Hello Traders,

welcome to the last trading week of August (technically).

How has your weekend been so far and how hope August market has been fair to you so far ?

Let’s head straight to our charts, and see what it has for us this week.

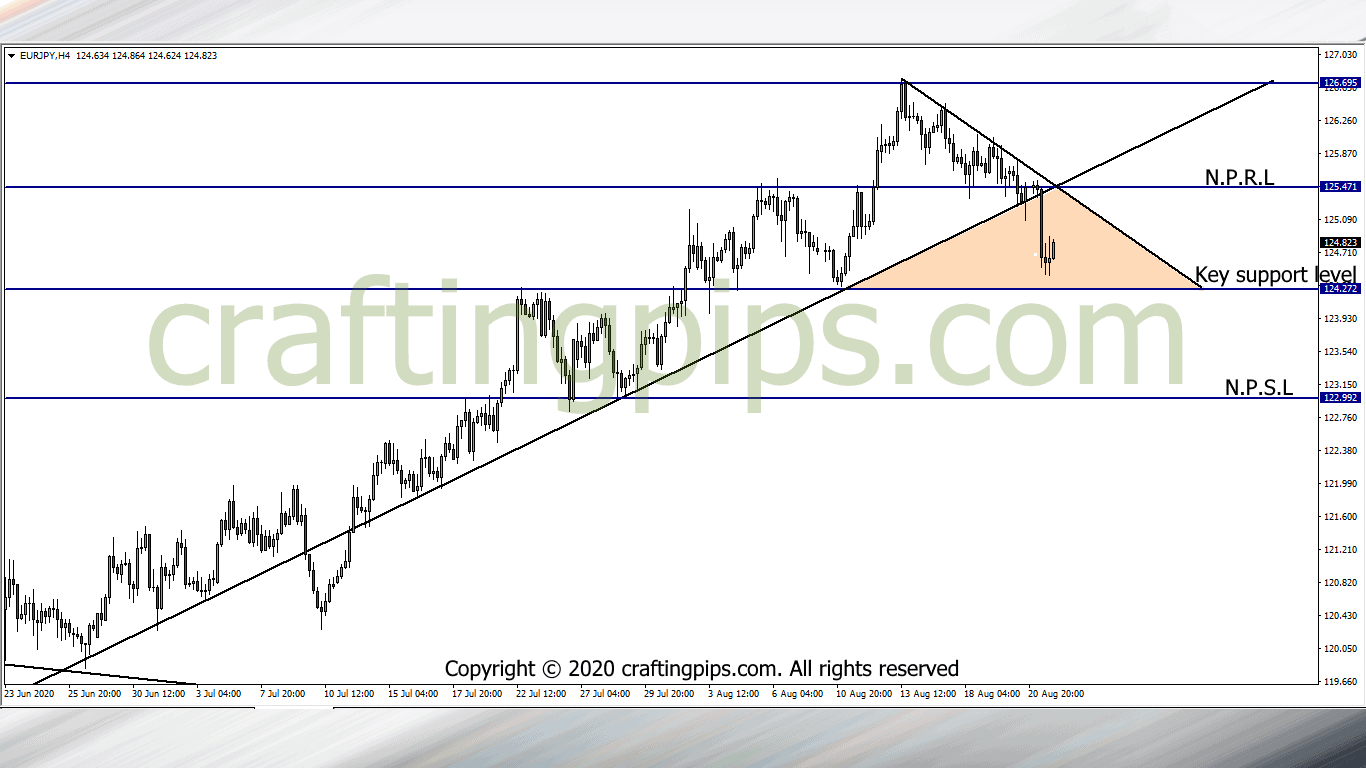

1. EUR/JPY

On Friday, we saw the EUR/JPY break out of a long-standing trendline which served as a support level.

Price barely hit support level 124.272 before giving us a bullish reversal signal.

This week we may see price get busy within the pink triangle, which to me may be more or less of a distraction.

