Hello traders,

let’s hit the charts:

1. USD/CAD

Remember USD/CAD is still bearish when judging from the daily time frame.

Last week, price broke out of a narrowing ascending channel on the 4-hours time frame, and is currently heading to a minor support level (1.28622)

There is a huge possibility that the minor support level may not hold price for long before we see price hit the next possible support level (1.28093)

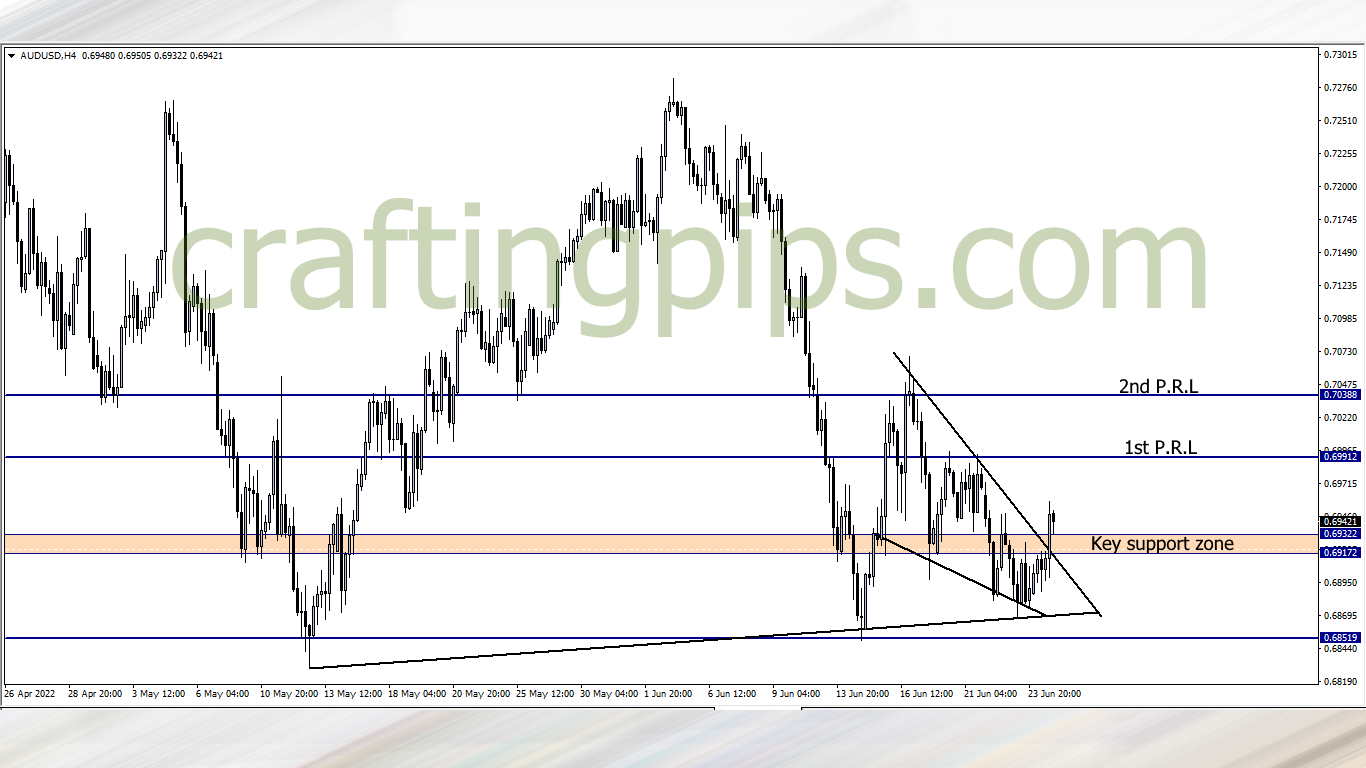

2. AUD/USD

AUD/USD broke through a key resistance zone which now serves as a support zone after bouncing off an ascending trendline which served as a support level.

