Hello Traders,

How did your weekend go?

Mine was spent thoroughly looking through my trading journal.

I decided to close the month of September on Friday. I think it was better I did so because we have just one day for the month of September this week, hence there is no need putting myself through all the hassle into closing my books during the trading week.

So, let’s head straight to our charts and see what pairs we have lined up for our trading pleasure.

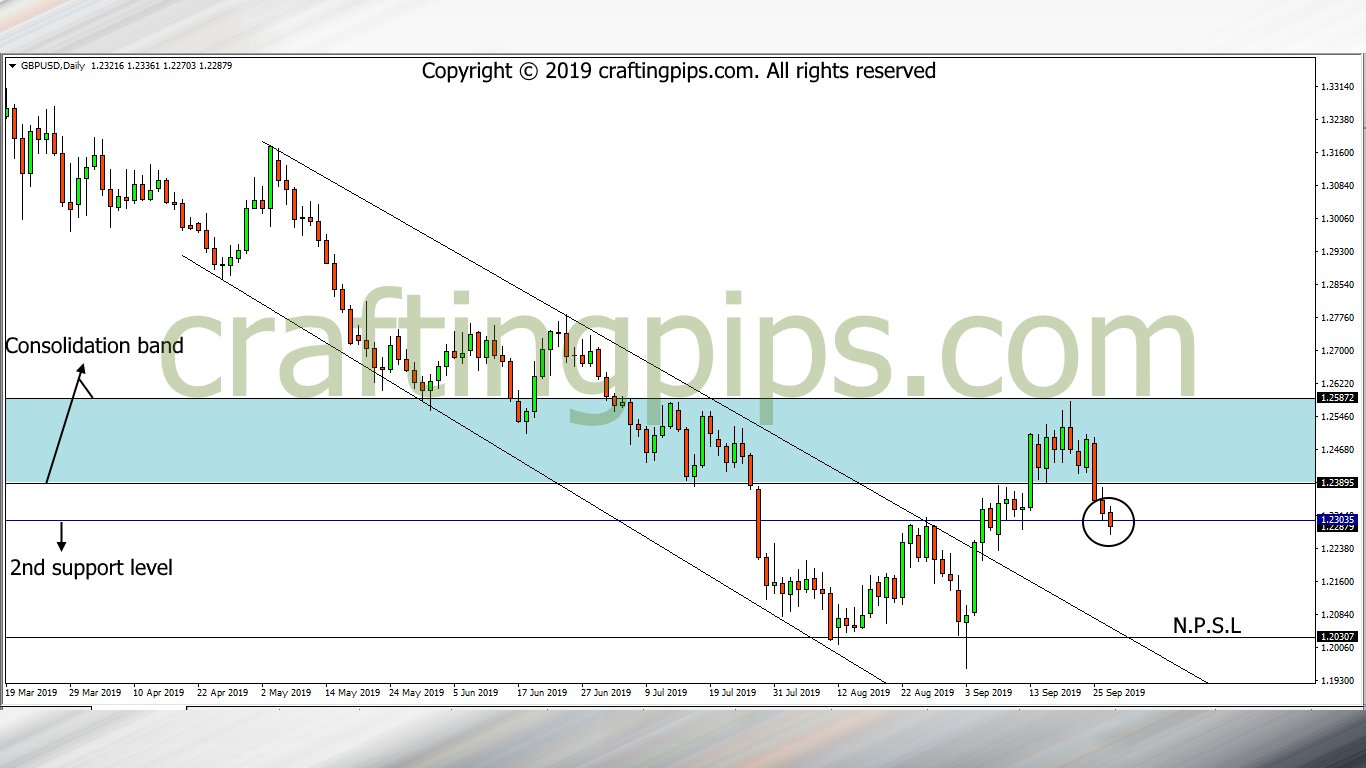

1. GBP/USD

The GBP/USD has been falling since the open of the market last week.

Presently price is resting on a minor support level (1.23035).

