Hello traders,

the holidays are here, and I have activated my rest mode. Meaning no more trading for me till next year

I will be sharing setups sparingly till January next year. That said, let’s see what the market has for us this week

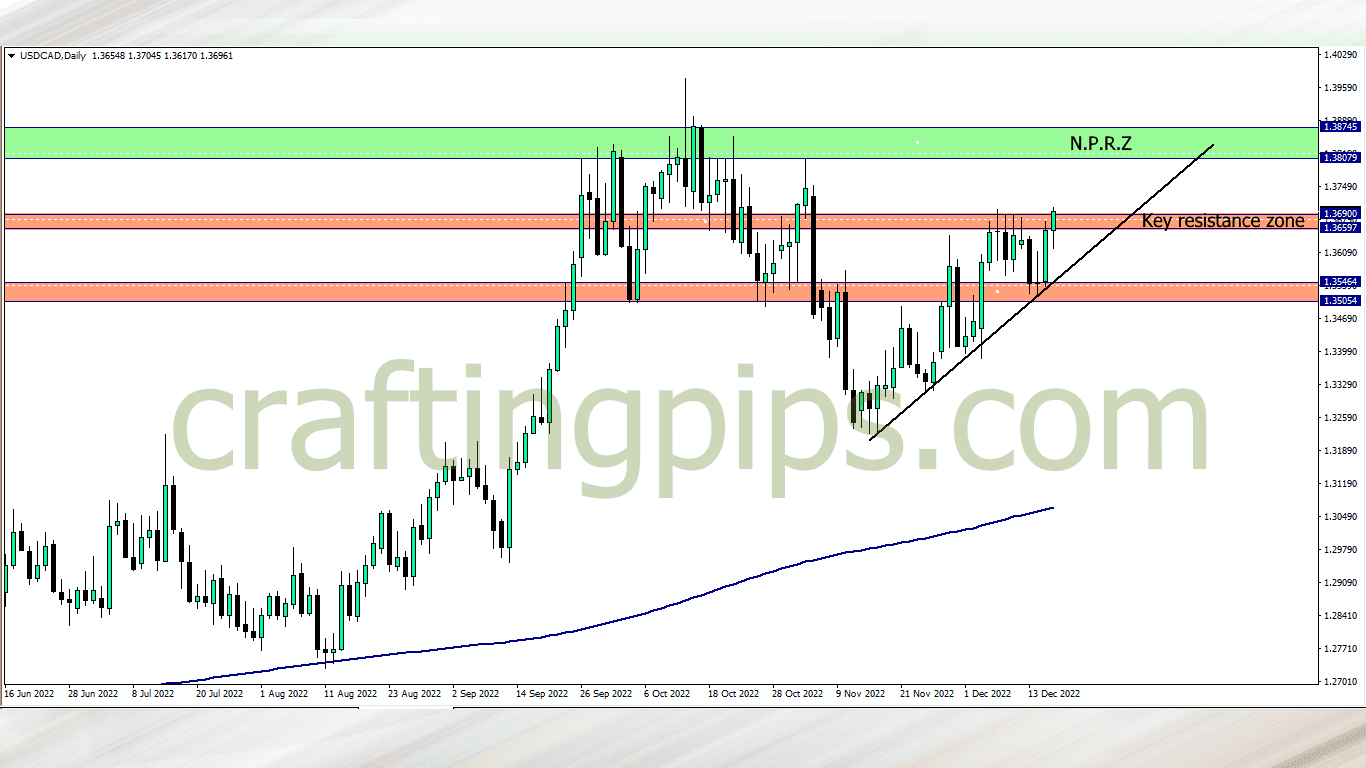

1. USD/CAD

USD/CAD closed last week being strongly bullish. Last week price closed within the key resistance zone.

All we should be looking out for this week is a breakout confirmation before joining the buyers to the next possible resistance zone market green.

