Hello traders,

It’s another new week, let’s hit the charts:

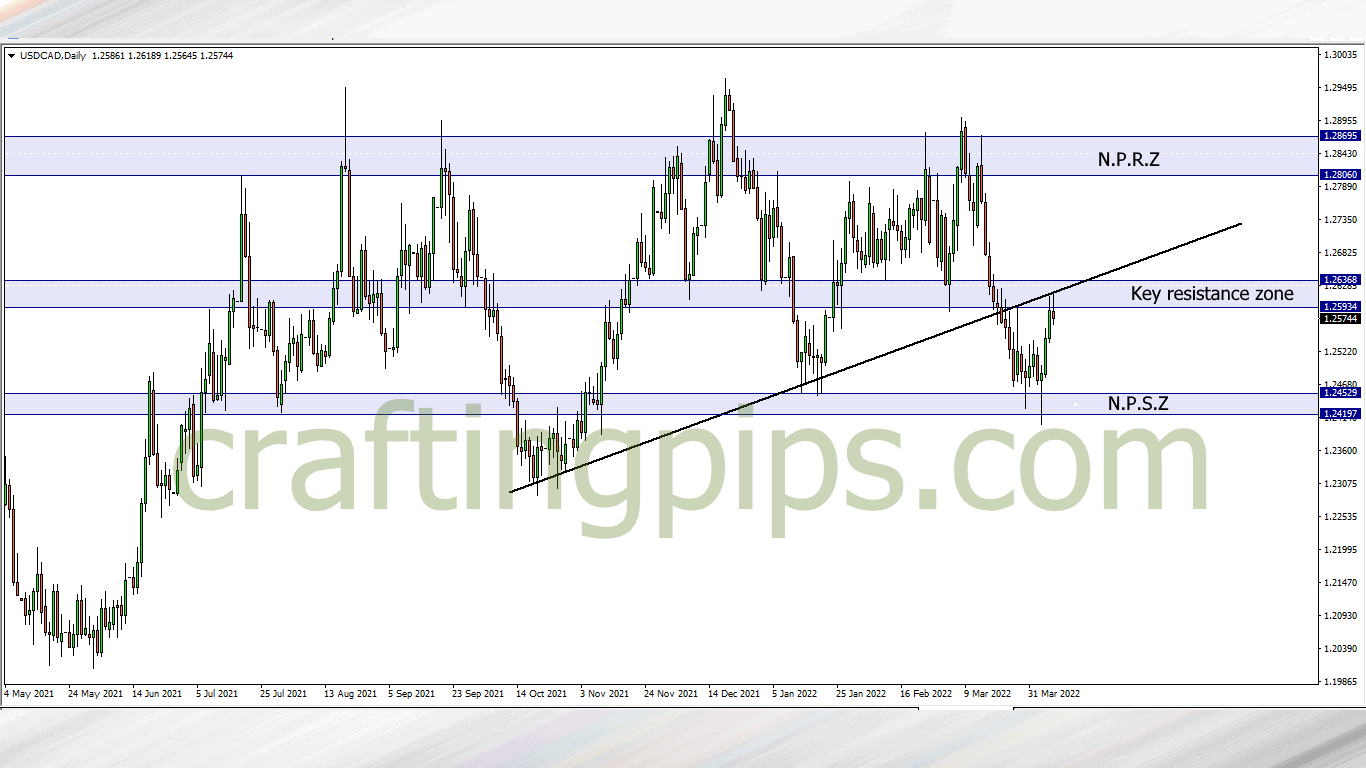

1. USD/CAD

Last week, USD/CAD buyers spent the entire week finding their way back to a key resistance zone (1.26368 – 1.25934)

This week there is a possibility that the sellers may come in and drive price back to a previous support zone (1.24529 – 1.24197) if the buyers lose steam.

However, if the bulls continue strong this week and we see a breakout of the key resistance zone, then we may see price go further up to the next possible resistance zone (1.28060 – 1.28695)

