Hello fellow traders,

Welcome to the eve of the second half of the year 2019.

It’s hard to believe that we have just 6 more months before we hit 2020.

It’s exciting to me because growing up as a kid, I remember watching some futuristic cartoons with flying cars, cyborgs, etc.

At the corner of the screen, you will see written:

“In the year 2020” (hahaha), and I start wondering a million and one things in my head, like:

How old would I be then?

Will I be part of the good guys? (lol)

Oh well, don’t mind my childhood reflections guys.

Secondly, I am also excited because each year for me closes with me being one step closer to that goal I have set. I hope it’s also that way for you?

Alright, alright, let’s come back to our world, let’s see what the new month of July has waiting for us…

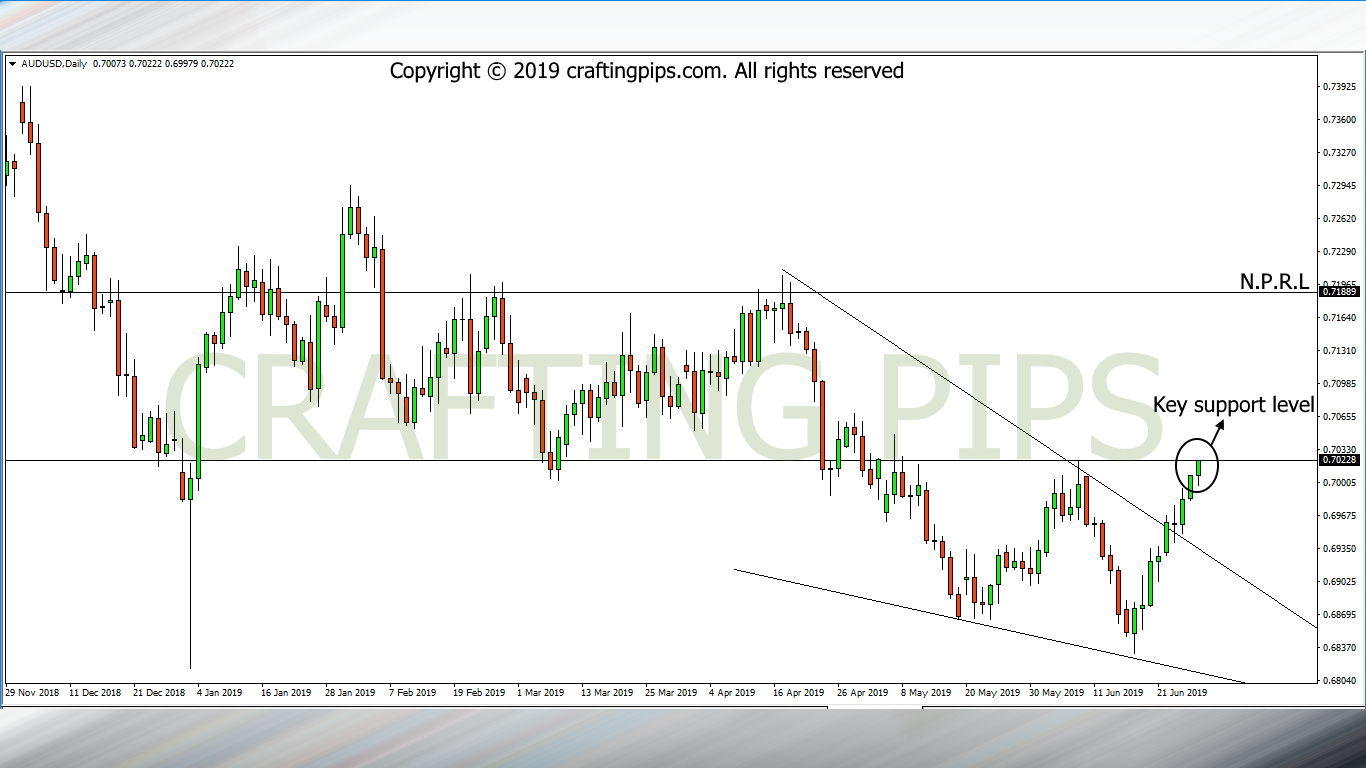

1. AUD/USD

The AUD/USD barely hit the last support level (0.68156) before beginning a bullish move.

