Good day traders,

it’s a cloudy and rainy morning over here, and I love it.

How is the weather over there and how did you fare in the market last week?

Personally, the market gave a few fair setups which I traded.

Let’s see how they went

Tweet

My Gold trade would have been a solid turning point last week, but guess what happened?

A few pips away from hitting my target profit, and price fell flat like a bread dough prematurely brought out of the oven. Thankfully I had my stop loss on a breakeven.

We are in the last week of the month of April already and I am looking forward to the market opening. There are some nice setups I will be trailing, and hopefully trading later this week.

Let’s check out those setups…

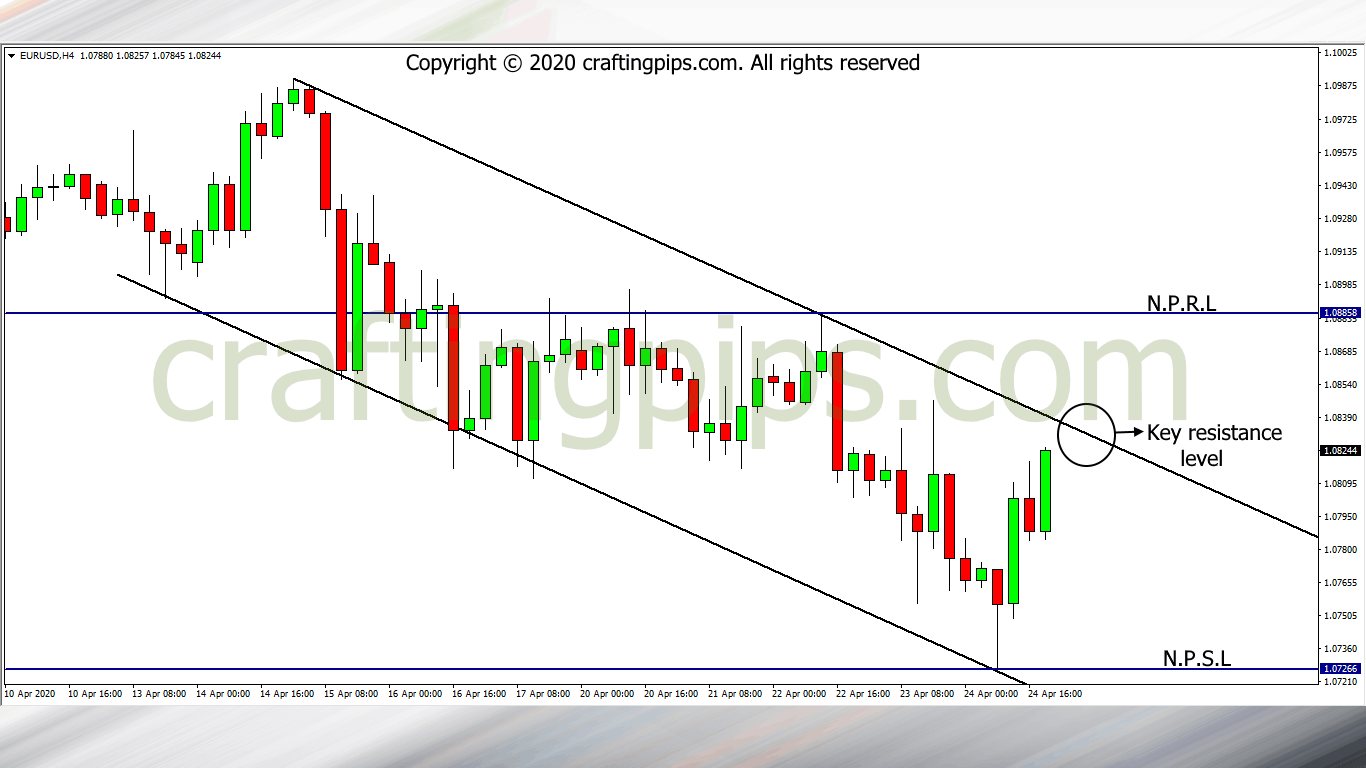

1. EUR/USD

The EUR/USD closed bullish on Friday.

