Happy Sunday traders,

How has your weekend been and how is your trading coming up this beautiful month of May?

Personally I have noticed that no matter how good your setup may be, you could get stopped out if you do not ensure you trail your profits or at least enable breakeven when price hits your direction.

These are times that really test your tenacity as a trader.

Alrighty, let’s see what the market has for us.

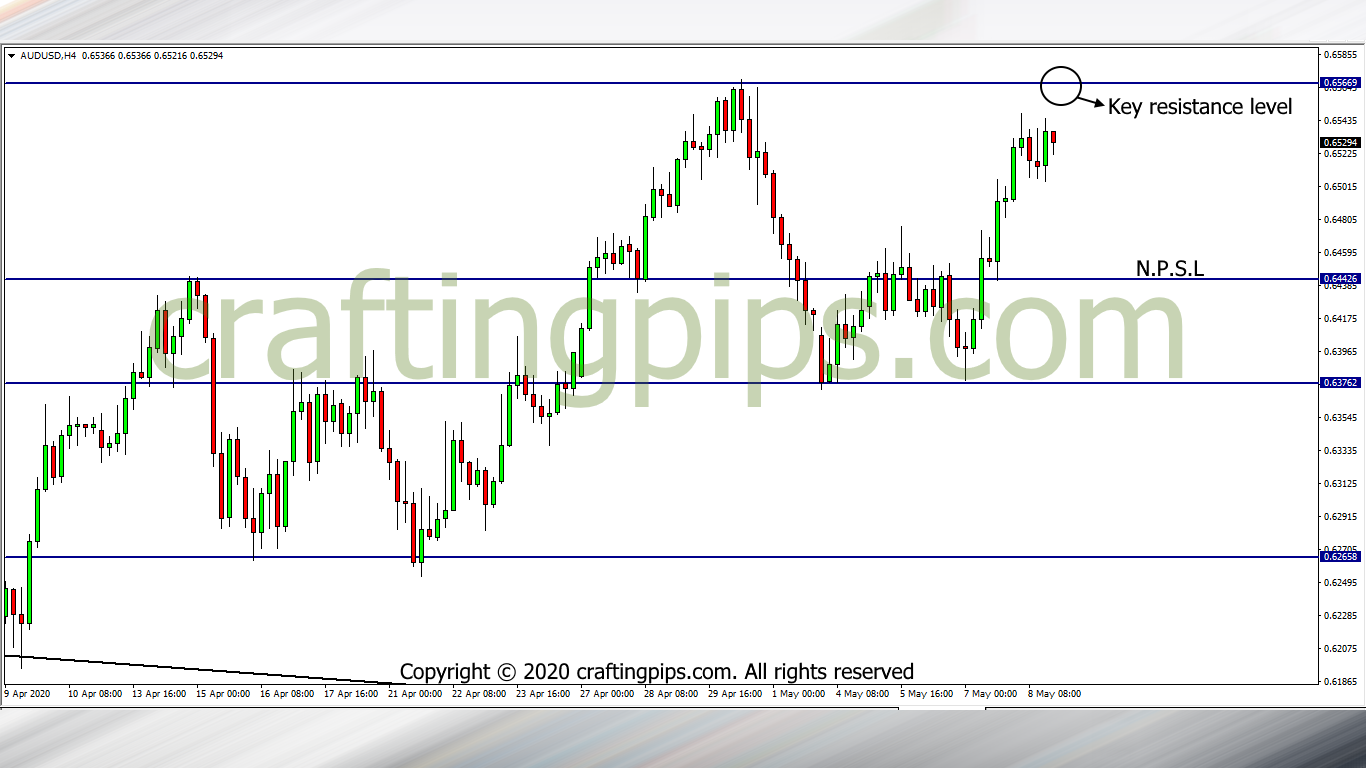

1. AUD/USD

AUD/USD closed on Friday just before hitting resistance level 0.65669.