Presently price is pressing against resistance level 0.70228. If we get a bullish breakout at this level, we may most likely see price move to the next resistance level (0.71062)

If after Sunday market opens, we see a reversal, there could be a tendency for price to hit support level 0.69469.

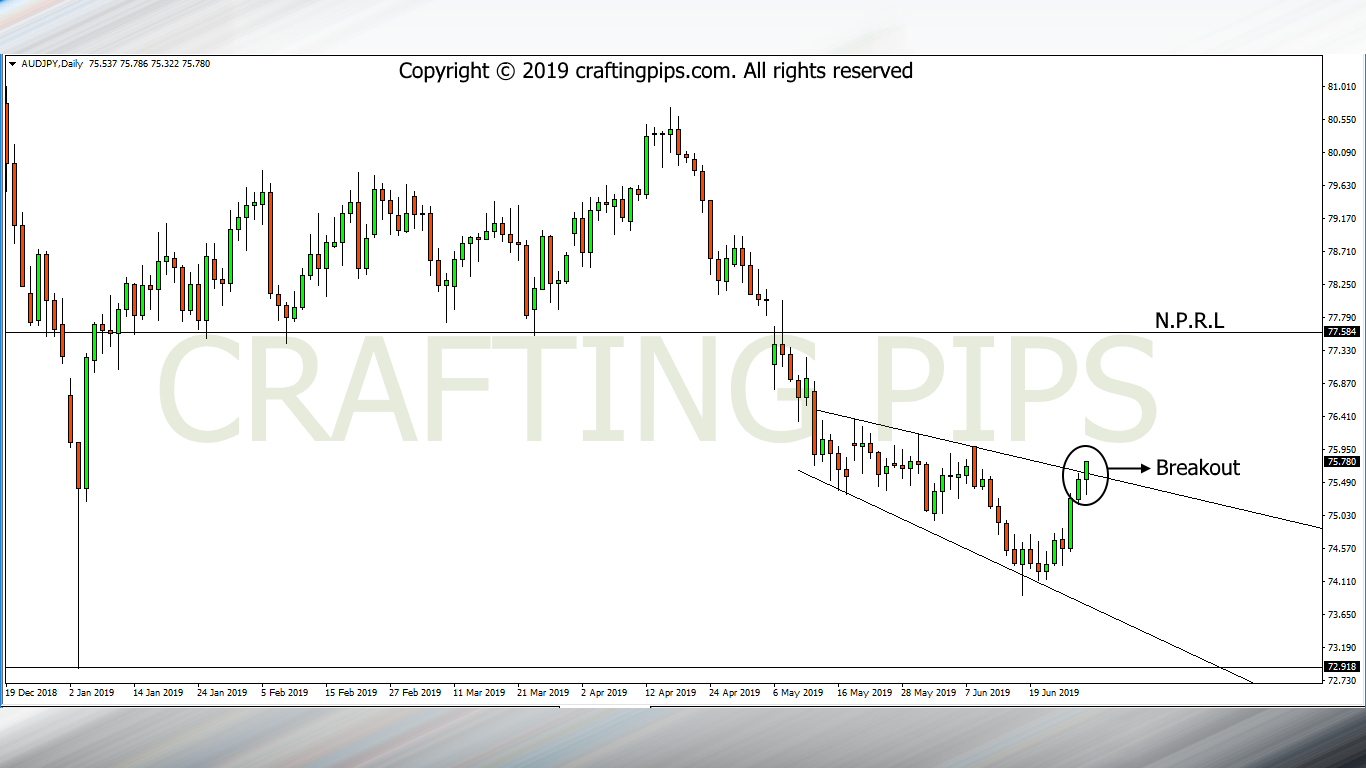

2. AUD/JPY

AUD/JPY closed with a highly bullish price. There was also a bullish breakout (75.622) on the daily descending channel pattern.

