In the dynamic world of financial markets, successful traders constantly seek an edge by employing various technical analysis tools. One such powerful tool is the pennant pattern—a herald of opportunity during periods of temporary price consolidation.

Whether you’re a seasoned trader or a budding investor, understanding how to trade bullish and bearish pennants can unlock remarkable profit potential. In this article, we delve deep into the intricacies of these patterns, equipping you with practical strategies to navigate the market with confidence.

Key note:

For the purpose of this system, we will be using just the 200 moving average to determine the overall trend of the market.

If price is above the 200 moving average, then the overall trend is bullish, hence we will be seeking for only buy opportunities using the bullish pennant while if price is below the 200 moving average, the overall trend is bearish, hence we will be seeking for only sell opportunities using the bearish pennant

Unveiling the Potential of Bullish Pennants:

Picture a flourishing uptrend in the market, where prices soar and optimism reigns supreme. It is during this exhilarating rally that a bullish pennant emerges, serving as a temporary pause before the continuation of the upward trajectory.

A pennant is a symmetrical triangle formation with converging trend lines and diminishing trading volume. Traders view the bullish pennant as a harbinger of bullish continuation—a signal that the upward surge is poised to resume its ascent.

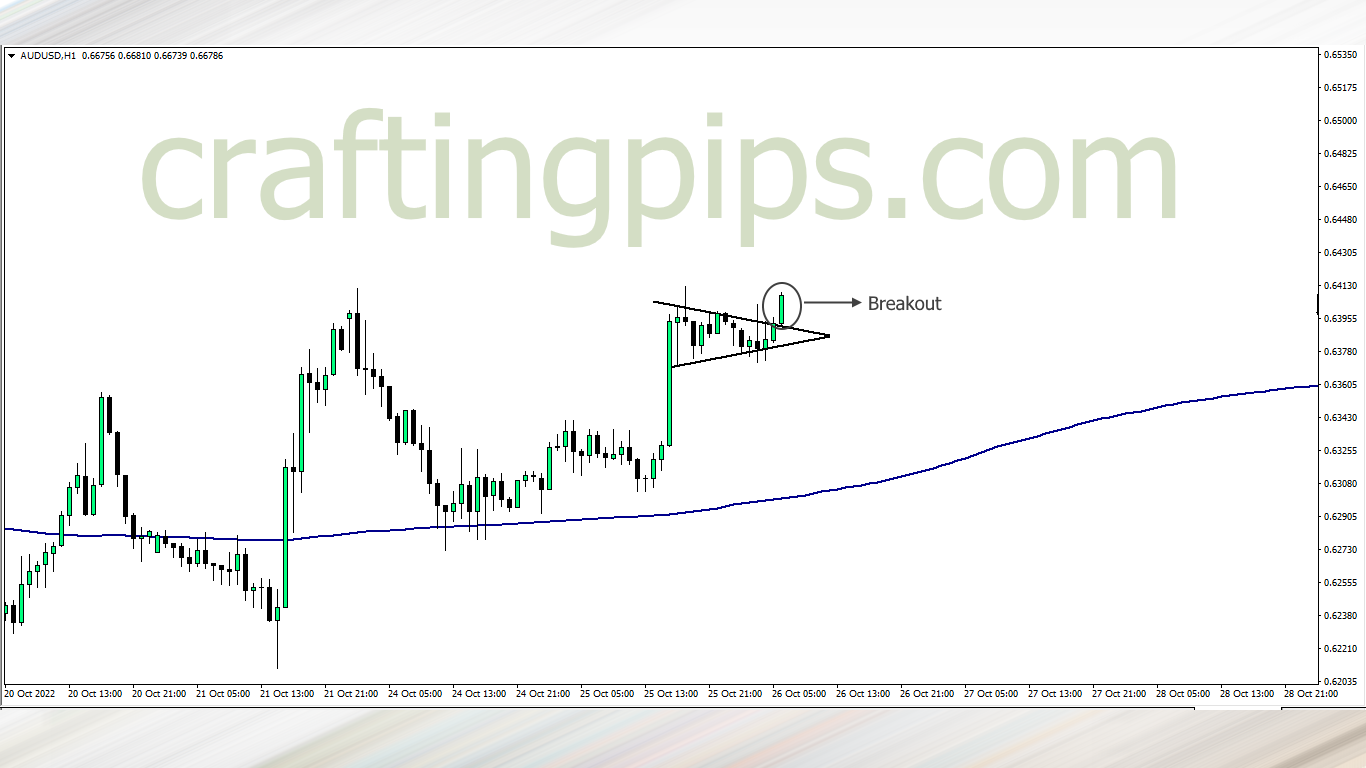

A bullish pennant

Decoding the Bullish Pennant Formation:

To identify a bullish pennant and unlock its potential, keep a keen eye on the following characteristics:

- The Prelude: A bullish pennant pattern typically materializes after a robust upward move.

