My reason for keeping a journal is to encourage traders to also keep one for two major reasons:

- Track weekly trading performance.

- have enough data, in order to be able to work on their trading technique and psychology

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY (29/05/2023)

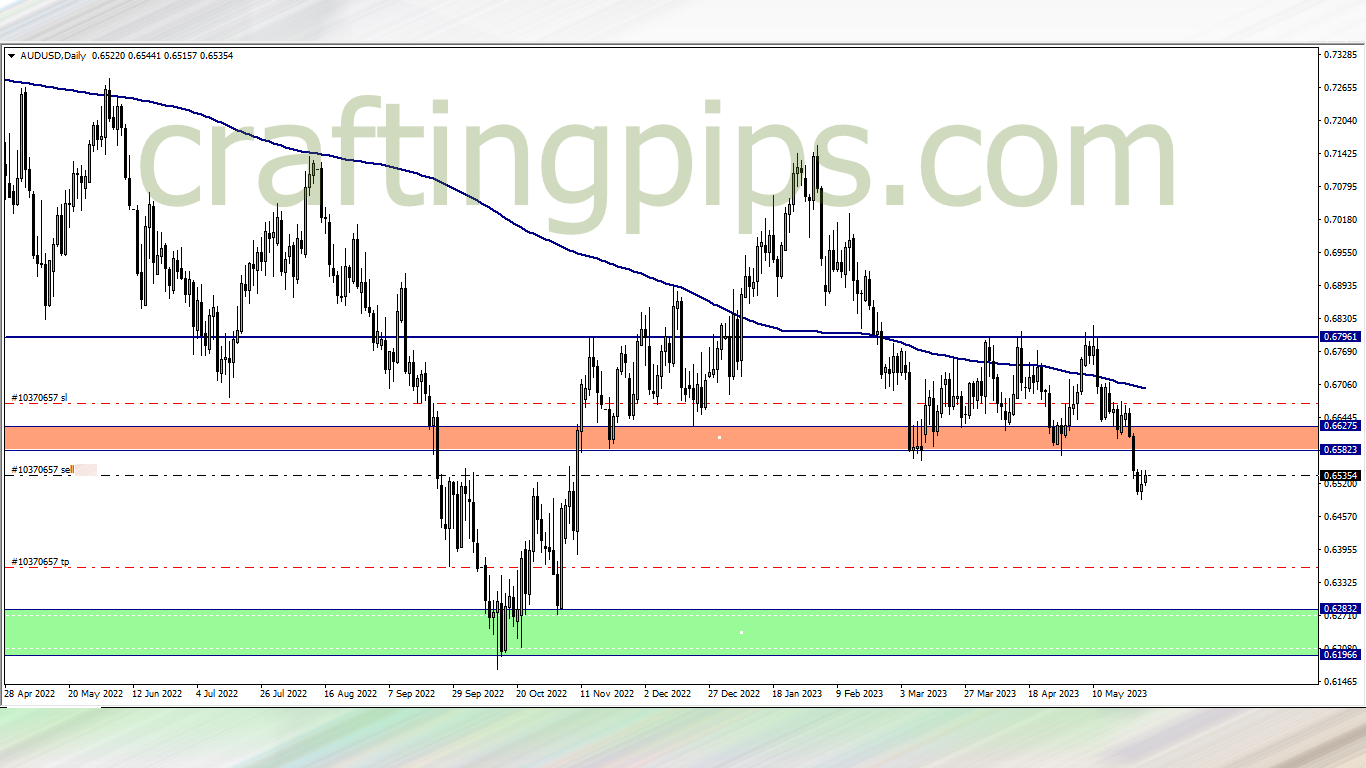

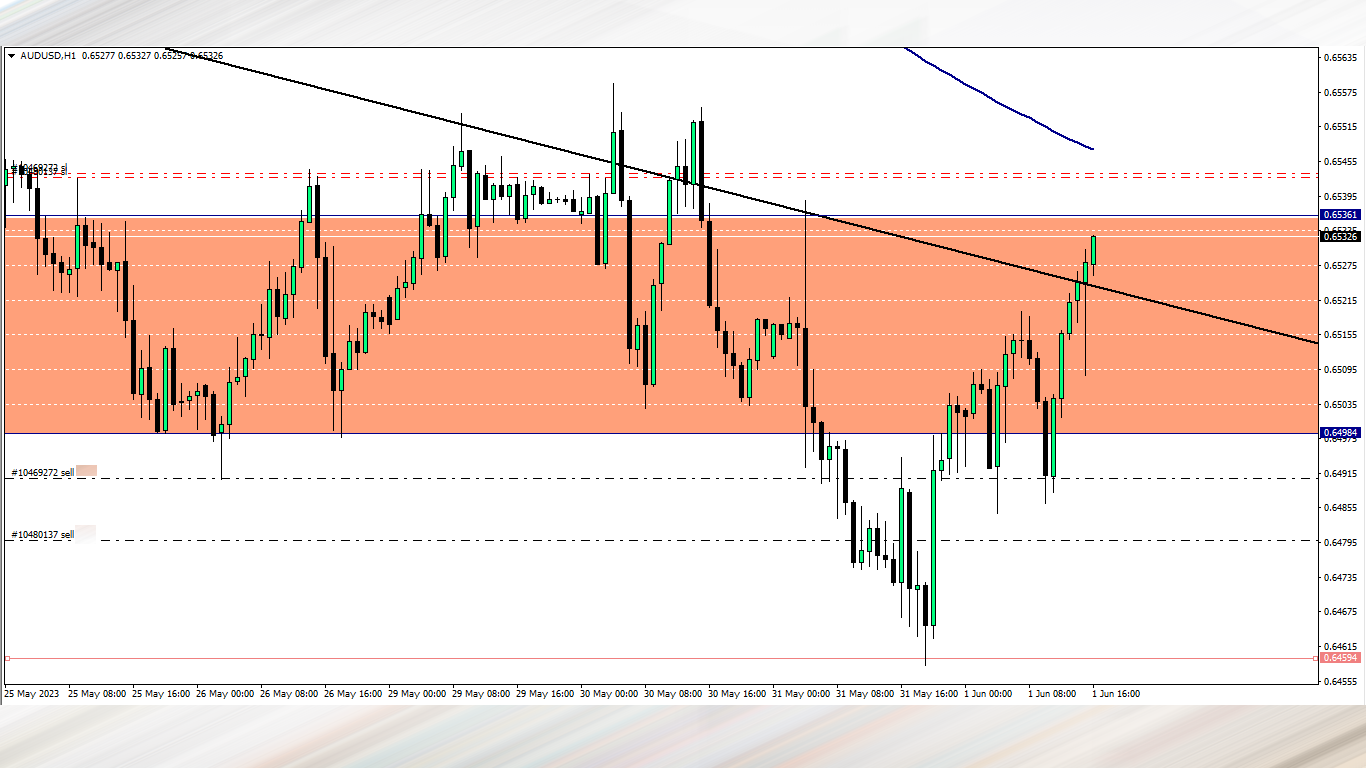

AUD/USD (4 am)

