Hello Everyone,

Welcome back to our weekly analysis of the market.

For those who are new, let me give you a low down of what we do.

Every Sunday, we pick up high probability setups and analyse them for the coming week.

This is to assist us in picking viable trades during the week.

All through the week, we also analyse the market on a daily basis. This helps traders stay on track with their favourite pair even if they are busy with other things in life.

All you need do as a trader is subscribe, so that you get updated as the week progresses.

Alrighty, without wasting any much of our time, let’s go check our charts and see what we have got for the week.

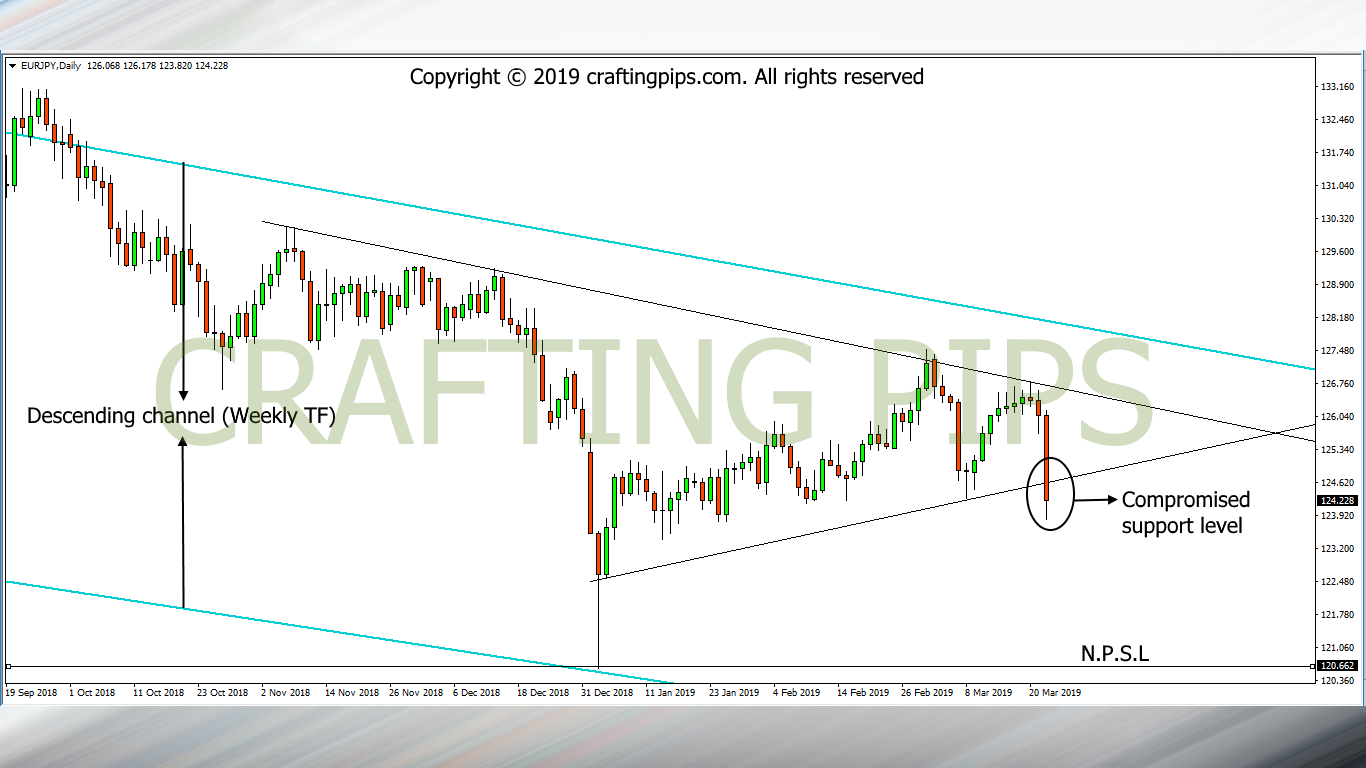

1. EUR/JPY

On the weekly time frame, there is a major downtrend on the EUR/JPY.

