Happy New Year Traders,

How is everyone doing, and how well are we prepared for the year 2021?

As we all know, the market guarantees nothing. It’s all up to us to work out a trading plan and execute when the opportunities arise.

That said, let’s see if we can take our first trade of the year this week

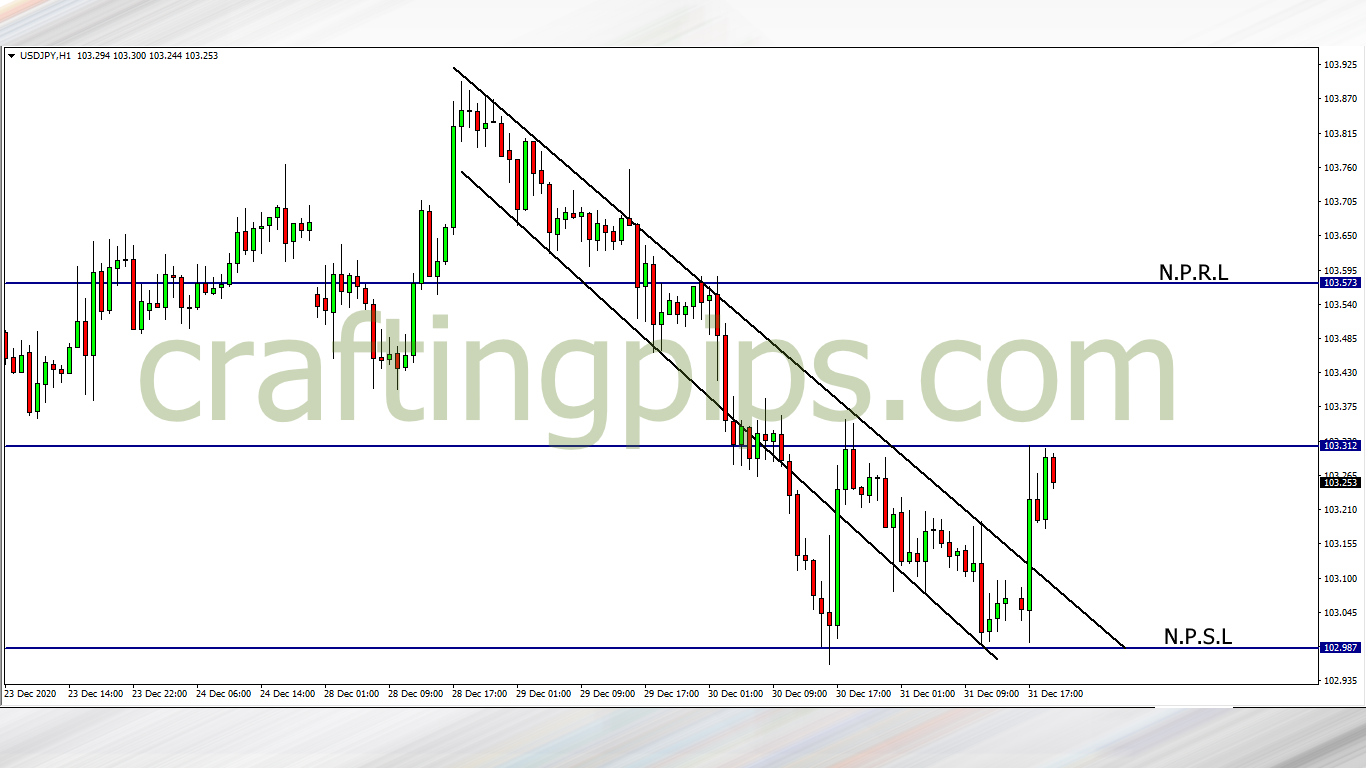

1. USD/JPY

Last week Friday, the USD/JPY closed by bouncing off the 102.987 support level, hence giving a strong bullish outlook.

The only barrier holding price is resistance level 103.312. If it gets broken, then price next stop will most likely be 103.573

We should also be mindful when trading this pair because price could reverse at the present resistance level.

If that happens, price could re-visit support level 102.987.

2. EUR/USD

Since last year November, price has been bouncing off the support level of an ascending trendline and on new year’s eve price broke the trendline

If the bears resume strong this year, we could see price go as low as 1.21598.

Personally, I will be waiting to see if a minor support level (1.22163) gets broken before making up my mind on whether to sell or just chill.

3. GBP/JPY

On the GBP/JPY, price has re-visited resistance level 141.206

All I will be looking out for is:

Price breaking resistance level 141.206, and if that happens, there is a huge tendency for price to hit the next possible resistance level (142.722)

While having such plans, let’s also put into consideration that the market could resume the year with the bears pushing price down, till support level 140.449 is broken and price starts another downward movement to 139.623

What say you?

ATTENTION:

For those who are interested in joining our FREE trading group on Telegram, where trade ideas are discussed, which may assist your trading career while being infected by positive vibes

Smash the link: https://t.me/joinchat/FN30PxlwXbk2BcuTDdH5yg