Analysis: My reason for selling can be seen on our weekly market analysis

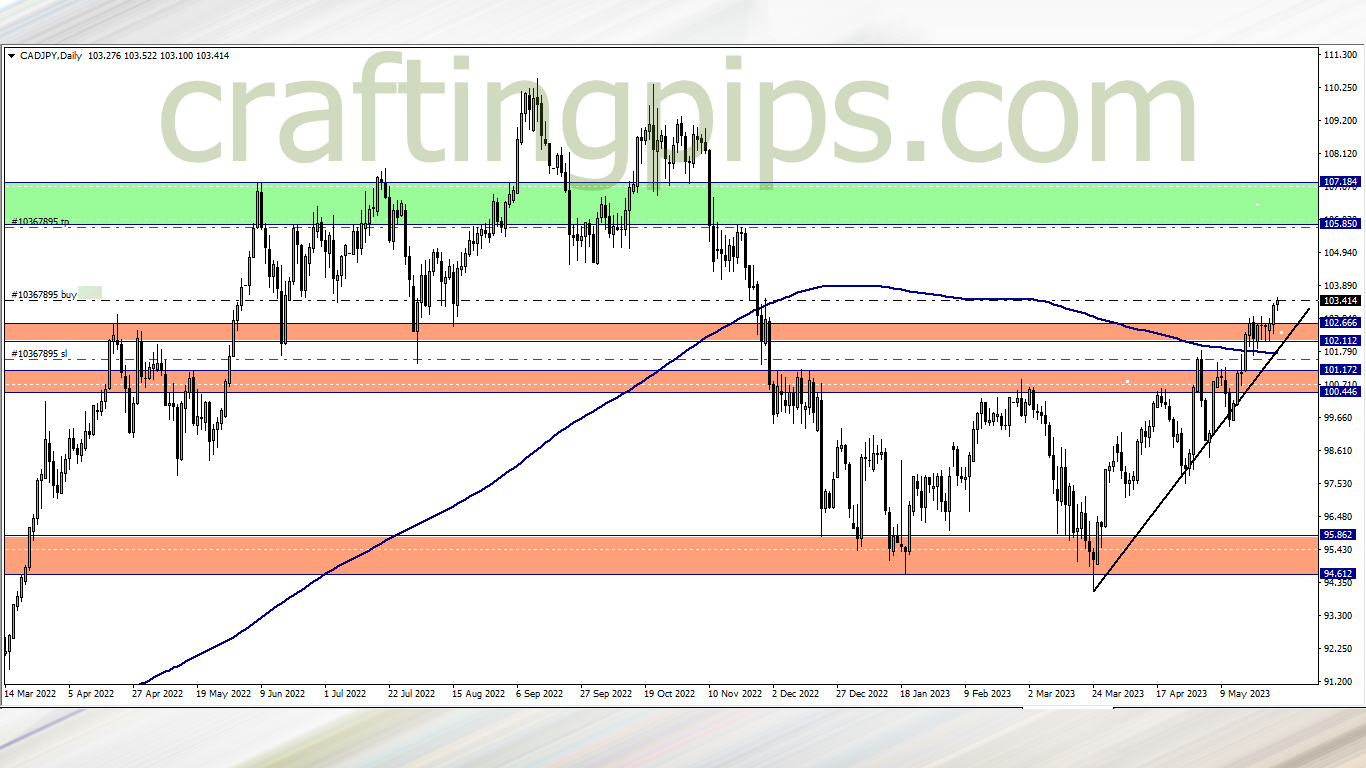

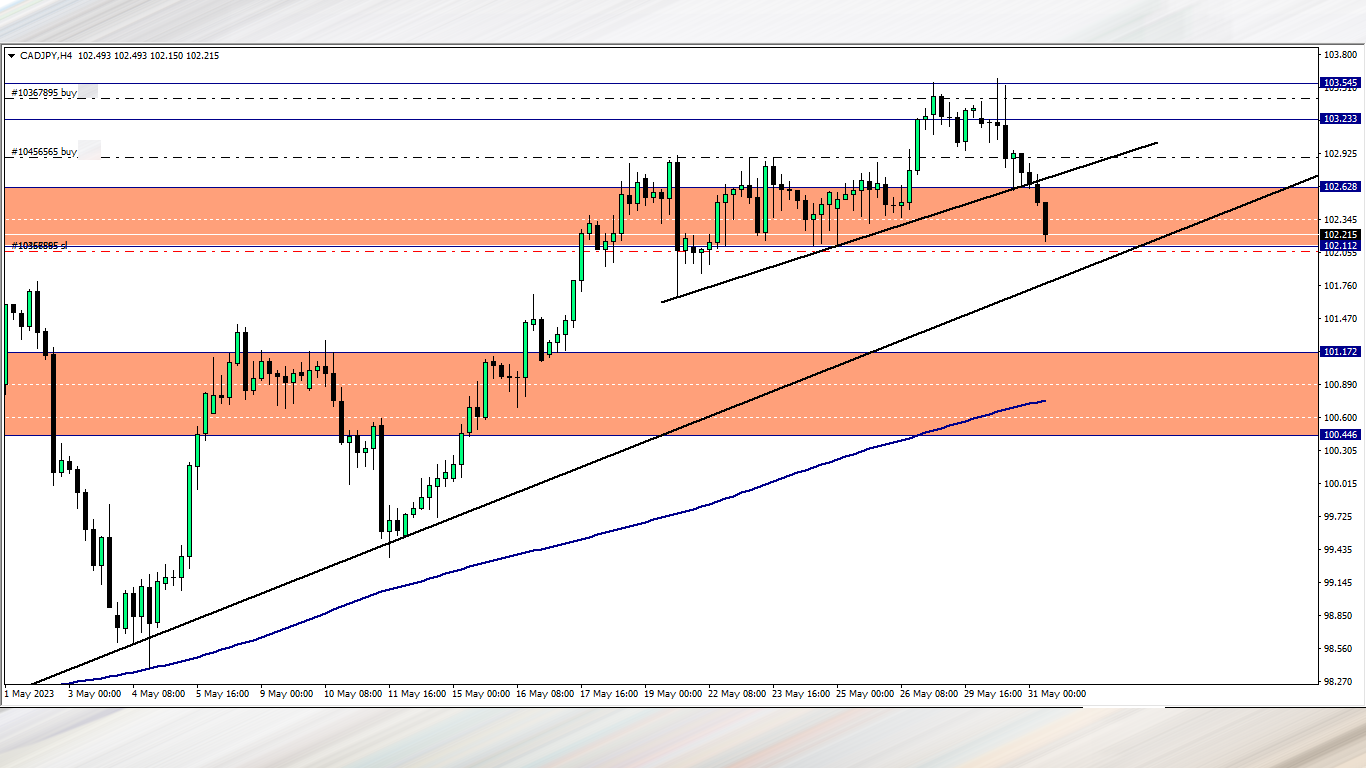