If the bullish breakout is confirmed, we could see price hit the next possible resistance level (77.584).

If for any reason, we see a reversal at this point, price could head back to support level 74.297.

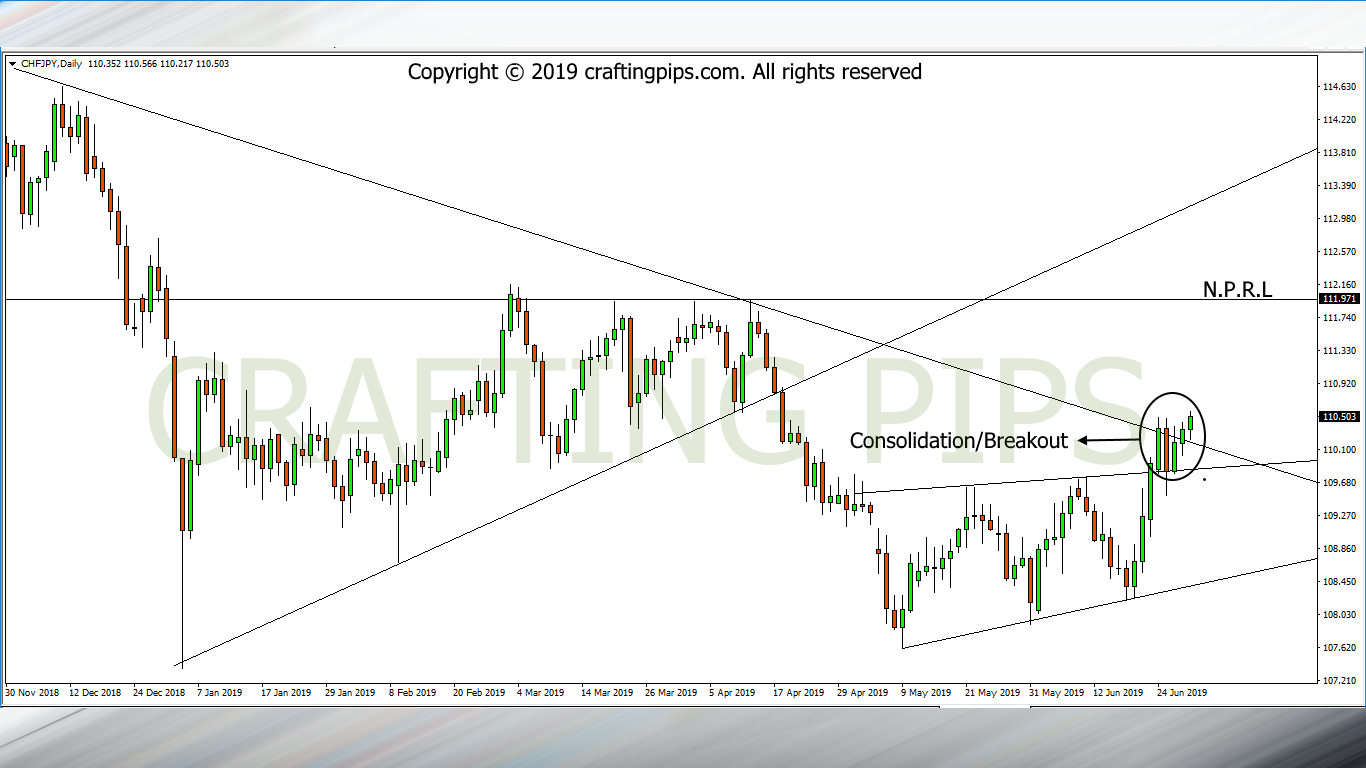

3. CHF/JPY

A descending resistance trendline was convincingly broken last week Friday on the CHF/JPY.

