Hello traders,

let’s see what the market has for us this week.

1. EUR/CHF

I shared this setup on Thursday and was hopeful of the breakout. I also made some pips from this trade.

So far 270 pips were given to those traders who were bold enough to take the trade. We still have over 2,300 pips to go if the bears continue to push price towards a previous support level (0.74900)

Remember though, price does not move in a straight line, so we may see pullbacks along the way.

2. NZD/USD

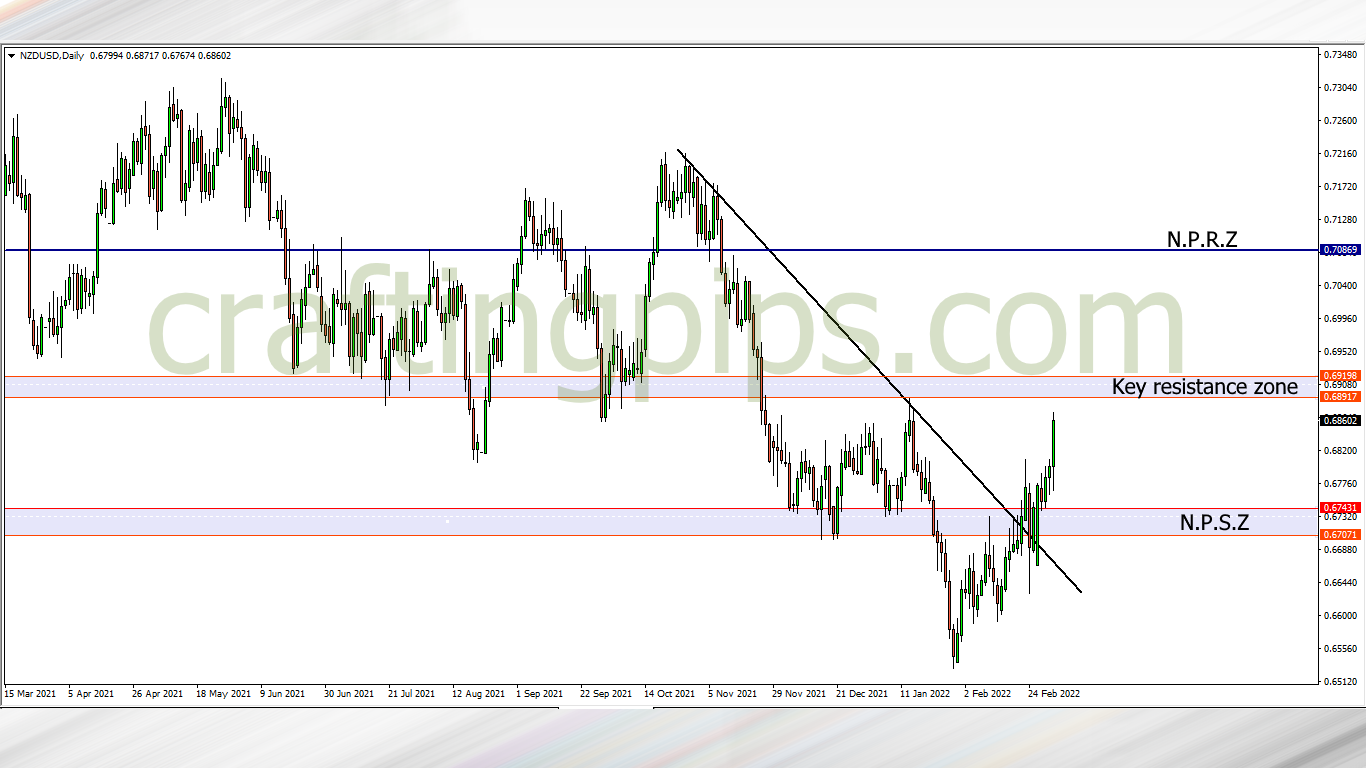

NZD/USD is approaching a key resistance zone (0.69198 – 0.68917), there is a huge probability that price would revisit a previous support zone (0.67431 – 0.67071)

If for any reason, price breaks the key resistance zone, then there will be no holding back for buyers as our next possible resistance level would be 0.70869

3. CAD/JPY

On the CAD/JPY, price has been ranging for over 2 months now. Presently price can be seen resting at a key support zone.

All we will be needing is a confirmation for a reversal which could send price back to resistance level 91.713, or a breakout of the present support zone which could send price further down to the next possible support level (87.713)

4. XAU/USD (GOLD)

Last week Friday closed with Gold giving us an aggressive breakout through a previous resistance zone, and price is currently close to the 1973.52 resistance level

There is a huge possibility that price may revisit support zone (1949.93 – 1945.33) this week. If a reversal fails, and price breaks the 1973.52 resistance level, price will most likely visit the next possible resistance level (2014.57)

What say you?

Traders who are interested in joining our FREE trading group on Telegram, where trade ideas and trade-related topics are discussed, which could assist your trading career while being infected by positive vibes

hit us on Pip Crafters