Hellloooooooo Tradeeeeers,

How many are ready to close the month of April with good memories?

If you are one of those traders, shout yaaaaaaaaaaaaaaay!!!

Alright, alright, alright, before we get carried away, let’s see what this week has got for us.

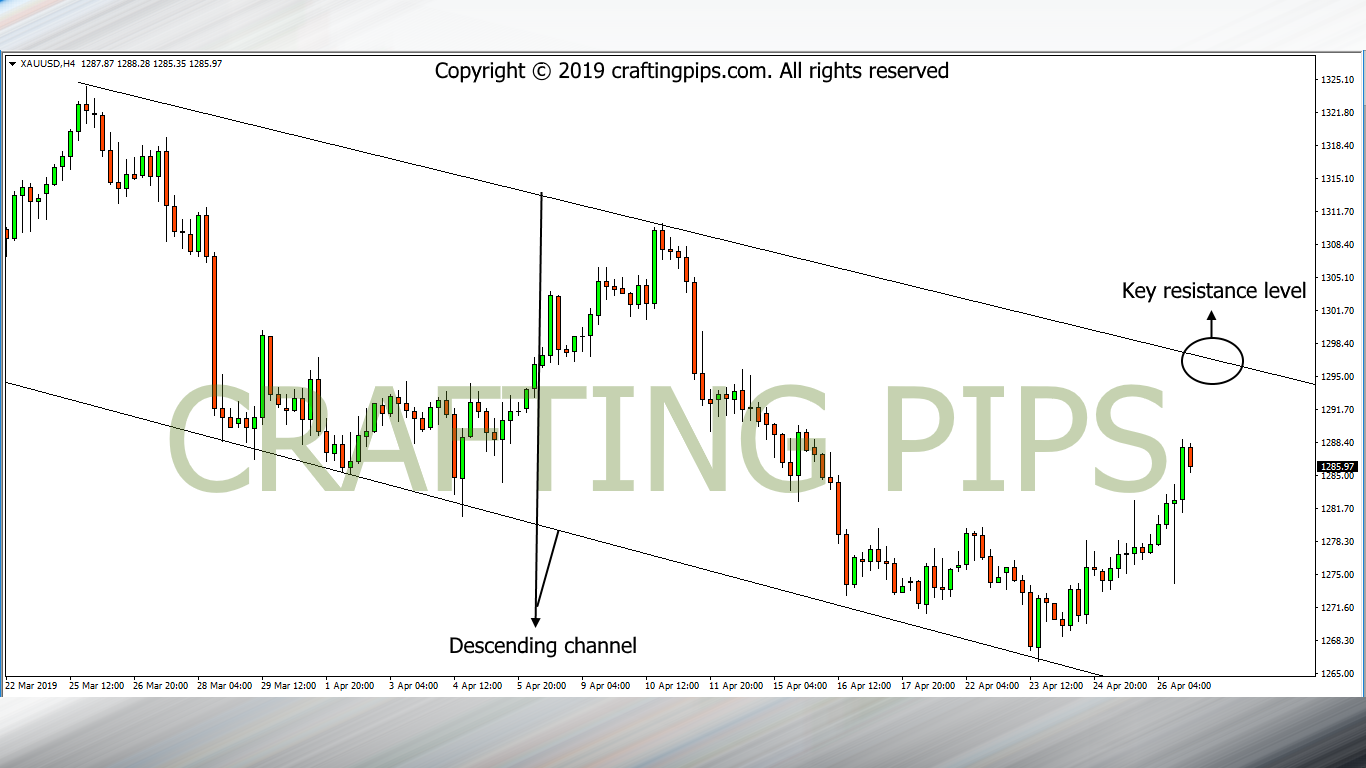

1. XAU/USD (GOLD)

Gold on the 4 hours time frame has price slowly crawling to its next resistance level (1296.94)

Once price gets to this key level, we should be expecting either a reversal or a breakout. If a reversal occurs, we may witness the market gift a patient trader over +260 pips before the week runs out.

