Happy Sunday Legendary Traders,

We have finally come to the last week of the month of August. Last week the market was quite slow but closed at very important price levels.

How did your weekend go?

Mine was crushed after Manchester United lost to Crystal Palace yesterday. It was even a home loss, that’s what made it worse.

Anyways, let’s check what the market holds for us this week.

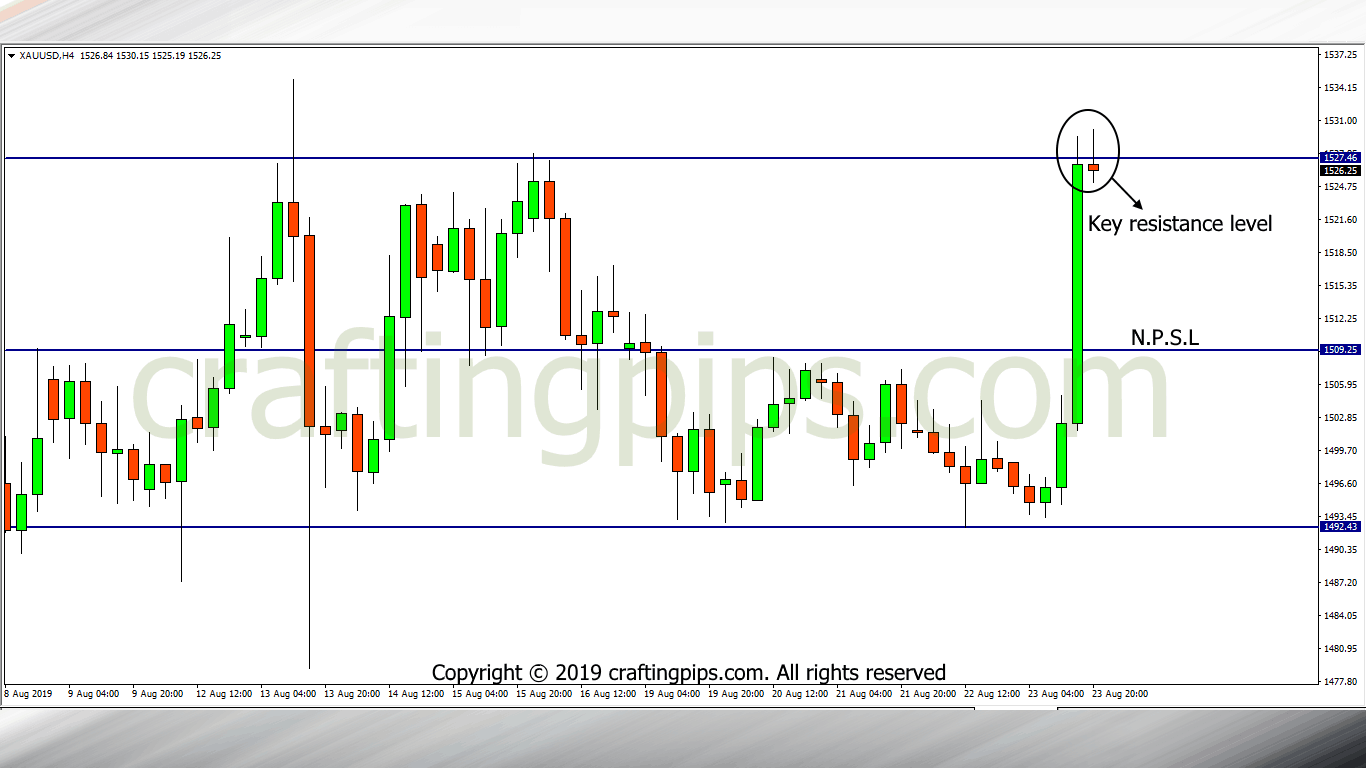

1. XAU/USD (GOLD)

After Trump’s tweet on Friday, we saw the huge depreciation of the dollar, this brought about a spike in pairs that share the Dollar currency.

Gold is no different. The spike took the precious metal to a key resistance level (1527.46) before the market closed on Friday.