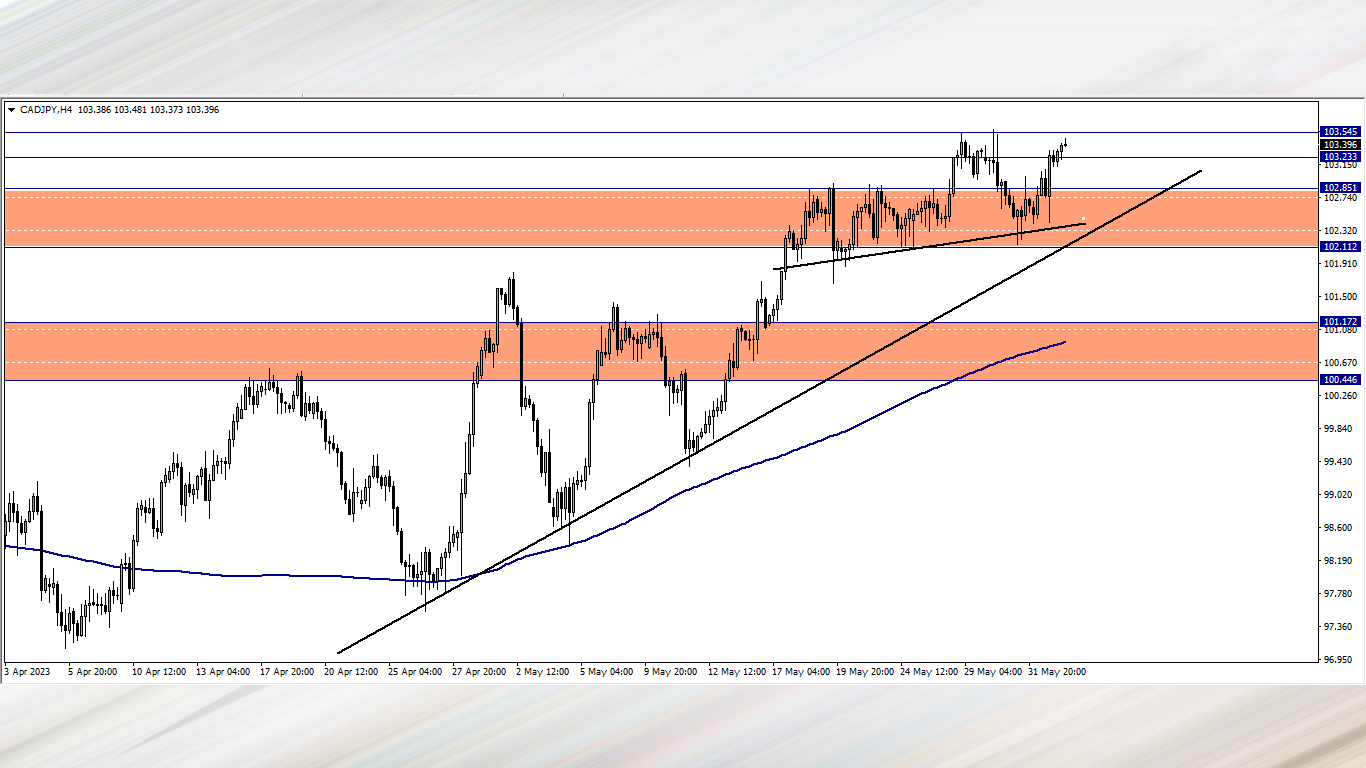

CAD/JPY (4 am)

Analysis: My reason for selling can be seen on our weekly market analysis

TUESDAY (30/05/2023)

AUD/USD Update (2.00 pm)

