Hello fellow traders,

Just got back from my borehole pumping machine infuriated. I just realized that while I was asleep last night, my dogs were being mischievous.

They dragged the wires connecting the control panel on the wall to the borehole, hence, bringing down the entire control panel. I just hope the control panel is still good because it looks smashed.

Damn those dogs…

Alright alright fellas, let’s get into our charts before the electrician gets here.

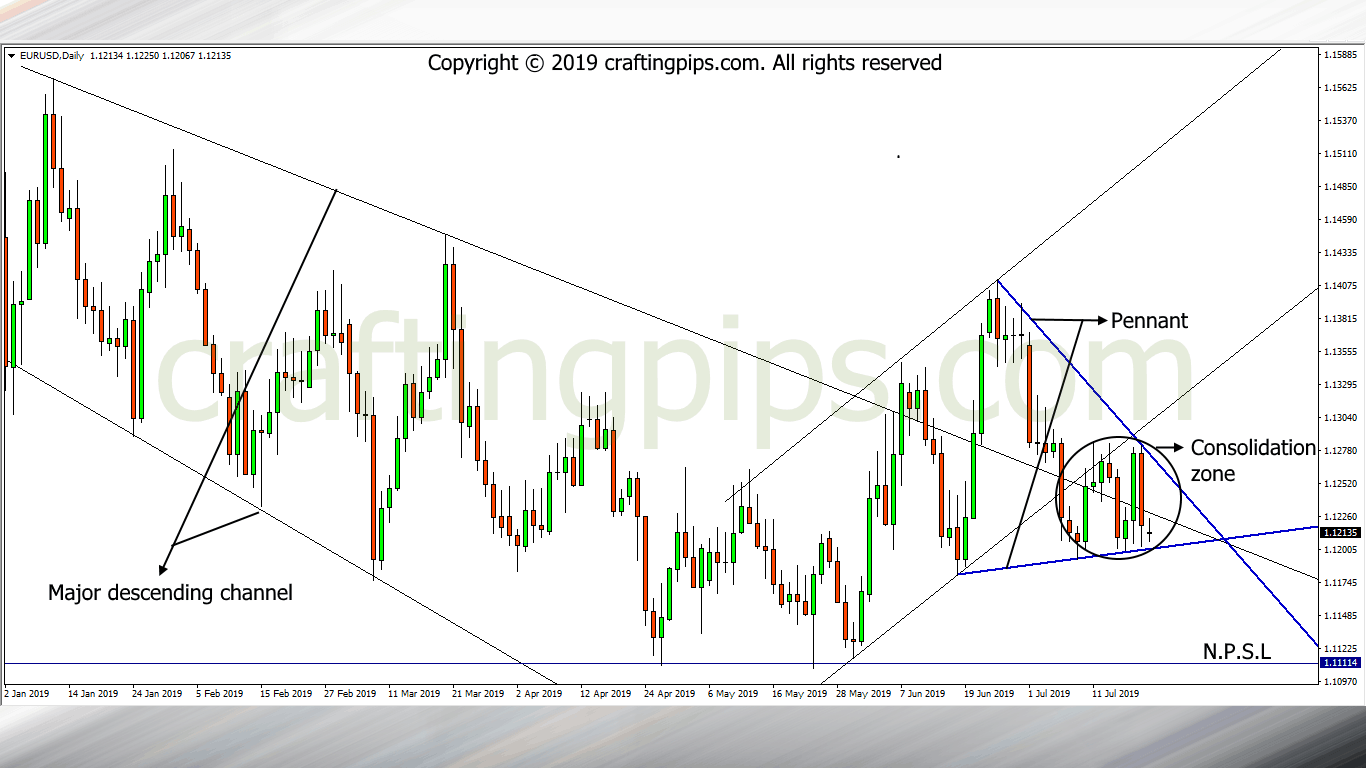

1. EUR/USD

Apologies for making the EUR/USD chart look more like a baby’s scribble, but I will explain.

EUR/USD on the daily time frame has been having it difficult to surpass the 1.14097 resistance level after breaking out of a descending channel.

Trying to also follow the downtrend on the EUR/USD after breaking the 1.12547 support level has also proven futile.

So, we see a consolidation formed towards the tail end of a pennant.

