Hello traders,

let’s hit them charts:

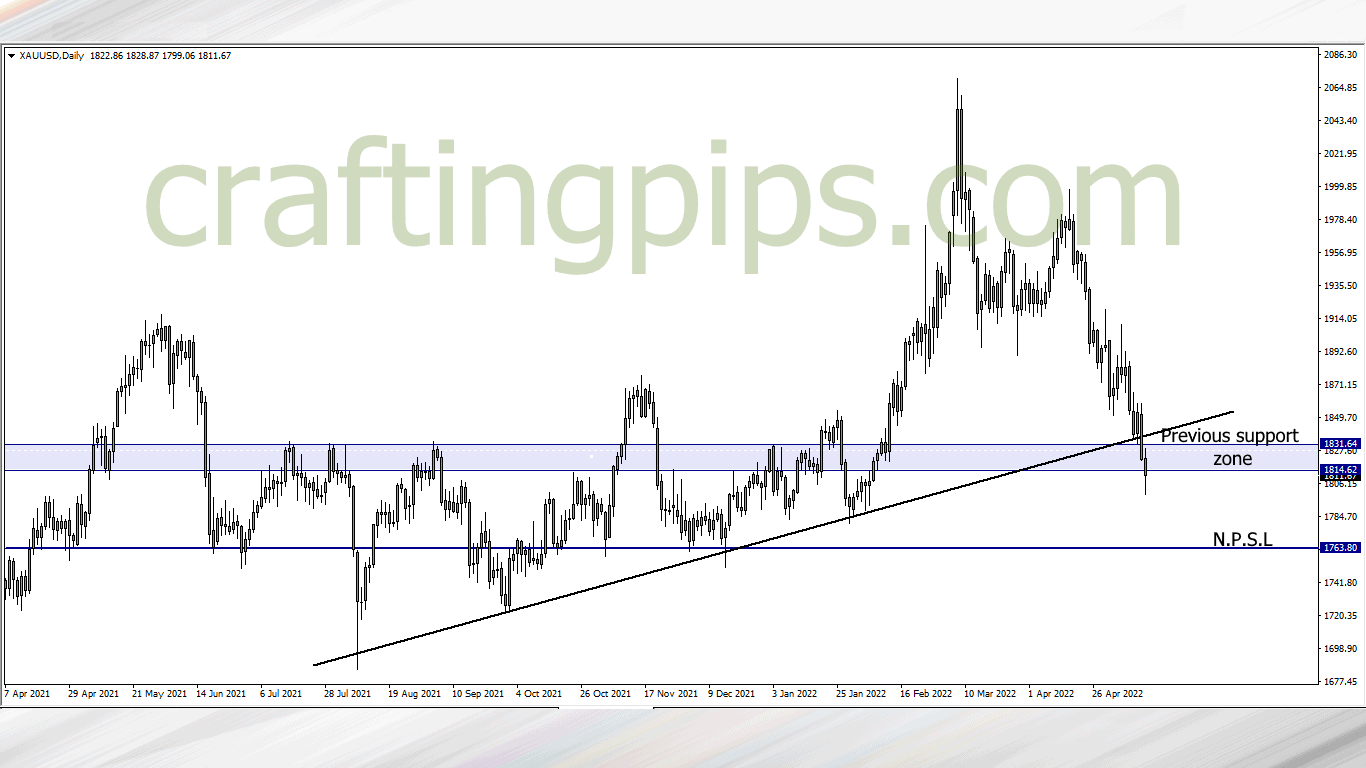

1. XAU/USD (GOLD)

The ascending trendline that held price for over 9 months finally got broken last week by the aggressive activity of the bears.

