As a trader, understanding the different sessions in the market and how to maximize trading opportunities during each one is crucial. The market is open 24 hours a day, but each session has its own unique characteristics.

In this article, we’ll explore the different market sessions and provide tips on how to make the most of them using relatable examples.

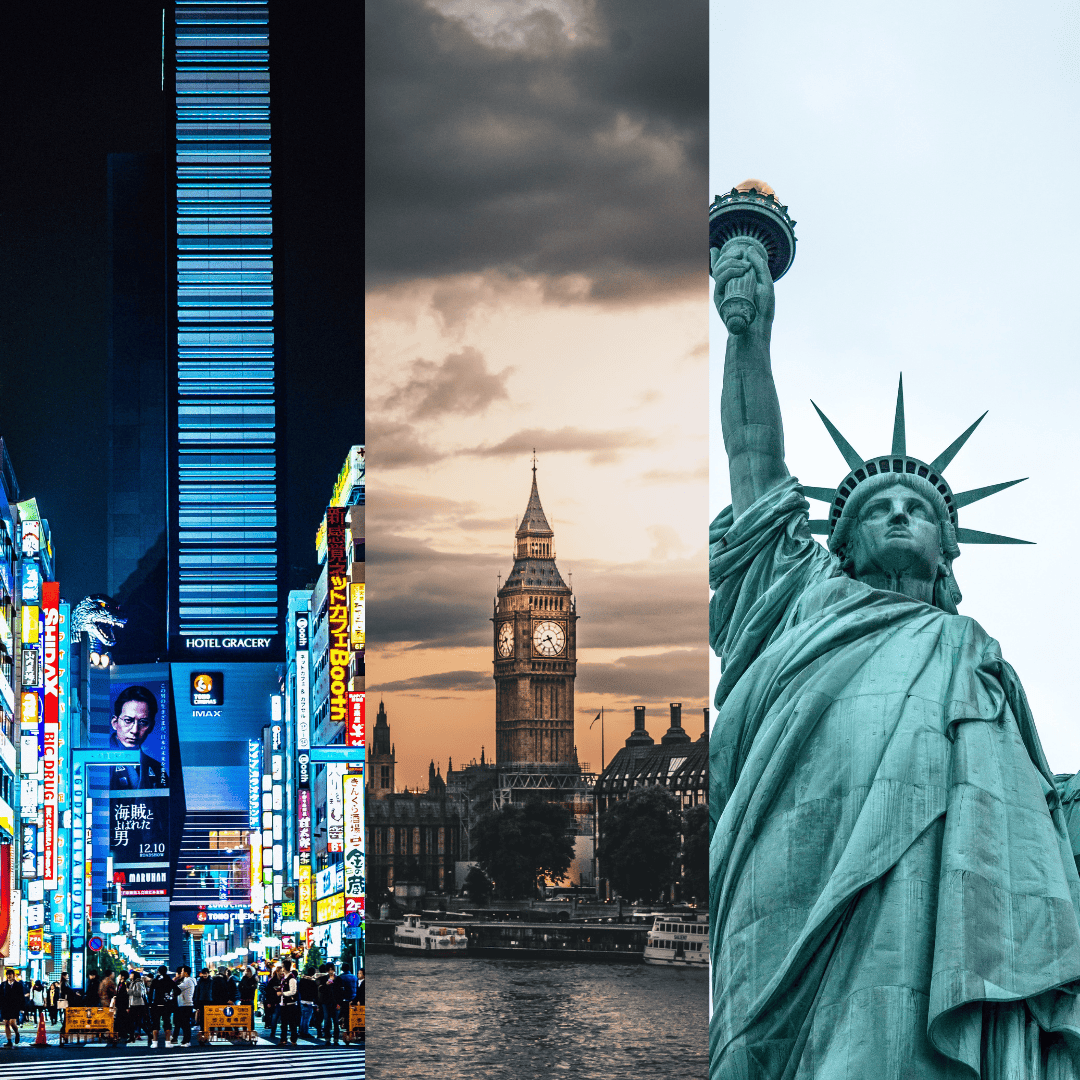

Asian Session

The Asian session starts at 6:00 PM EST (11 pm GMT) and ends at 3:00 AM EST (8 am GMT). When contrast to the other sessions, this one is typically quieter and has less volatility on the major currency pairs. Yet, there are still chances to trade this session.

