Hello Traders,

It’s been a rainy weekend over here, and as I type away this beautiful Sunday morning, I can hear raindrops spatter the floor of my yard, giving off a pleasing melody to my ears.

I tell you, It’s a heavenly experience sipping a hot cup of coffee while analyzing the market.

Another thing to note is:

Summer break is upon us and liquidity in the market usually drops as most institutions reduce/stop trading activities due to vacations.

This causes a choppy market and quite a difficult time to trade in.

In my opinion, we all have been on compulsory break since February due to the Covid-19 pandemic and the fact that most countries still have issues accepting tourists, I don’t know how the market will look like.

Will the big traders/banks still trade during the summer break, making it a relatively better summer break than previous years?

Or are we still going to go through the usual experience of trading through the tough market conditions?

I guess it’s our job to find out.

Alright ladies and gents, let’s hit the charts and see what trading opportunities we should be looking out for this week.

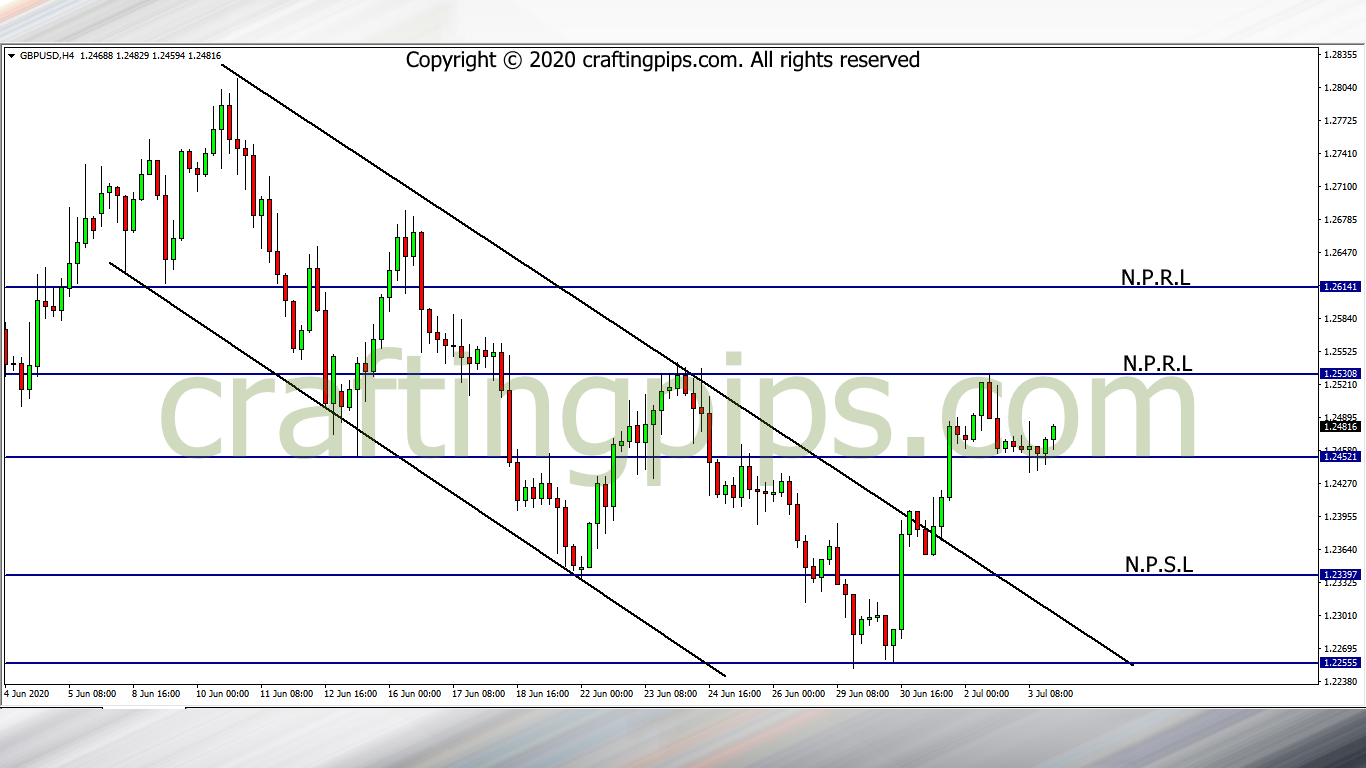

1. GBP/USD

On the GBP/USD after price was rejected by support level 1.24521, we saw price close halfway it’s journey to 1.25308.