On the daily chart, we can see a breakout through the support level (124.612) of a pennant. Let’s hope that Monday trading activities further authenticate this breakout.

If it does, we may most likely see price hit 120.662 as the next support level.

On the other hand, if the present breakout is false, we may see the bulls take price back to resistance level 126.507.

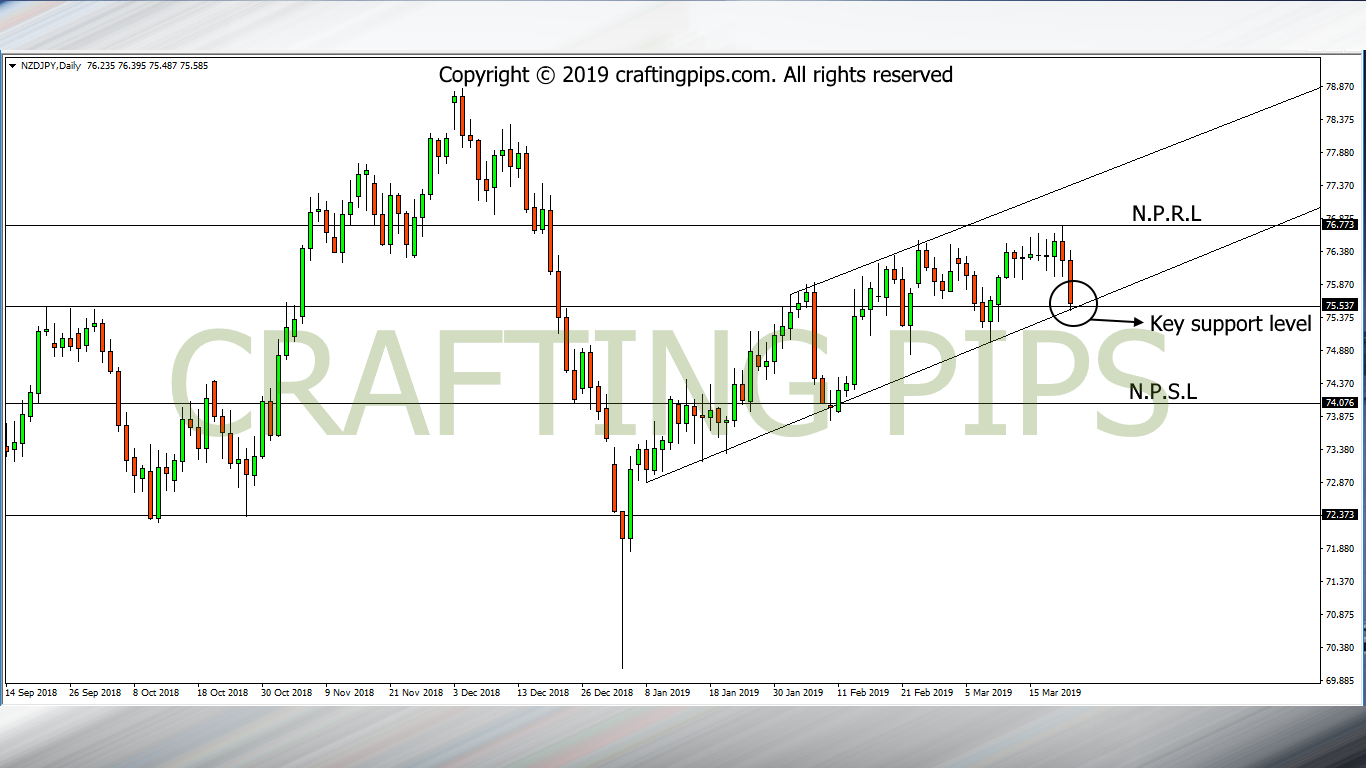

2. NZD/JPY

After NZD/JPY got rejected by resistance level 76.773, we found price resting on a critical support level (75.537).

A breakout from the present support level will further encourage the bears to drag price to the next support level (74.076).

However, if for any reason price is rejected at present support level, the bulls could start another push of price to the upside, hence targetting resistance level 76.773.

