Hello traders,

let’s hit them charts:

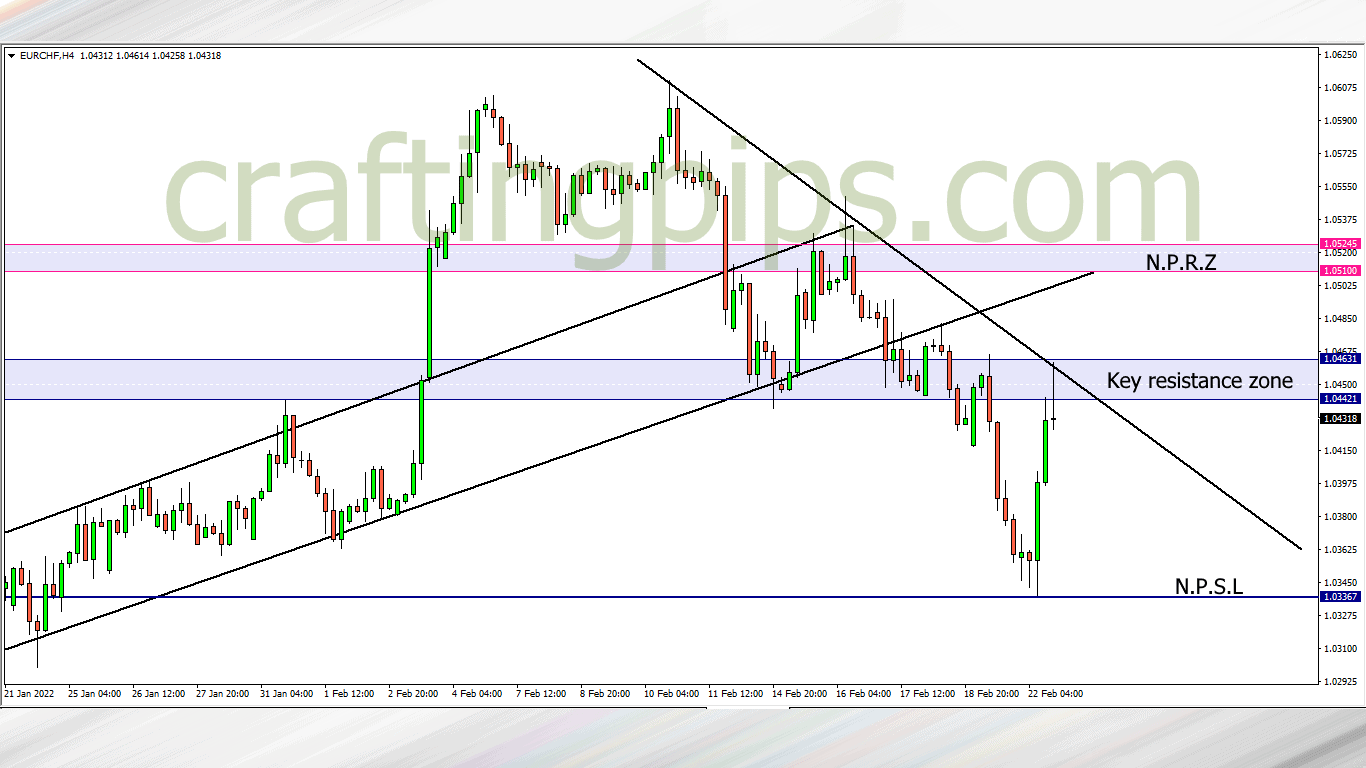

1. EUR/CHF

Price on the EUR/CHF is touching a key resistance zone, and the 4 hour time frame is giving us a dragonfly doji which signifies a bearish outlook.

The daily time frame is looking bullish… though it may be too early to make such inference, but its important to know that on the daily time frame we had a triple bottom, and the third bottom is the lowest price has hit in over 5 years.

So, we may most likely see a breakout of price on the 4-hour time frame, hence resistance level 1.05100 getting hit.

My advice would be for us to wait to see how the daily time frame closes before making any decision. If the daily candlestick breaks the key resistance zone, then we could join the buyers. If not, we could engage the market by selling short-term.

2. CAD/JPY

The 1-hour time frame of the CAD/JPY is showing bears dominating the market after hitting resistance level 90.525.

If price breaks the key support zone, then we may see the next possible support level (89.751) get hit. But if price bounces within the key support zone, there is a possibility for a reversal of price and resistance level 90.525 being revisited.

What say you?

Traders who are interested in joining our FREE trading group on Telegram, where trade ideas and trade-related topics are discussed, which could assist your trading career while being infected by positive vibes

hit us on Pip Crafters