Hello traders,

It was a very busy day for me, I barely looked at my charts. How did your trading go today?

Well, Thursday is right in front of us, let’s head into the forex jungle and see which setup we should be looking at.

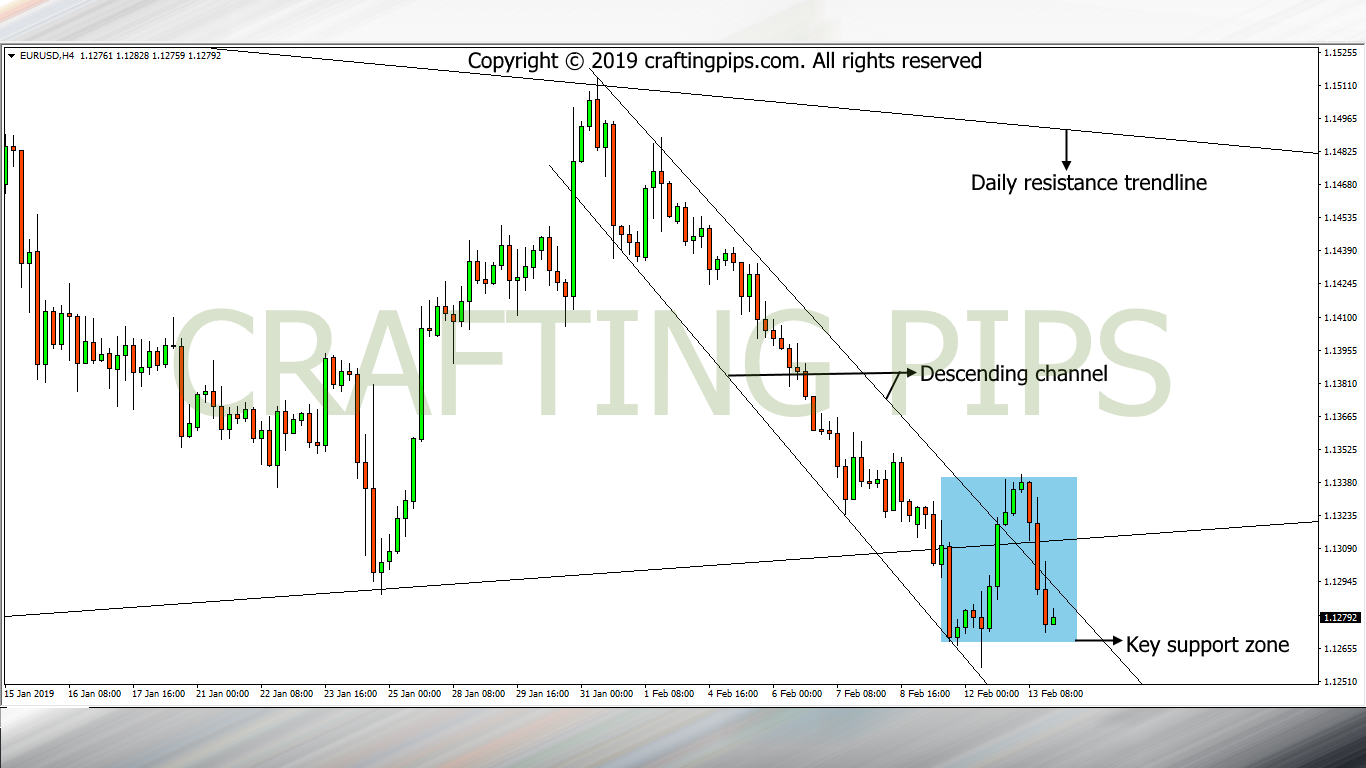

1. EUR/USD

The bears are after the EUR/USD.

After the dramatic bearish breakout of an ascending support level 1.13052 on Monday. I was pissed seeing this pair pull back the same volume of price it gave the day before.

Well, it does happen in trading, there is nothing like a 100% setup. We all have to learn to work with probabilities.

That said, looking at the same pair through the 4 hours time frame, we can see that price is revisiting a previous price level (1.12683), hence turning that level into a key support level within a descending channel.

If the US dollar continues to stay strong throughout Thursday, we may most likely see the present support level of EUR/USD broken, this may further send price to the next key support level 1.12159.

If the present support level is strong enough, we may see price retrace its steps back to resistance level 1.13129.