- The Flagpole: Representing the initial rally, the flagpole precedes the formation of the pennant.

- Consolidation in Motion: Observe the symmetrical triangle taking shape, with trend lines converging harmoniously.

- The Volume Story: Notice how trading volume diminishes during the consolidation phase, signaling a temporary lull in market participation.

Trading Strategies for Bullish Pennants:

Navigate the bullish pennant terrain with these effective strategies:

1. Timing Your Entry:

Initiate a long position when the price breaks out above the upper trend line of the pennant pattern. This breakout validates the resumption of the upward trend.

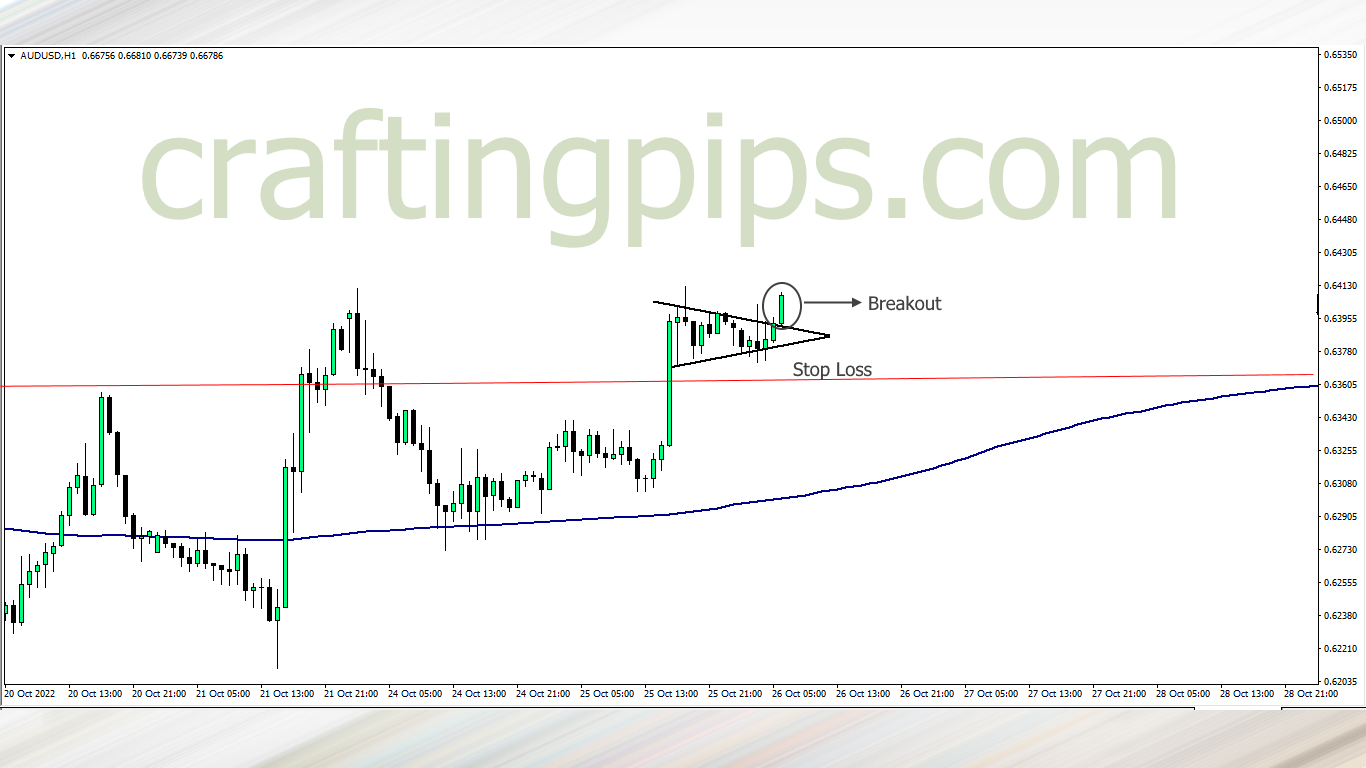

2. Guarding Against Risk:

Safeguard your investments by placing a stop loss order slightly below the lower trend line of the pennant. A breakdown below this level may indicate a potential failure of the pattern.

