Hello Traders,

How is your weekend going and what are your plans for the charts this coming week?

If you have non, say no more fam, you are in the right place.

Let’s see what the charts have for us this week.

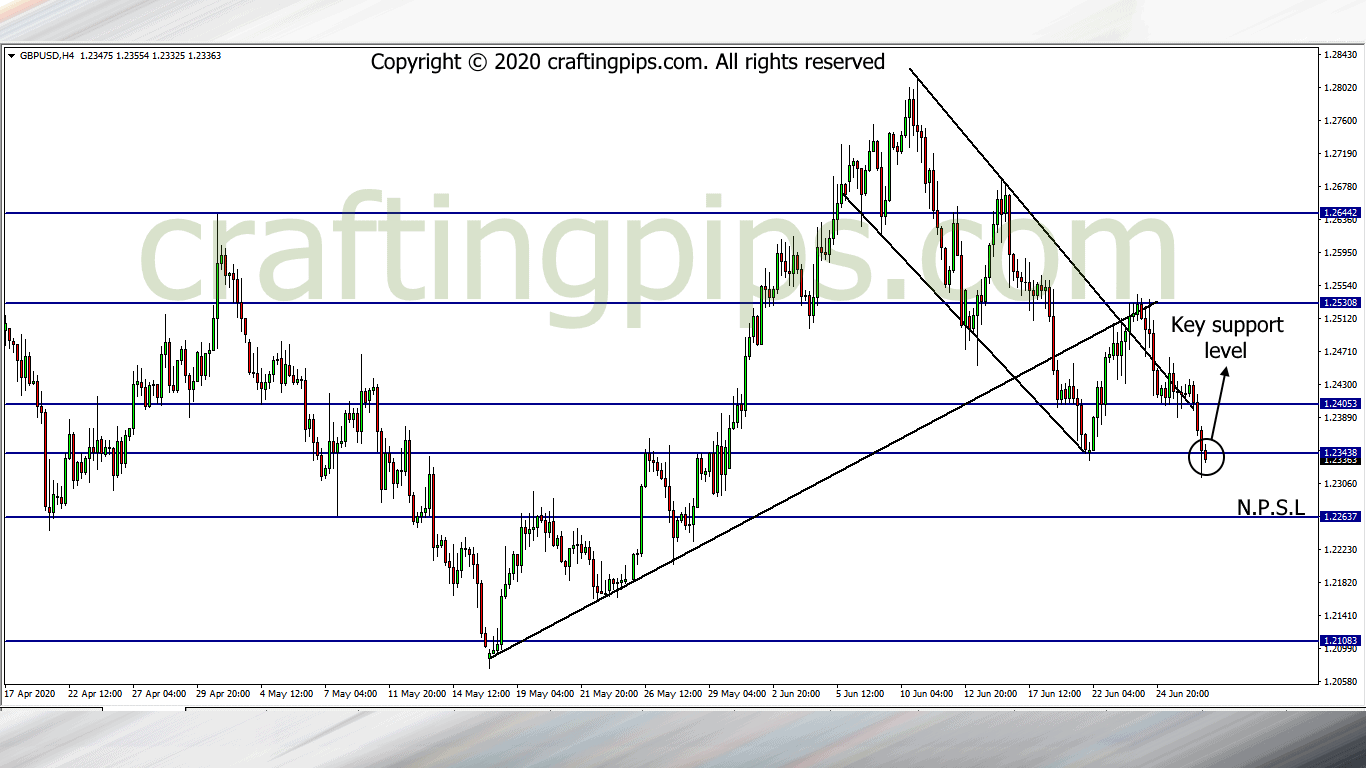

1. GBP/USD

Price on the GBP/USD closed highly bearish on the daily time frame.

That said, price also closed in between a key support level (1.23438). If the market continues this week with a strong bearish bias, we could see price hit 1.22637 which is our next possible support level.