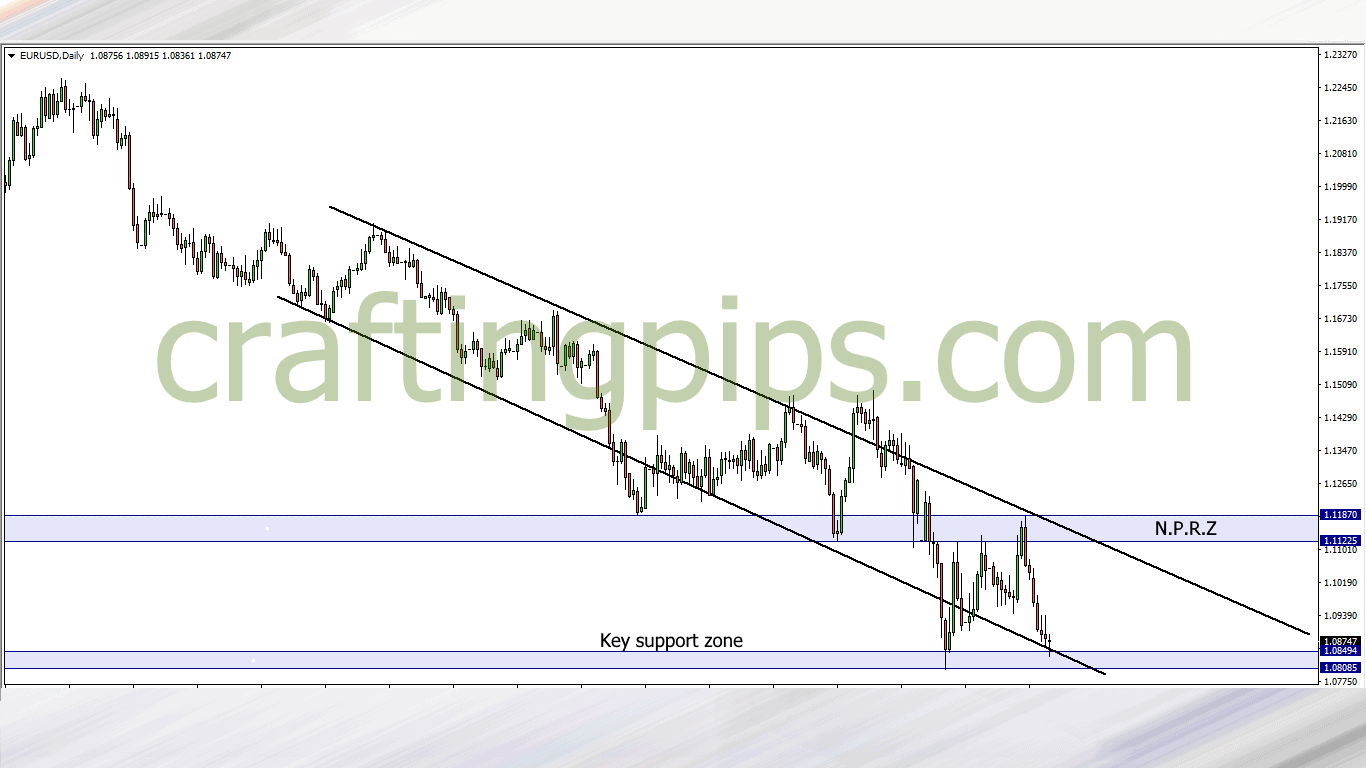

2. EUR/USD

This week we may see a bounce in the EUR/USD.

Price is currently resting on a key support zone and sellers may find it difficult to progress any further without pull back. There is also a possibility that price may revisit the previous resistance zone.

If the sellers for any reason resume this week highly motivated and the key support zone is broken, then price next bus stop will most likely be support level 1.06552

