My reason for keeping a journal is to encourage traders to also keep one for two major reasons:

- Track weekly trading performance.

- have enough data, in order to be able to work on their trading technique and psychology

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY (22/05/2023)

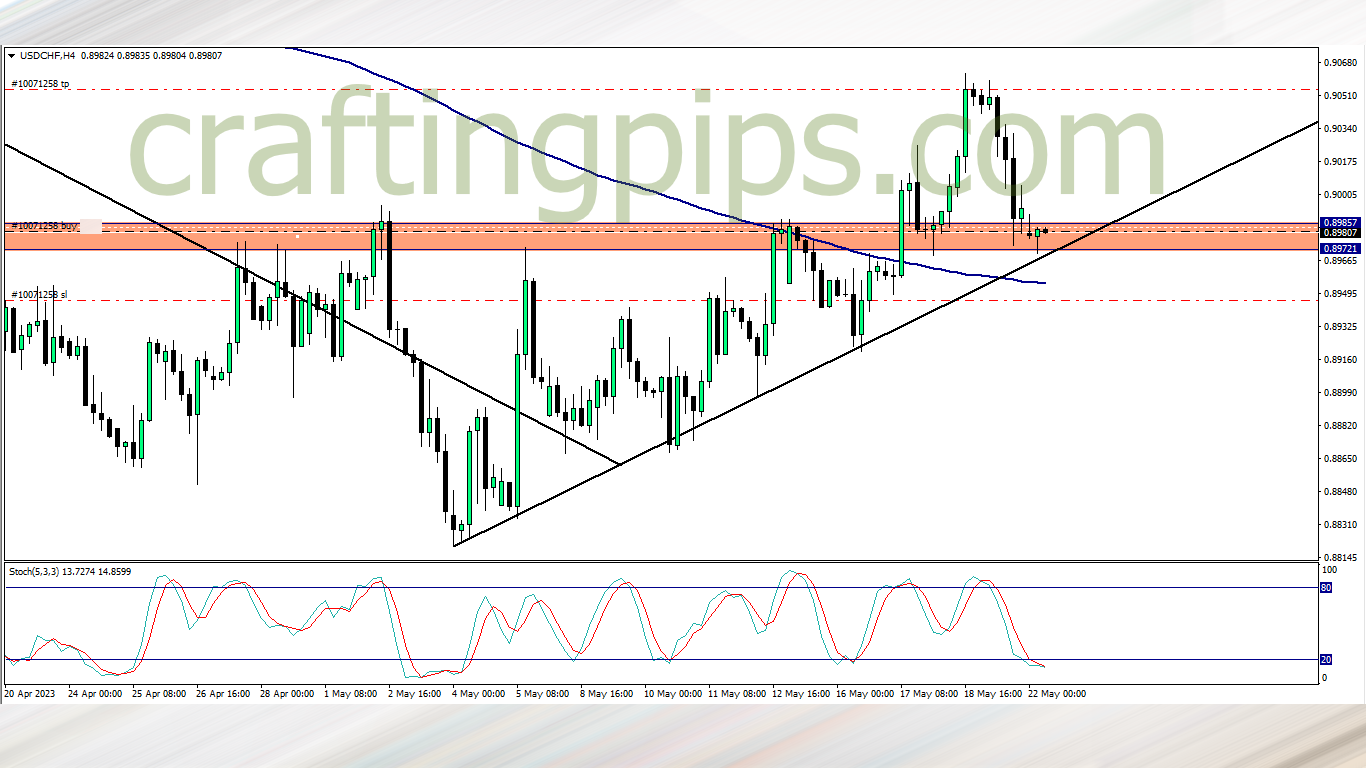

USD/CHF (6.27 am)

Analysis: My reason for buying was shared on our weekly market analysis

USD/CHF Update (3 pm)

