Hello fellow traders,

The week is gradually coming to an end, and guess what?

Today’s analysis could also have been titled: “The attack of the CONSOLIDATIONS” (lol)

Seriously, all our analysis for Thursday is centered around consolidation breakouts. Let’s hit the charts, and dissect what tomorrow’s market may most likely look like.

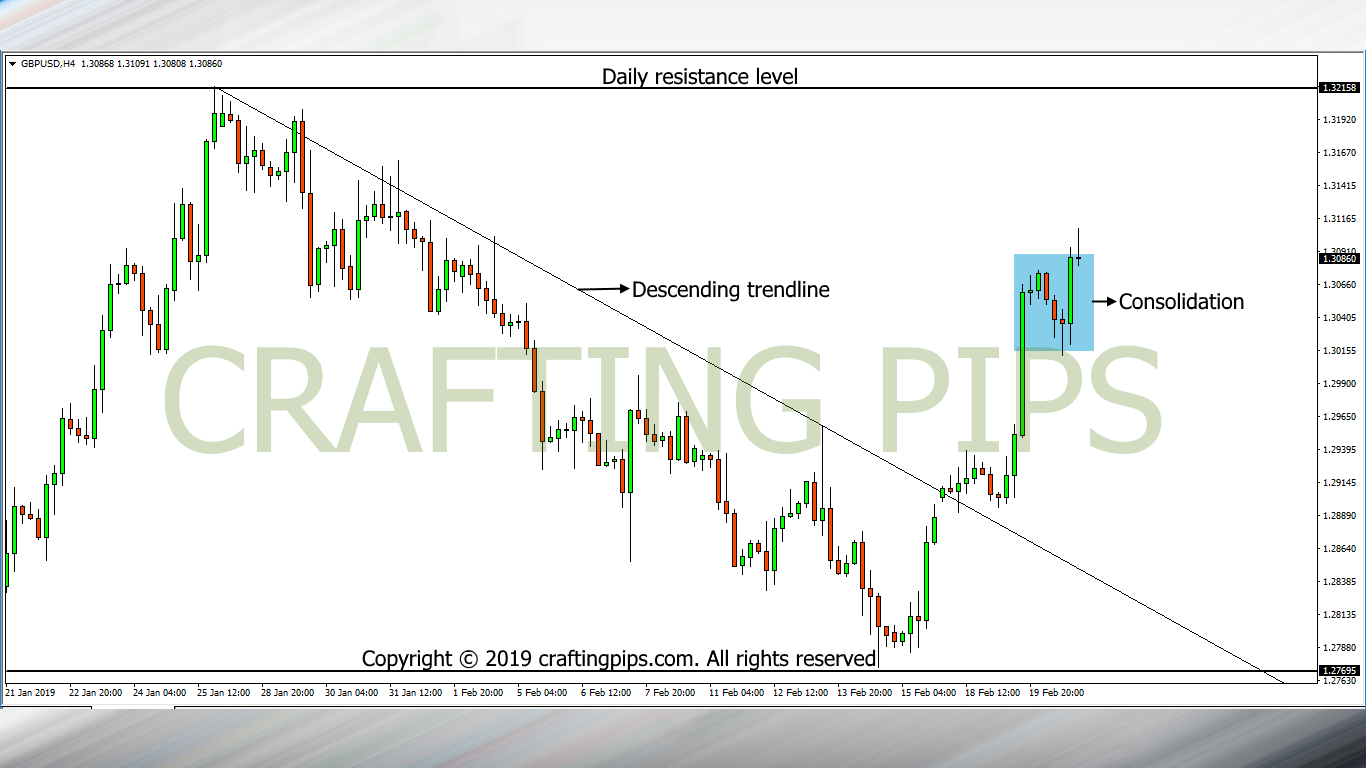

1. GBP/USD

On the 4 hours chart, GBP/USD looks yummy!

After breaking out from the resistance level (1.29079) of a descending trend line, price continued it’s bullish run, until it hit resistance level (1.30780). At this price level, consolidation set in for 24 hours.

The big question now is:

Can price break out through the consolidation’s resistance level and continue it’s bullish run to the daily resistance level, or

Will price breakout through the consolidation’s support level (1.30144) and head back down to a former resistance level, which will now act as a support (1.28420).

These questions can only be answered by our respective trading systems when the time is right?

2. EUR/USD

Another consolidation puzzle to solve on the EUR/USD pair.

This pair is becoming more interesting.

Reason been:

Price broke through the daily resistance level (1.13307) just yesterday, after giving off a fakey reversal withing the descending channel of a 4 hours time frame.

After breaking through the resistance level, almost immediately, price began to form a consolidation. Presently the bulls and bears are in a heated battle, and the winner is still undecided.

A breakout through the resistance level (1.13621), will most likely encourage price to continue it’s bullish run to the next resistance level (14587)

A breakout through the support level (1.13277) of the consolidation, will most likely send price on a bearish move to it’s next support level (1.12078).

A good dose of patience will be required to take these trades when they materialize.

Do have a grand day ahead folks