If the bulls still remain motivated when market resumes, then there is a possibility that price will hit 0.69912 and 0.70388 as the next possible resistance levels

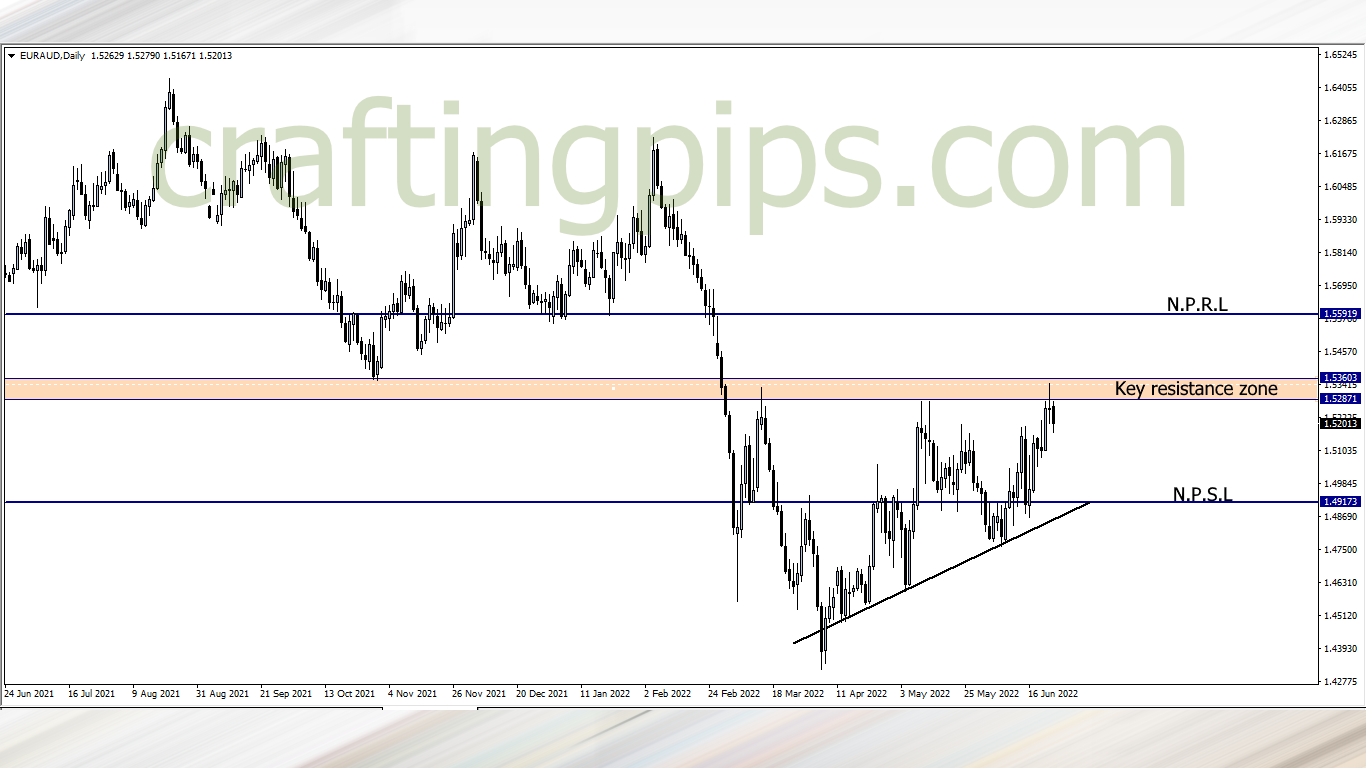

3. EUR/AUD

For over 3 months price has been finding it difficult breaking a key psychological resistance zone on the EUR/AUD.

The higher lows and higher highs formed indicates that the key resistance zone may most likely get broken this week, and price may hit resistance level 1.55919

For short term trades, price could revisit support level 1.50473 or 1.49579 within the first few hours or days this week, forming higher lows.