Analysis: I trailed AUD/USD, and closed the trade with +15 pips

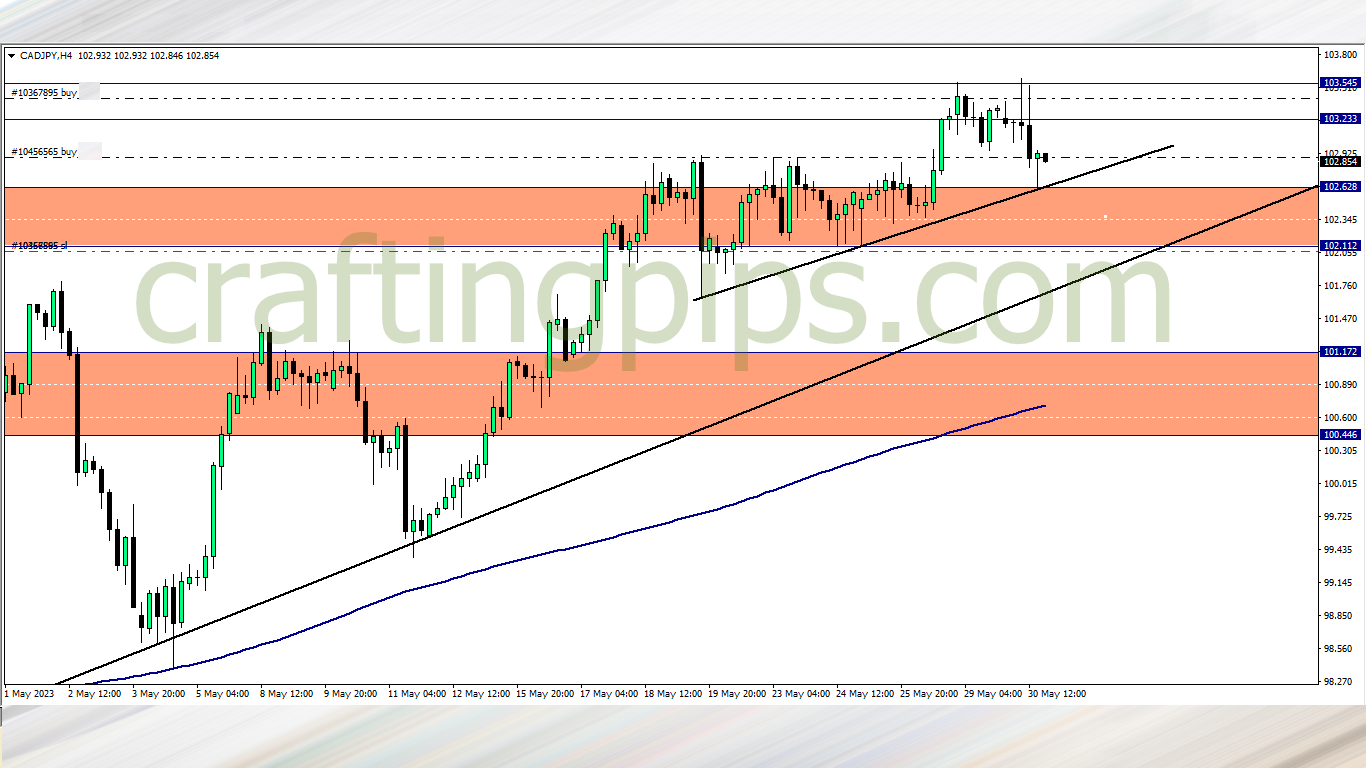

CAD/JPY Update (6 pm)