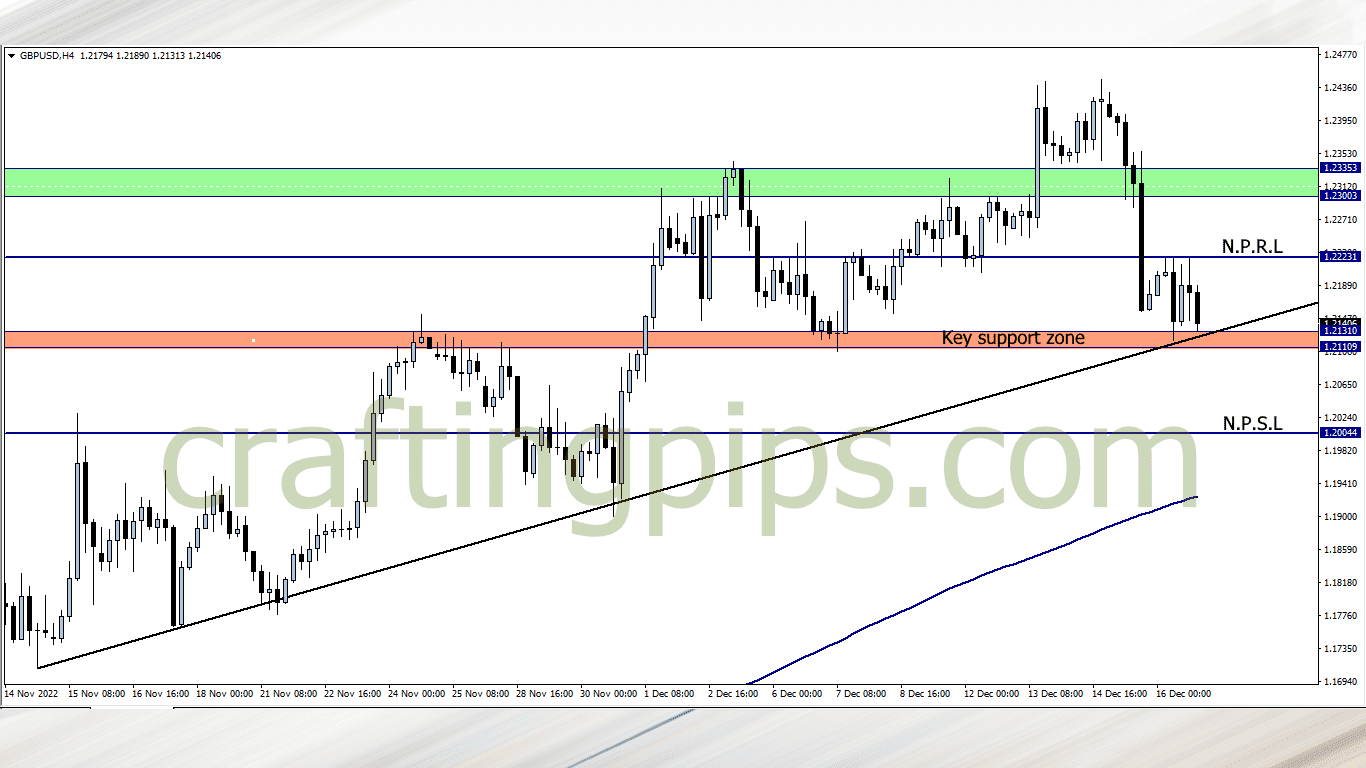

2. GBP/USD

Since November 14th price has used the ascending trendline as a support level. Currently buyers are too weak to break the 1.22231 resistant level.

The key support zone is something to watch out for this week. A breakout may encourage sellers to take price further down to 1.19462. which is over 150 pips from the current support zone

