Hello traders,

If there is one observation I have made this Sunday, it would be that the market has not too many great setups. Let me share the few setups I found

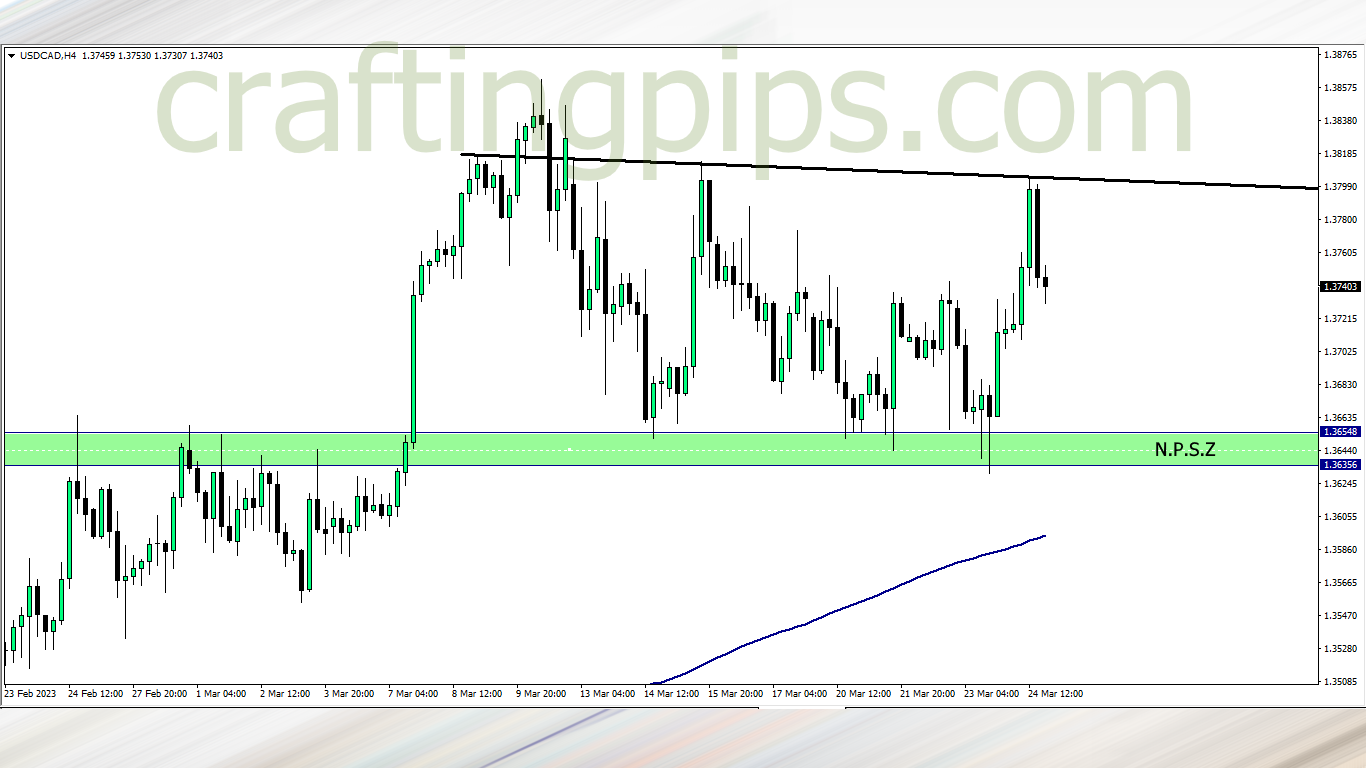

1. USD/CAD

Last week USD/CAD was locked within a consolidation.

This week we may most likely see the bears pull price down to NPSZ since the bearish engulfing candlestick formed at a key resistance level further authenticates our bearish bias