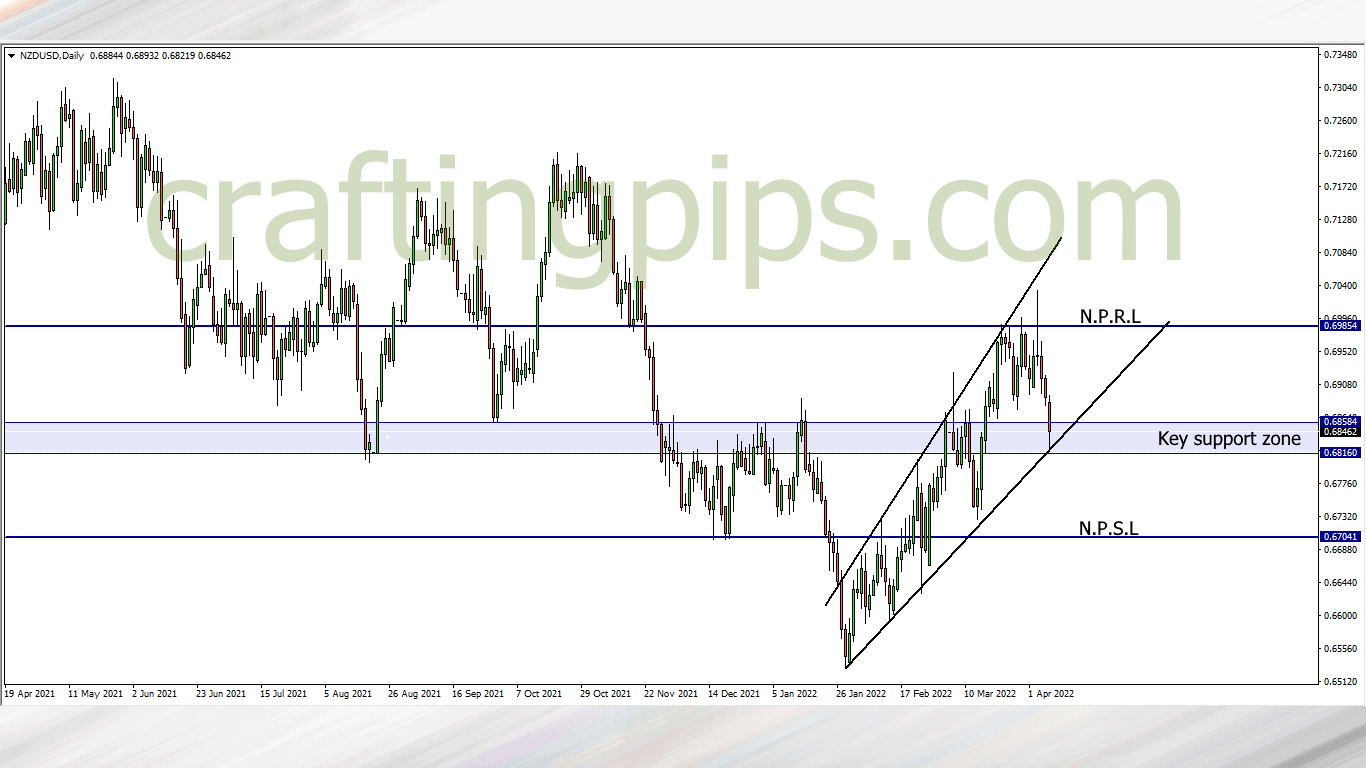

3. NZD/USD

The ascending expanding channel on the NZD/USD looks quite inviting for all prospective buyers and sellers.

If the key support zone presently holding price fails, price next support level will most likely be 0.67041. If the bulls for any reason come in strong during the week, then price may revisit resistance level 0.69854.

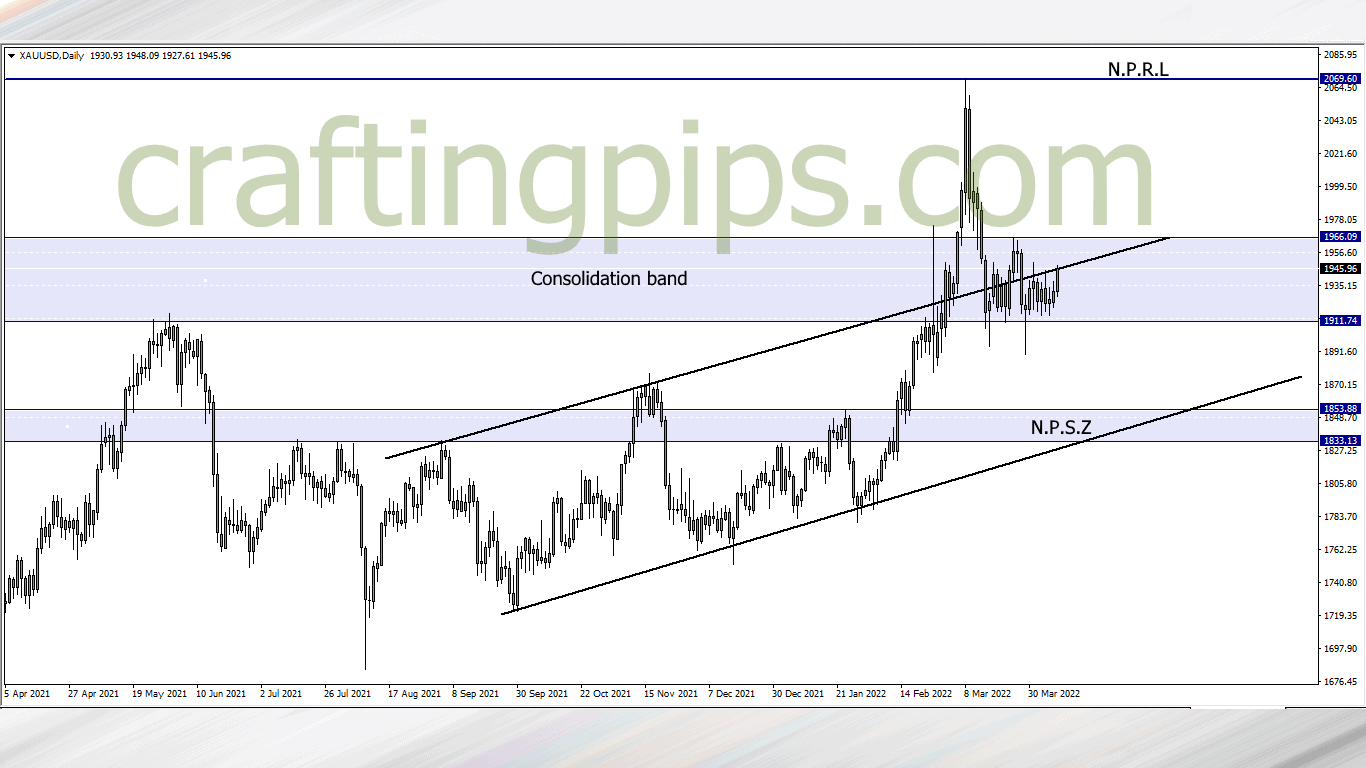

4. XAU/USD

Gold has been ranging within the consolidation band for a little over a month now.

Waiting for a breakout through the consolidation band won’t be a bad idea.

If price breaks the upper band, then we may see price hit a previous resistance level (2069.60), but if price breaks below the consolidation band, then we may see price hit the next possible support zone (1853.88 – 1833.13)

What say you?

Traders who are interested in joining our FREE trading group on Telegram, where trade ideas and trade-related topics are discussed, which could assist your trading career while being infected by positive vibes

hit us on Pip Crafters