Hello traders,

Let’s hit the charts:

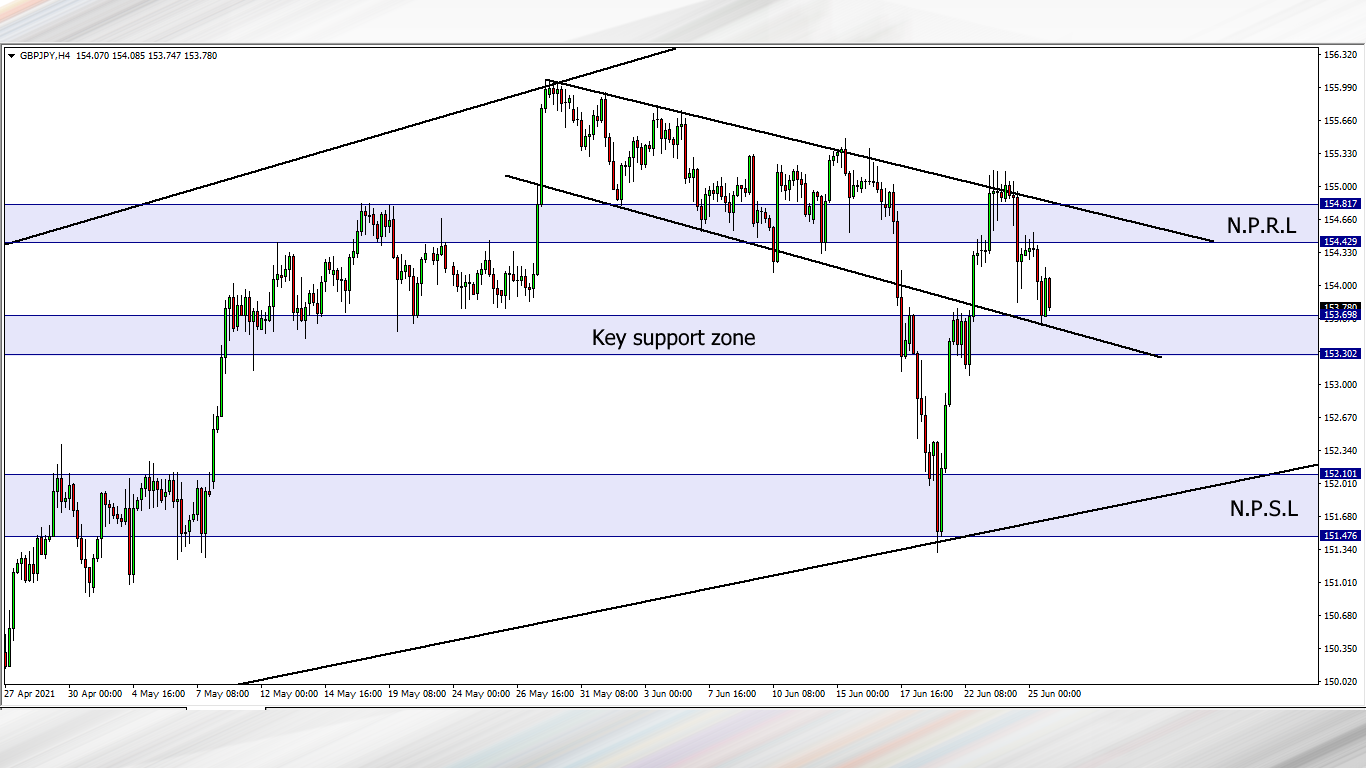

1. GBP/JPY

Last week GBP/JPY closed with a strong bearish momentum.

Presently price is resting on a key support zone. If the bears are well motivated and break through the support zone, we may most likely see price hit 152.101.