There a huge possibility that the next possible resistance level would be 111.971

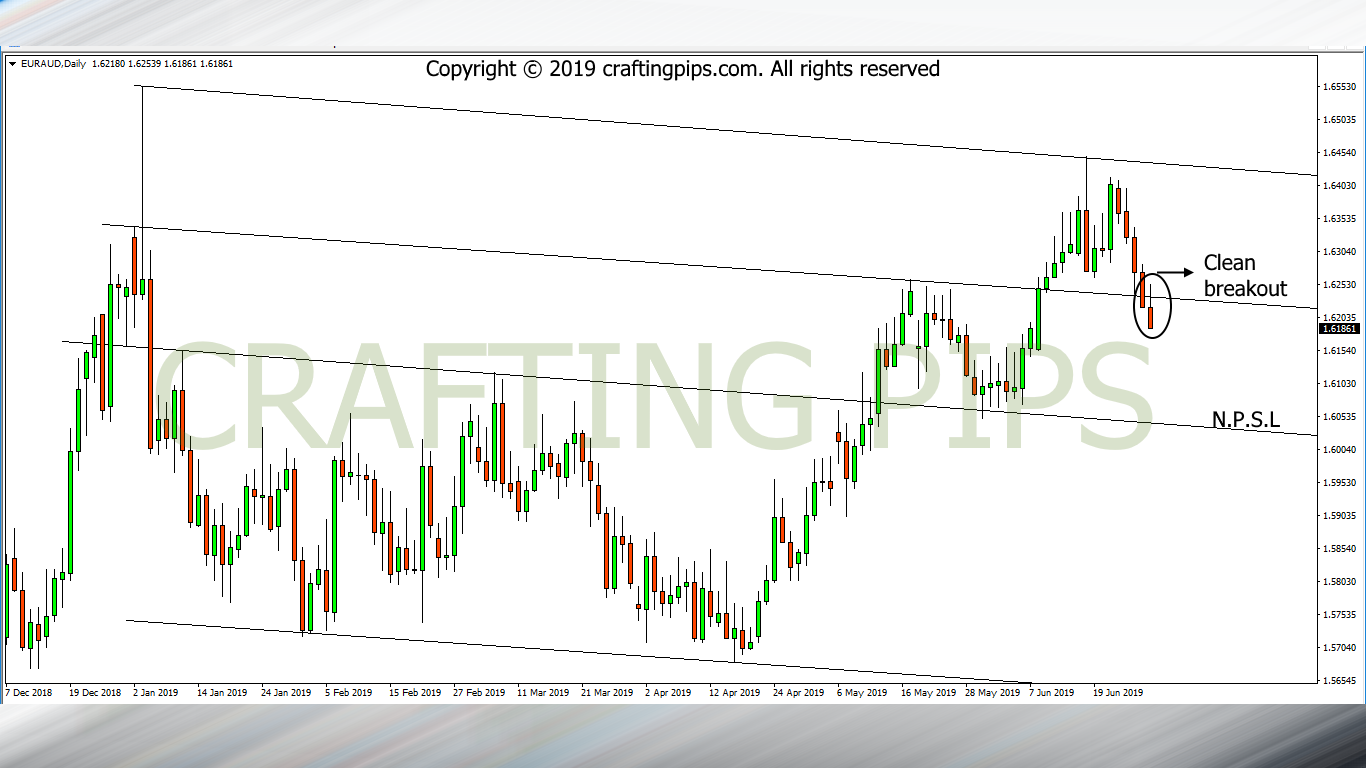

4. EUR/AUD

EUR/AUD spent the whole of last week on a bearish run.

The reason why you should put this pair under your radar is because price broke through a very important support level (1.62319) and we may be looking at a potential +140 pips fall before the week runs out.

NOTE: These setups though look viable, the market could start this evening and trash our entire analysis for the week.

So, always have it at the back of your mind that, when we resume a new week trading session, care must be taken in order to confirm that all our setups are still viable before we commit our hard earned shekels.

That said, comment below your thoughts regarding these setups and which you may most likely trade this coming week.

Also share our work and subscribe to our blog so that you don’t miss a thing during the week.