Hello Traders,

Sorry for being absent for the most part of this week. The past couple of weeks has been stressful due to some projects I am trying to complete.

That said, let’s see what the market has for us.

1. GBP/CHF

GBP/CHF has a beautiful bearish pinbar on a key resistance level (1.28109)

Most traders will be looking forward to price re-visiting support level 1.27372, but I would advise we exhibit caution and wait for the close of the daily candlestick before making any move.

A break of resistance level 1.28109 may encourage buyers to take price further up to the next resistance level (1.28937)

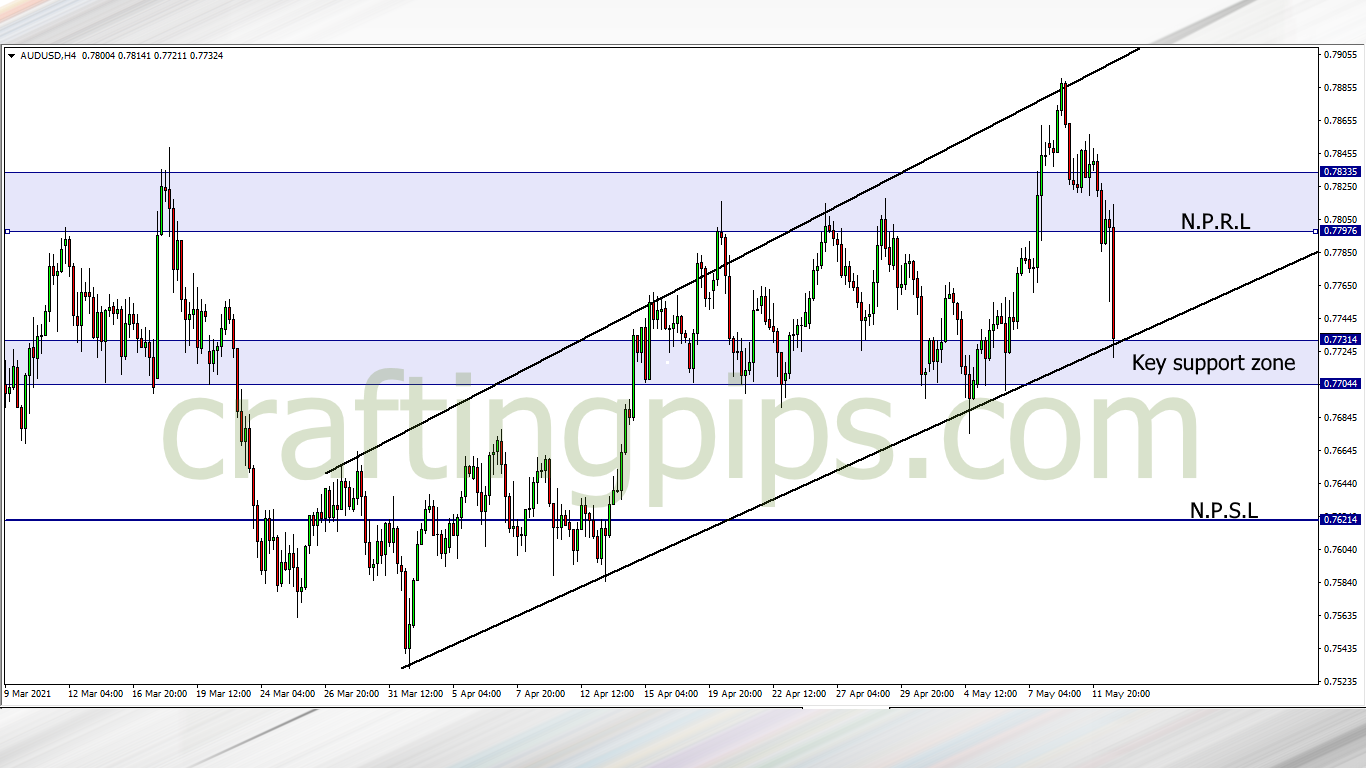

2. AUD/USD

AUD/USD is playing around a key support zone, and price is locked within an ascending channel

The close of the daily candlestick will reveal to us what we should be looking out for this Thursday.