If for any reason a reversal is formed within the first few hours after the market opens, we may see price revisit resistance level 154.429

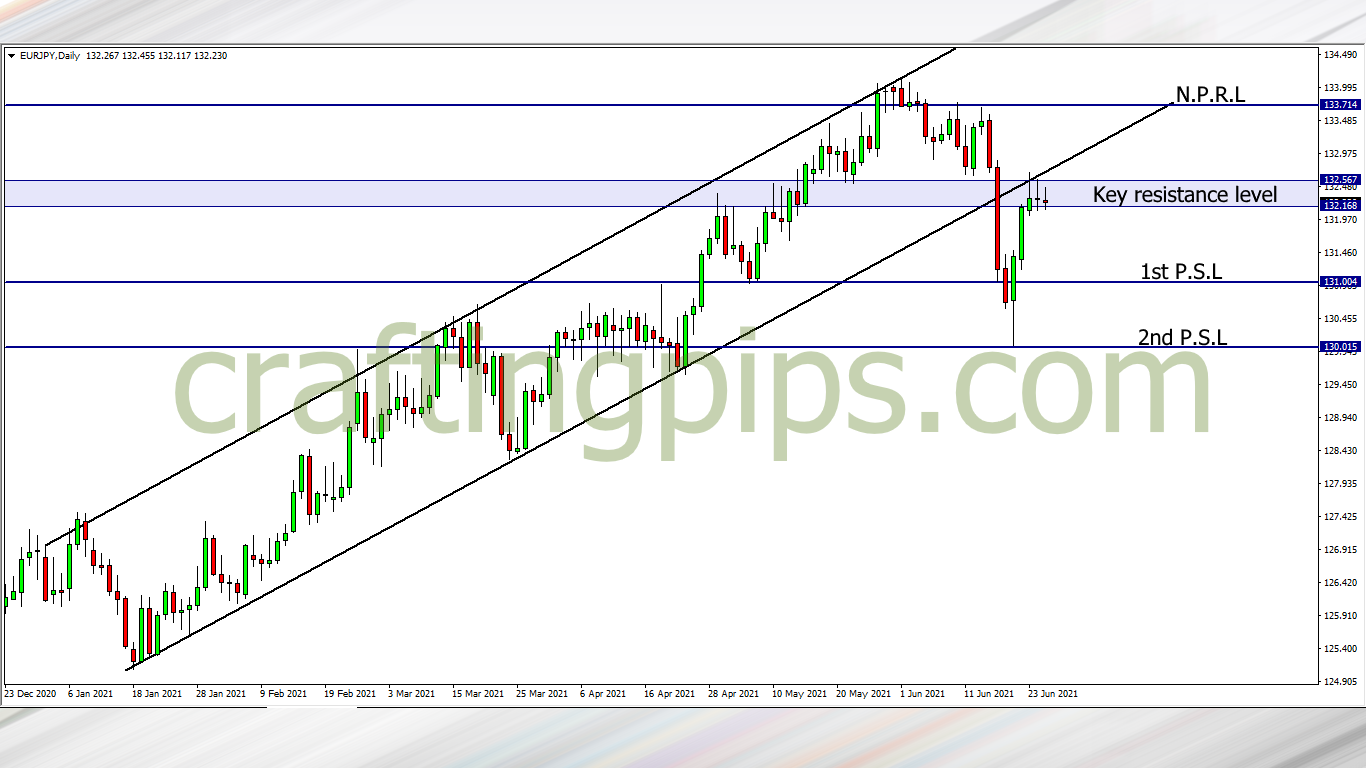

2. EUR/JPY

On the EUR/JPY, several attempts by the bulls to break the 132.567 resistance level proved futile.

All we can see is bearish spinning tops which may encourage the bears to come in this week. If the bears flood the market this week, price may most likely visit 131.004 as the first possible support level.

If the bears are aggressive, they may most likely hit the second possible support level (130.015)

3. EUR/CHF

This would be the 5th time price will be bouncing off an ascending support level of a trendline in over a month.

If we do get a reversal this week, price may revisit resistance level 1.09650, and if we do get a bearish breakout, our eyes should be fixed on 1.09100 as our next possible support level.