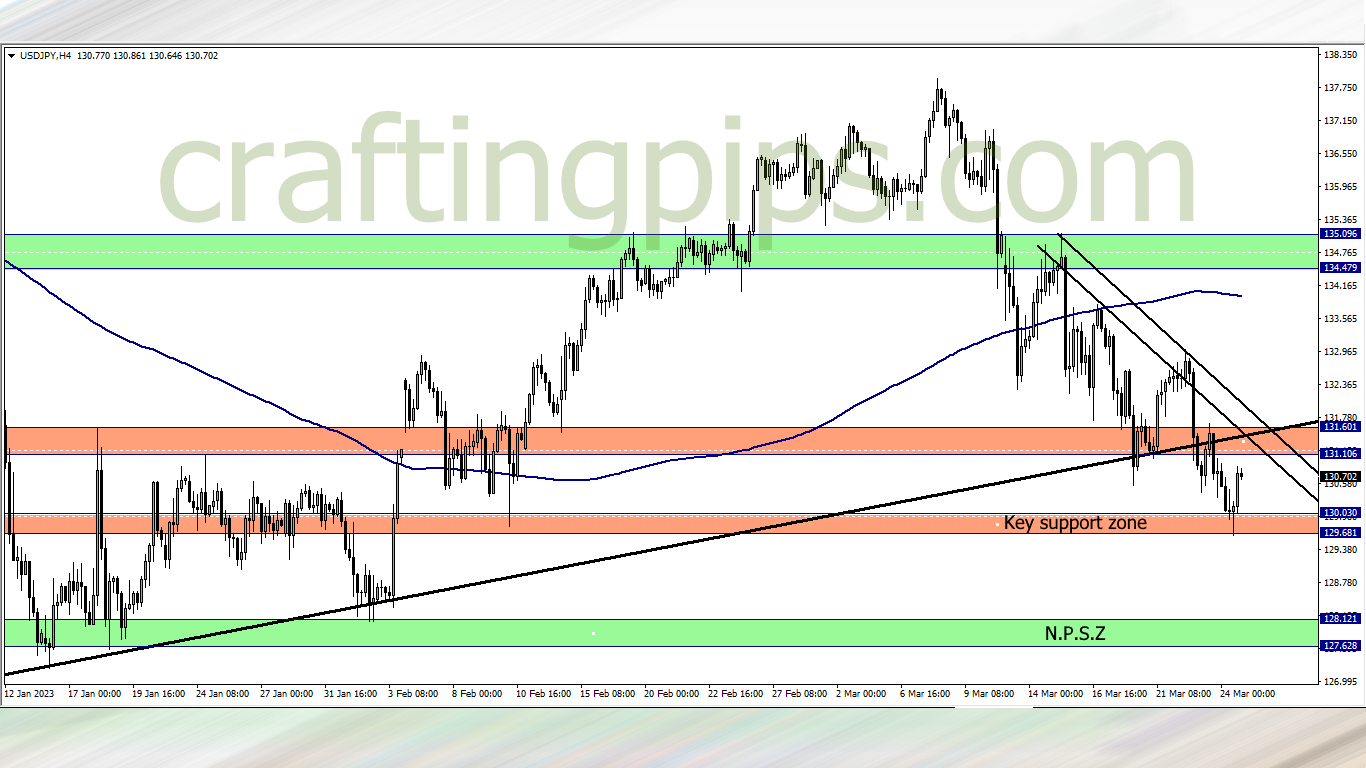

2. USD/JPY

USD/JPY is playing hard to get. At the close of last week we saw a partial breakout on the daily time frame. On the 4-hour time frame we can see a pullback after price hit a key support zone.

This week there are two ways we could trade the USD/JPY:

- We could wait for price to reach previous support zone which is now a resistance zone (also a zone where the descending trendline serves as a resistance zone ), then sell if we do get a bearish confirmation candlestick pattern

- We could wait for price to return to the key support zone, possibly break through it, then join the sellers to NPSZ

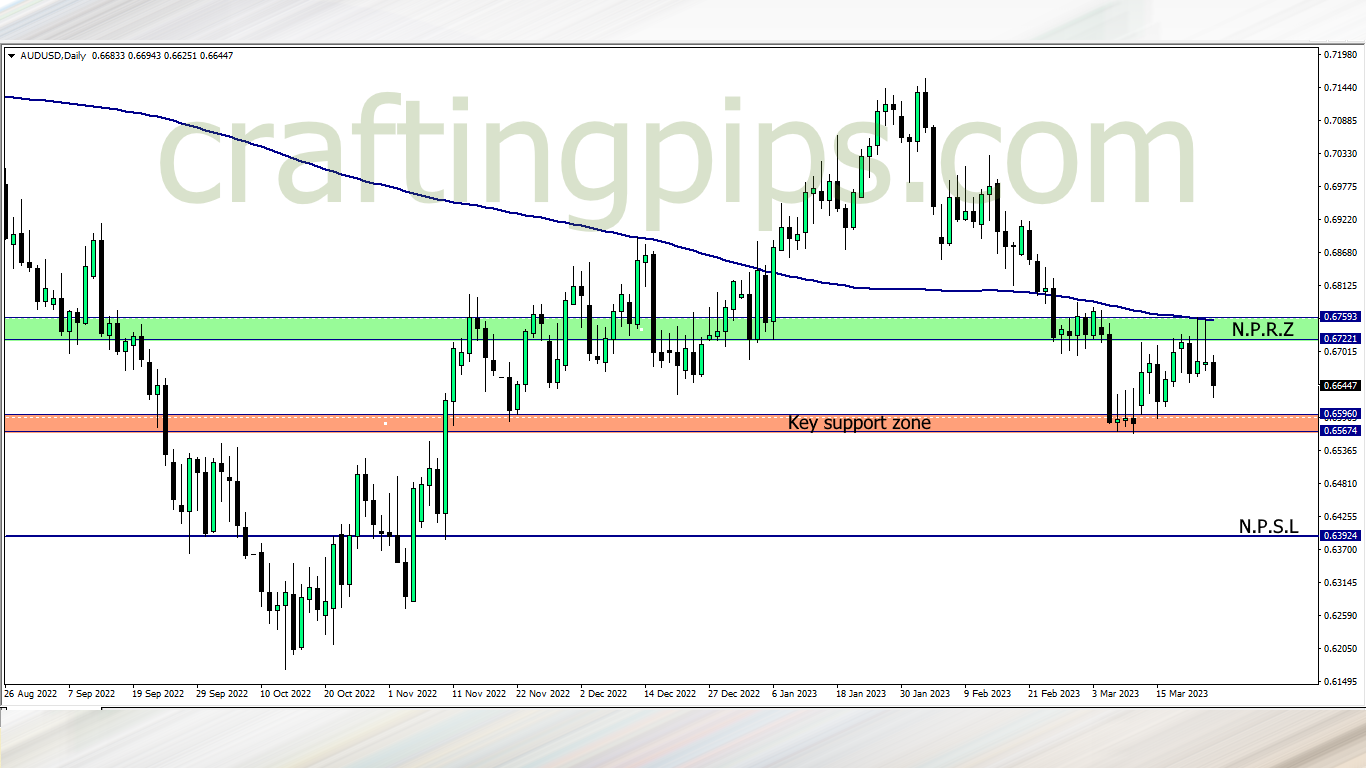

3. AUD/USD

The AUD/USD has a yummy setup but not yet ripe for plucking

If the week presents us with a breakout below the key support zone, then we can join the bears to the NPSL. However if price bounces off the key support zone, we may also join buyers to the NPRZ

What say you?

-

FIDELCREST: https://fidelcrest.com/#CRAFTER

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.com/#a_aid=THE_CRAFTER

.