This week we may most likely see price hit support level 1763.80

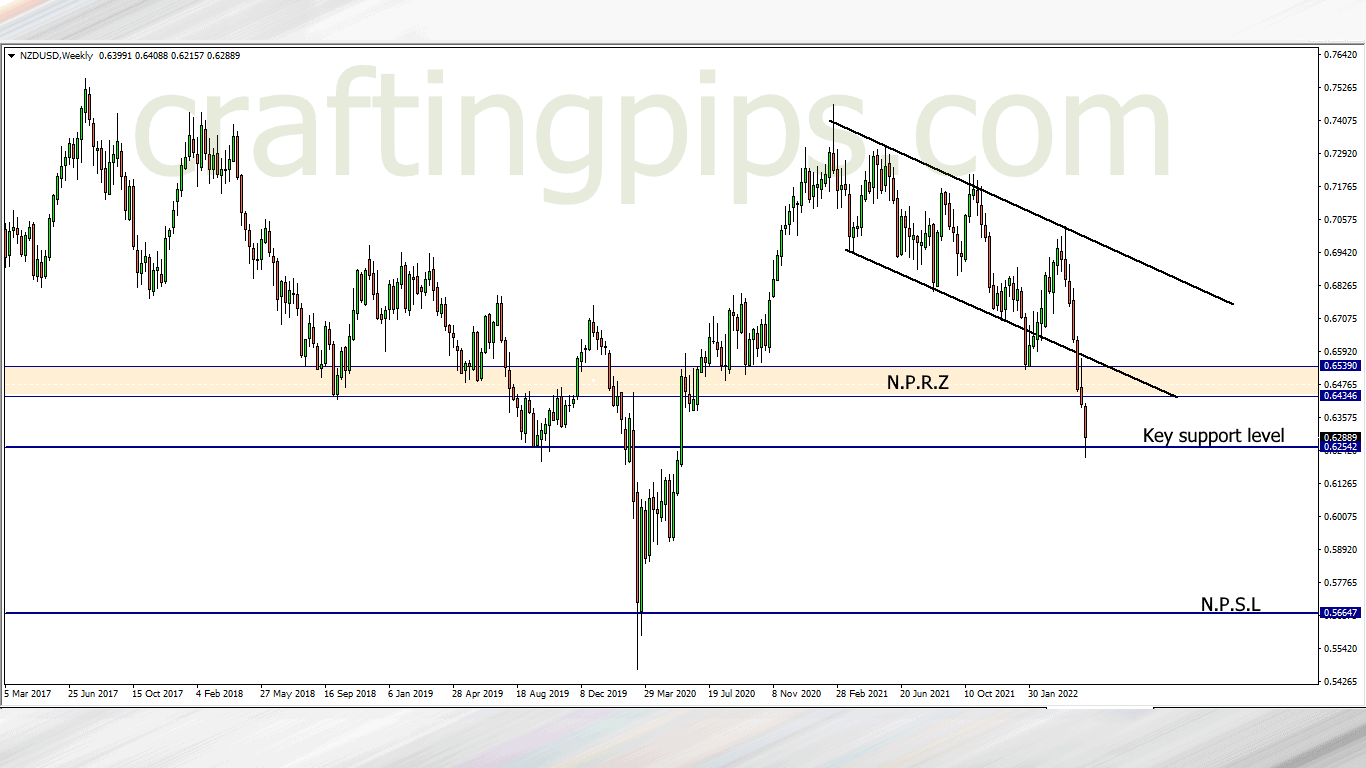

2. NZD/USD

This will be the third time price will be testing support level 0.62542 in the last 8 months.

Remember that this is a weekly time frame, so it may be too early to determine who (bulls or bears) would win this week. This analysis may serve bullish biased traders make decisions this week.

If we do get a bullish setup this week, there is a possibility that price could reach resistance level 0.64346

