Hello traders,

let’s hit the charts:

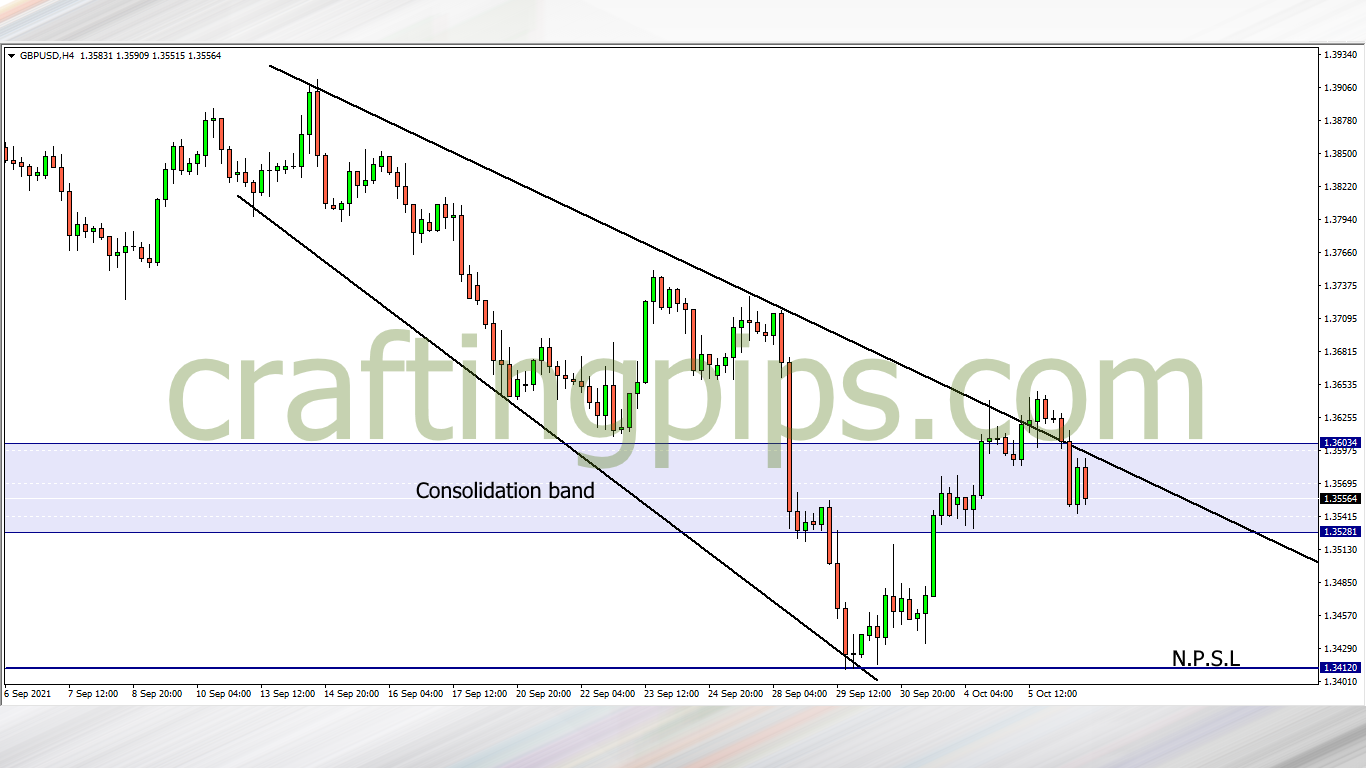

1. GBP/USD

After GBP/USD closed with the daily candlestick breaking the descending trendline, it gave most traders a false impression about the market dominated by buyers.

Today we are seeing that the breakout may most likely be a fakeout, and depending on how the daily candlestick closes, we may see either the sellers of buyers take over.

If we are thinking of going bearish, the consolidation band is a support level to watch out for. If price breaks it, then we may see price hit the next possible support level (1.34120), but if price revisits and breaks resistance level 1.36410, then our next possible resistance level would be 1.37172

2. GBP/CHF

On the GBP/CHF, the bears are ruling the market. The consolidation band is the only thing holding the bears from further slipping.

