Hello traders,

let’s see what the charts have for us this week.

1. EUR/CHF

We are starting the week on the EUR/CHF with a strong bearish engulfing candlestick from last week’s daily close.

Depending on how well the sellers are motivated this week, there is a possibility that price will first consolidate before going south to the next possible support level (1.07481)

2. AUD/USD

On the daily time frame, AUD/USD is bearish, however, the key support zone (0.73467 – 0.73195) has proven time and time again that its a formidable zone sellers tend to respect.

So this week, there is a huge possibility that price may range between 0.74088 and 0.73467. If the bears come in strong within the week and the present support zone is broken, price next stop would be support level 0.72409

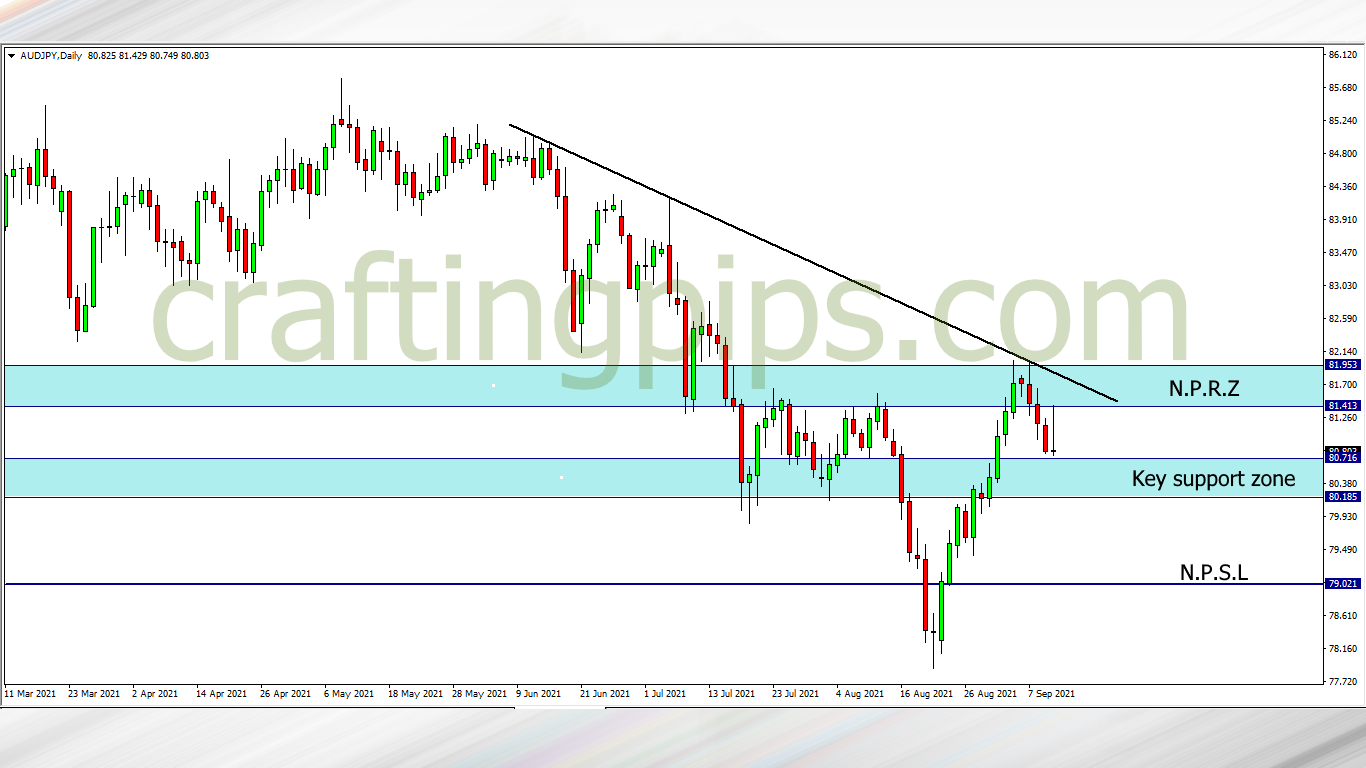

3. AUD/JPY

AUD/JPY and AUD/USD have similar pattern formation when you zoom out to the daily time frame. The key support zone is something to watch out for