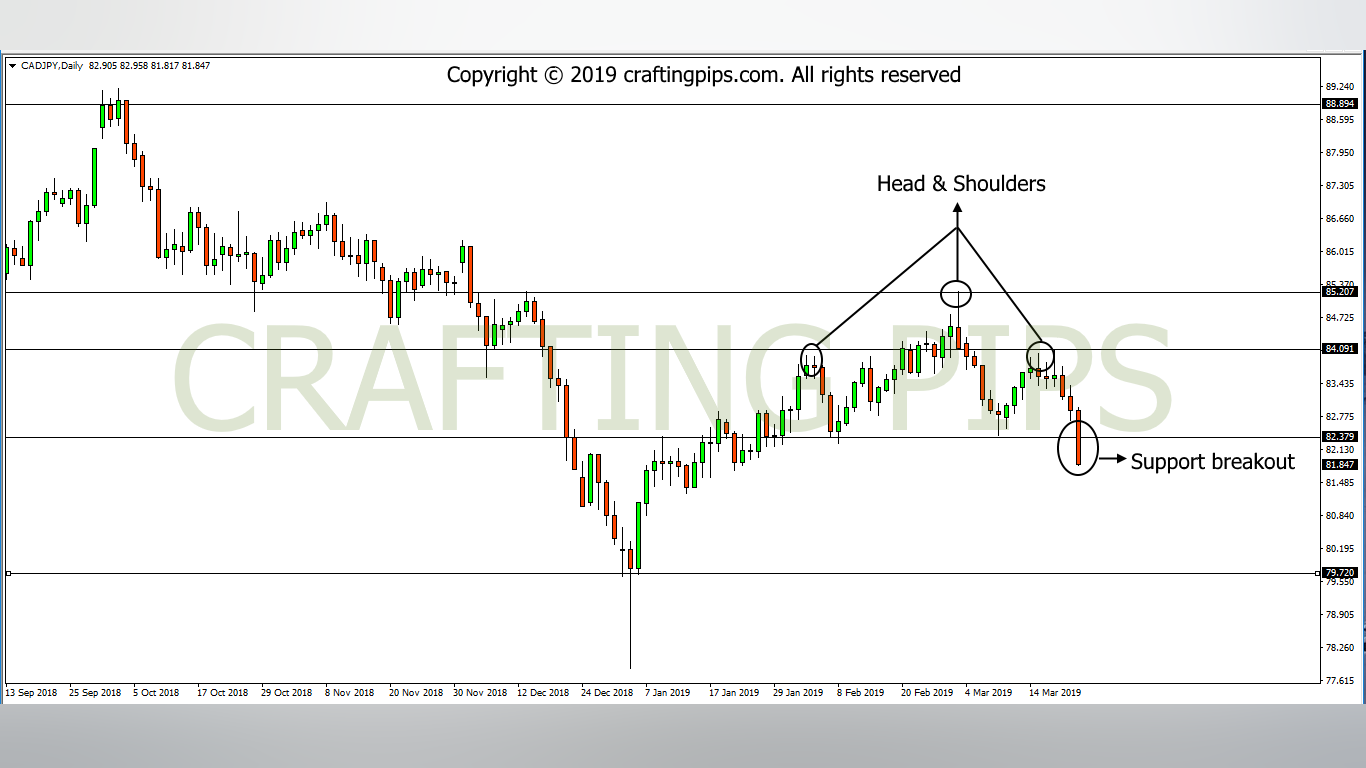

3. CAD/JPY

Watch out for a head and shoulders pattern on the daily chart of the CAD/JPY.

The neckline (82.379) was broken on Friday by a powerful bearish Marubozu.

We may experience a pullback before the bears fully take over.

Or…

We may see a crazy gap downwards as soon as the market opens by 11 pm GMT.

That said, if the breakout is not ruined by Monday’s unpredictability, we will be seeing price hit next support level (79.720) before the week runs out.

In all of these setups, it is advisable to be patient in order for your system to confirm the setup before committing to the trade.

That’s all we have for this coming weel folks. Join us again tomorrow for another analysis of the market.

Do have a great week ahead.