My bias is bearish, there is a huge possibility that price will continue to fall till it gets to the next possible support level (1.20307).

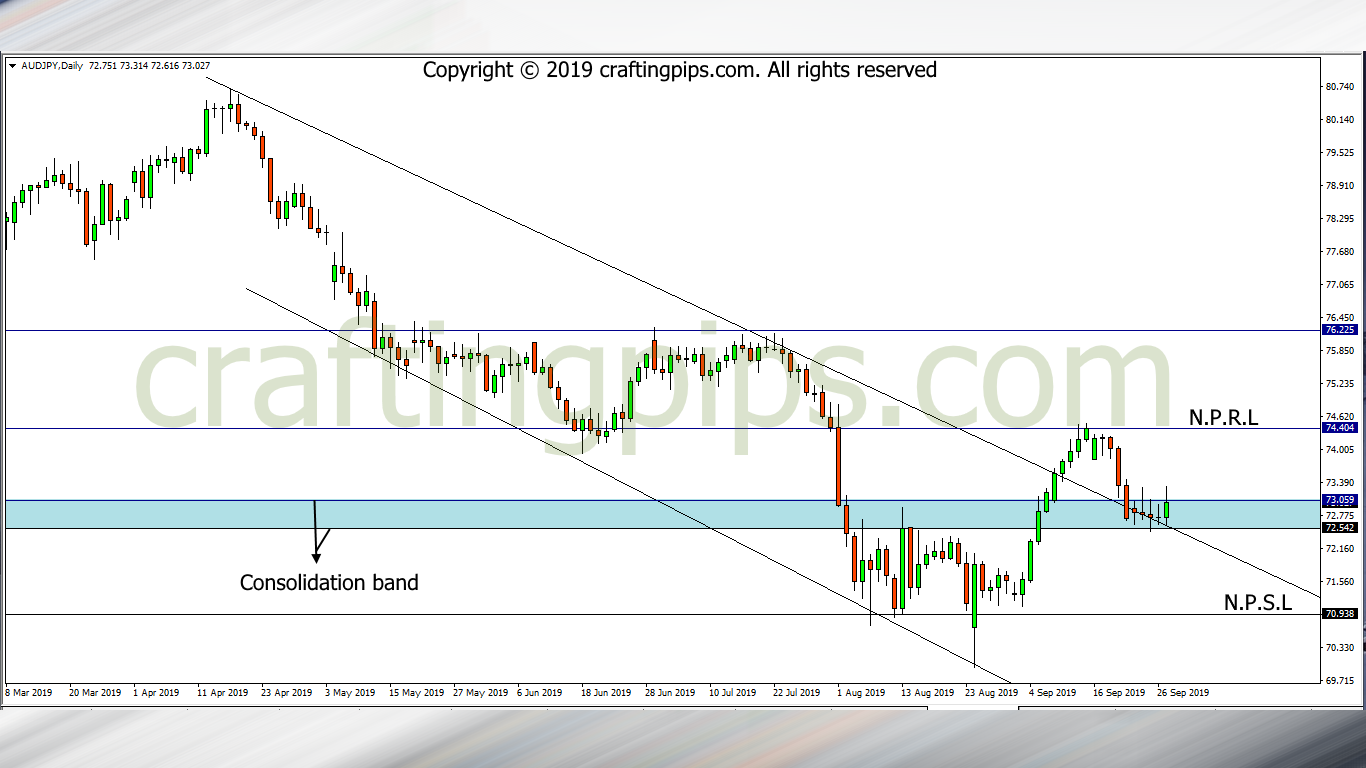

2. AUD/JPY

The AUD/JPY closed the week, ranging in-between the consolidation band.

This week we should be looking out for a breakout from either side (73.059 or 72.542) of the consolidation band.

A bullish breakout will most likely encourage price to hit resistance level 74.404 and a bearish breakout should encourage price to hit the support level 70.938.