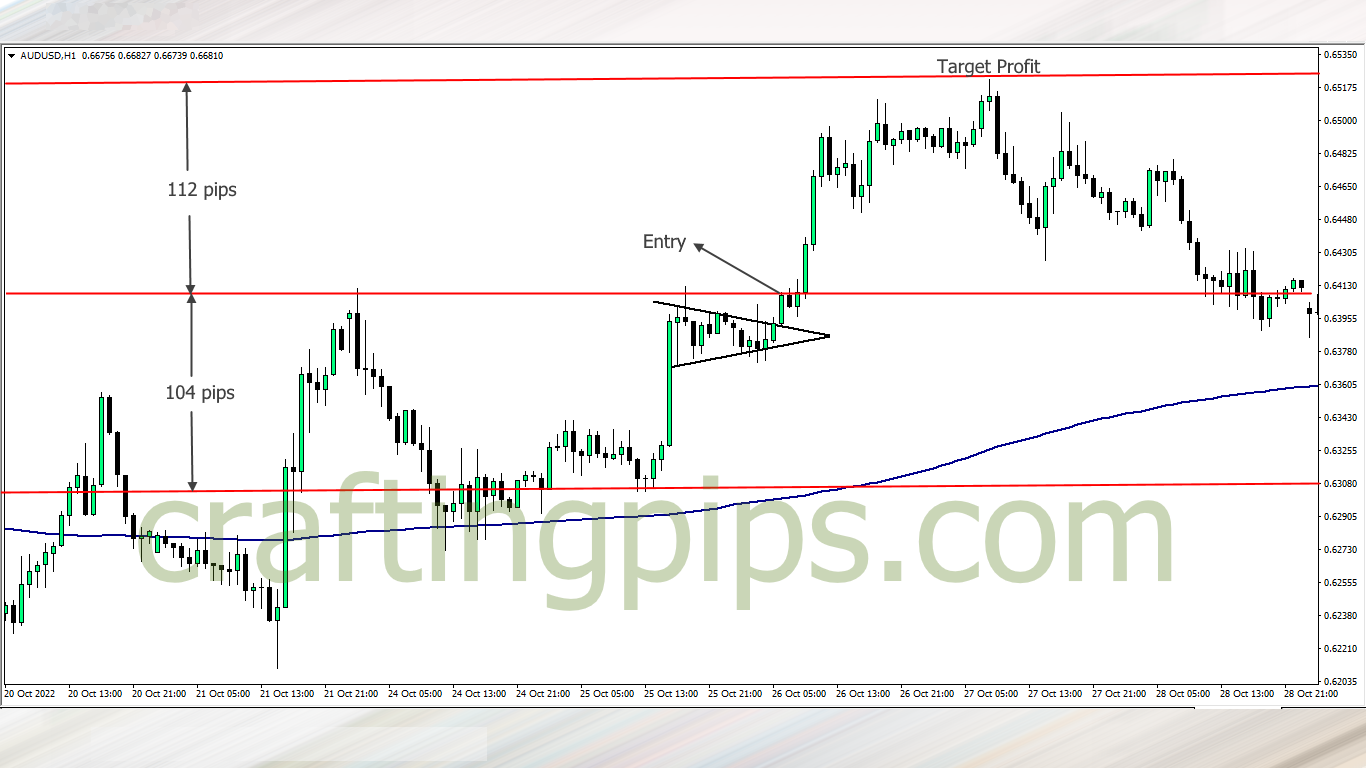

3. Aim for the Stars:

Measure the height of the flagpole and project it upwards from the breakout point. This estimation provides a plausible price target, giving you a tangible goal for the continuation of the uptrend.

Unleashing the Power of Bearish Pennants:

In the ever-changing landscape of the market, there are times when prices undergo a significant downward movement. During this descent, a bearish pennant emerges, signifying a momentary respite before the continuation of the downtrend.

Similar to its bullish counterpart, the bearish pennant is characterized by a symmetrical triangle formation, converging trend lines, and dwindling trading volume. Traders perceive the bearish pennant as an invitation to partake in bearish continuation—a sign that the downward spiral is primed to persist.

