Happy Sunday Traders,

February is fast coming to an end, don’t forget, our focus should be towards the end of the month and how we performed. Not just in February, but each month.

Are we ready for the new week…?

If YES, let’s hit the charts

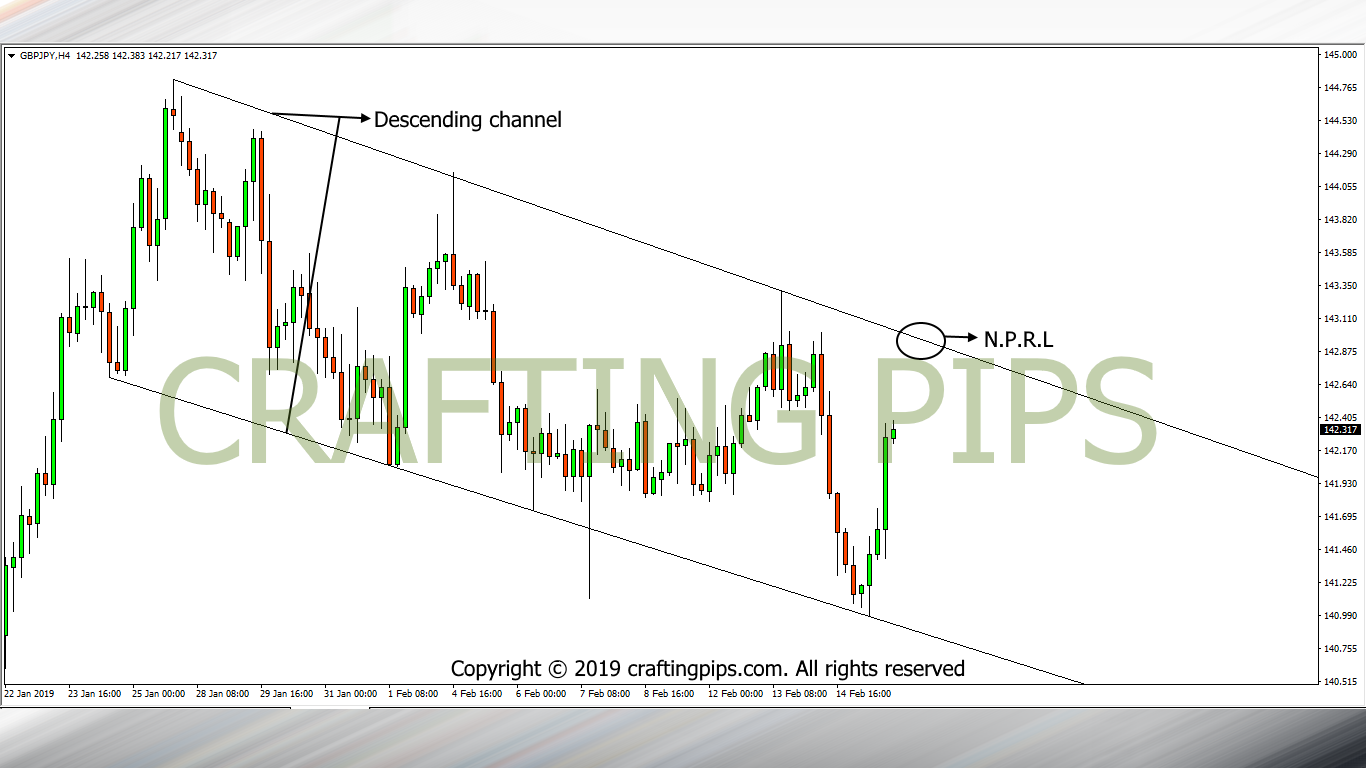

1. GBP/JPY

GBP/JPY has price locked within a descending channel in a 4 hour time frame.

The beauty of this setup is that: We have the luxury of waiting in order for price to hit the next resistance level (143.020). No need rushing this trade.