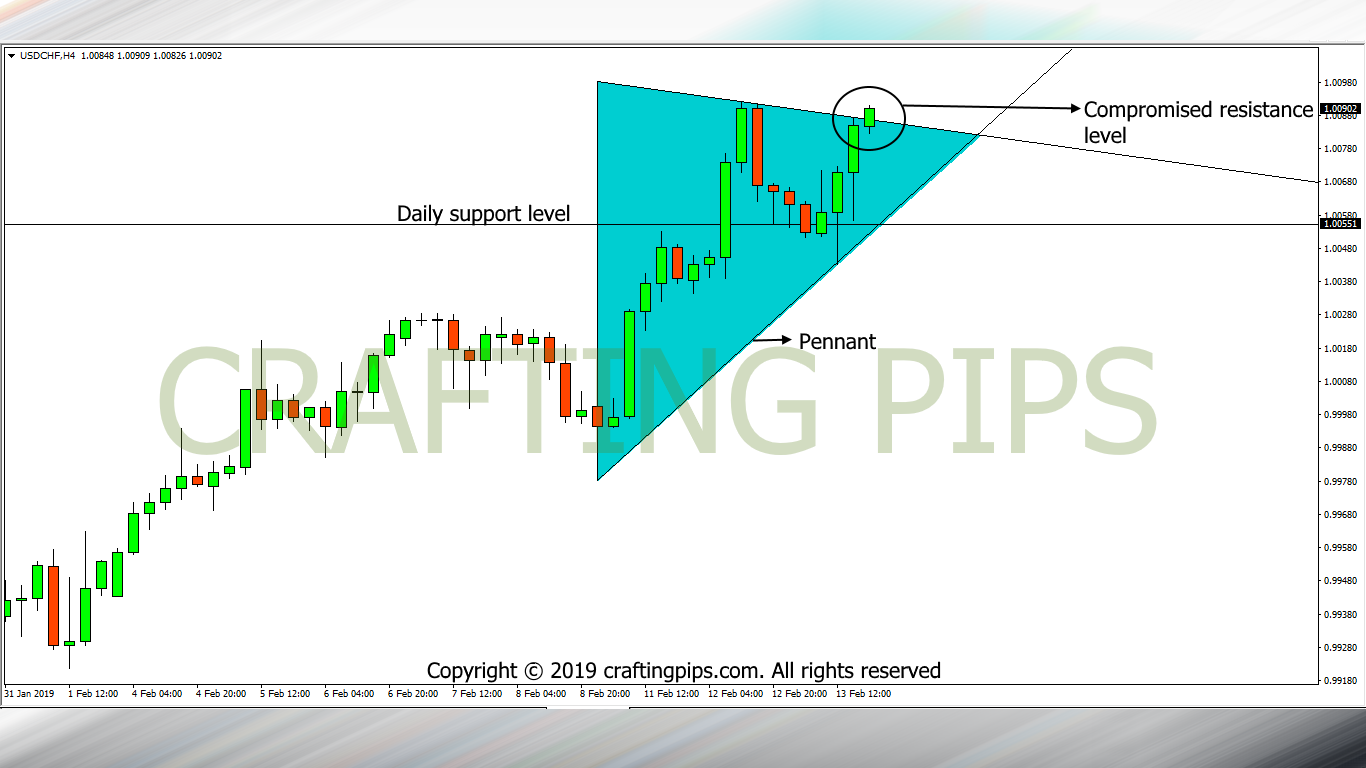

2. USD/CHF

A beautiful pennant was printed on the USD/CHF 4 hours time frame.

Already a key resistance level (1.00551) was broken on Tuesday. The resistance level has now become an important support level.

If the US dollars remain strong on Thursday, we may most likely see a bullish breakout through level 1.00871, and this may further motivate buyers to take price to the next key resistance level 1.01284.

If the US dollar fizzles out, we may see price consolidate between support level 1.00551 and resistance level 1.00871.

NOTE: A descent stop loss should be applied to either trades if taken and a good money management technique should not elude you

Thanks for your time and do help us share our analysis among your pip loving friends and family.

And ohhh!!!

Lest I forget, do subscribe to our blog, so that you can continuously get our:

Daily analysis

Weekly analysis and our

Articles.

Do have a great day ahead guys