Happy Sunday traders,

let’s see what April has for us this week

1. AUD/USD

AUD/USD spent the whole of last week stalling within the resistance zone.

Buyers were out of steam after hitting a double top formation. The last time price hit this zone was 6 months ago. This week we may most likely see sellers take charge and push price down to the first possible support level (0.73252)

If the selling pressure is high, we may see price hit the second possible support level (0.71674)

2. GBP/CHF

Buyers found it difficult going back up after breaking through the triangle, so price spent Thursday and Friday consolidating.

If the bears come in this week and break the support zone, we are likely to see price fall over 300 pips to the next possible support level (1.17340)

If for any reason the bulls come in roaring, then price may start another painful move upwards, which means resistance level 1.21879 may get hit and if the bulls are still strong, price may continue further go up to the next possible resistance level (1.22627).

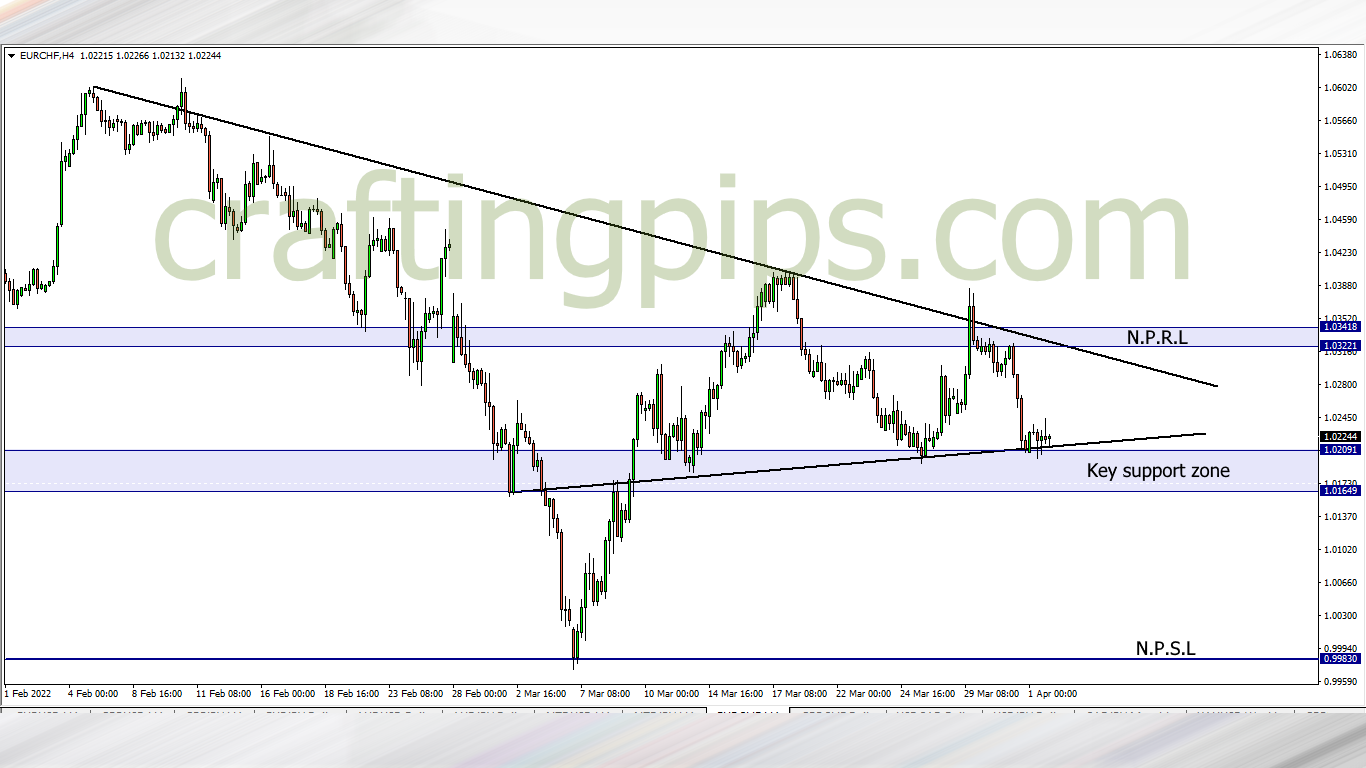

3. EUR/CHF

EUR/CHF buyers lost steam last week Friday on the EUR/CHF.