If support level 1.25943 is broken by the sellers, then we have two support levels (1.25519 & 1.25059) price may most likely hit before the close of Thursday’s London session.

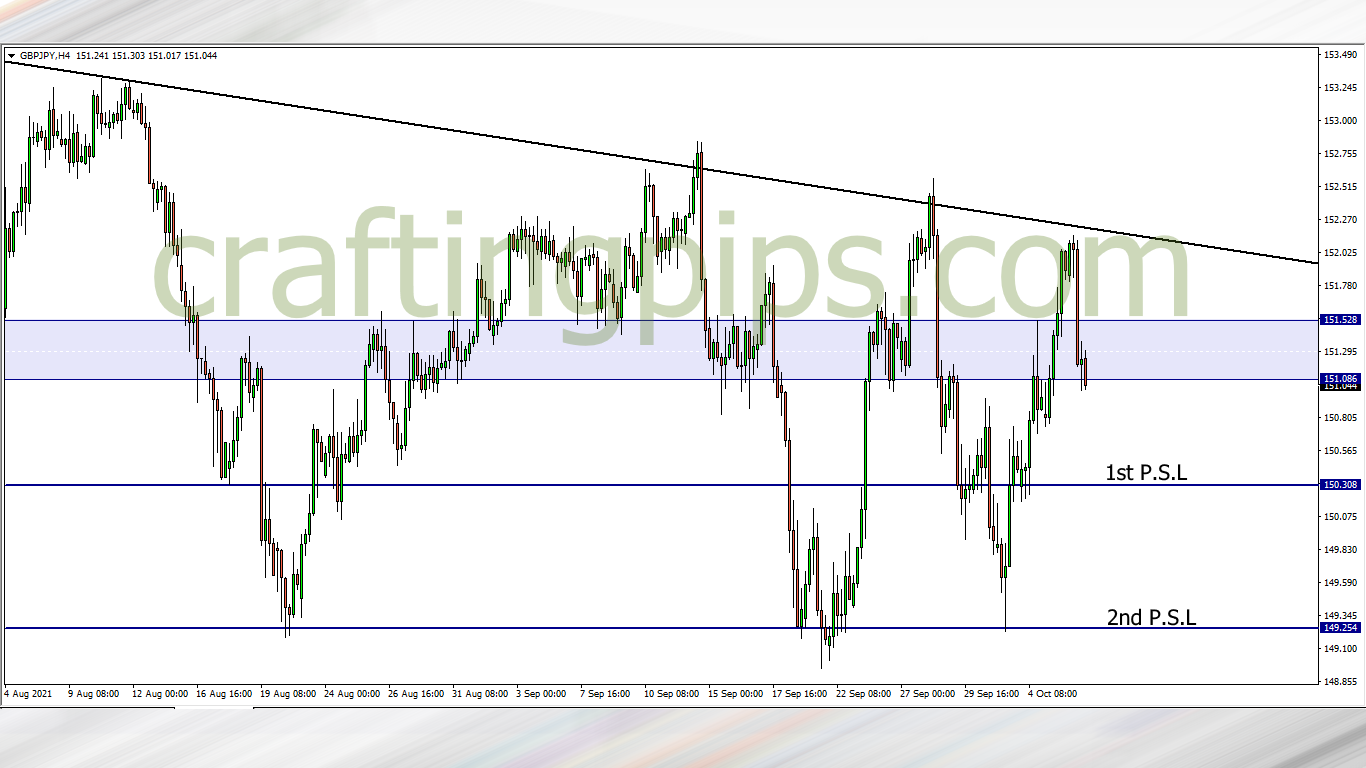

3. GBP/JPY

GBP/JPY is bearish and we can also see that price is held by a consolidation band. If we do get a breakout, then we have two support levels price may hit before the close of Thursday’s London session.

Those support levels would be 150.308 & 149.254

4. EUR/JPY

Another bearish momentum on the EUR/JPY.

The key support zone is broken already on the EUR/JPY, and we may see the previous support level act as a strong resistance level. If we do get price rejection around the key resistance zone, then our next support target would be 127.953

What say you?

For those who are interested in joining our FREE trading group on Telegram, where trade ideas and trade-related topics are discussed, which could assist your trading career while being infected by positive vibes

hit us on Pip Crafters