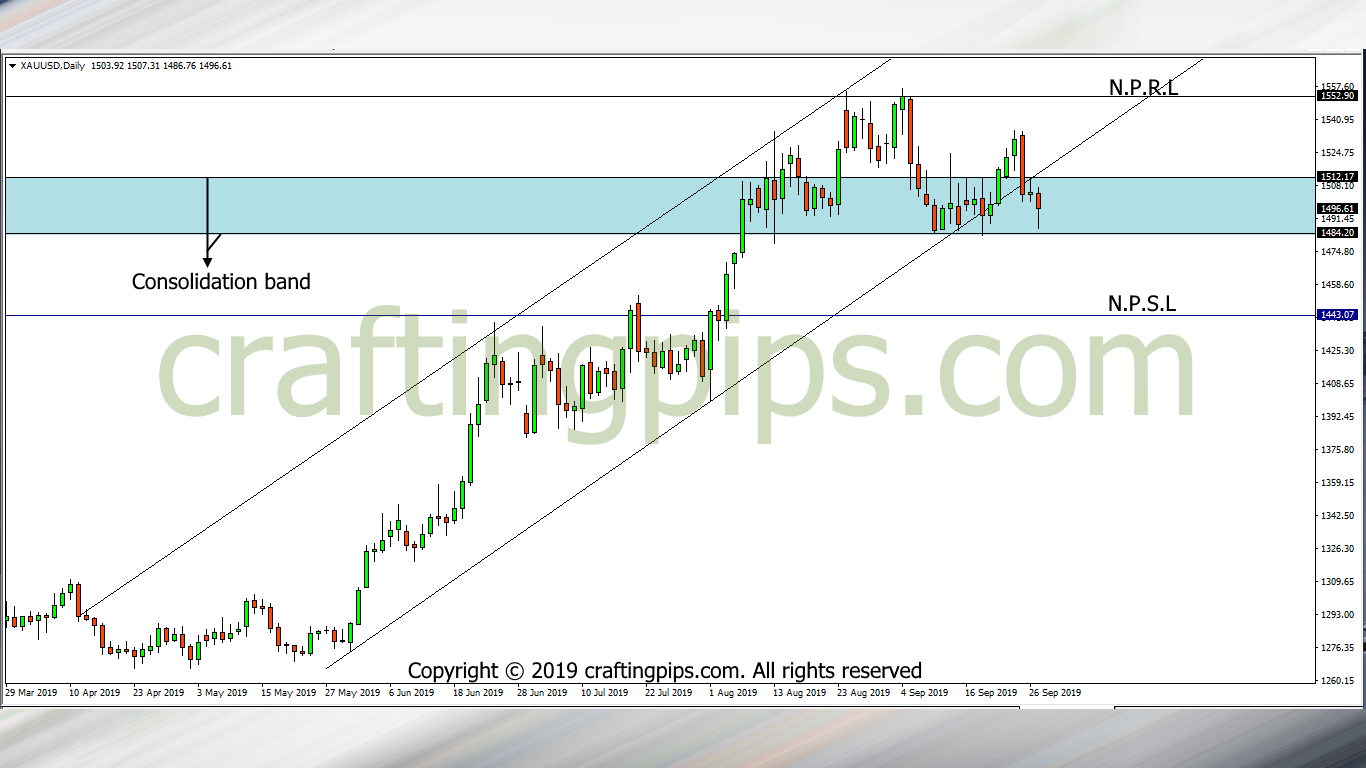

3. XAUD/USD

Gold was tricky last week.

We did experience a fake breakout on Monday.

Looking at the pair presently, apart from it tightly held together by the consolidation band, we can clearly see a head and shoulder formation.

A bearish breakout through the consolidation band will most likely encourage price to hit the next possible support level (1443.07)

That said, my bias is indifferent regarding the direction of Gold. All we need to do is patiently wait to see what price action tells us this coming week.

We are done with our weekly analysis, all we can do now is wait to see how our analysis plays out in the market, and steal trading opportunities that present themselves.

Join us through the week as we continue to analyze your favorite pairs and also assist you in spotting viable setups all through the week.