If the bulls don’t start the week strong and take price back to resistance level 1.03221, we may see the current key support zone get broken, and sellers may be encouraged to pull price down over 150 pips to a previous support level (0.99830) which was last visited at the beginning of March.

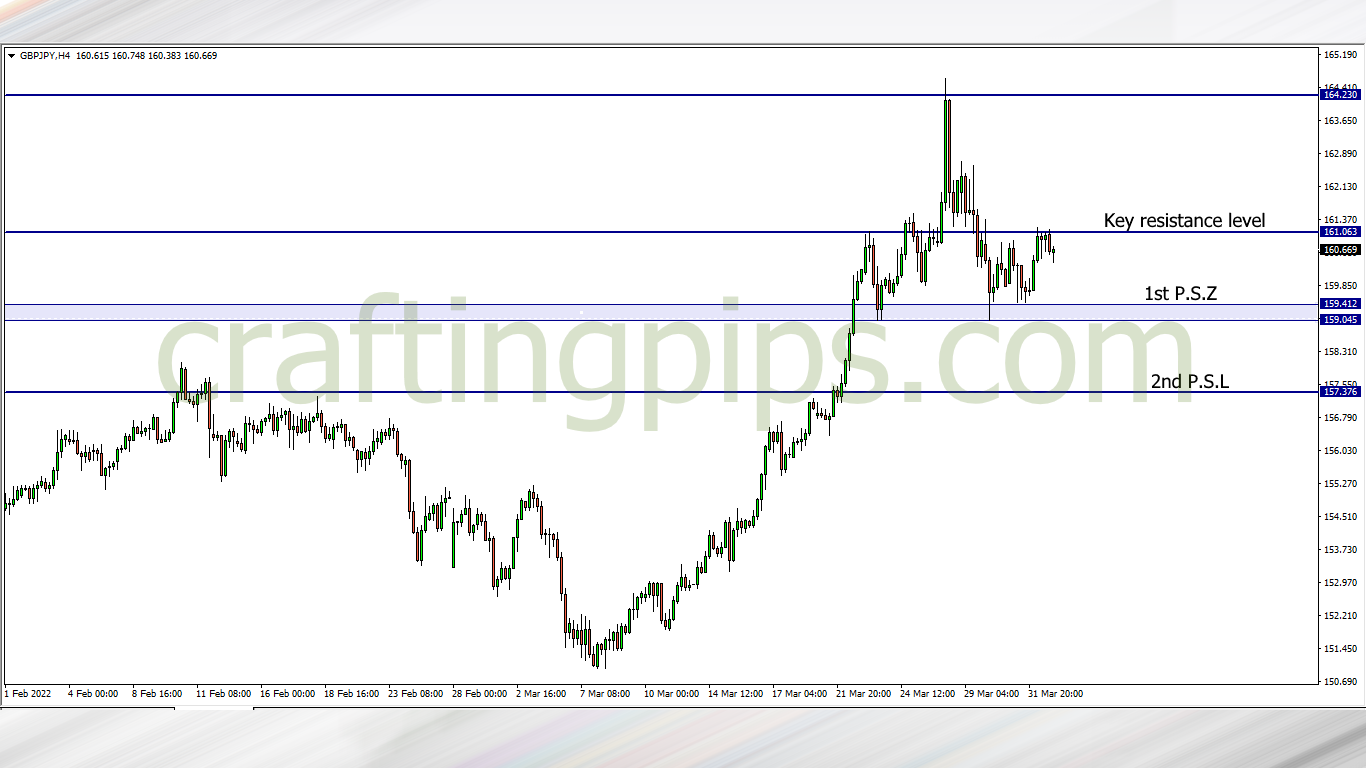

4. GBP/JPY

Our heads and shoulders pattern from last week still stands.

Friday market closed giving us a bearish engulfing candlestick. This means we could see price revisit support level 159.412 this week, and if the selling pressure is high, we may see price go further down to visit the next possible support level (157.376)

Let’s also be cautious as the head and should pattern is not immune to getting invalidated by the market. If that happens and the current resistance level gets broken, then resistance level 164.230 may be re-visited.

what say you?

Traders who are interested in joining our FREE trading group on Telegram, where trade ideas and trade-related topics are discussed, which could assist your trading career while being infected by positive vibes

hit us on Pip Crafters