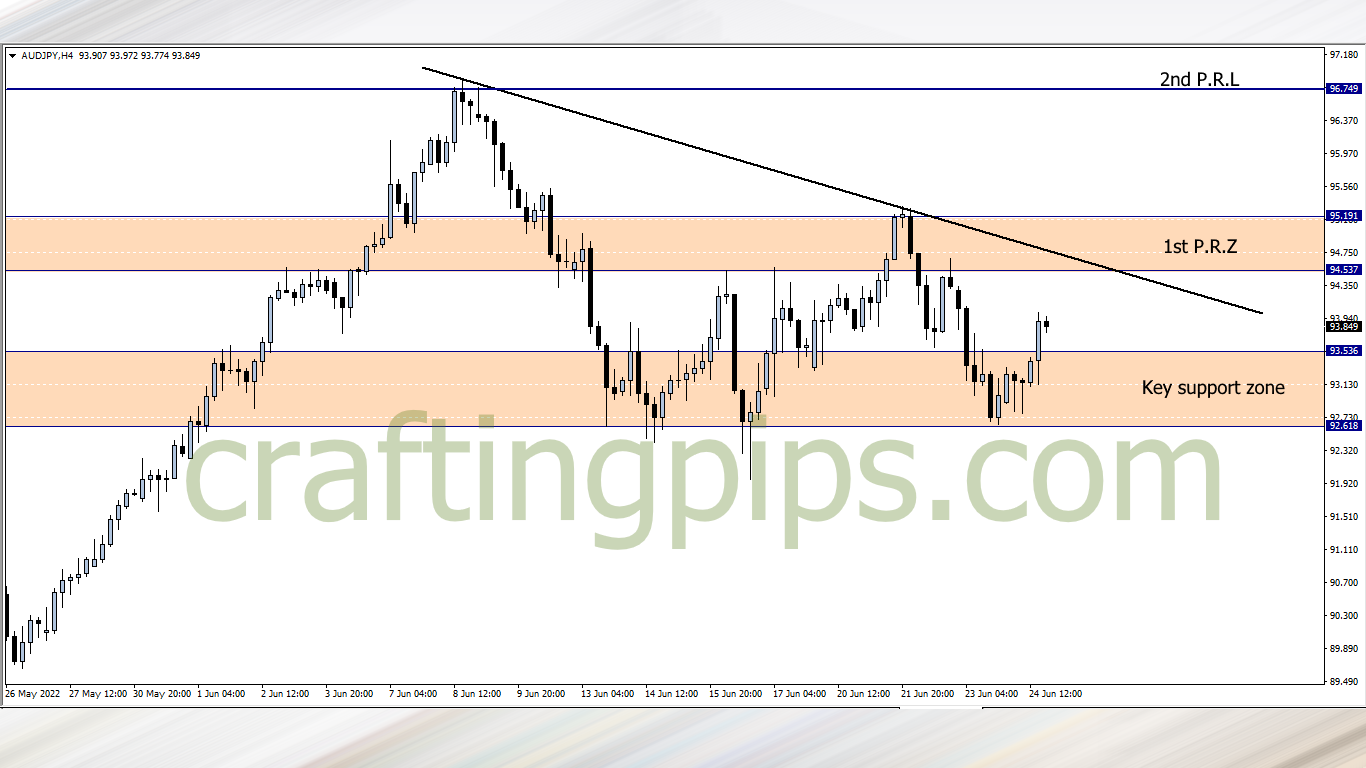

4. AUD/JPY

AUD/JPY closed last week with a bullish breakout.

This will be a good trading opportunity for traders who know how to trade a ranging market. Price next move will most likely be the resistance zone (94.537-95.191).

If the bulls manage to break through the resistance zone, then next possible resistance level would be 96.749

5. CAD/JPY

The bulls tried proving a point the last few hours before market closed on Friday by breaking the resistance level of an expanding descending channel

If buyers resume the week motivated, then we may most likely see price hit the next possible resistance zone (105.302 – 105.449)

What say you?

Traders who are interested in joining our FREE trading group on Telegram, where trade ideas and trade-related topics are discussed, which could assist your trading career while being infected by positive vibes

hit us on Pip Crafters