If price beaks out of the resistance level, we may see more buyers push price to the next resistance level (144.151), and if a reversal occurs, which is 60% more likely to happen, we should be seeing the sellers take price down to price level (141.065)

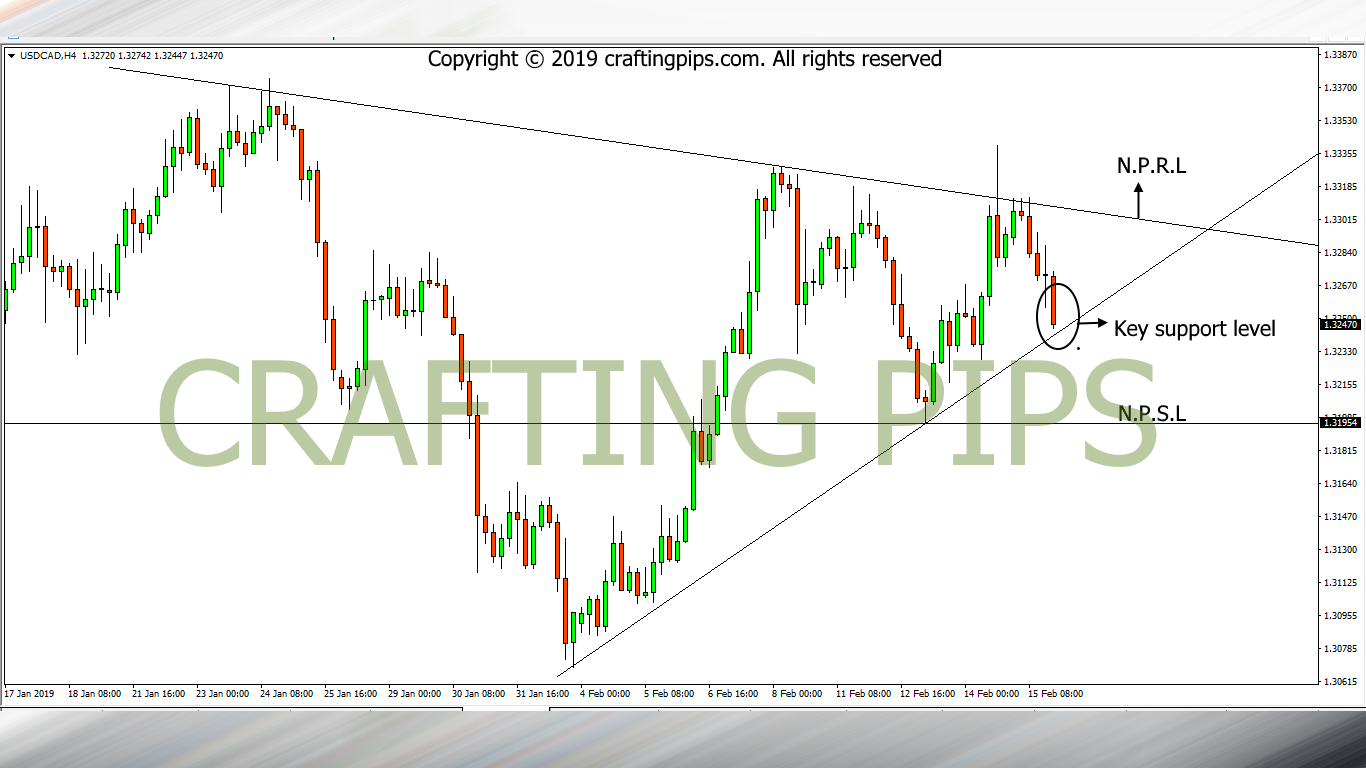

2. USD/CAD

USD/CAD on the 4 hours chart has got price forming a pennant

Looking at the weekly chart, this pair is still bullish. However, a breakout through price level 1.32420, could set the bears off, hence sending price to the next support level (1.31954),

I am bullish biased because of the USD/CAD weekly chart. That said, I may just be sitting by the sidelines as the market resumes today. Monday is not a day to be messing around in the market.

That said, if the bulls take over this pair as the market opens, price’s first stop would be 1.33066 and if that resistance level doesn’t hold price, we may see the bulls take price to the next bullish level (1.33713)

3. EUR/AUD

EUR/AUD has another great setup on the 4 hours chart.

There is a giant ascending channel separated by a support/resistance level currently being formed on the 4 hours chart.

Price is currently resting on a key support level 1.580219. A breakout, may most likely take price to the next support level (1.57726) and if price bounces off this level, the next resistance level price will be aiming at would be 1.59513.

We have come to the conclusion of our weekly analysis. What is your opinion on our analysis so far?

Kindly share our analysis among your pip loving friends and you could also subscribe to our blog, in order to get daily analysis posted to you via your e-mail.

Thanks for you time and do have a great week ahead.