Personally I will be waiting to see if support level 1.24521 will be re-tested and broken, hence encourage sellers to pull price to the next possible support level (1.23397)

Or wait to see how price reacts when it hits resistance level 1.25308.

A breakout would mean price next resistance level would be 1.26141 and a reversal may mean price returning to support level 1.24521.

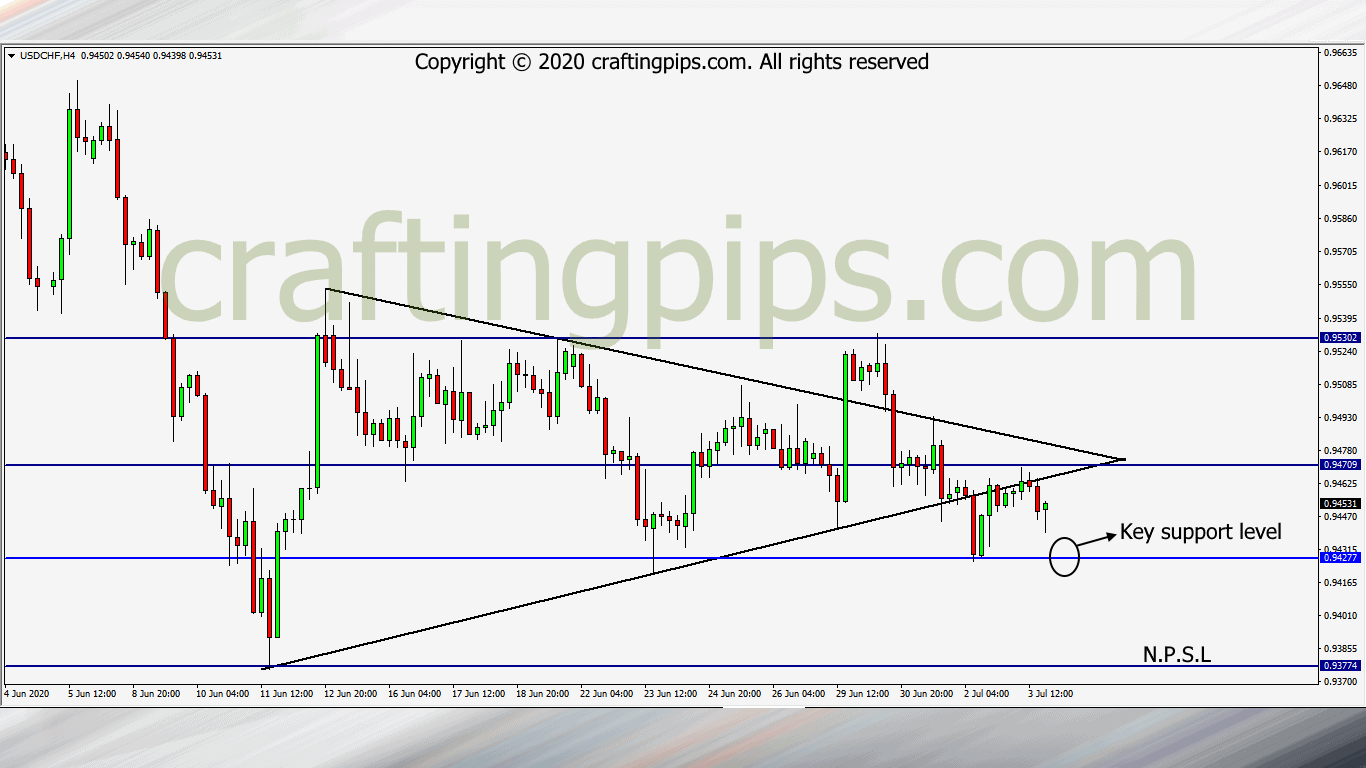

2. USD/CHF

USD/CHF has a giant pennant formed.