The two key areas to focus on would be:

- Resistance level: 125.471 and

- Support level: 124.272

If price breaks resistance level 125.471, there is a huge probability that the next possible resistance level to likely get would be 126.695 and

If price succeeds in breaking support level 124.272, our next target support level would be 122.992.

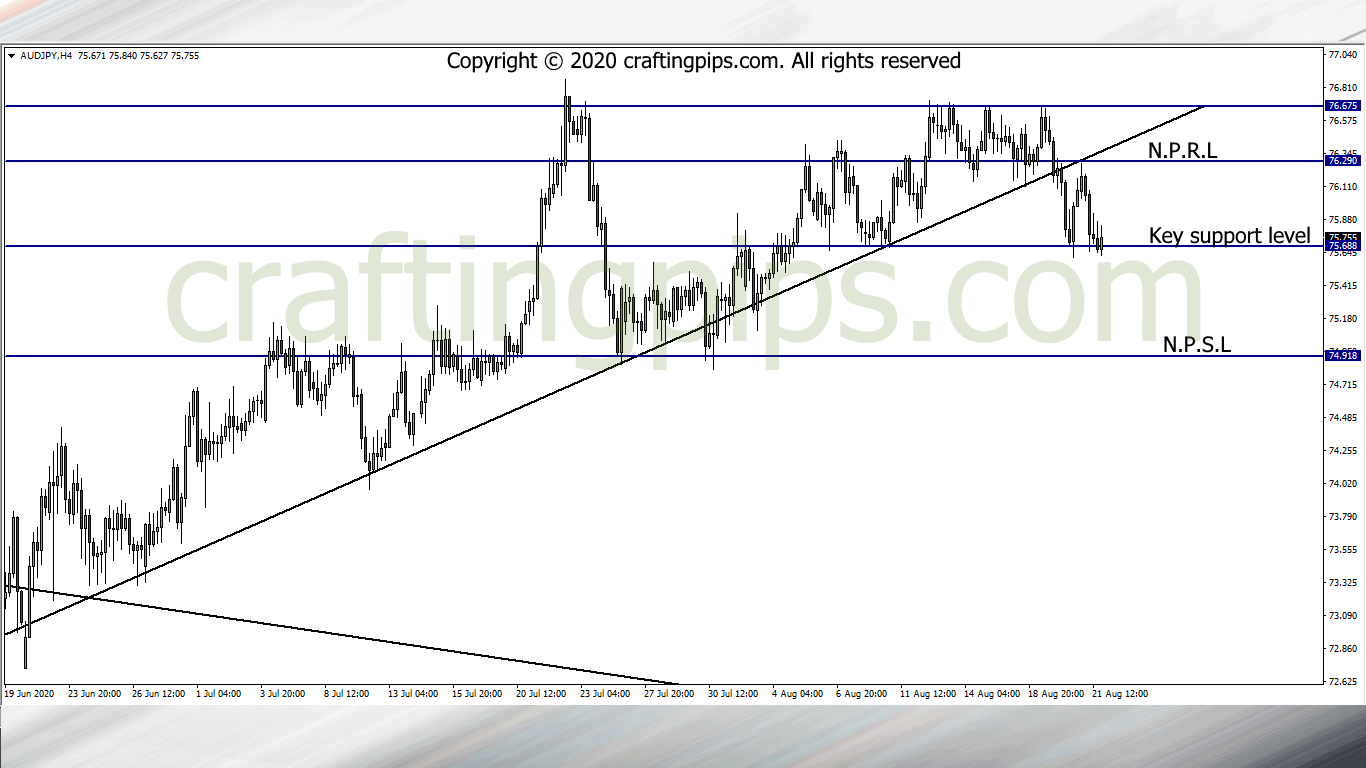

2. AUD/JPY

On Friday we saw the AUD/JPY retest a former support level (76.290) which now serves as a resistance level.

Market finally closed forming a half-backed double bottom.

The big question here now is:

Are the Bears strong enough to break the current support level (75.688), or are we going to see price head back up to resistance level 76.290 ?,

If the Bears are strong enough, price next possible support level would be 74.918.

