Hello Traders,

Let’s hit the charts:

1. EUR/USD

Since Friday, EUR/USD has struggled to rise above 1.18555

My major interest is seeing how today’s daily candlestick closes. If we get a decent breakout, all we should be looking out for tomorrow would be a sell, and our target may most likely be 1.15621

If a breakout doesn’t occur, then we should be watching out for a bullish close on the daily time frame, which could take price back to resistance level 1.20008

Mind you we could also get mixed signals, which means that we do not get a bearish breakout nor a bullish close which may indicate that price may most likely go North.

In such instances, my advice is always to sit on your hands.

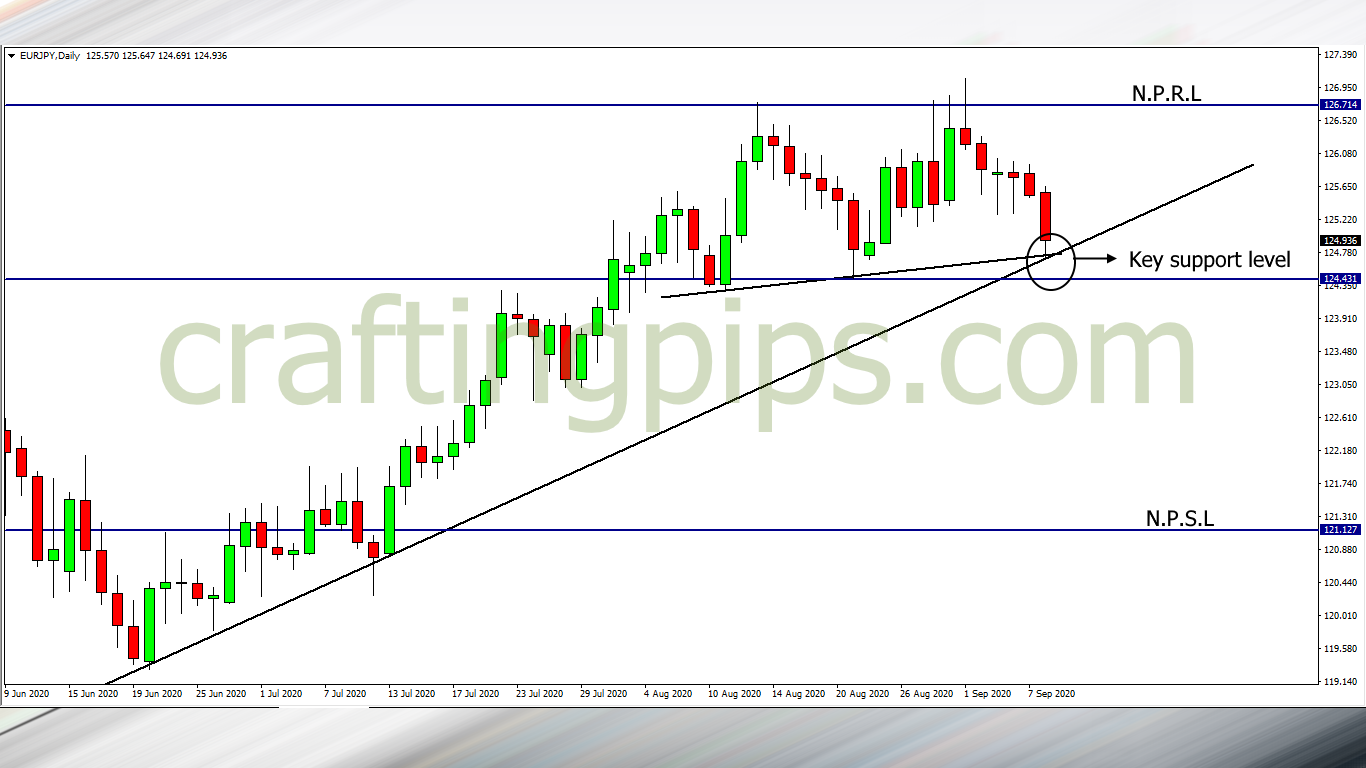

2. EUR/JPY

EUR/JPY has the same outlook as the EUR/USD

All we are looking at is either a bearish breakout which may encourage price to hit the next possible support level (121.127) or a bearish reversal sign which will most likely encourage the buyers to push price back to resistance level 126.714.

3. GBP/CHF

We can already see a breakout of a key support level (1.19782) on the GBP/CHF.

Waiting till the daily candlestick closes is very important. If at the end of the day we still have a bearish candlestick close, which is below the present support level, then we most likely will be looking at 1.17442 as our next possible support level

If we do not get a close below the present support level, then we may have to wait for a bullish confirmation which may drive price back to resistance level 1.21985

In any case, if we do not get either confirmation, you know the drill… “Sit on your hands”

What say you?

ATTENTION: For those who are interested in joining our FREE trading group on Telegram, where trade ideas are discussed, which may assist your trading career while being infected by positive vibes

Smash the link: https://t.me/joinchat/FN30PxlwXbk2BcuTDdH5yg