Hello traders,

Apologies for my analysis coming in late, I was on a trip, far away from home. I came in late and exhausted and decided to push our Sunday analysis into Monday.

Looking at the charts, some of the major USD pairs (GBP/USD & EUR/USD) have no support level or zone to look forward to because they were all smashed last week.

My suggestion trading them going forward is:

Waiting for a pullback and use an intraday system that could ride the bearish move as it continues to (if the bearish fall continues this week)

That said, some setups I will analyze today still have a visible support level or zone, so let’s hit them charts:

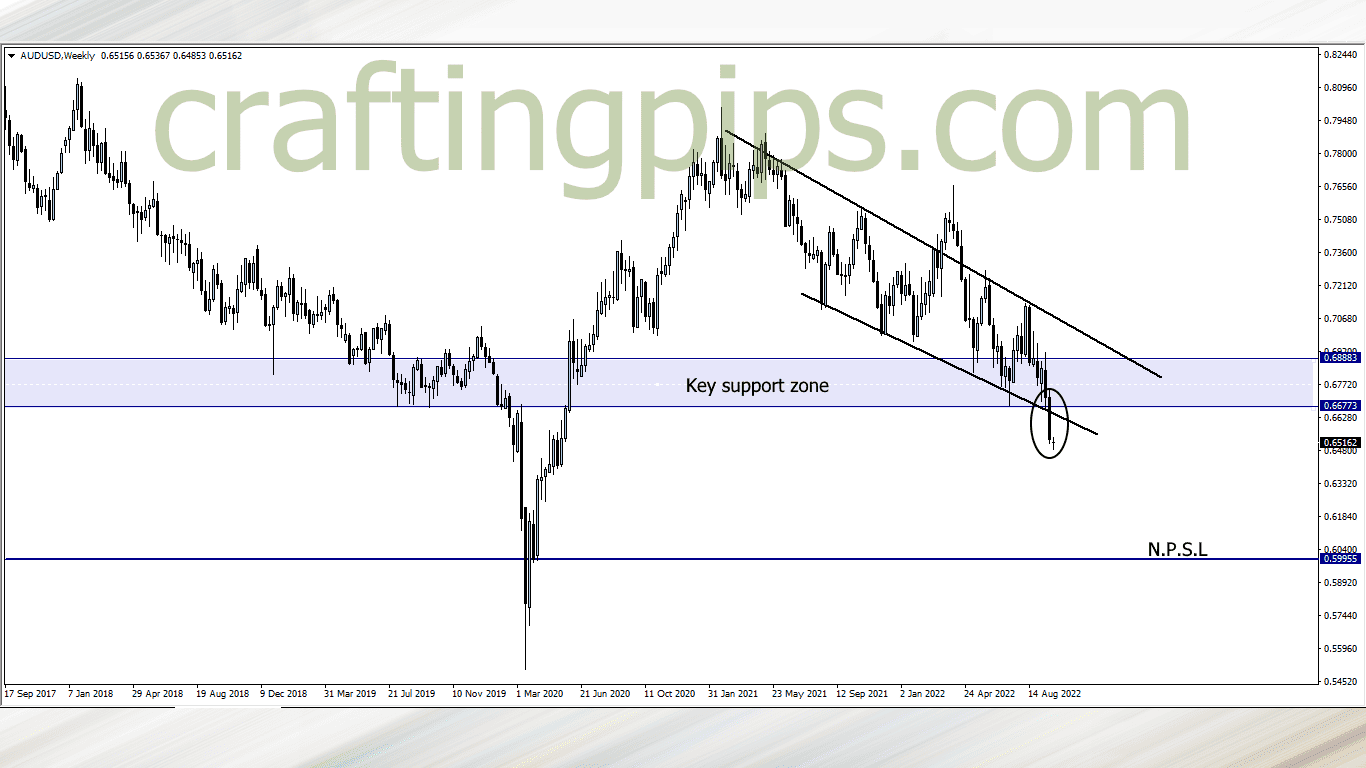

1. AUD/USD

On the weekly time frame of the AUD/USD we can see a decent breakout from last week.