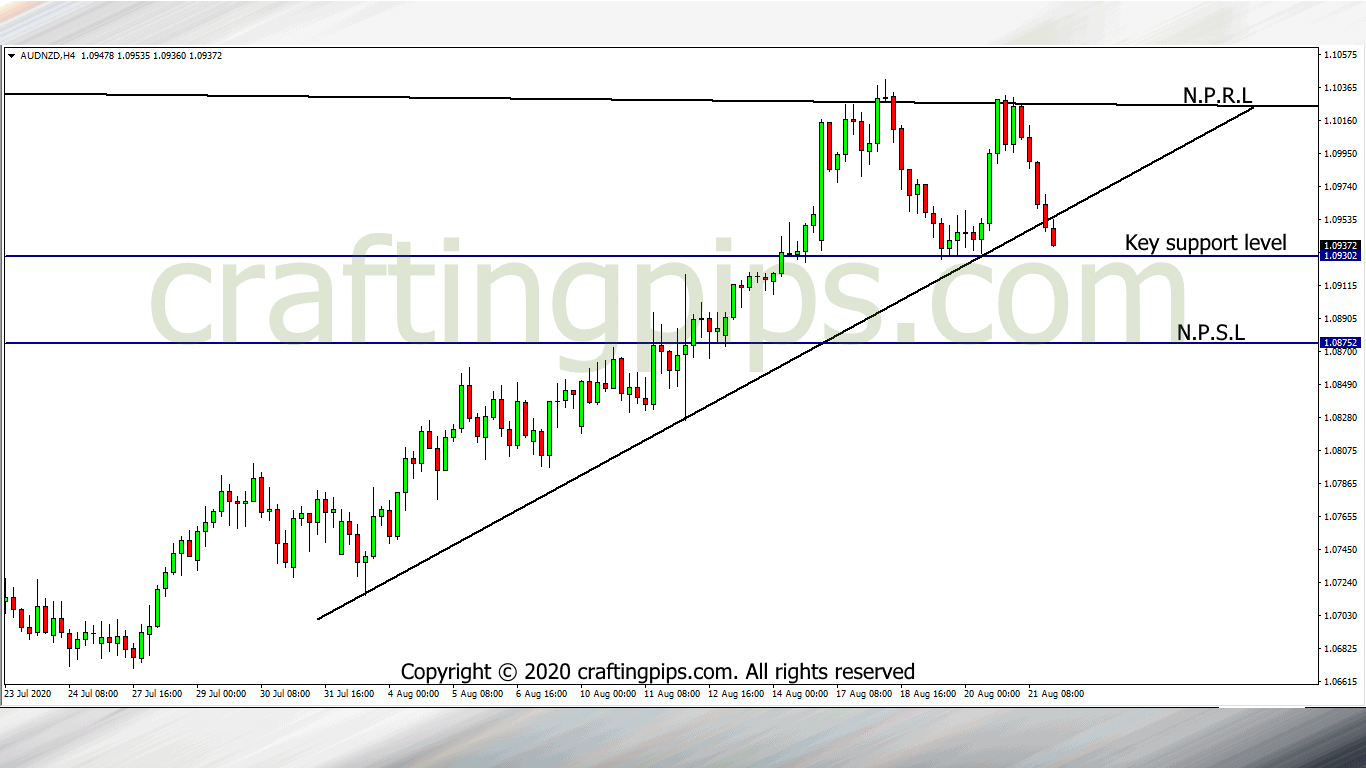

3. AUD/NZD

The AUD/NZD closed with a strong bearish outlook last week Friday.

However, in order for the Bears to continue their party this week, support level 1.09302 has to be broken.

If the bearish breakout is confirmed, then our next possible support level would be 1.08752.

If on the other hand we have price rejected at the current level, resistance level 1.10287 may be retested once more.

What are your thoughts?

ATTENTION: For those who are interested in joining our FREE trading group on Telegram, where trade ideas are discussed, which may assist your trading career while being infected by positive vibes

Smash the link: https://t.me/joinchat/FN30PxlwXbk2BcuTDdH5yg