Happy Sunday traders,

How was your weekend?

Mine was super. Already planning to get the FIFA 2020 for my PS4 console. I still have the PES 2019, but I am planning to migrate to FIFA after many considerations.

How many of my fellow traders here are online ballers?

If there are, we could play online when I purchase it.

Alright. alright alright… let’s get back to work, there are some cool setups this week. Let’s see how we could harness them.

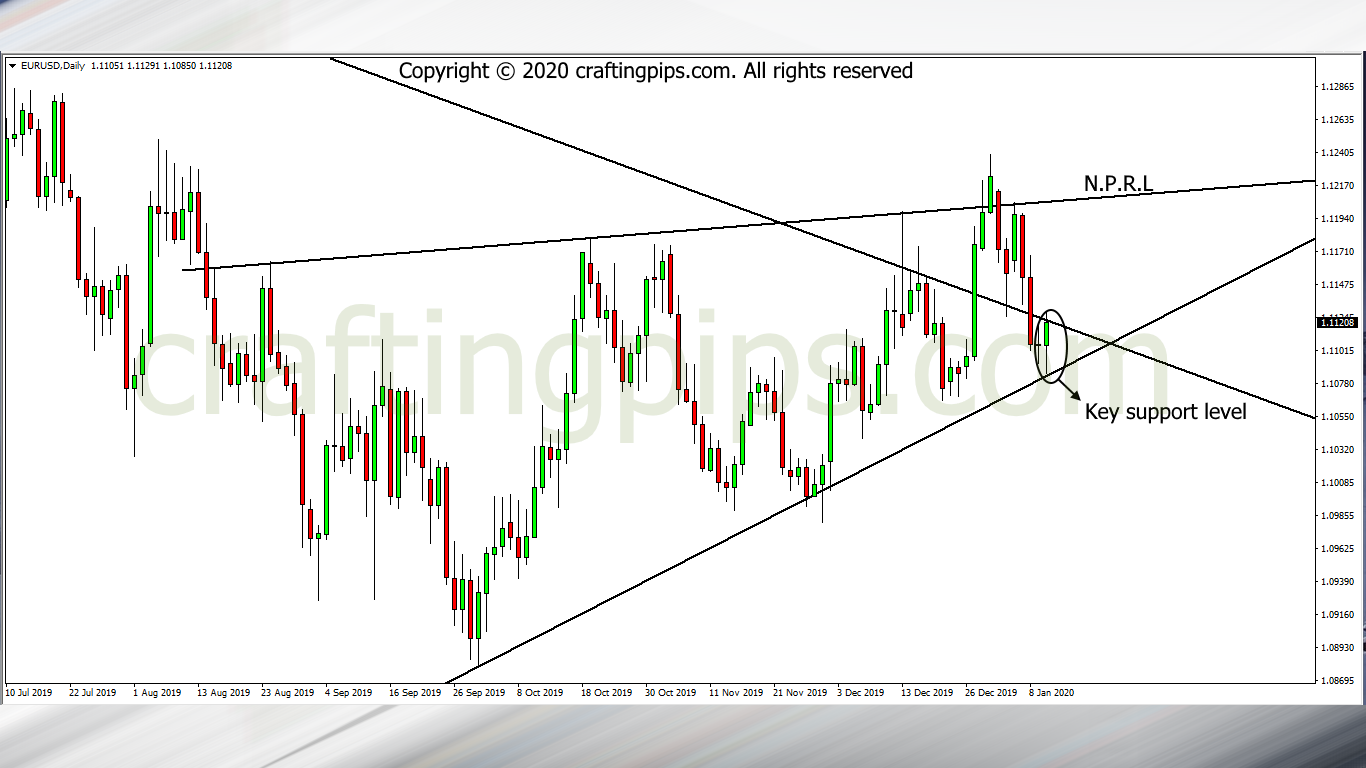

1. EUR/USD

EUR/USD on the daily chart closed with a beautiful bullish pin bar on Friday.

On the weekly chart, we could be looking at price bouncing off support level 1.10999 which could be termed as a pullback after an initial price breakout on the weekly chart.