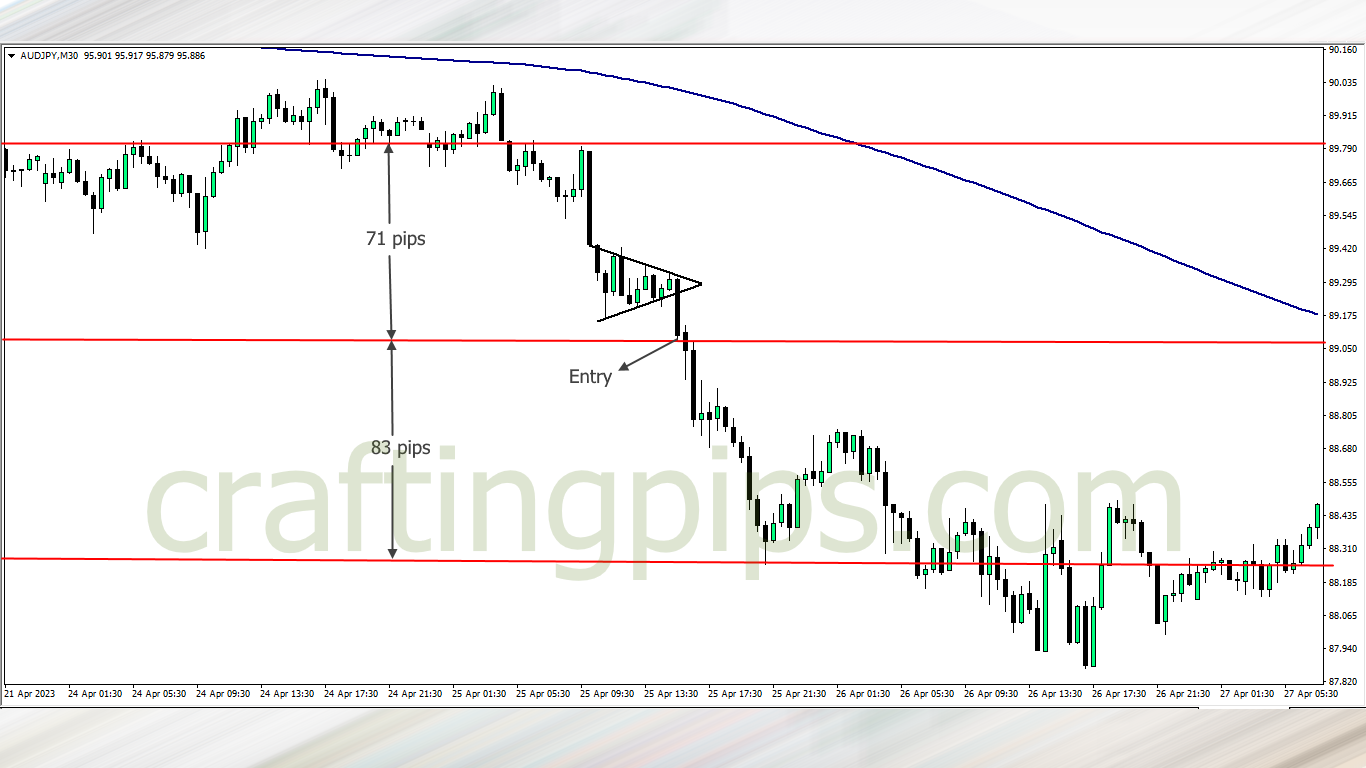

A bearish pennant

Unmasking the Bearish Pennant Formation:

Grasp the essence of bearish pennants by identifying these key traits:

- The Prelude to a Downtrend: A bearish pennant typically manifests after a substantial downward move in prices.

- The Flagpole’s Tale: The flagpole illustrates the initial decline that paves the way for the pennant’s formation.

- Consolidation Takes Shape: Observe the symmetrical triangle forming as trend lines converge, indicating a period of consolidation.

- The Volume Narrative: Pay attention to diminishing trading volume during the consolidation phase, reflecting a decrease in market participation.

Trading Strategies for Bearish Pennants:

Embark on successful trades using these prudent strategies for bearish pennants:

1. Seizing the Moment:

Initiate a short position when the price breaks out below the lower trend line of the bearish pennant pattern. This breakout confirms the continuation of the downtrend, signaling a prime opportunity for profit.

2. Managing Risk:

Mitigate potential losses by placing a stop loss order slightly above the upper trend line of the pennant. If the price breaks out upwards, it may indicate a failure of the pattern and the need to exit the trade.

3. Setting Profit Targets:

Measure the height of the flagpole and project it downwards from the breakout point. This calculation provides an estimate for the potential price target, guiding your profit-taking strategy for the continuation of the downtrend.

Conclusion:

In the exciting realm of trading, understanding and effectively trading bullish and bearish pennants can unlock substantial profit potential.

By identifying these continuation patterns and employing prudent strategies, traders can capitalize on temporary price consolidations and ride the wave of the market’s underlying trends. Remember, success lies in meticulous observation, precise timing, and prudent risk management.

So, equip yourself with the knowledge and skills to navigate bullish and bearish pennants, and seize the opportunities they present in your journey towards trading mastery.

NOTE:

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.tech/purchasechallenge/?sl=758

- BESPOKE FUNDING PROGRAMME: https://www.bespokefundingprogram.com/The_Crafter?ref=The_Crafter