Looking at our four hours time frame we can see price within a descending channel. A breakout through resistance level 1.08333 will most likely encourage the buyers to push price to 1.08851 which is the next possible resistance level

A reversal at 1.08333 may cause the Bears to pull price to a previous support level (1.07266).

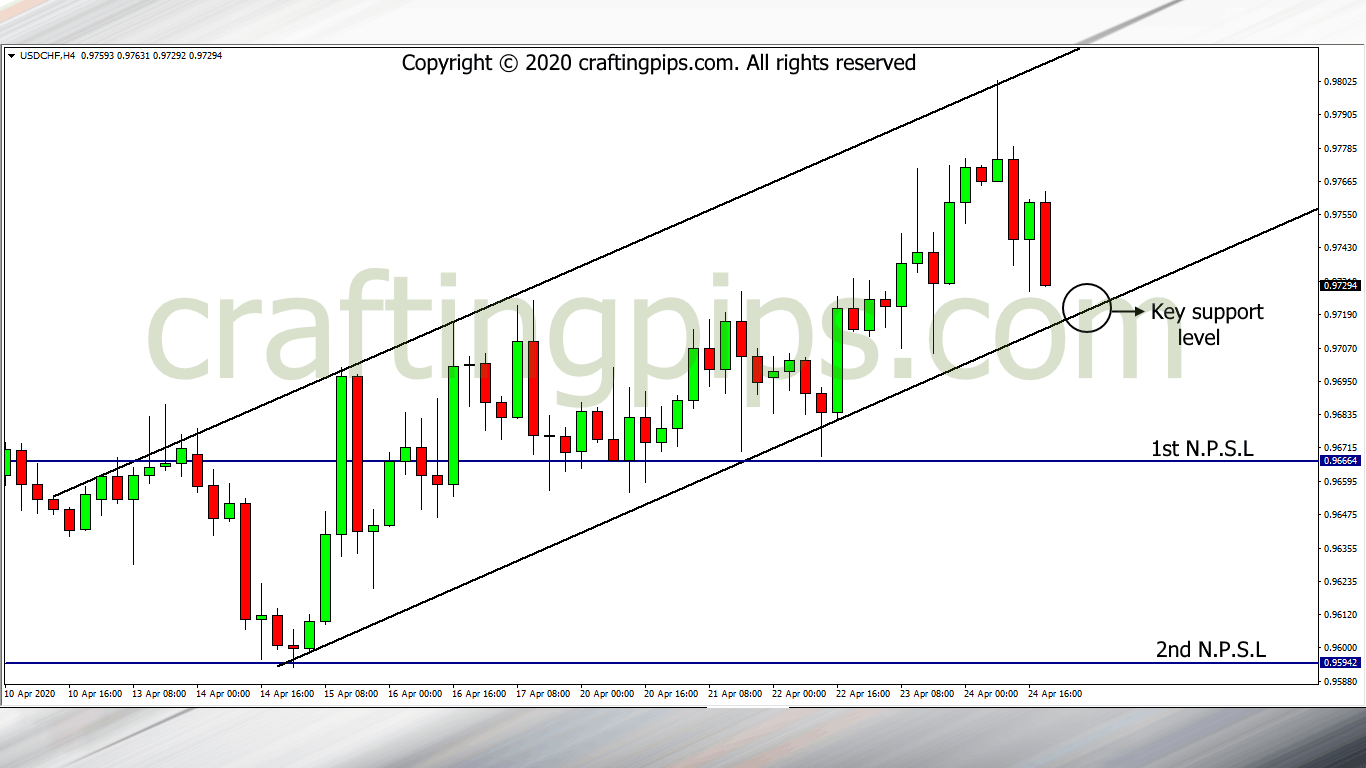

2. USD/CHF

The USD/CHF closed bearish on Friday.