This week will definitely reveal to us if we are to see a reversal that will take price back to support level 0.64426 or a breakout of resistance level 0.65669, which may most likely take price to the next possible resistance level (0.66777)

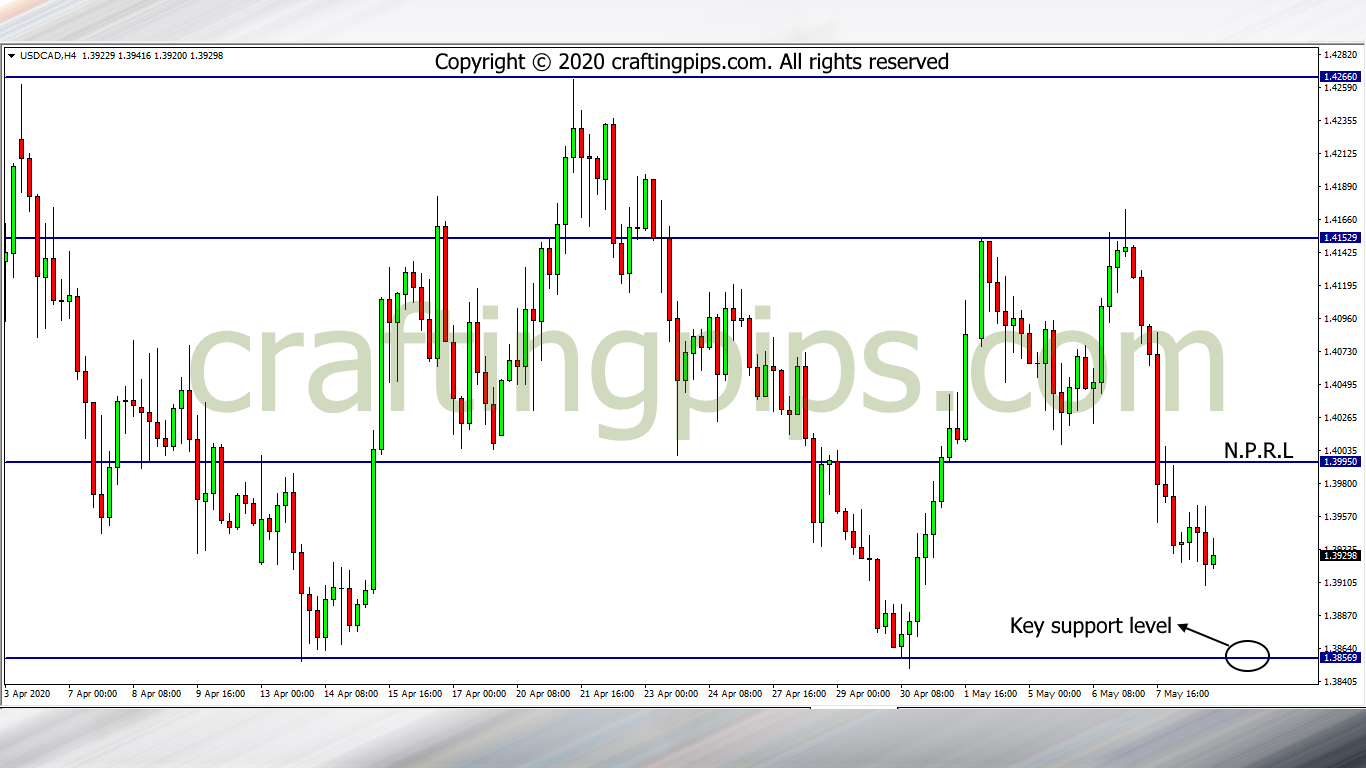

2. USD/CAD

The double top formed on the USD/CAD last week sent price on a bearish rampage that broke support level 1.39950.

Price is currently a few pips away from hitting a previous support level (1.38569).

A reversal will most likely send price back to resistance level 1.39950 and a breakout may further pull price down to resistance level 1.36711.

3. USD/CHF

The USD/CHF is one hell of an angry pair.

If you observe, price does not have a smooth upward or downward movement, hence if you are taking this trade, you may need a decent stop loss to make up for any surprise whipsaw that could potentially take out your stop.

That said, price is currently held by support level 0.96827, but still has a bearish outlook.

If a breakout of the present support level happens, then we will most likely be seeing price hitting the next possible support level (0.95942).

What are your thoughts?