I closed the trade manually with -28 pips

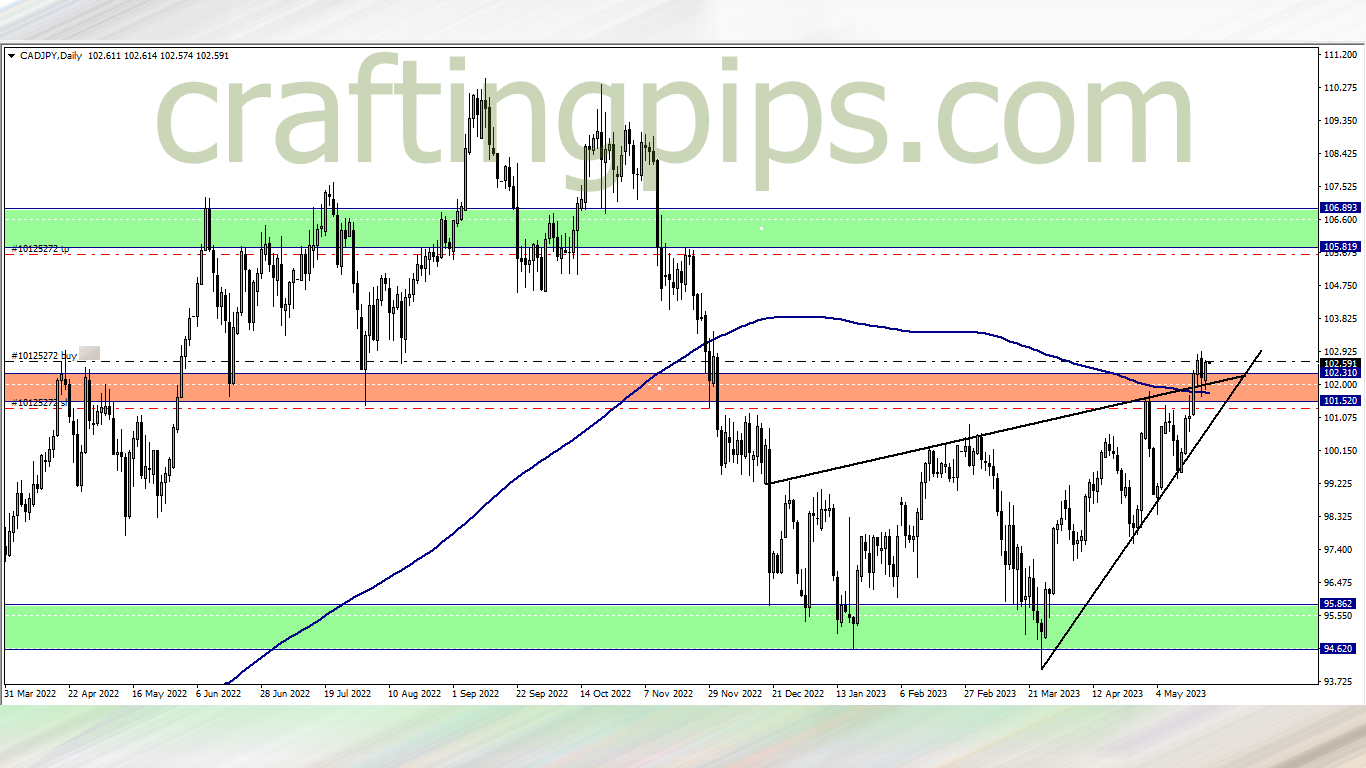

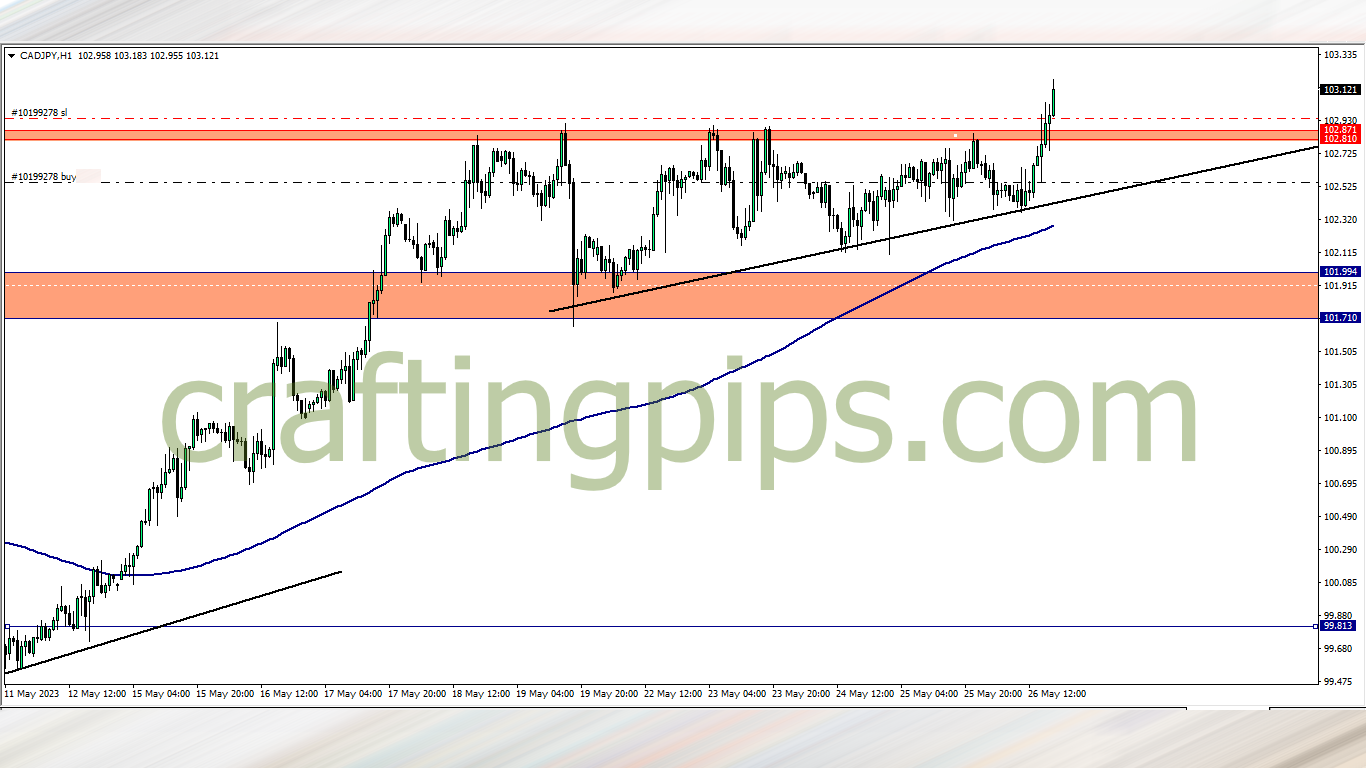

CAD/JPY & USD/JPY(11 pm)

Analysis: I bought both CAD/JPY and USD/JPY (forgot to screen grab the UJ, I guess I was half asleep). The reason behind me buying both setups can be seen in our weekly analysis

WEDNESDAY (24/05/2023)

Analysis: After 48 hours of buying both CAD/JPY and USD/JPY, Price barely moved, and CPI news on GBP was scheduled for 7 am Wednesday. I exited both trades with -6 and -16 pips respectively