This is a swing/position trader’s ideal setup. There is a huge possibility that we may see a pullback this week, but the bears will most likely pull price down to the next possible support level (0.59955)

Note that this setup may end up materializing some time around October

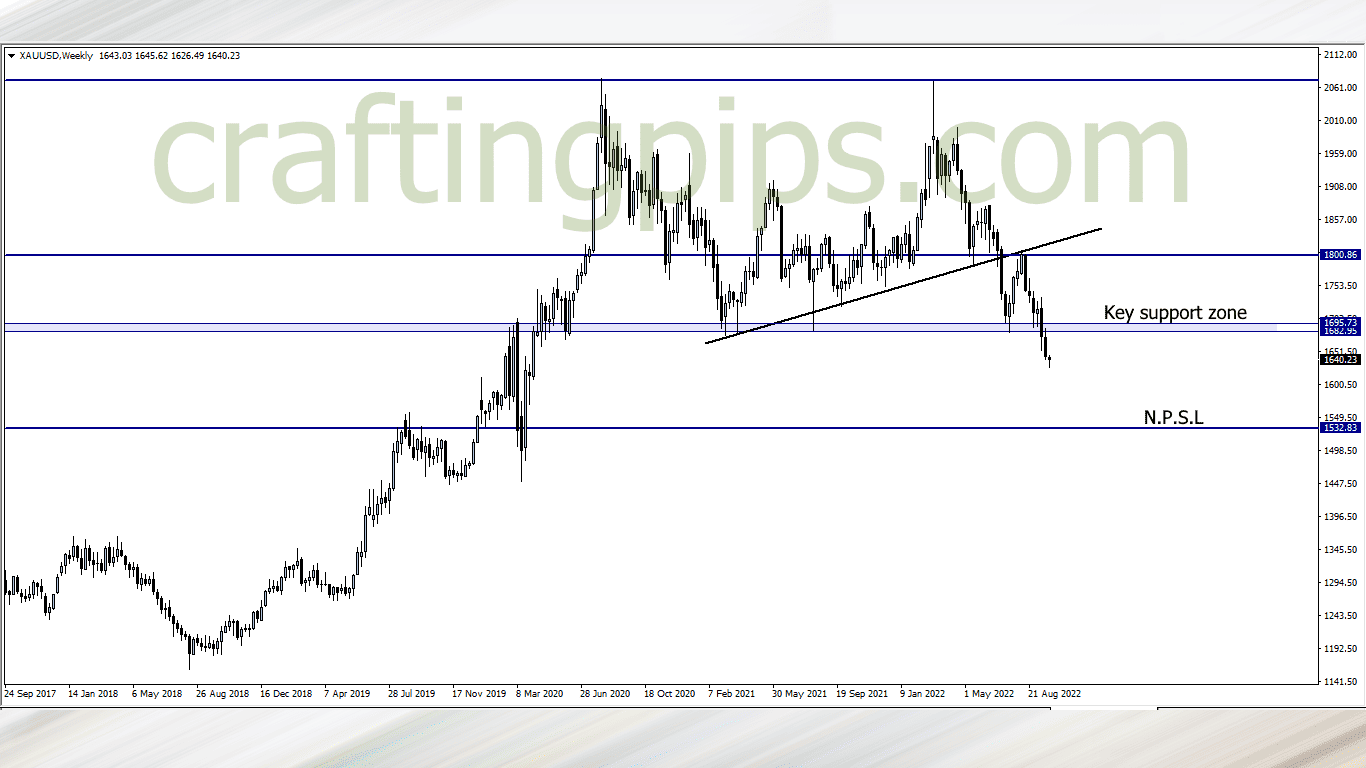

2. XAU/USD (Gold)

Gold is another swing/position trader’s ideal setup. A decent breakout and bearish confirmation candlestick popped up last week.

We may see a pullback this week, but price is most likely going to reach support level 1532.83

3. NZD/JPY

The bears took over the market last week, and what we are seeing today on the NZD/JPY is price taking a breather on a key support zone.

A breakout of price below the present support zone on the daily time frame means price may hit the next possible support level (79.414) before the week is over.

If that fails, we may see bulls gradually take price back to the previous resistance zone (86.233 – 86.948)

What say you?

NOTE:

Hello traders, Are u tired of wasting ur money on failed prop firm challenges?

Say no more…

Fundyourfx is willing to give u a DIRECT FUNDED account at an affordable price If u are interested, contact me & get my coupon code for a -5% discount.