On the four-hour time frame we can see price almost touching 0.97182 which is a key support level. If the Bears are strong enough to break this level, then our next possible support level would be 0.96662.

There is also a possibility of a reversal, and in my opinion, if that happens, the trade would be invalid.

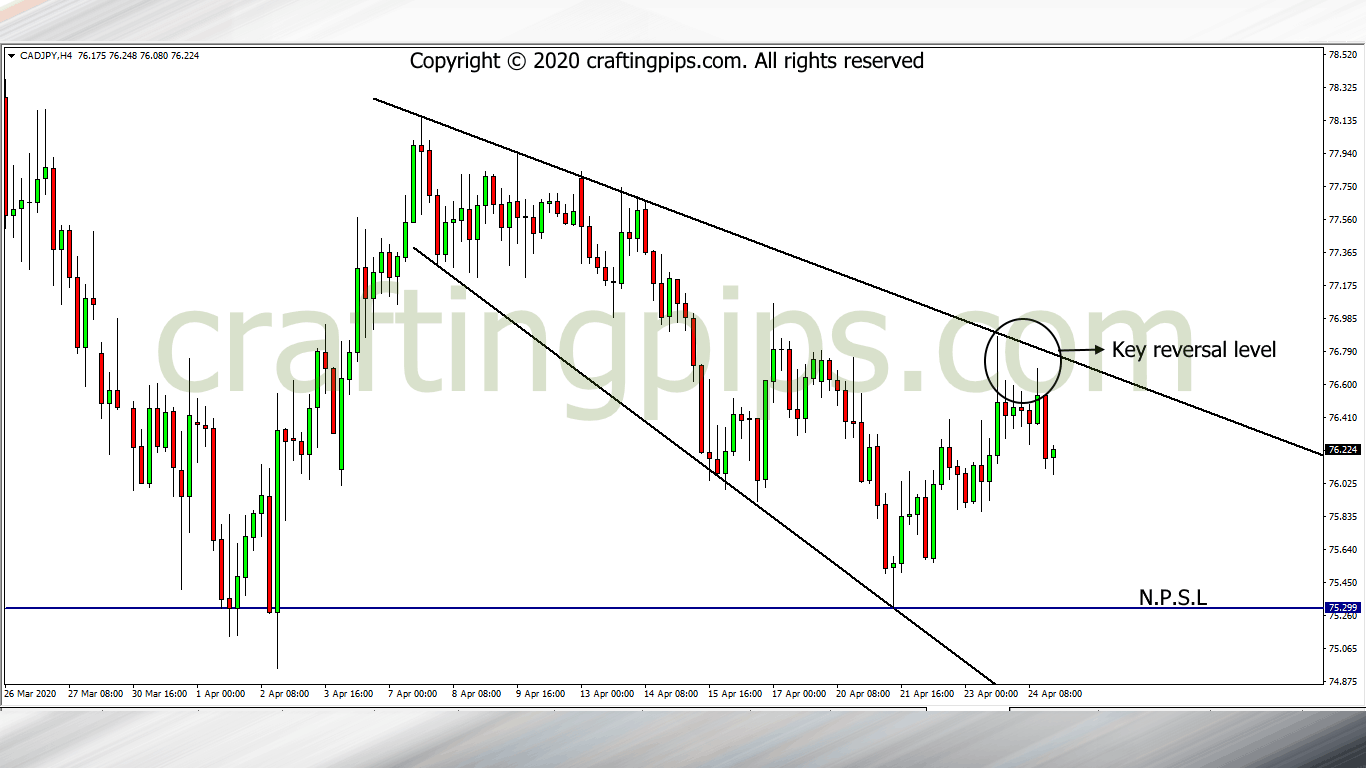

3. CAD/JPY

CAD/JPY is another pair that closed bearish and price also formed an expanding descending channel.

In my opinion, all we should be looking out for is a slight pullback before price continues it’s bearish journey to the next possible support level (75.299).