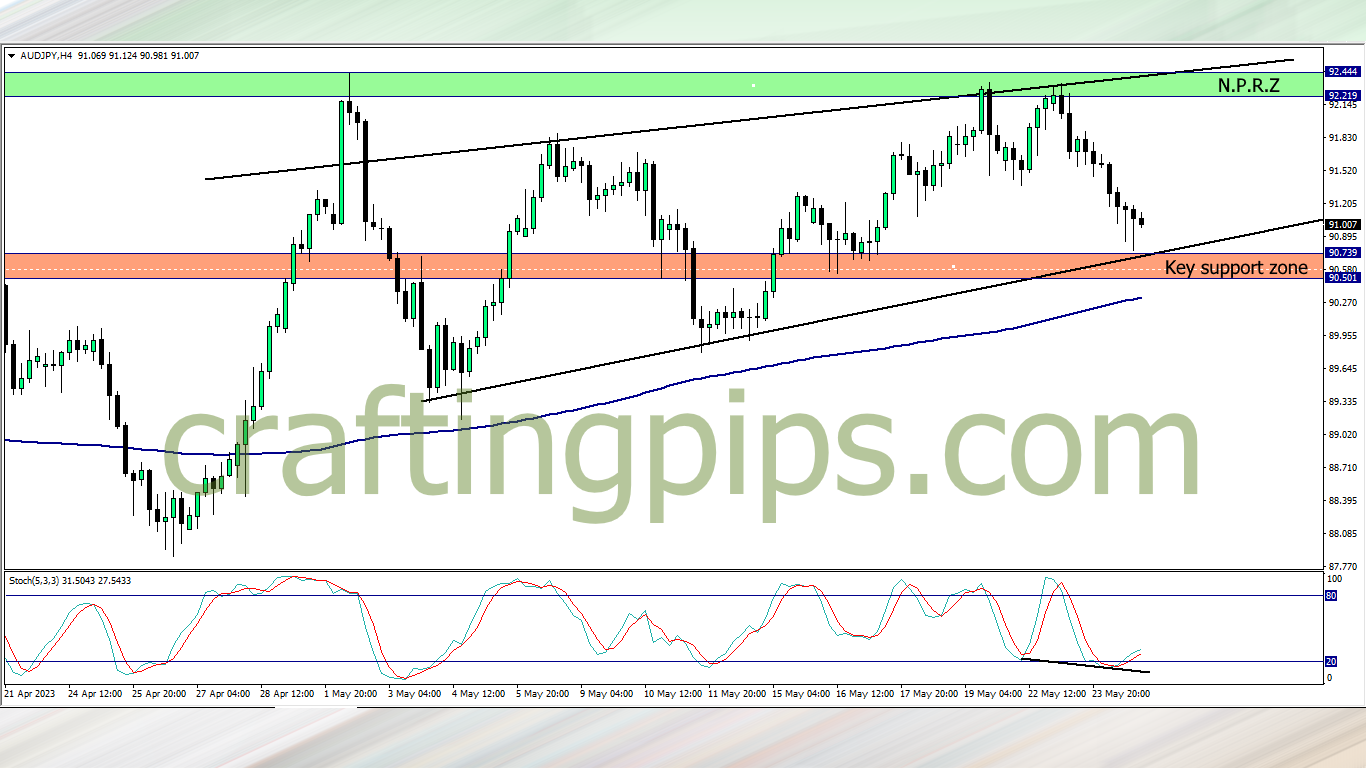

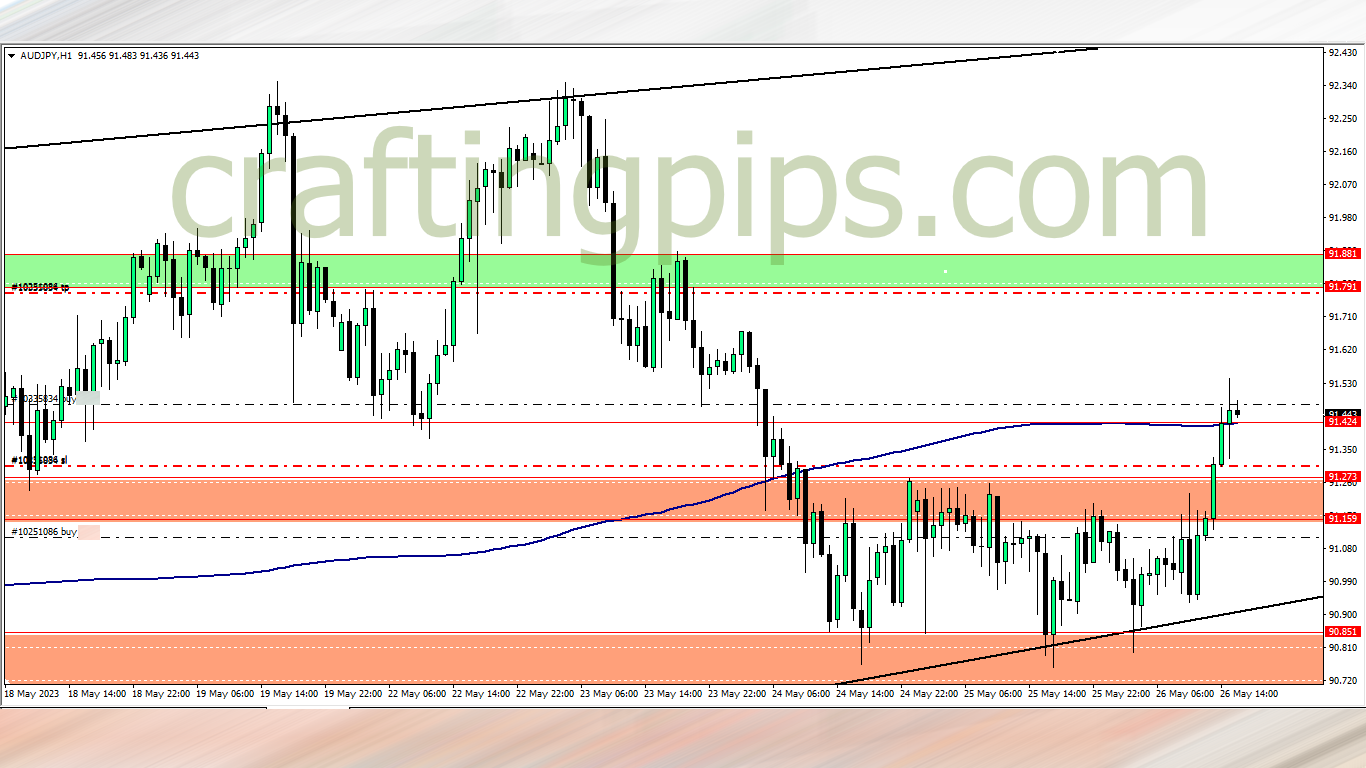

AUD/JPY (6.20 pm)

Analysis: My inspiration for taking this trade can be seen on our Thursday market analysis