We should also be on the lookout, because the market may resume with fewer sellers, and buyers may want to take advantage of the situation, which may take price back to resistance level 1.24053

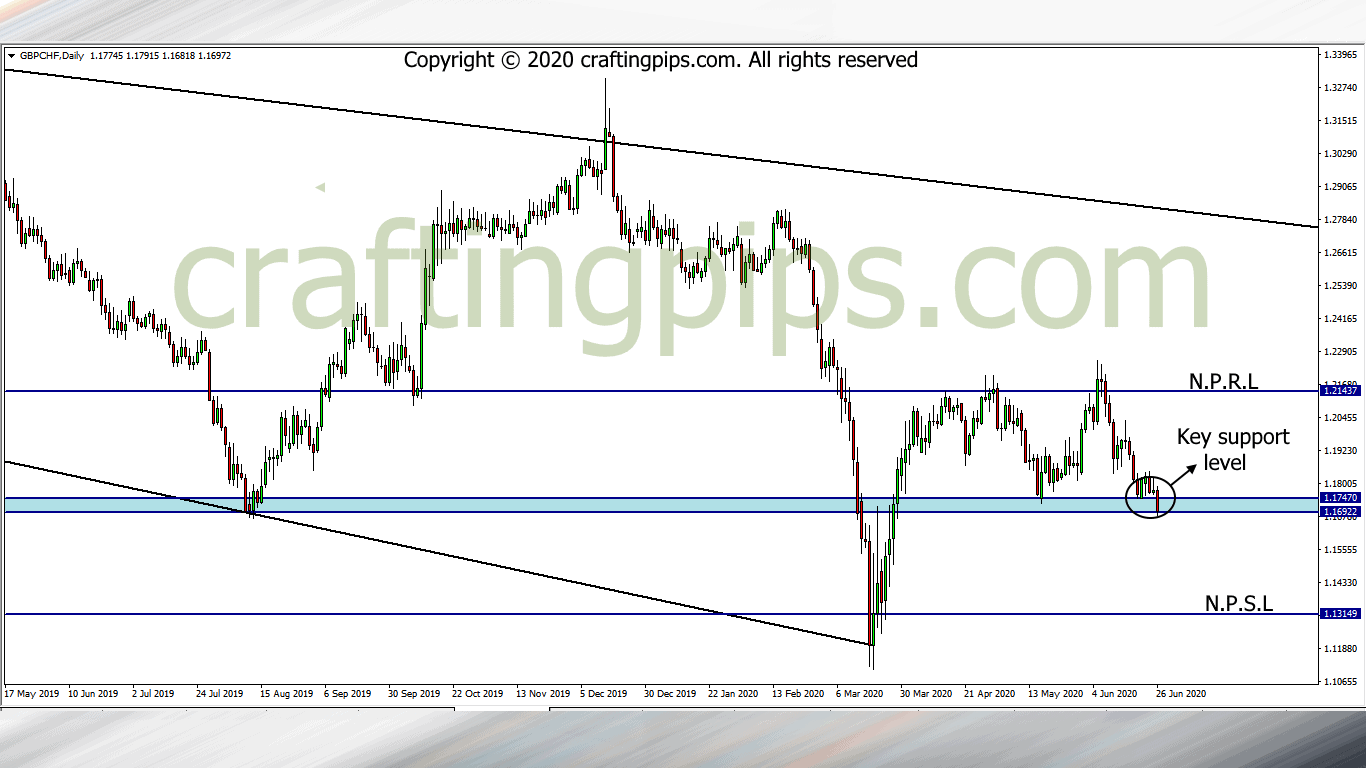

2. GBP/CHF

Price on the GBP/CHF has been locked within a consolidation for over 8 weeks now.

On Friday we saw price hit a new low (1.16922). The last time price got this far was over 9 months ago.

If price succeeds in breaking this level, we could be seeing support level 1.13149 get hit this coming week.

If price also reverses at the present support level, resistance level 1.17470 will most likely be our first bus stop, and if price breaks through, then we could be seeing price hit resistance level 1.18453.