Analysis: A strong bullish pinbar on an area of support inspired another sell opportunity

WEDNESDAY (31/05/2023)

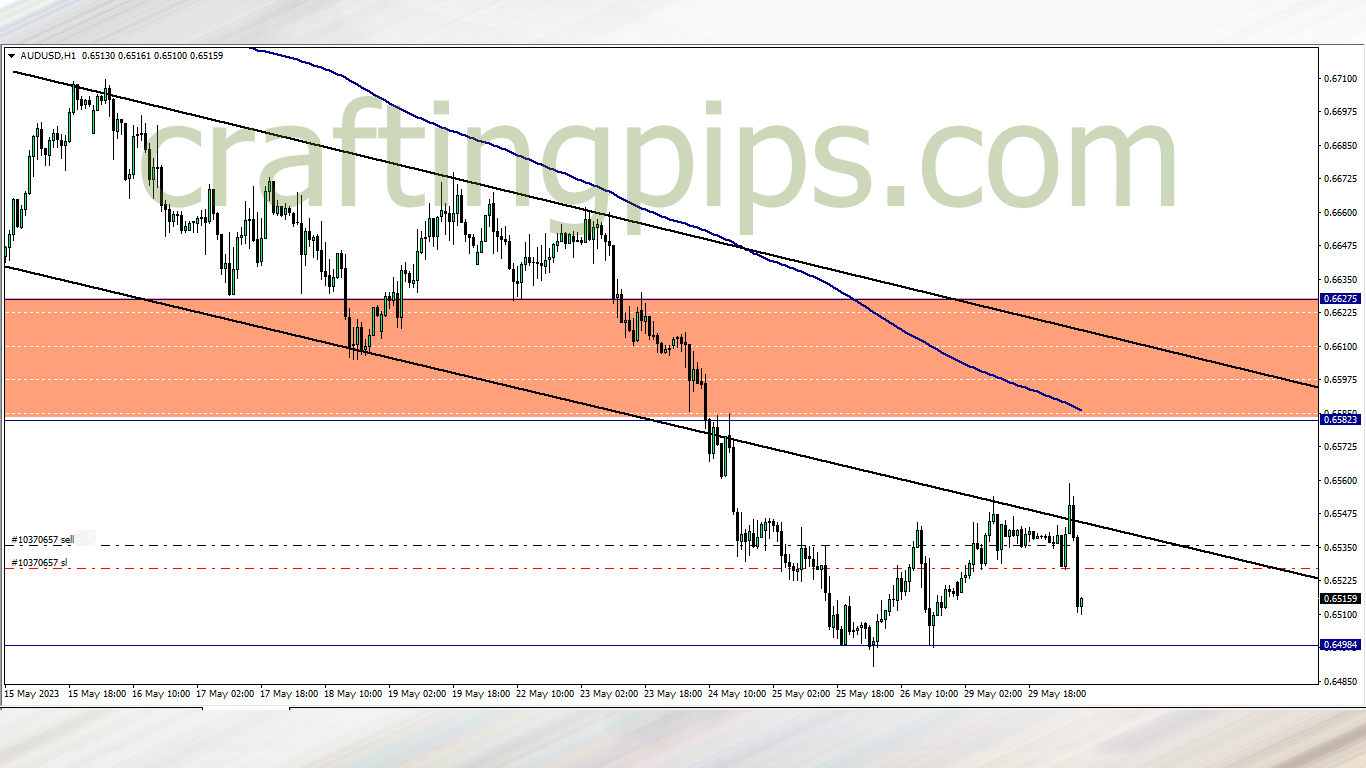

AUD/USD (7am)