If we witness a breakout, price may most likely continue it’s bullish move to the next possible resistance level (1310.49).

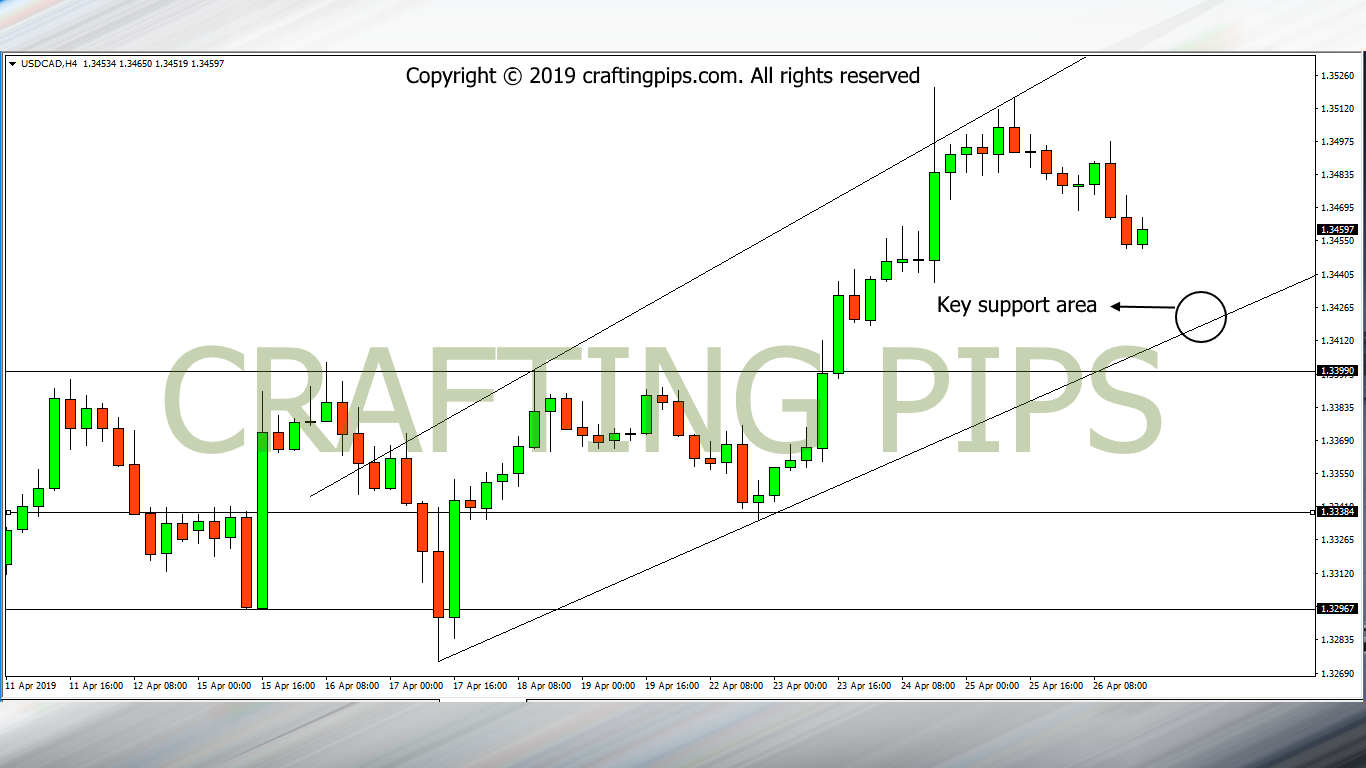

2. USD/CAD

USD/CAD has an interesting support level (1.34177) waiting for price to settle on.

After a key resistance (1.34142) breakout on the daily chart on Tuesday, we saw price gradually starting a retracement on Thursday.

How far this retracement will go before USD/CAD continues it’s journey upwards, is something we don’t know, but are willing to observe.

If price finally settles on support level 1.34177 after the retracement is over, we may see the bulls take price back to resistance level 1.35092.