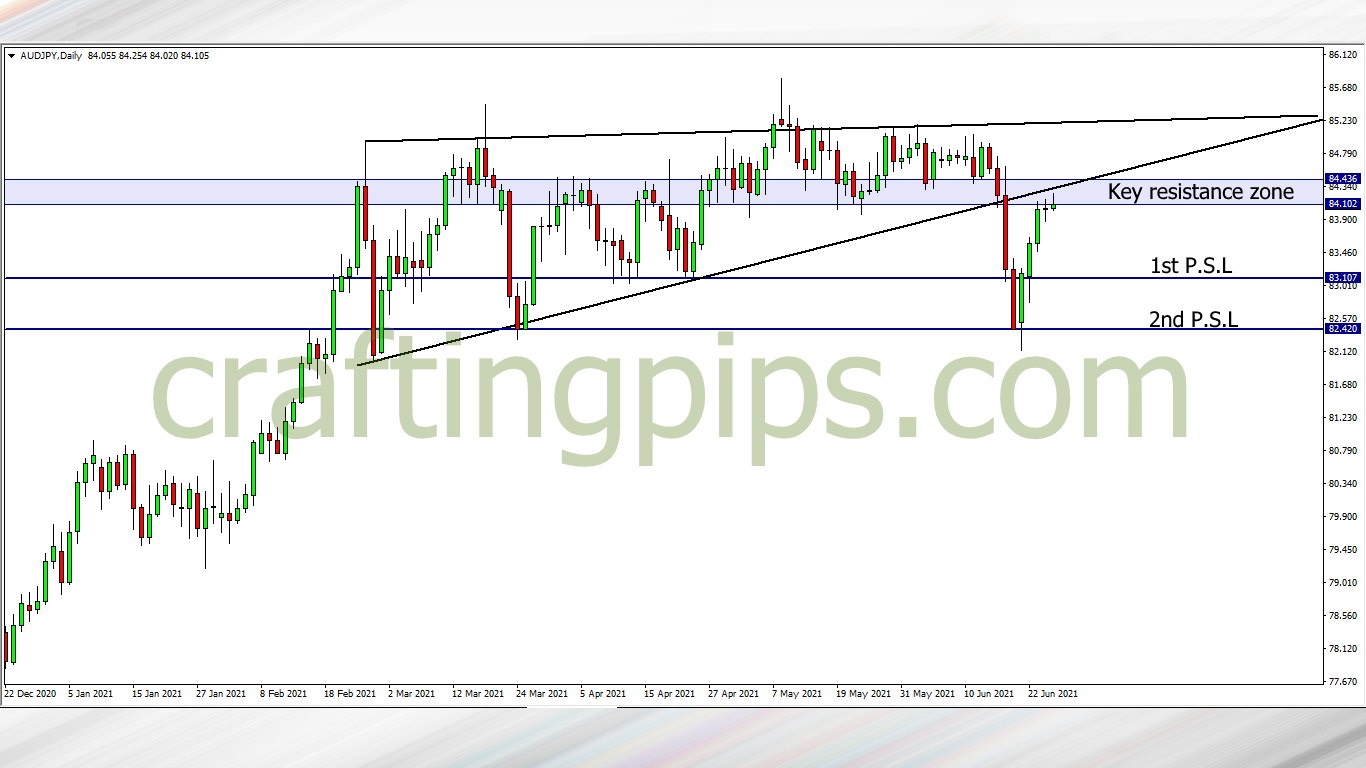

4. AUD/JPY

The AUD/JPY looks similar to EUR/JPY.

If resistance level 84.436 stands strong this week, the bears may take price back to support level 83.107 (and that’s what I am hoping for)

But hey, don’t take my word for it, if wishes were horses, I would be the richest man in the world.

Price could also break the current resistance level and re-visit a previous resistance level (84.916), so it’s important we are patient to get a proper confirmation before taking the trade

What say you?

ATTENTION:

For those who are interested in joining our FREE trading group on Telegram, where trade ideas are discussed, which may assist your trading career while being infected by positive vibes

Smash the link: https://t.me/joinchat/FN30PxlwXbk2BcuTDdH5yg

[newsletter_form type=”minimal”