If the bears are well motivated, then price next major move would hit support level 79.021

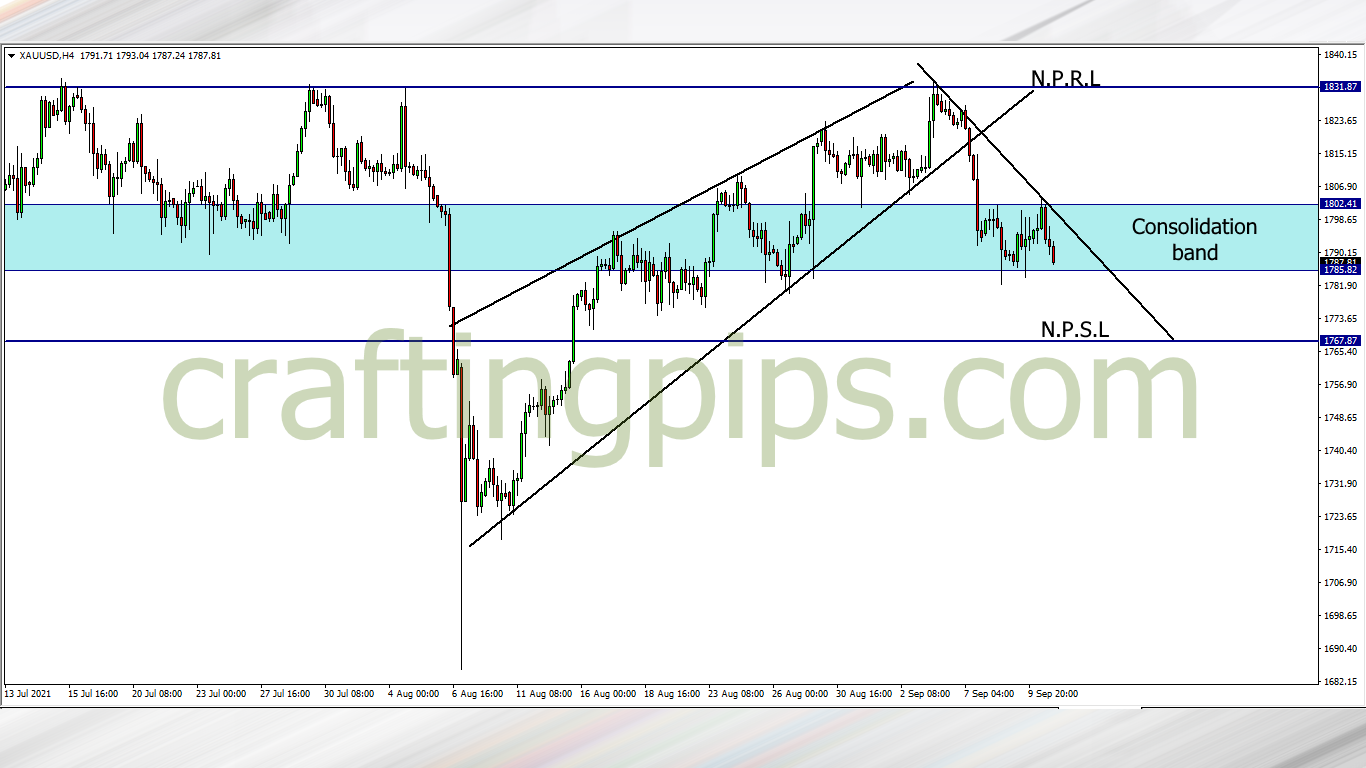

4. XAU/USD (GOLD)

Gold closed the week ranging between 1802.41 and 1785.82

This week anything can happen. If the bottom of the consolidation band is broken this week, price may further drop to support level 1767.87.

If the buyers are motivated and break the upper band, then we may most likely see 1831.87 as the next possible resistance level.

What say you?

For those who are interested in joining our FREE trading group on Telegram, where trade ideas and trade-related topics are discussed, which could assist your trading career while being infected by positive vibes

hit us on Pip Crafters