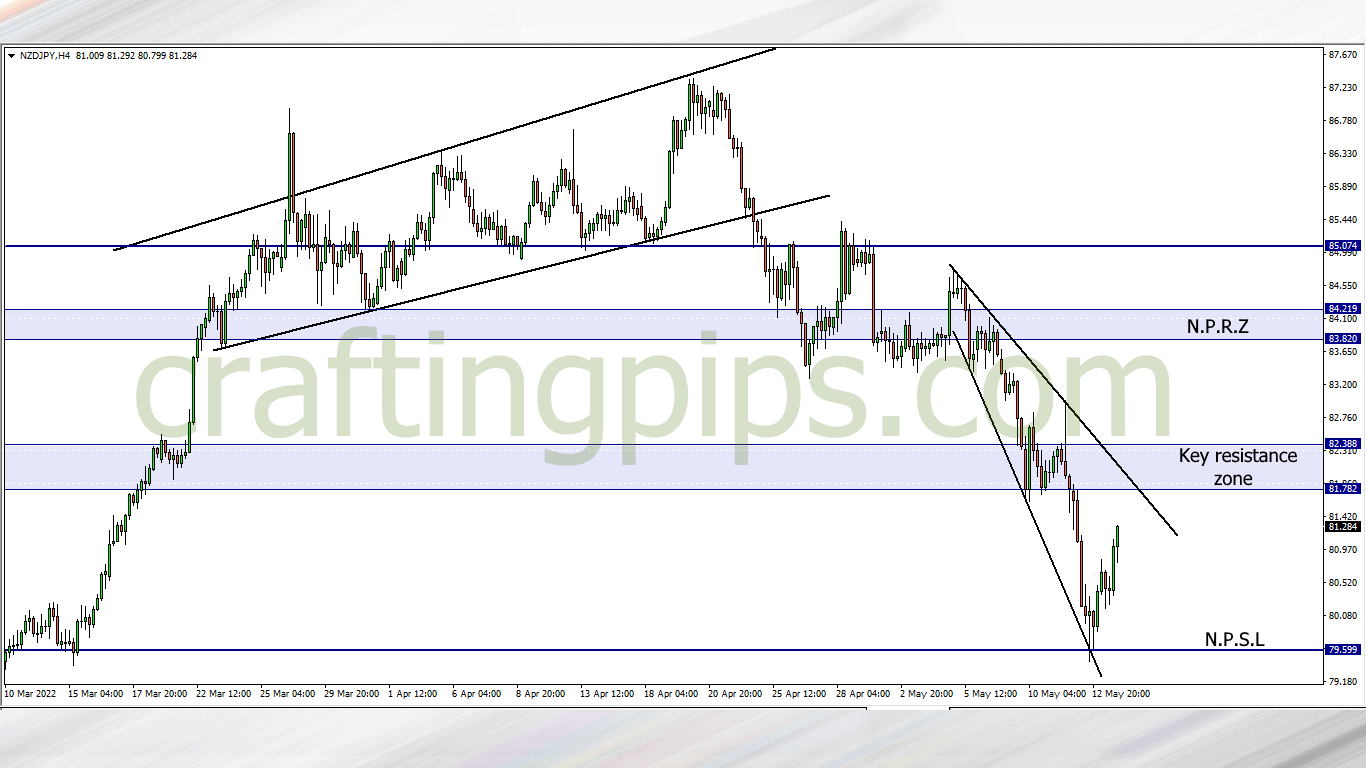

3. NZD/JPY

A descending expanding triangle can be seen in the 4-hour time frame of the NZD/JPY

The bulls took over the market after sellers got tired around the 79.465 support level. A key zone to watch out for is the 81.782 – 82.388. We may see price reverse at that level, or break it.

If a reversal or breakout happens this week at the key resistance zone, then we should be aiming for support level 79.465 or 83.820

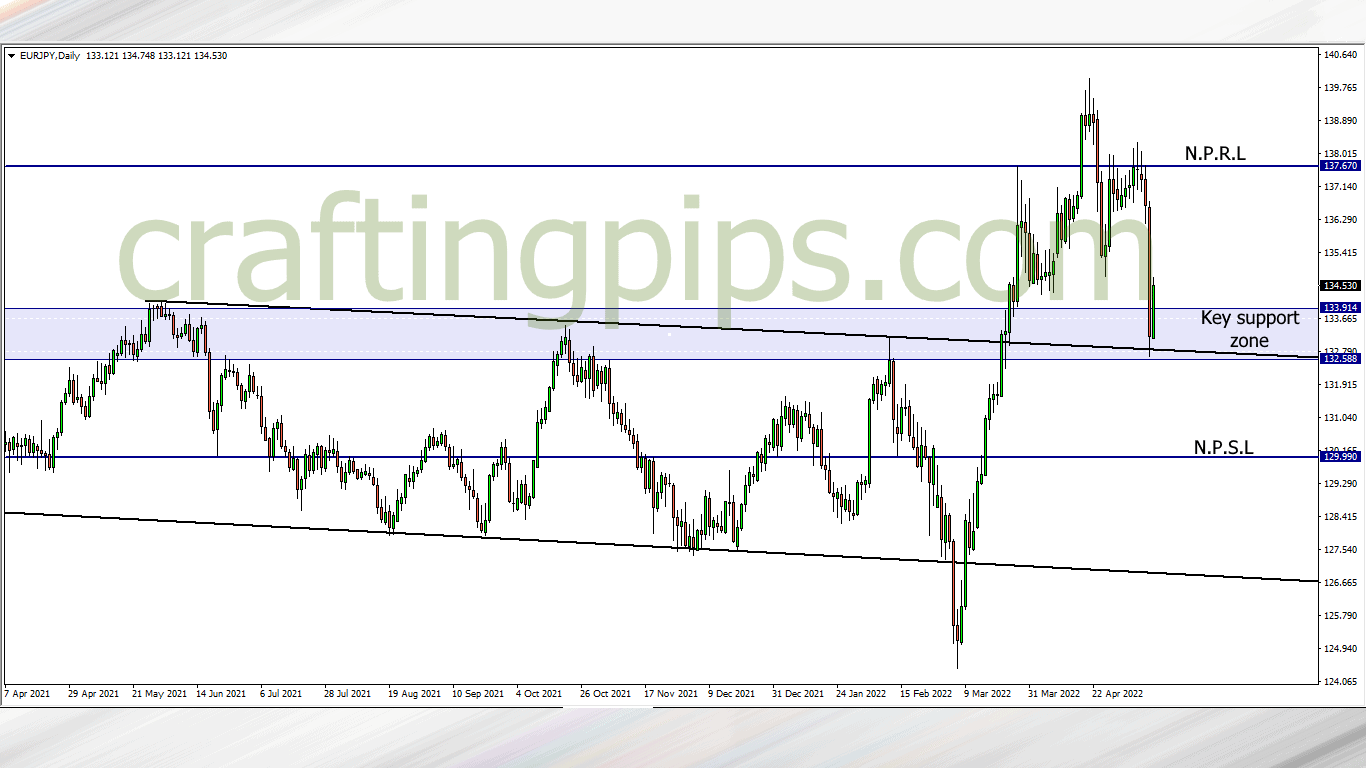

4. EUR/JPY

The key support zone prove too strong for last week’s bears, so the market closed with a bullish candlestick, which is NOT necessarily a confirmation for us to resume the week buying the EUR/JPY, but an opportunity to wait for a possible additional bullish confirmation.