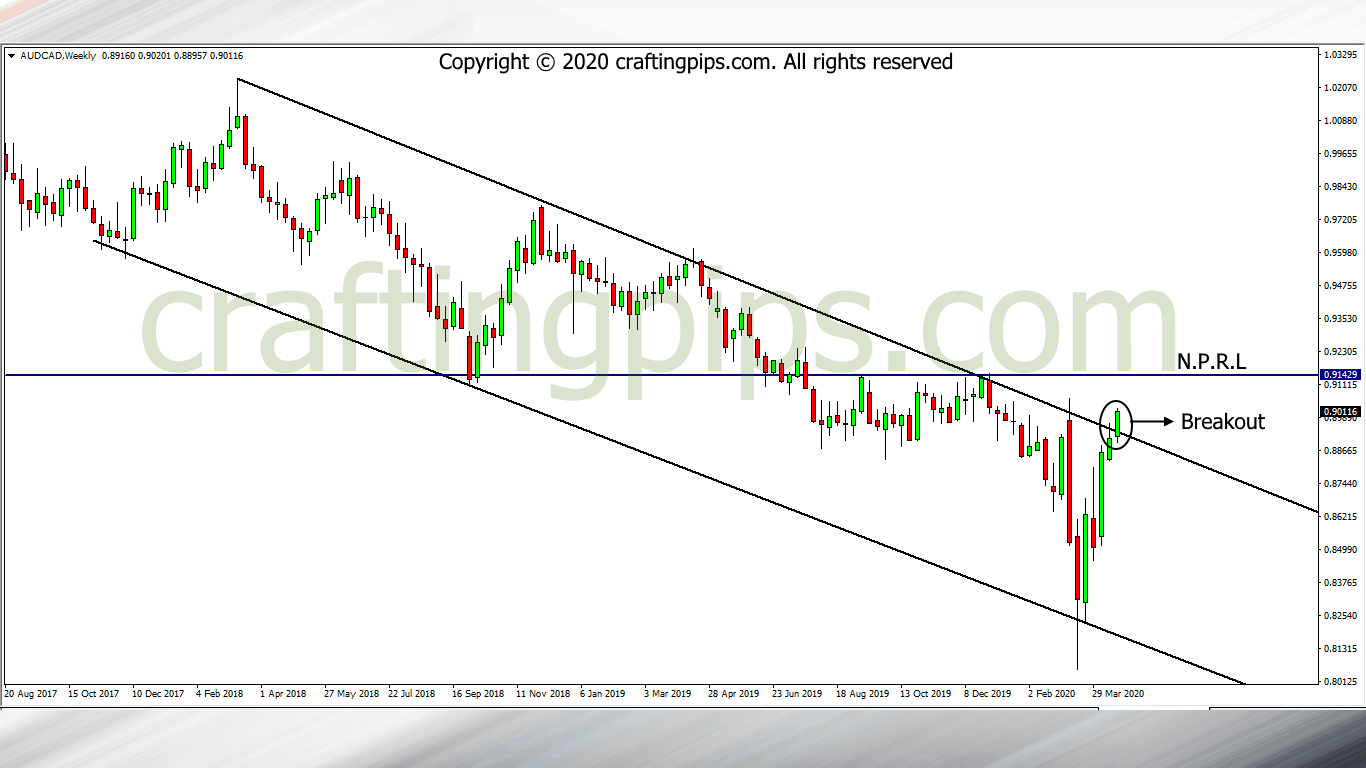

4. AUD/CAD

AUD/CAD on the weekly chart closed with price breaking out of resistance level 0.89713.

We may most likely see a pullback before price proceeds to its next possible resistance level (0.91429).

What are your views?

Thanks for taking the time out to read through our market analysis.

If you haven’t subscribed please do, if you haven’t shared our articles or analysis with your pip loving friends, please do.

If you are also interested in joining us on our Telegram channel where I share a few of my weekly live trades, here is the link

I wish you a pip-full week ahead.