A bearish breakout through support level 1.11896 should drive price to the next possible support level 1.11114.

On the other hand, there is also a possibility that price may remain Bullish till Wednesday, simply because price may bounce off the present support level (1.12009).

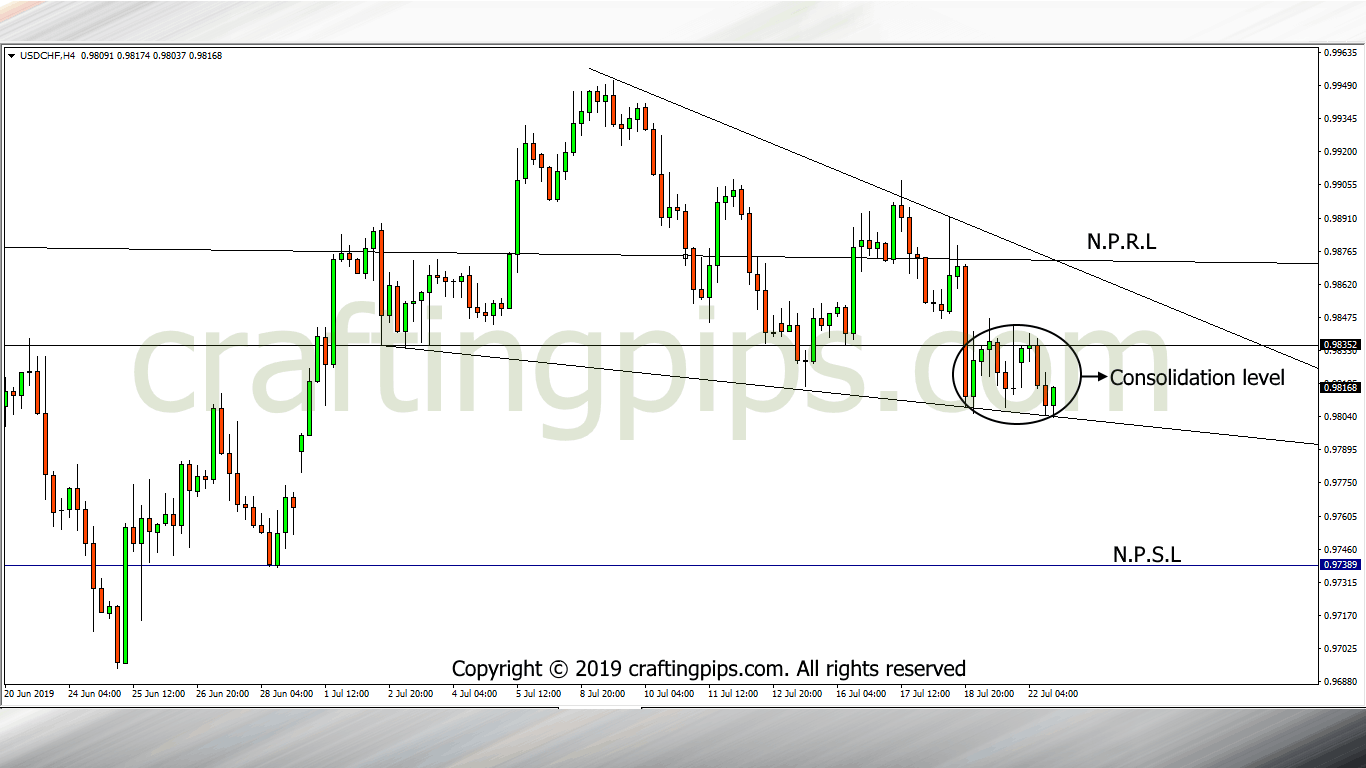

2. USD/CHF

Price in the USD/CHF is locked within a narrowing channel, however, the most important things noticed in this pair is:

Price is finding it difficult exiting the consolidation level.

In my opinion, I sense weakness of the USD and if we get to see a breakout of the support level 0.98032, price may most likely be forced down to the next possible support level (0.97389)

On the other hand, there is a slight possibility that price could break the 0.98352 resistance level, which will encourage the buyers to drive price to the next possible resistance level (0.98712)

Alright, ladies and gents, we are done for today, we will be here again. same time same blog. giving you the lowdowns of what’s happening in the currency market.

Stay blessed.