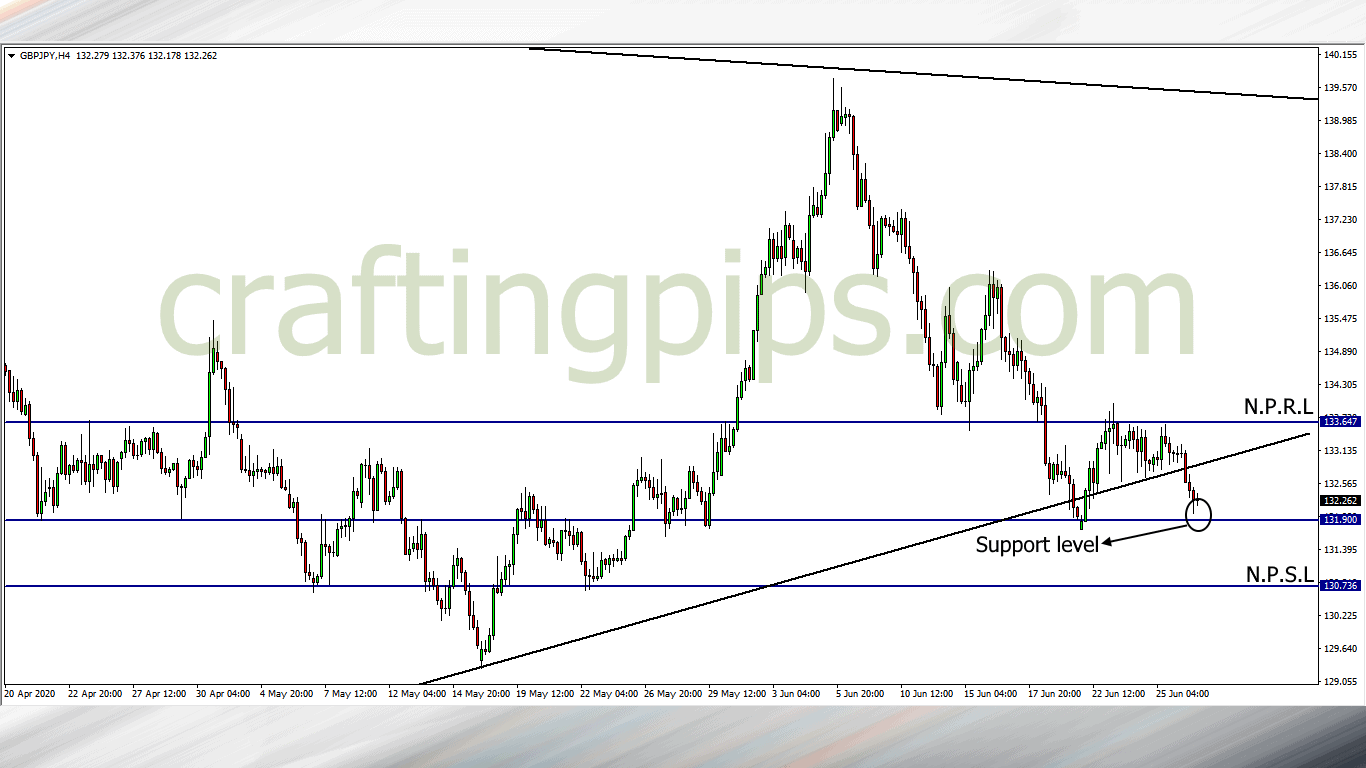

3. GBP/JPY

On the GBP/JPY, support level 131.900 is a key support level to watch out for.

A breakout will most likely encourage more sellers to take price to our next possible support level (130.736), and a bounce off the present support level may encourage price to revisit resistance level 132.884 first, before further going up or perhaps price reversing.