If the Dollar continues to depreciate this coming week, we could further see a +300 pip move on gold to its next possible resistance level (1566.31).

If the Dollar stabilizes, there is a probability that price may form a consolidation between price level 1527.46 and 1509.25.

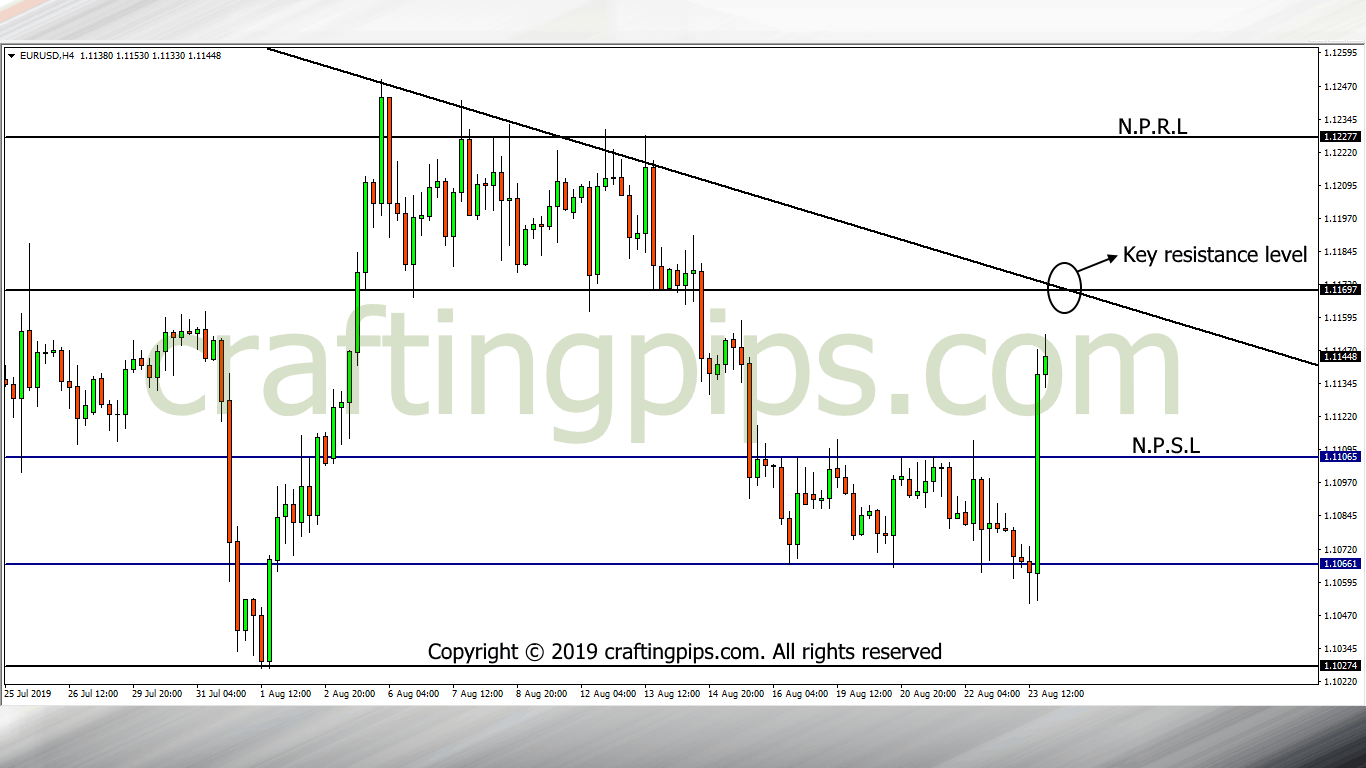

2. EUR/USD

On the EUR/USD, we will be watching out for how price will react to the descending channel’s key resistance level (1.11697).

A bullish breakout could see price hit 1.12277 as the next possible resistance level and a reversal of price could also take price back to support level 1.11065.