If the support level we are hoping for fails for any reason, price should drop down to its next support level 1.33392.

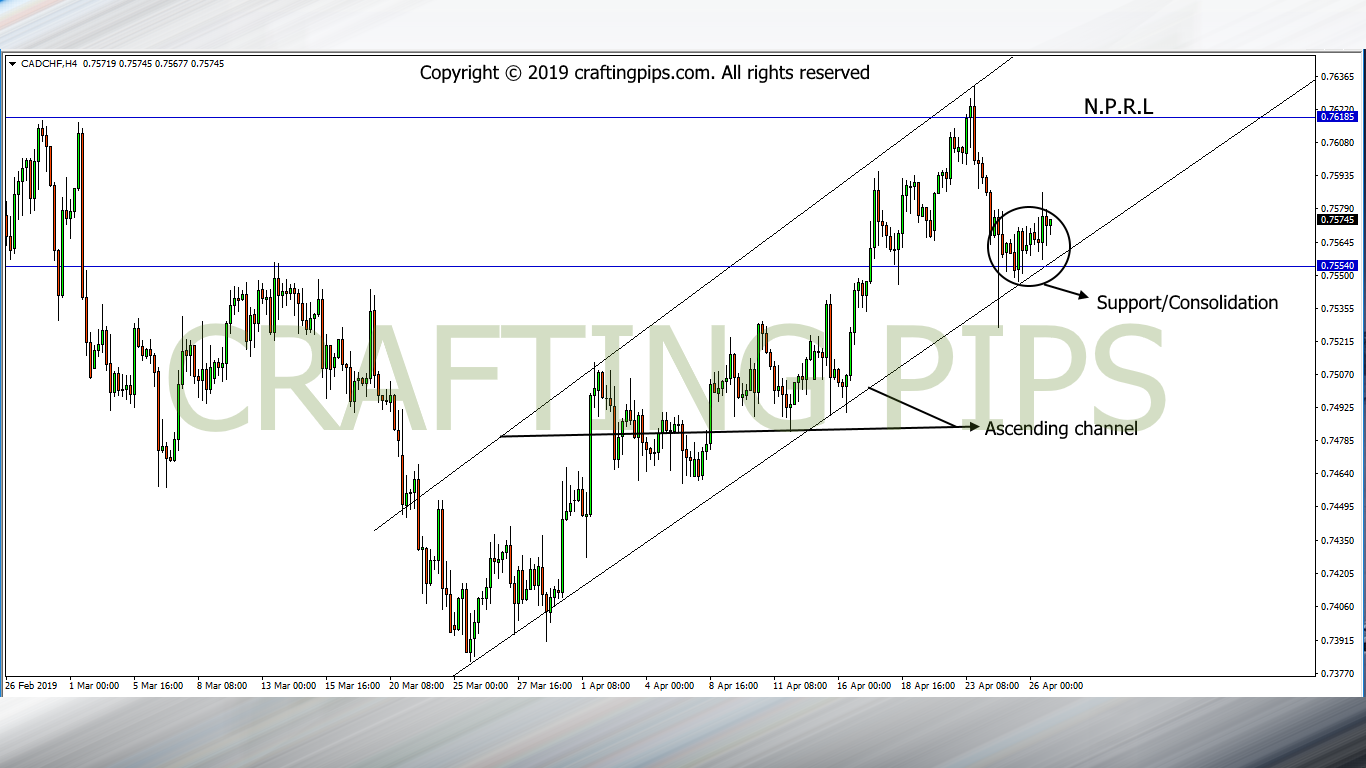

3. CAD/CHF

CAD/CHF has a beautiful uptrend on the 4 hours chart.

We may see the bulls carry on from where they left off on Friday, taking price to the next possible resistance level (0.76185).

If a breakout on support level (0.75540) happens, we are most likely to see the bears dominate the market and take price to the next possible support level (0.74947).

Oh well, we are done with our weekly trade update.

All we can pray for is:

self-control during market hours.

Do have a great week ahead ladies and gentlemen and do stay blessed.