Hello Traders,

Welcome to the last week of the month of February.

Let’s hit the charts and see what we should be looking at this coming week.

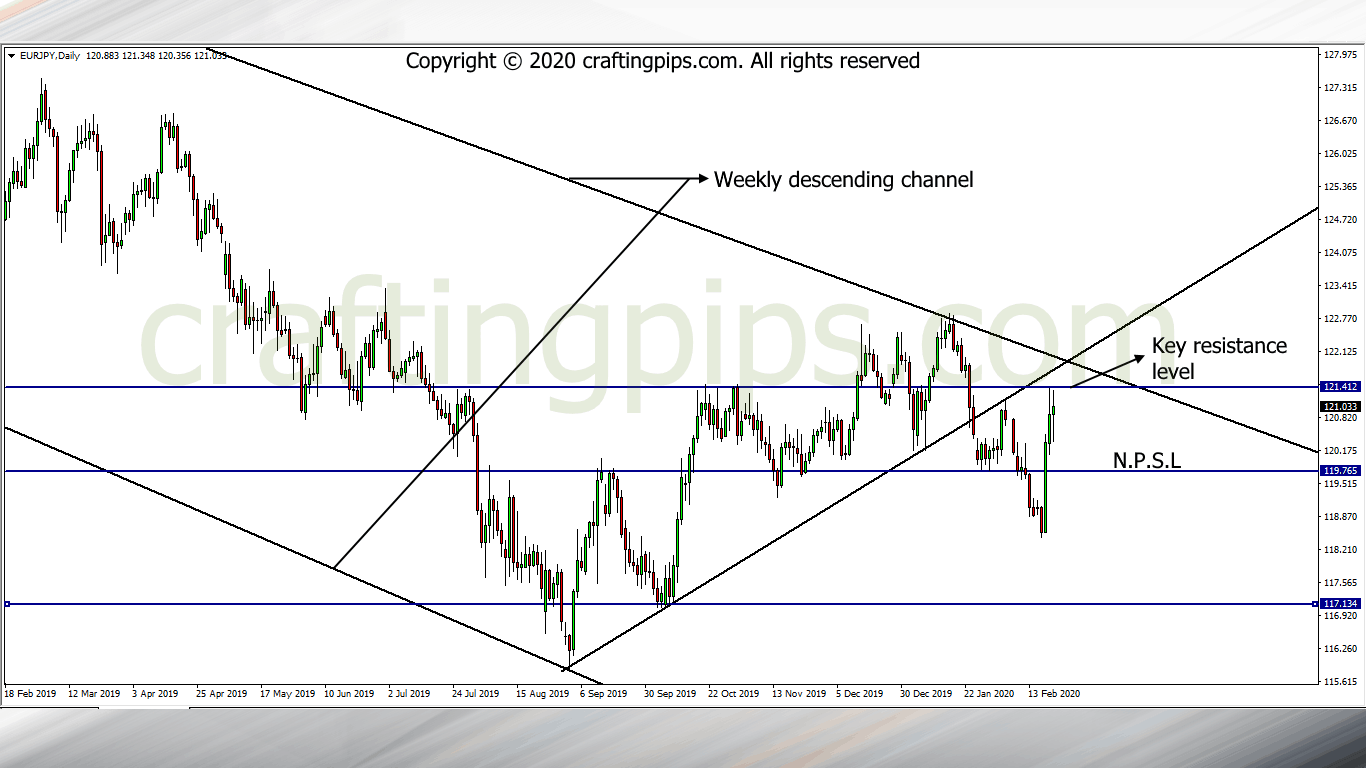

1. EUR/JPY

We saw a bullish move on most Euro pairs in the last three trading days of the week.

The EUR/JPY was no exception, as we expected price to hit 117.134 as the next possible support level, but the market had other plans.

Last week the market closed by price re-visiting resistance level 121.412. Let’s not forget that on the weekly chart, price is still locked within a descending channel.

Meaning that price could STILL reverse at the present level, and if it does, our next possible support level would be 119.765.