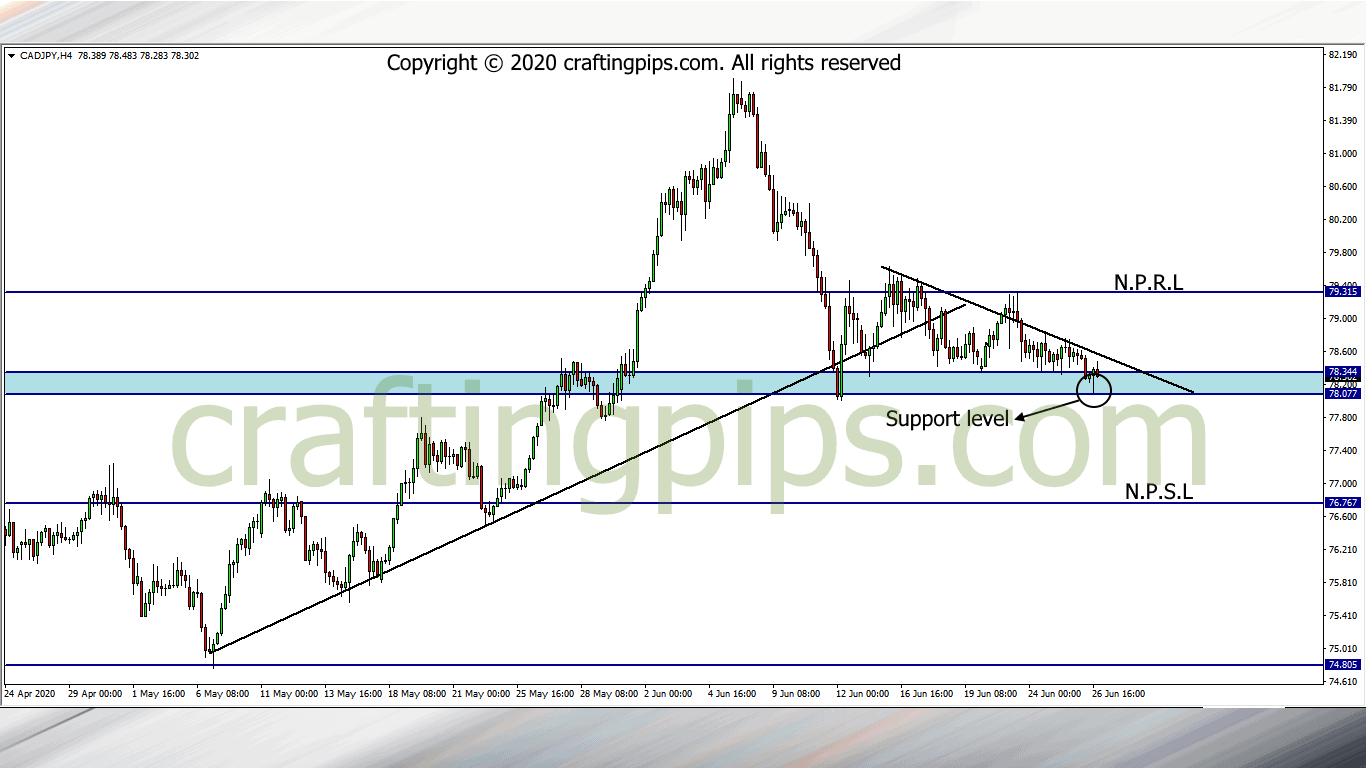

4. CAD/JPY

Price on the CAD/JPY has formed a subtle pennant.

Price on the CAD/JPY has formed a subtle pennant.

Price breakout of support level 78.077 may be all sellers are waiting for before joining the party till price hits the next possible support level (76.767).

Waiting for confirmation should be our goal as the market opens.

Sunday’s and Monday’s are usually erratic in the market and analysis most times could hit a brick wall.

So be cautious!

That said, we are done with our weekly review, kindly place your comments below, I would appreciate your opinions on what is likely to go down in the market this week.

Do have a pip-full week ahead and don’t forget to share with your pip-loving family.