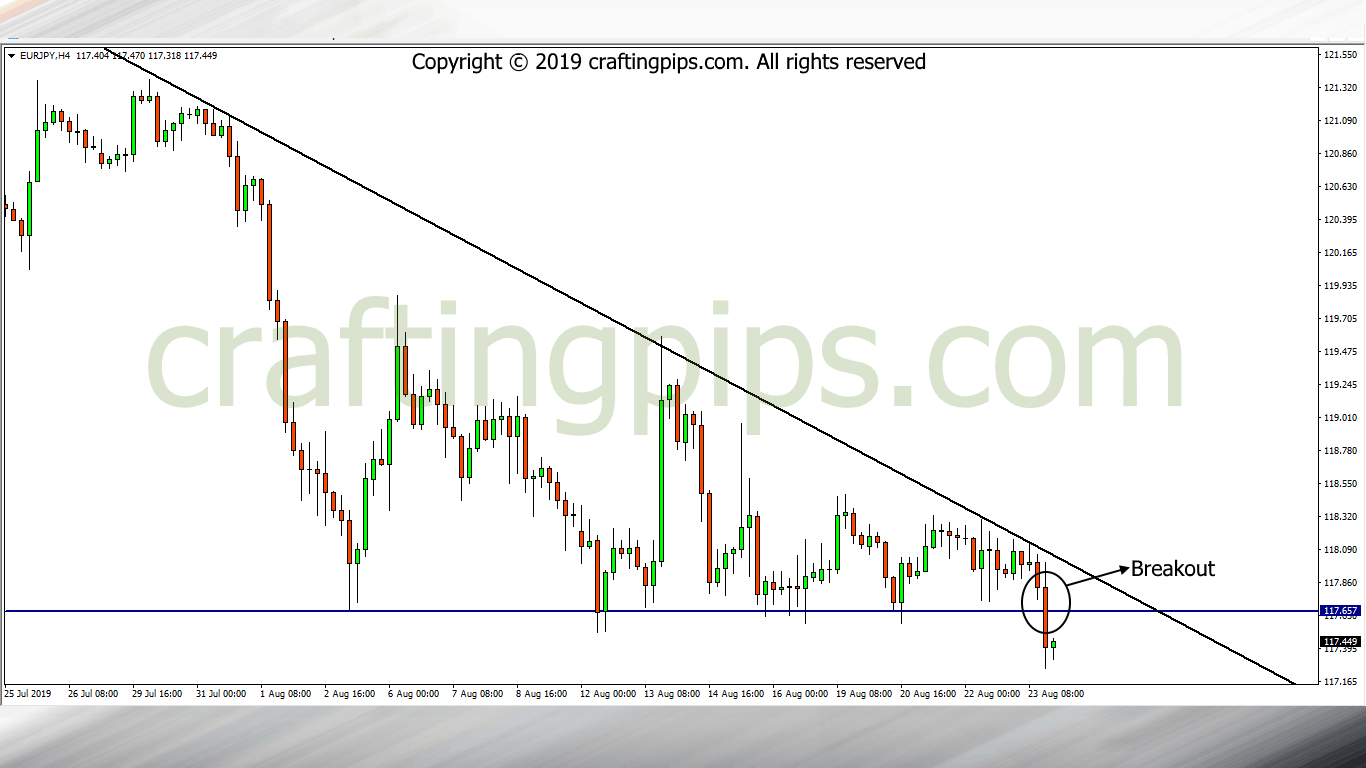

3. EUR/JPY

On the 4 hours chart of the EUR/JPY, we saw the 6 pm candlestick breaking out of a key support level (117.657).

If the market resumes this week with the Japanese Yen still having enough steam, there is a huge probability that the EUR/JPY next possible support level could be 115.012, which is over +200 pips move.

These are the pairs I and my team will be focusing on this week. I will also be doing a follow up on these pairs and other pairs that are viable all through the week, so do subscribe to our market analysis.

NOTE

For those who also struggle with making pips, you could subscribe to our premium signal group, we do not just give out signals, but also teach you how to locate viable entry points.

If you have your doubts, you could check our weekly progress in the premium signal group via our Facebook group

Thank you for your time ladies and gentlemen and as always, do remain pip-full.