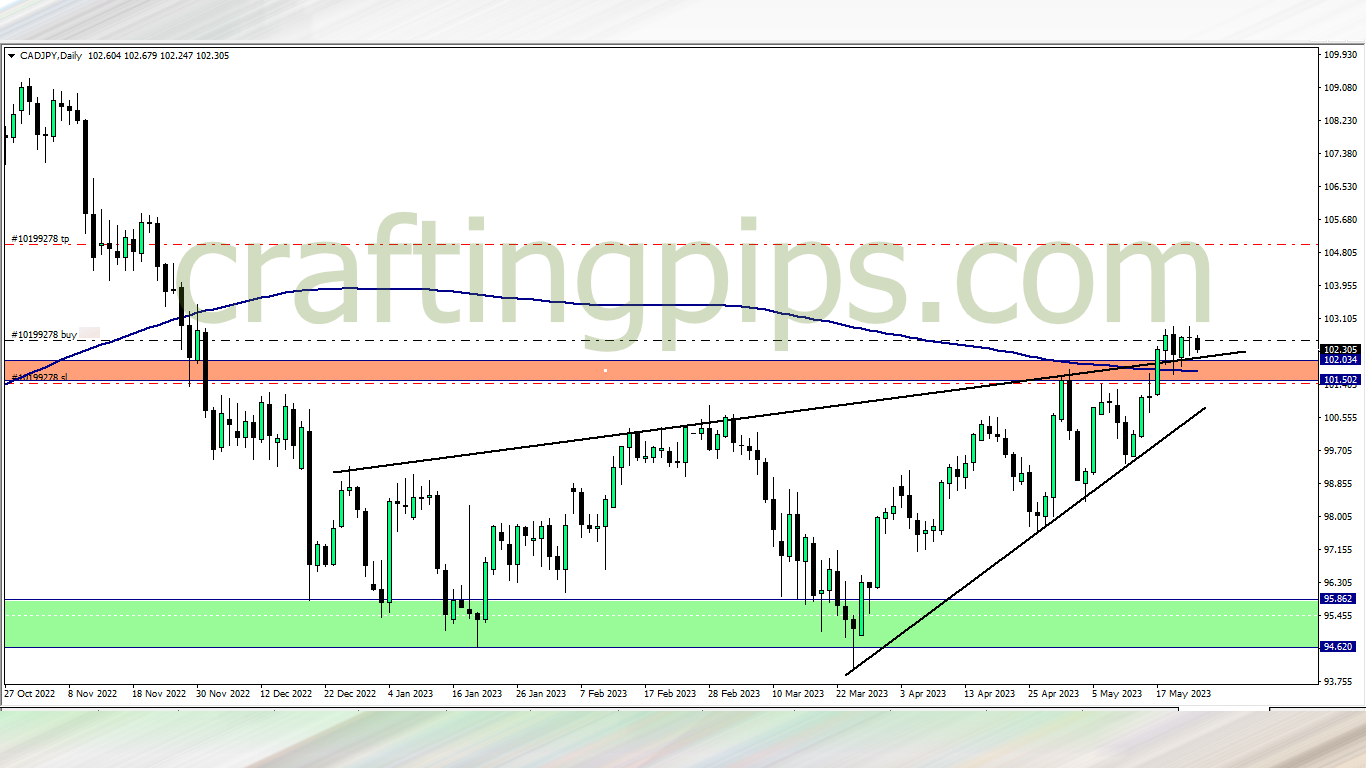

CAD/JPY Re-entry (7.50am)

Analysis: The CPI news had no effect on USD/JPY and CAD/JPY, so I decided to re-enter the CAD/JPY trade and discard USD/JPY due to the high impact news on USD for the rest of the week.

THURSDAY (26/05/2023)

AUD/JPY Update(6.20 pm)

Analysis: Added a second trade after the 2pm candlestick gave us a sign that the bulls were coming in.

Conclusion on AUD/JPY trade: A few minutes after adjusting my SL and adding to my position, I was taking out by a deep pullback, so I closed this trade at breakeven. If my stop loss was a few pips away, I would have made some decent profits from just this trade

CAD/JPY Update(10 pm)

Analysis: This trade trade took a long time to materialize, but it paid off on the long run. I closed it manually, bagging +70 pips. My only regret was I did not scale this setup because I was already doing that with AUD/JPY.

In this scenario I would have made over 3 times what I risked on the CAD/JPY because its retracements were not deep, but again, this is me looking at the trade in retrospect. When live conditions present themselves, its a 50/50 probability

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (22/05/2023 | USD/CHF | BUY | – 28 pips |

| CAD/JPY | BUY | – 16 pips | |

| USD/JPY | BUY | – 6 pips | |

| WED (24/05/2023) | AUD/JPY | BUY | Breakeven |

| CAD/JPY | BUY | + 70 pips | |

| TOTAL | + 20 pips |

In conclusion:

Closed the week with -0.50 loss despite the positive pips. The reason was because I started the week with risking a little more on the USD/CHF

trade. Funny enough the trade played out as planned, only that there was a deep retracement which cleared out my SL before hitting our intended TP.

This week also had a couple of high impact news that had no effect in the market, so it was difficult playing catch up since I had to go in and out of trades due to this. For instance the USD/JPY trade I refuse to re-take after exiting did so well. That was another lost trading opportunity that would have clearly knocked out my bad trade on USD/CHF, but the high impact news anticipation shut down my intentions trading it

Overall I am happy I kept to my trading rules and I was able to recoup some of my lost capital. Next week should be explosive in the market, as I can see some great setups lined up

How did your trading week go?

NOTE:

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.tech/purchasechallenge/?sl=758

- BESPOKE FUNDING PROGRAMME: https://www.bespokefundingprogram.com/The_Crafter?ref=The_Crafter