A break below the key support zone may encourage the bears to continue the downward move to the next possible support level (0.76214), and if price still finds it difficult breaking the present support level at the close of the daily candlestick, we may see price slowly retracing its pips back to resistance level 0.77976

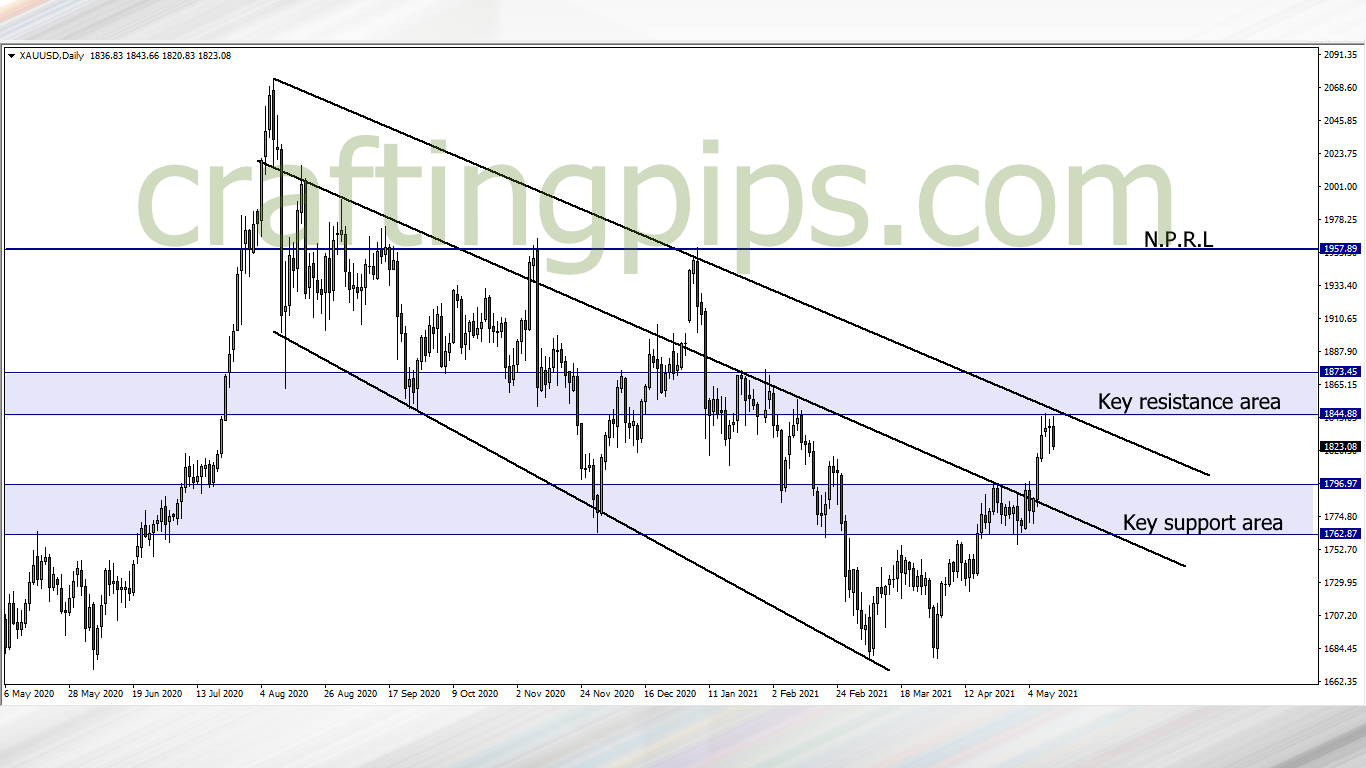

3. XAU/USD (GOLD)

Gold has fought many battles around the 1844.88 resistance level and we are currently seeing the bears gain control of price.

In my opinion, we may see Gold form a consolidation between the 1844.88 and 1796.97 level before we see any real move on Gold

Personally, I will be waiting for price to either break the key resistance area or key support area, then I will aim for resistance level 1957.89 or support level 1683.76