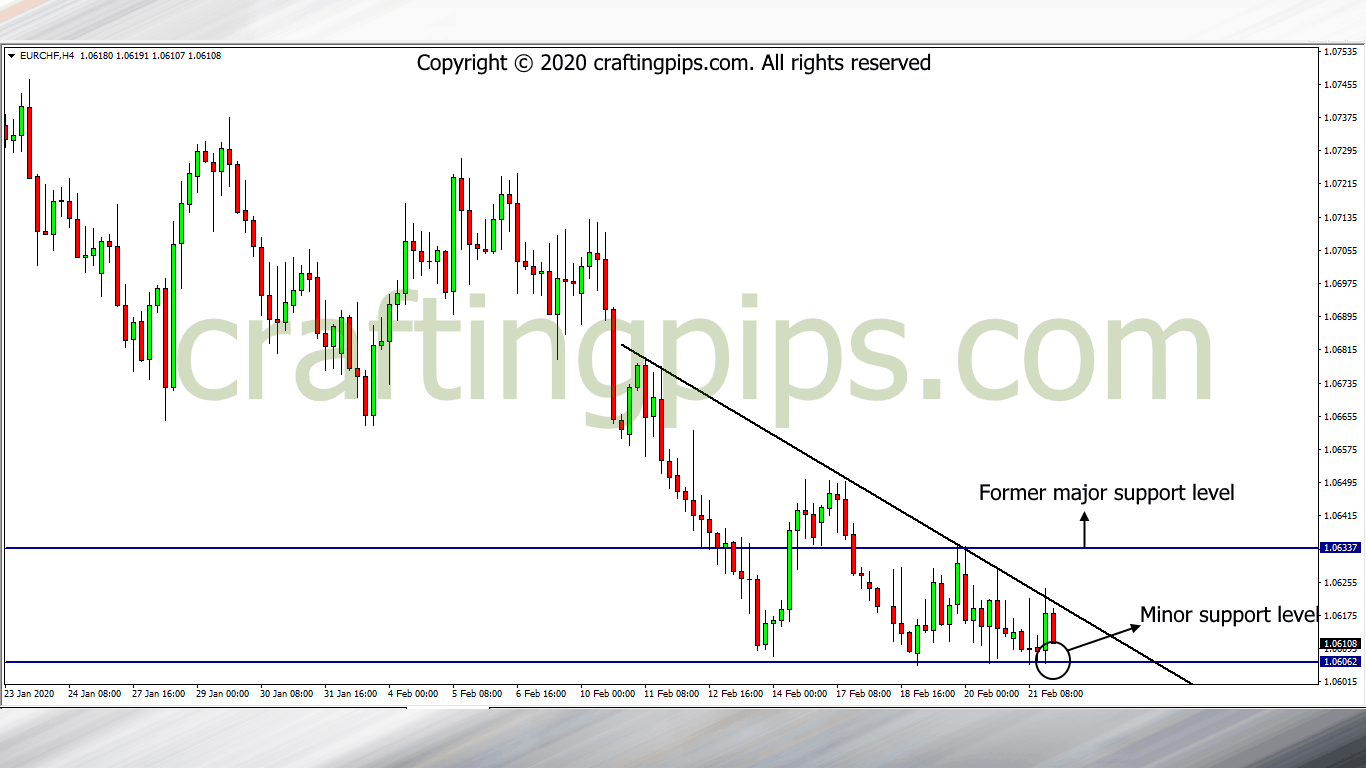

2. EUR/CHF

We analyzed this pair last week under our weekly setups, if you missed it, you can check here

The EUR/CHF on the 4 hours chart formed a triangle pattern only after a major support level 1.06346 was broken last week.

Price is still stalling within the triangle but my bias is bearish. If a bearish breakout is confirmed, we could see price reach support level 1.04163.