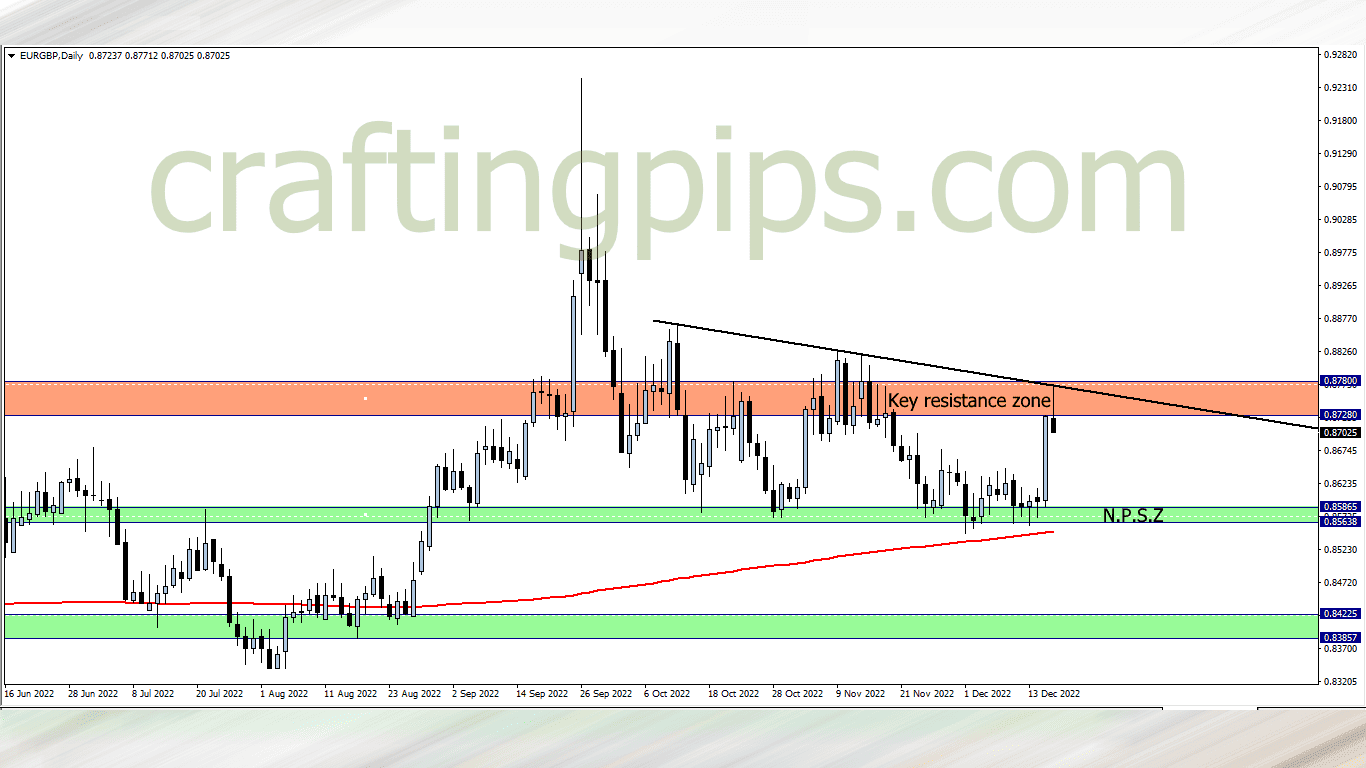

3. EUR/GBP

A bearish pinbar can be spotted on EUR/GBP around a key resistance zone, signifying that this week may be ruled by sellers.

If we do get a sell confirmation this week, we may join the sellers to the next possible support zone marked green

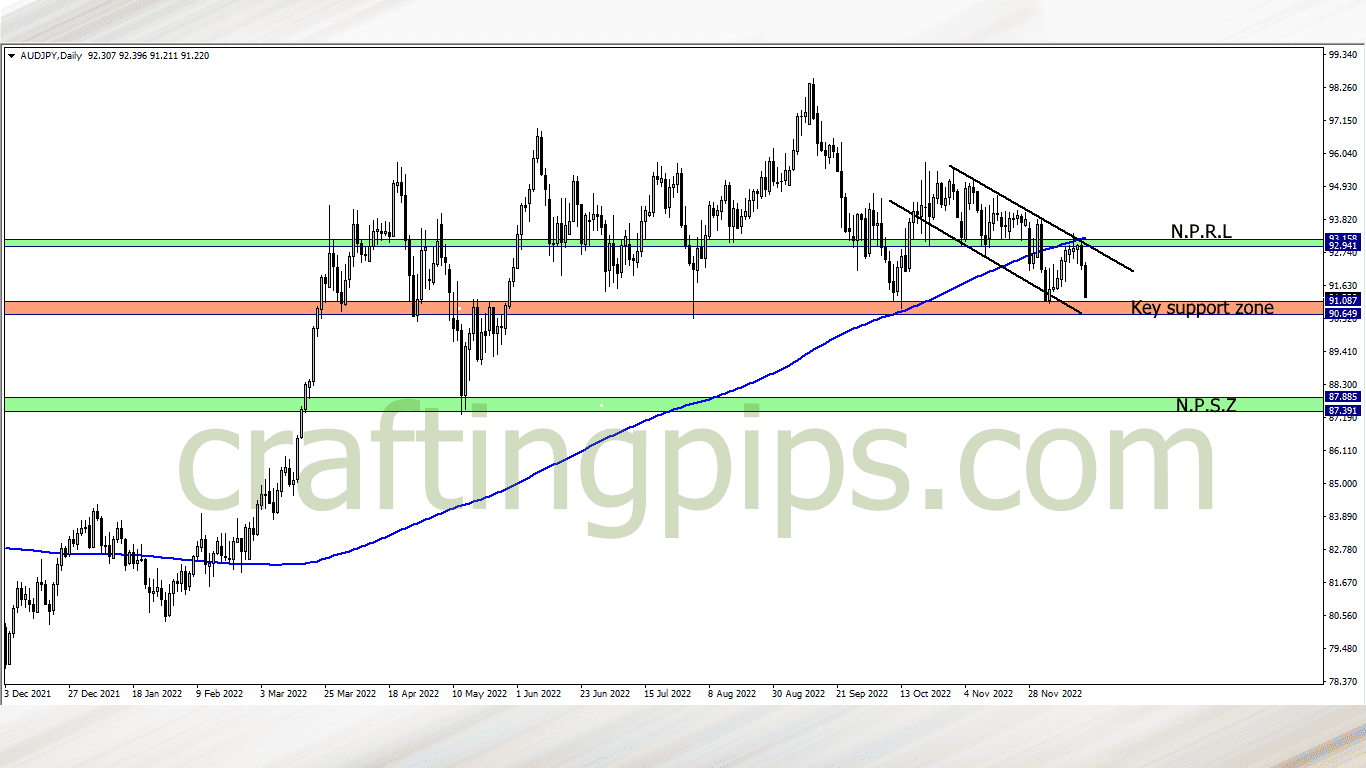

4. AUD/JPY

On the AUD/JPY, the key support zone is something to watch out for.

If a daily close confirms a reversal, then we could buy and use the roof of the descending channel as our target profit. However, if the present key support zone gets broken, then the next possible support zone is over pips away (87.885)

What say you?

Traders who are interested in joining our FREE trading group on Telegram, where trade ideas and trade-related topics are discussed, which could assist your trading career while being infected by positive vibes

hit us on Pip Crafters

NOTE:

Hello traders, Are you tired of wasting your money on failed prop firm challenges?

Say no more…

Fundyourfx is willing to give you a DIRECT FUNDED account at an affordable price If you are interested, contact me and get my coupon code for a -5% discount.