If the bullish setup is confirmed, we should be looking at 1.12039 as our next possible resistance level, if not, we could then pick 1.09872 as our next possible support level (If we get a bearish confirmation)

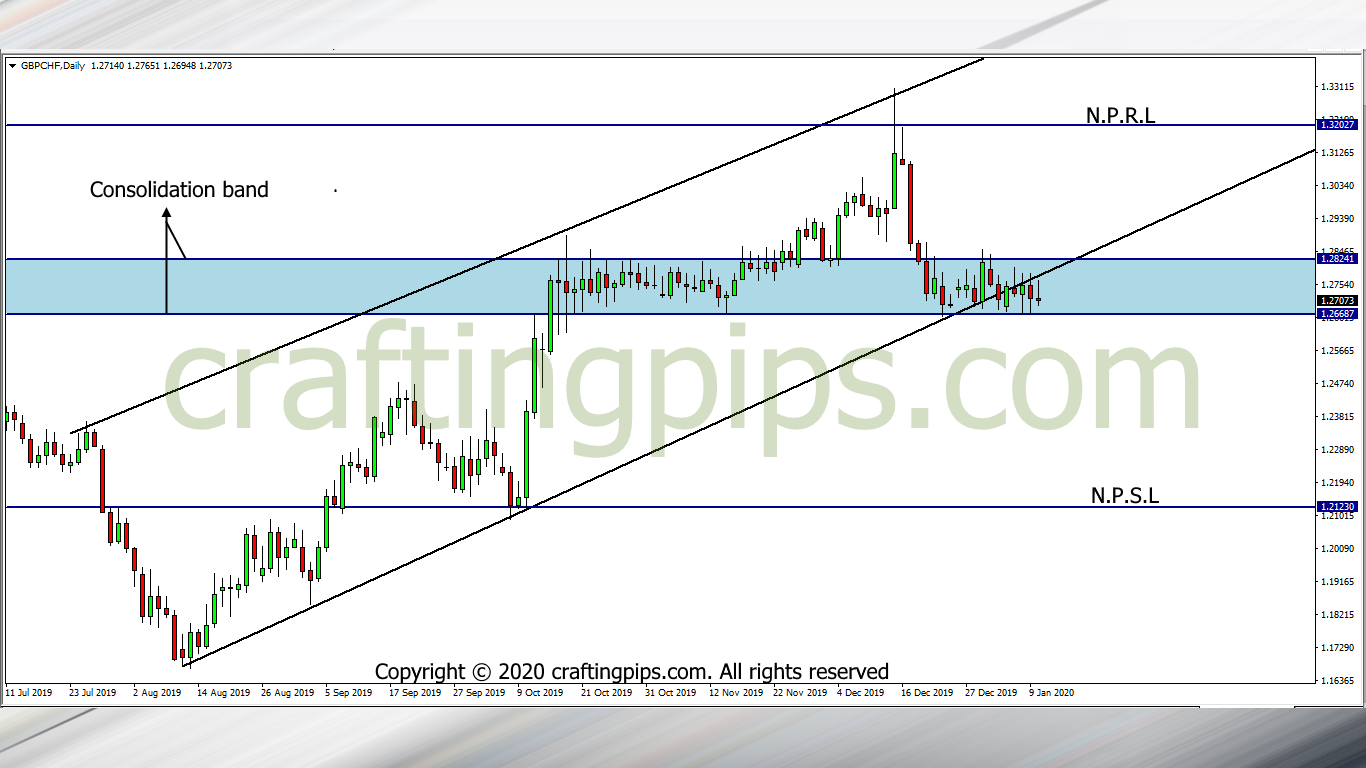

2. GBP/CHF

GBP/CHF is still on still.

Still tracking this pair and hopefully, IF we get a bearish breakout, price’s next bus stop would be 1.21230.

I am still bearish biased regarding this pair

If you missed our analysis on the GBP/CHF, you could check here

3. AUD/JPY

After price broke out from support level 75.206, AUD/JPY hit support level 73.732 before there was a pullback.

Presently price is touching a key resistance level (75.682).

The big question is:

- Will price bounce back to support level 73.732 or

- Are we going to see a breakout of the present resistance level to the next possible resistance level (76.543)?

That question will be answered as soon as the market opens.

Thanks for your time folks, kindly subscribe if you haven’t, this would help us send our analysis to your inbox as soon as we publish.

If you also have pip loving friends, kindly share.

You could also join our trading channel on Telegram (https://t.me/craftingpips). We share one trade every week, from call to how we execute in the market. This could assist your trading career if you still struggling.

That said, do have a productive week ahead.