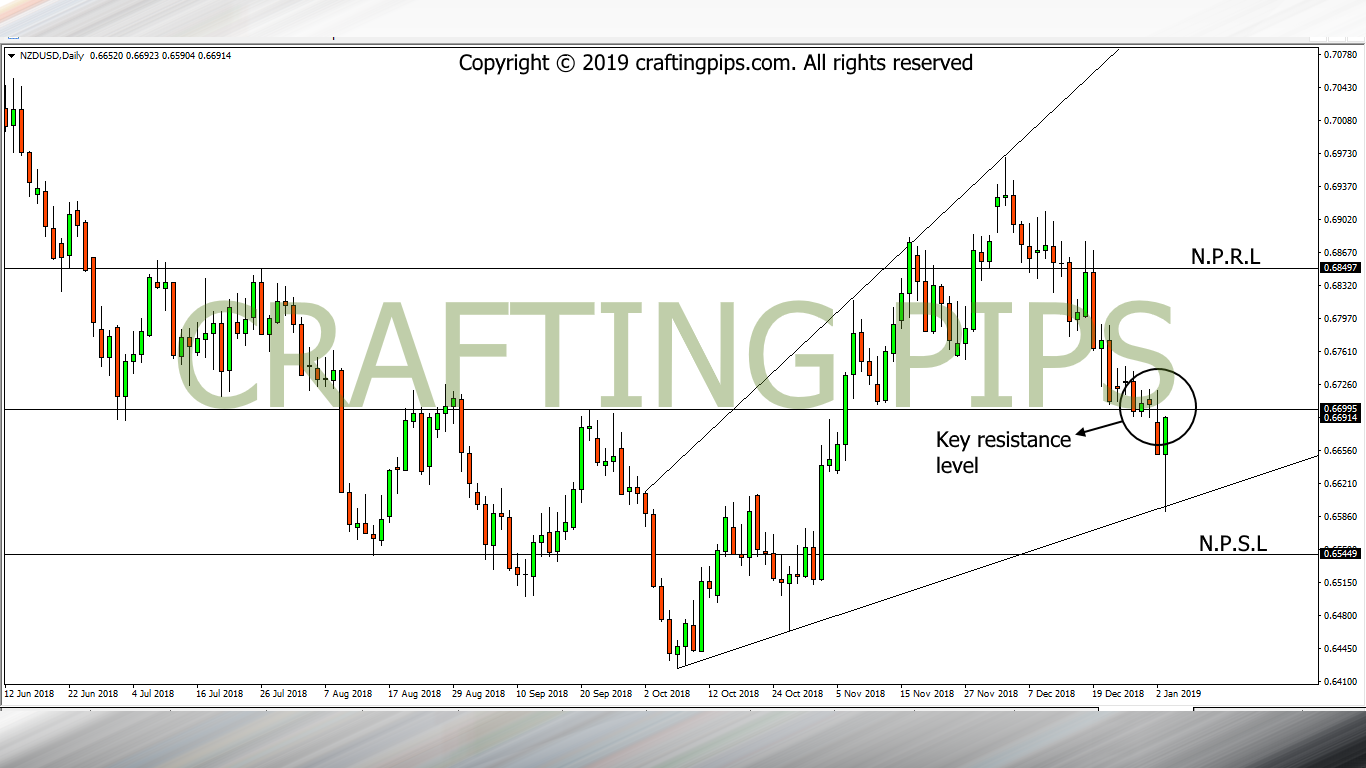

2. NZD/USD

After yesterday’s colorful move on the NZD/USD, I noticed that the bears suddenly ran out of steam and the bulls decided to pull back price, before hitting a key support level (0.65449).

I am suppose to be happy over the bullish pin bar in view (not yet complete though), but I am not, and the reason is, there is still one more resistance level (0.66995) to be broken before I can trust the bulls to take price to the next resistance level (0.68497).

If price refuses to break the current resistance level (0.66995), there is a possibility that price would commence a bearish move to the support level (0.65449) it intended to get to after yesterday’s breakout.

Don’t forget, it’s tricky Friday, and I would advice you to trade on the side of caution.

Do have a great weekend and stay safe crafters