Bullish confirmation means our next possible target will be 137.670.

If the week resumes with the bears continuing their campaign, and the support zone formed last week gets broken, then our next possible support level would be 129.990

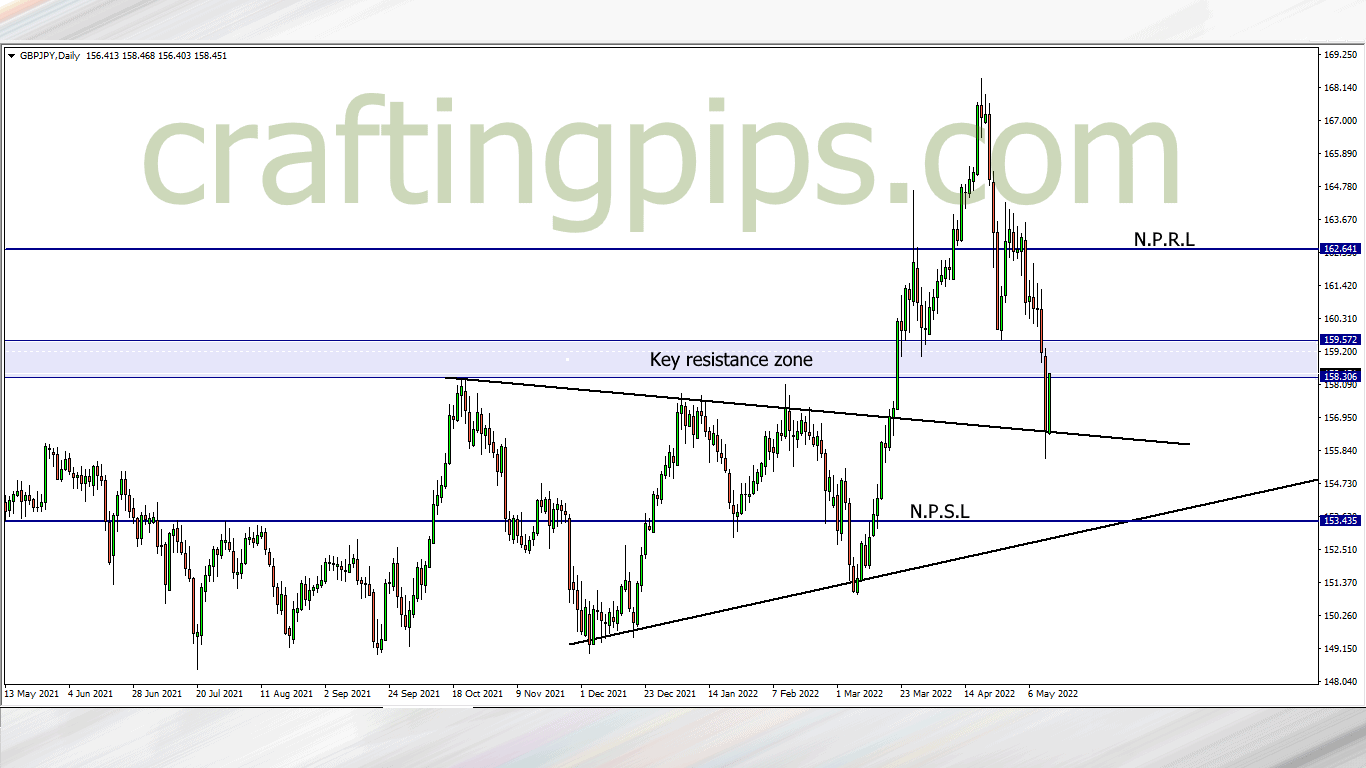

5. GBP/JPY

Last week GBP/JPY bears got rudely stopped by support level 156.442.

Bullish confirmation here for me will be: If the price breaks the key resistance zone. Then our next target will most likely be 162.641

If for any reason the week resumes with the bears breaking the 156.442 support level, then our next possible support level would be 153.435

What say you?

Traders who are interested in joining our FREE trading group on Telegram, where trade ideas and trade-related topics are discussed, which could assist your trading career while being infected by positive vibes

hit us on Pip Crafters