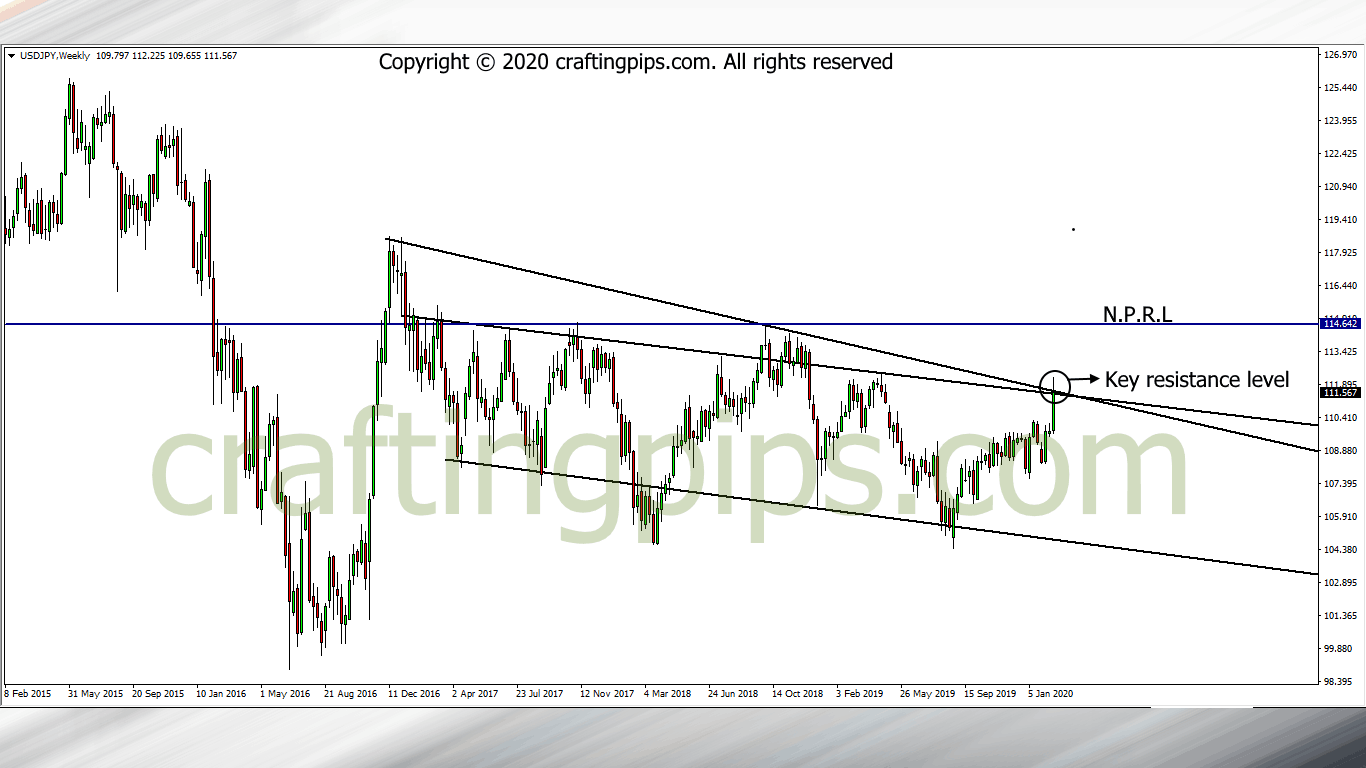

3. USD/JPY

On the weekly chart, USD/JPY has reached a critical resistance level (111.696).

We could expect anything at this point. A breakout confirmation will most likely push price to the next possible resistance level (114.642) and reversal confirmation means 108.234 will be our next support level.

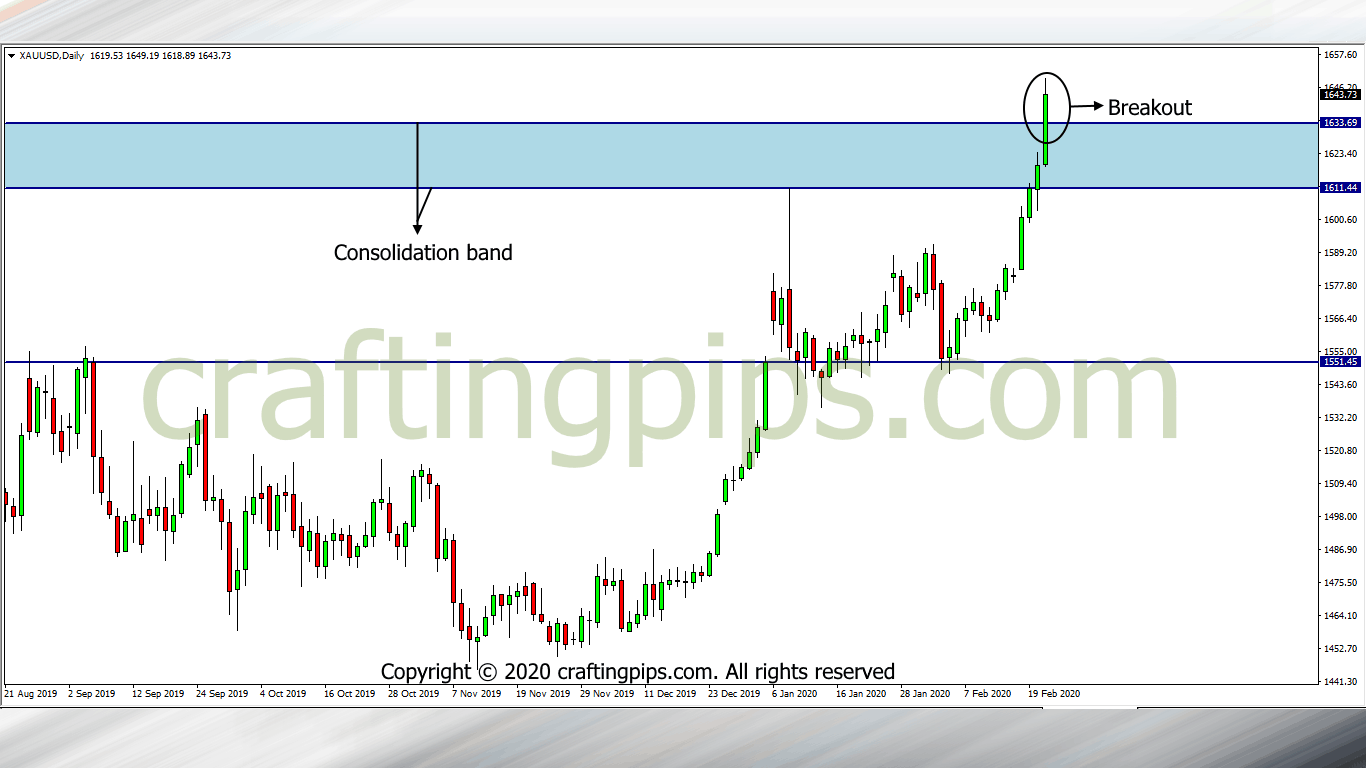

4. XAU/USD

Gold was on a bullish rampage last week, it broke through resistance level 1611.14. and had no problems going through the consolidation band and breaking it at 1633.69.

This week will be fireworks if Gold continues it’s bullish run because our next possible resistance level would be 1780.00.

What are your thoughts concerning these pairs?

Do have a productive week ahead.