If price will test and break support level 0.94277 is something to watch out for this coming week.

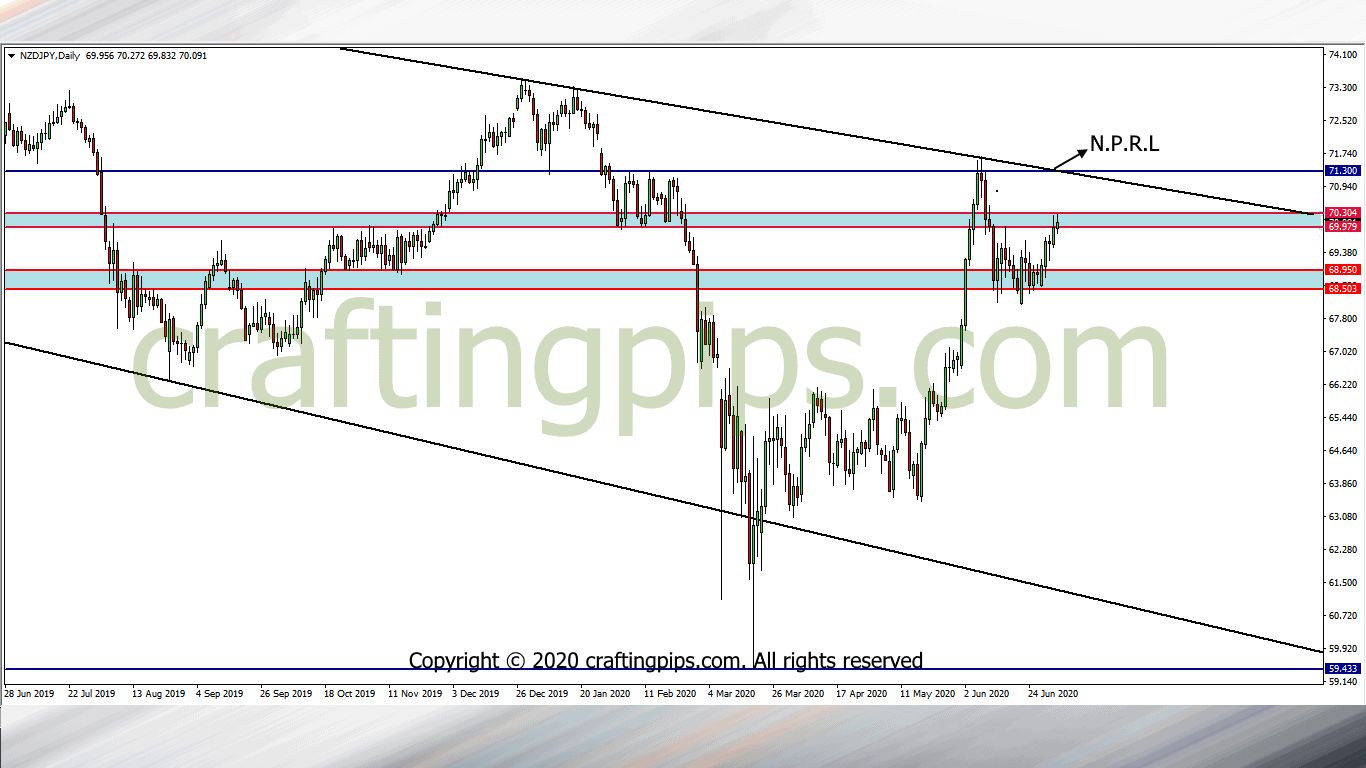

3. NZD/JPY

Do the buyers of the NZD/JPY pair still have a strong conviction to take price to resistance level 71.300 or are we going to see them fizzle out this week?

If the Japanese Yen resumes the trading week weak, then we could see NZD/JPY hit resistance level 71.300, if not we could see a reversal of price this week.

4. XAU/USD (GOLD)

Gold is refusing to drop after hitting a very strong resistance level 1788.63.

In my opinion, we could be seeing a breakout of resistance level 1788.63, and if that happens, we could see buyers flood the market and send price to 1899.48 which is over +1000 pips.

However, if our ascending channel gets broken this week, then price safe haven would be 1744.00.

What is your thought?

Kindly comment below