Think of yourself as a trader who specializes in the Australian Dollar, New Zealand Dollar or the Japanese Yen pairs, for instance. You will benefit from reduced spreads and relatively stable volatility during the Asian session when trading currency pairs that are liquid during this session.

European Session/London session

The European session starts at 3:00 AM EST (8 am GMT) and ends at 12:00 PM EST (5 pm GMT). High volatility is a characteristic of this session, especially the opening two hours. The opening of the European markets coincides with a spike in trade activity.

For instance, let’s say you’re a trader who favors the EUR/USD pair. You might profit from more liquidity and tighter spreads during the European session. Also, when volatility is strong early in the session, you can apply a breakout approach to you trading system.

North American Session/New York session

The North American session starts at 8:00 AM EST (1 pm GMT) and ends at 5:00 PM EST (10 pm GMT). The is known to be another volatile session. The opening of the American markets also coincides with a spike in trade activity. Think of yourself as a trader who favors the USD/JPY, EUR/USD, or GBP/USD pairs.

You might profit from high liquidity, narrow spreads, and the publication of crucial economic data during the North American session. The release of US non-farm payroll data, for instance, can have a big impact on the USD/JPY pair.

Tips to maximize your trading during each session

1. Research and Understand the Market:

Before trading during a particular session, it is important to understand the market and the economic factors that influence it. For example, if you’re trading the USD/JPY pair during the New York session, you need to be aware of the latest economic news from the US.

2. Choose the Right Trading Strategy:

Different sessions require different trading strategies. For instance, if you’re trading the EUR/USD pair during the London session, you might use a breakout strategy when volatility is high.

3. Monitor Economic Data:

Economic data releases can have a significant impact on the market, particularly during the New York session. Traders should keep a close eye on economic indicators such as GDP, employment figures, and interest rate decisions.

4. Use Stop Losses and Take Profits:

Stop losses and take profits are essential risk management tools that help traders minimize losses and maximize profits. For example, if you’re trading the USD/JPY pair during the New York session, you might set a stop loss to minimize losses if the market moves against you.

5. Keep an Eye on the News:

News events such as political developments, natural disasters, and geopolitical tensions can have a significant impact on the market. Traders should stay up-to-date with the latest news and adjust their trading strategies accordingly.

For example, if there’s political unrest in a major oil-producing country, it could impact the price of oil, and you might adjust your trading strategy for the Canadian Dollar.

In conclusion:

In conclusion, it’s crucial for traders to comprehend the various market sessions and the opportunities they present. You may optimize your gains and reduce your losses by understanding when and how to trade throughout each session, each of which has its own distinct characteristics.

A great trader understands how to read the market and pick the best trading technique, just like a chef who knows which ingredients to utilize to make the perfect dish., a successful trader knows how to read the market and choose the right trading strategy.

By staying up-to-date with the latest news, monitoring economic data, and using risk management tools such as stop losses and take profits, you can navigate the market with confidence and achieve your trading goals.

Trading is not just about numbers and charts, it’s an exciting adventure that requires a combination of science, art, and intuition. Like a skilled sailor navigating through rough waters, a successful trader needs to read the market’s waves and steer the trading ship in the right direction.

By mastering the different market sessions and knowing when to strike, a trader can become a fearless warrior, taking on the market’s challenges with confidence and skill. With the right mindset and tools, every market session can be an opportunity to grow and achieve success.

So, embrace the thrill of the trade, experiment with different strategies, and stay curious about the market’s twists and turns. Remember, trading is a journey, and every session is a new chapter.

With hard work, dedication, and a bit of luck, you can write your own success story and become a legendary trader. So hoist your trading sails and set your course for success!

-

FIDELCREST: https://fidelcrest.com/#CRAFTER

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.com/#a_aid=THE_CRAFTER