Analysis: The sell was inspired by the AUD/USD setup in our weekly market analysis. All I did was hunt for a sell opportunity on the 4 hr time frame

CAD/JPY Update (7am)

Analysis: After scaling in, CAD/JPY got stuck at the 103.545 resistance level, and this is my screenshot price getting to my set SL

AUD/USD Update (7am)

Analysis: Closed with -113 pips. This loss would have been completely avoidable if I had trailed my win

WEDNESDAY (31/05/2023)

CAD/JPY Update

Analysis: Closed both positions at +40 pips. Only my first entry counted here, My second entry was where price got trapped. That was position closed that breakeven

Trade activity summary for the month

| 1st TRADING WEEK |

|

|||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (01/05/2023) | GBP/CAD | BUY | + 100 pips | |

| TUE (02/05/2023) | AUD/USD | SELL | + 14 pips | |

| WED (03/05/2023) | AUD/JPY | SELL | + 76 pips | |

| THUS (04/05/2023) | NZD/USD | BUY | + 18 pips | |

| TOTAL | + 208 PIPS | |||

| 2nd TRADING WEEK | ||||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (08/05/2023) | CAD/CHF | BUY | – 40 pips | |

| THUS (11/05/2023) | CAD/JPY | BUY | + 17 pips | |

| GBP/CHF | SELL | + 11 pips | ||

| FRI (12/05/2023) | EUR/USD | SELL | + 31 pips | |

| TOTAL | +19 PIPS | |||

| 3rd TRADING WEEK | ||||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON 15/05/2023 | GBP/JPY | SELL | -120 pips | |

| WED 17/05/2023 | GBP/USD | SELL | – 60 pips | |

| THUS 18/05/2023 | USD/JPY | SELL | – 90 pips | |

| USD/JPY | BUY | Pending | ||

| FRI 19/05/2023 | EUR/JPY | BUY | – 40 pips | |

| TOTAL | – 310 PIPS | |||

| 4th TRADING WEEK | ||||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (22/05/2023 | USD/CHF | BUY | – 28 pips | |

| CAD/JPY | BUY | – 16 pips | ||

| USD/JPY | BUY | – 6 pips | ||

| WED (24/05/2023) | AUD/JPY | BUY | Breakeven | |

| CAD/JPY | BUY | + 70 pips | ||

| TOTAL | + 20 pips | |||

| 5th TRADING WEEK | ||||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (29/05/2023) | AUD/USD | SELL | +15 pips | |

| CAD/JPY | BUY | + 40 pips | ||

| WED (31/05/2023) | AUD/USD | SELL | -113 pips | |

| TOTAL | -58 pips | |||

| GRAND | TOTAL | – 199 PIPS |

In conclusion:

This week CAD/JPY could have yielded more profits if I held on to it till the last few hours before the close of markets on Friday, but I did not because of the high impact news on USD. the AUD/USD could have also closed in little profits if I decided to trail… This I regret, because I could have closed the week in profits

Also I noticed that I had significantly more trades in the month of May (21 trades) than the month of April (12 trades). In retrospect, after my first flawless trading week, I should have taken my foot off the gas for the rest of the month. That alone would have put me in good profits.

I am closing the month with a breakeven. My lesson this month in the market is: Profitable trading most times is actually trading less.

How did the month of May in the market go for you?

NOTE:

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.tech/purchasechallenge/?sl=758

- BESPOKE FUNDING PROGRAMME: https://www.bespokefundingprogram.com/The_Crafter?ref=The_Crafter